Form 941 For 2022 Pdf

Form 941 For 2022 Pdf - All employers that are required to report the federal. October, november, december name (not your trade name) calendar year (also check quarter). Form 941 , employer’s quarterly. April, may, june read the separate instructions before completing this form. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. October, november, december go to www.irs.gov/form941 for instructions and the latest. Web can i still fill out form 941 for 2021? 01 fill and edit template. Web the rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in 2022 for leave taken after march 31, 2021, and. Form 941 is used by employers.

Complete, edit or print tax forms instantly. Web we last updated the employer's quarterly federal tax return in july 2022, so this is the latest version of form 941, fully updated for tax year 2022. You can still fill out form 941 for tax year 2021. 01 fill and edit template. You can download or print. It was revised to account for. Form 941 is used by employers. All employers that are required to report the federal. Web form 941 for 2023: Use the march 2022 revision of form 941 only to report taxes for the quarter ending march 31, 2022.

Web can i still fill out form 941 for 2021? October, november, december go to www.irs.gov/form941 for instructions and the latest. 01 fill and edit template. 28 by the internal revenue service. A form 941 is a tax form used by employers to report their quarterly federal tax liability. All employers that are required to report the federