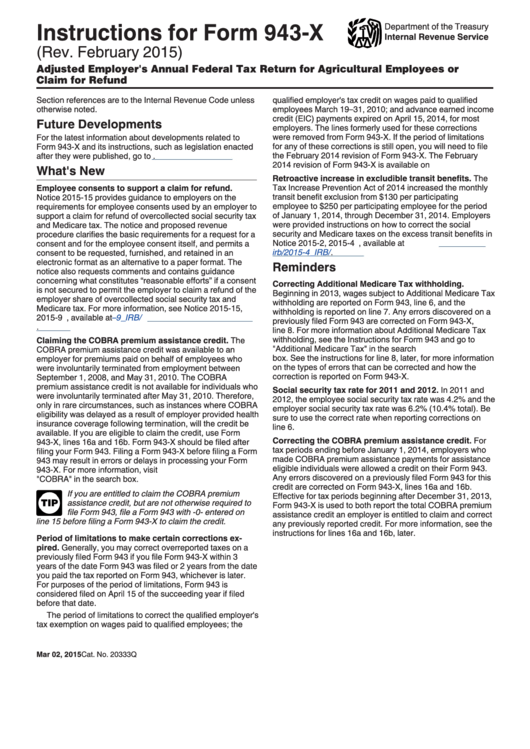

Form 943 X

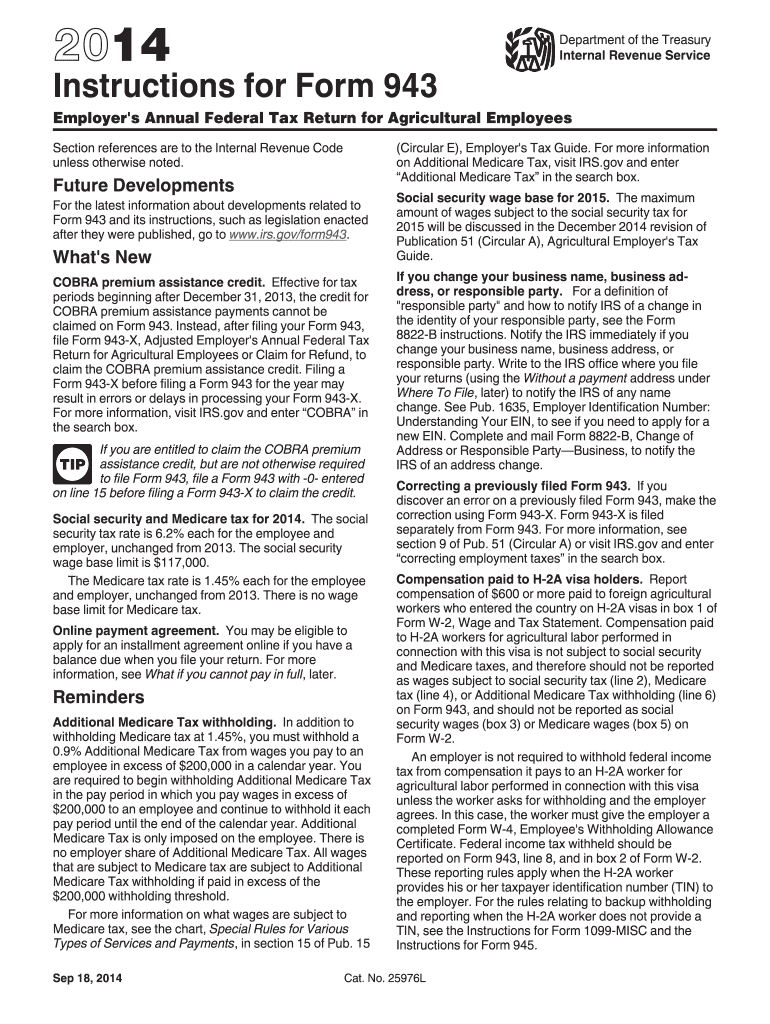

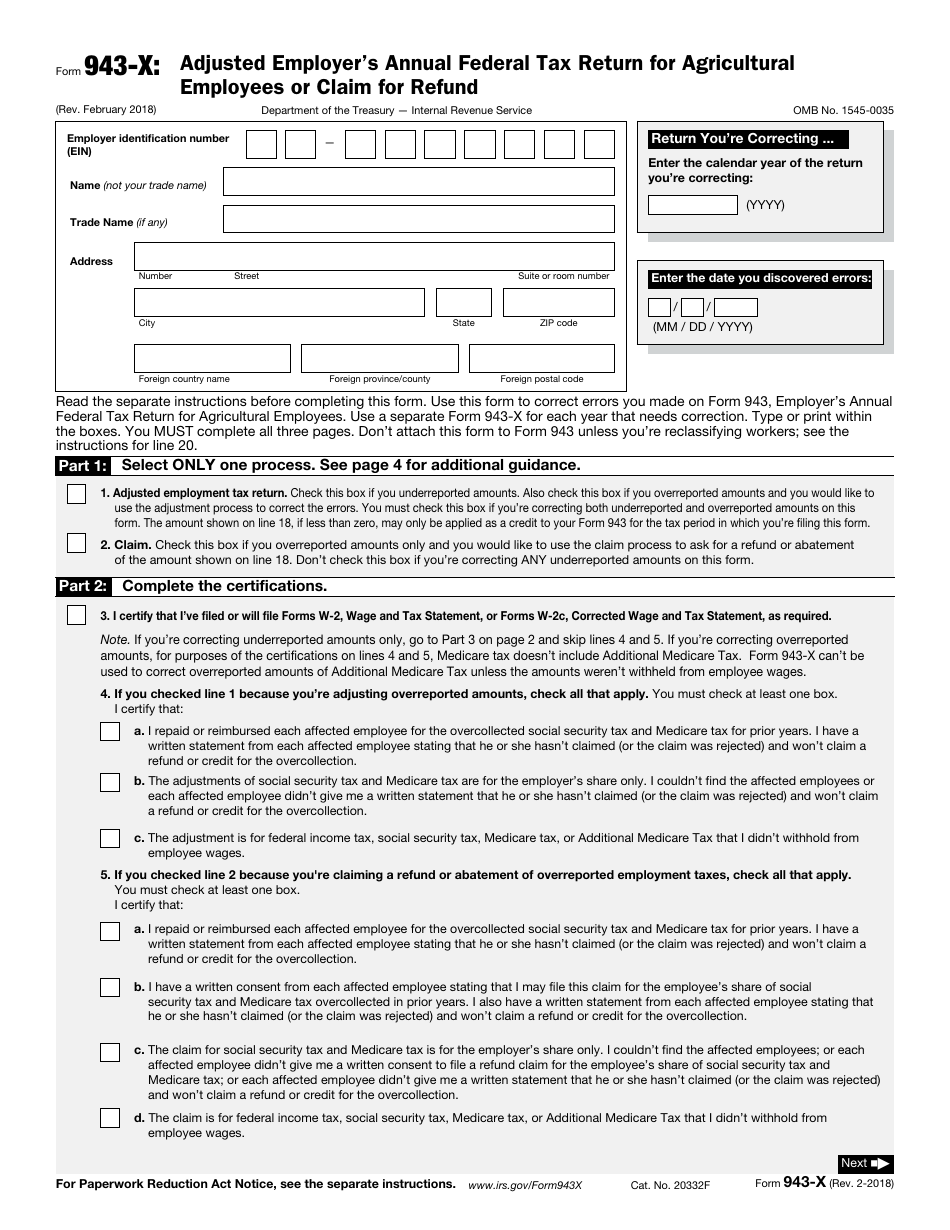

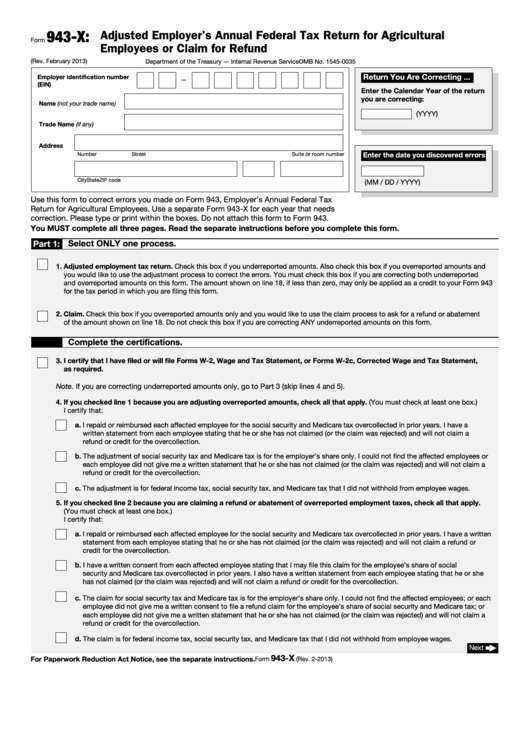

Form 943 X - Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. Department of the treasury internal revenue service. February 2018) adjusted employer’s annual federal tax return for agricultural employees or claim for refund department of the treasury — internal. Web use this form to correct errors you made on form 943, employer’s annual federal tax return for agricultural employees. Web form 943, is the employer's annual federal tax return for agricultural employees. Web request an abatement of interest on a tax by writing “request for abatement of interest under section 6404 (e)” at the top of form 843. Federal, state, and local governmental entities; Employer’s annual federal tax return for agricultural employees. To ensure proper processing, write “branded prescription drug fee” across the top of form 843. See the instructions for form 943 for due.

February 2018) adjusted employer’s annual federal tax return for agricultural employees or claim for refund department of the treasury — internal. Complete lines 1 through 3. Employer’s annual federal tax return for agricultural employees. Web special filing addresses for exempt organizations; Web employer’s annual federal tax return. Web form 943, employer's annual federal tax return for agricultural employees pdf: Department of the treasury internal revenue service. Web request an abatement of interest on a tax by writing “request for abatement of interest under section 6404 (e)” at the top of form 843. Web use this form to correct errors you made on form 943, employer’s annual federal tax return for agricultural employees. To ensure proper processing, write “branded prescription drug fee” across the top of form 843.

To ensure proper processing, write “branded prescription drug fee” across the top of form 843. Web request an abatement of interest on a tax by writing “request for abatement of interest under section 6404 (e)” at the top of form 843. Employer’s annual federal tax return for agricultural employees. February 2018) adjusted employer’s annual federal tax return for agricultural employees or claim for refund department of the treasury — internal. See the instructions for form 943 for due. In other words, it is a tax form used to report federal income tax, social. Department of the treasury internal revenue. When reporting a negative amount in columns. Web form 943, employer's annual federal tax return for agricultural employees pdf: Department of the treasury internal revenue service.

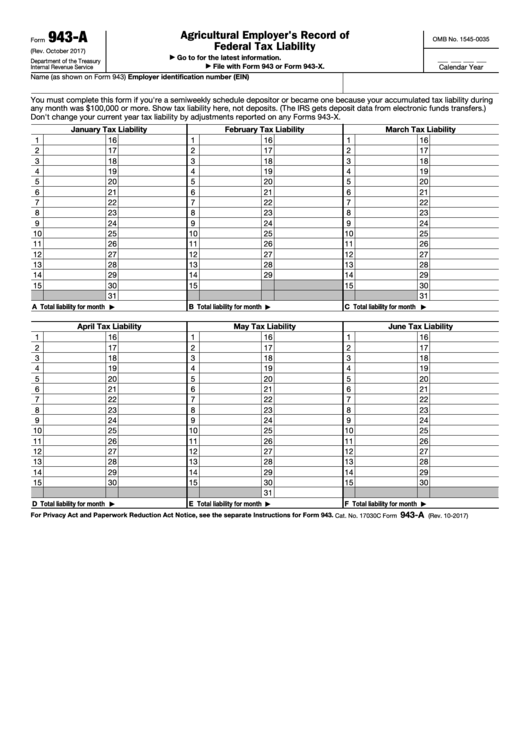

Fill Free fillable Form 943A 2017 Agricultural Employer's Record of

Web special filing addresses for exempt organizations; Department of the treasury internal revenue service. When reporting a negative amount in columns. Web employer’s annual federal tax return. Web form 943, employer's annual federal tax return for agricultural employees pdf:

Irs Form 943 Fill Out and Sign Printable PDF Template signNow

Department of the treasury internal revenue service. To ensure proper processing, write “branded prescription drug fee” across the top of form 843. In other words, it is a tax form used to report federal income tax, social. Web employer’s annual federal tax return. Complete lines 1 through 3.

Instructions For Form 943X 2015 printable pdf download

When reporting a negative amount in columns. In other words, it is a tax form used to report federal income tax, social. Exception for exempt organizations, federal,. Employer’s annual federal tax return for agricultural employees. Department of the treasury internal revenue.

Form 943 What You Need to Know About Agricultural Withholding

Employer’s annual federal tax return for agricultural employees. Web request an abatement of interest on a tax by writing “request for abatement of interest under section 6404 (e)” at the top of form 843. When reporting a negative amount in columns. Exception for exempt organizations, federal,. Web form 943, is the employer's annual federal tax return for agricultural employees.

Instructions for IRS Form 943x Adjusted Employer's Annual Federal

February 2018) adjusted employer’s annual federal tax return for agricultural employees or claim for refund department of the treasury — internal. Web the inflation reduction act of 2022 (the ira) makes changes to the qualified small business payroll tax credit for increasing research activities for tax years beginning after december. Employer’s annual federal tax return for agricultural employees. Web form.

Fillable Form 943A Agricultural Employer'S Record Of Federal Tax

Web the inflation reduction act of 2022 (the ira) makes changes to the qualified small business payroll tax credit for increasing research activities for tax years beginning after december. Web form 943, is the employer's annual federal tax return for agricultural employees. Web special filing addresses for exempt organizations; When reporting a negative amount in columns. Federal, state, and local.

Fill Free fillable F943x Accessible Form 943X (Rev. February 2018

Employer’s annual federal tax return for agricultural employees. Web form 943, employer's annual federal tax return for agricultural employees pdf: When reporting a negative amount in columns. Department of the treasury internal revenue. Web the inflation reduction act of 2022 (the ira) makes changes to the qualified small business payroll tax credit for increasing research activities for tax years beginning.

943a Fill Online, Printable, Fillable, Blank pdfFiller

Web employer’s annual federal tax return. Web special filing addresses for exempt organizations; Exception for exempt organizations, federal,. Federal, state, and local governmental entities; February 2018) adjusted employer’s annual federal tax return for agricultural employees or claim for refund department of the treasury — internal.

IRS Form 943X Download Fillable PDF or Fill Online Adjusted Employer's

Web the inflation reduction act of 2022 (the ira) makes changes to the qualified small business payroll tax credit for increasing research activities for tax years beginning after december. When reporting a negative amount in columns. Department of the treasury internal revenue. Federal, state, and local governmental entities; Web form 943, is the employer's annual federal tax return for agricultural.

Fillable Form 943X Adjusted Employer'S Annual Federal Tax Return For

Employer’s annual federal tax return for agricultural employees. Web special filing addresses for exempt organizations; Web employer’s annual federal tax return. Web form 943, employer's annual federal tax return for agricultural employees pdf: Employer’s annual federal tax return for agricultural employees.

Employer’s Annual Federal Tax Return For Agricultural Employees.

In other words, it is a tax form used to report federal income tax, social. When reporting a negative amount in columns. Web employer’s annual federal tax return. Web special filing addresses for exempt organizations;

Web Form 943, Is The Employer's Annual Federal Tax Return For Agricultural Employees.

Federal, state, and local governmental entities; Department of the treasury internal revenue service. Complete lines 1 through 3. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file.

Employer’s Annual Federal Tax Return For Agricultural Employees.

Web use this form to correct errors you made on form 943, employer’s annual federal tax return for agricultural employees. To ensure proper processing, write “branded prescription drug fee” across the top of form 843. February 2018) adjusted employer’s annual federal tax return for agricultural employees or claim for refund department of the treasury — internal. Web the inflation reduction act of 2022 (the ira) makes changes to the qualified small business payroll tax credit for increasing research activities for tax years beginning after december.

Web Form 943, Employer's Annual Federal Tax Return For Agricultural Employees Pdf:

See the instructions for form 943 for due. Exception for exempt organizations, federal,. Web request an abatement of interest on a tax by writing “request for abatement of interest under section 6404 (e)” at the top of form 843. Employer’s annual federal tax return for agricultural employees.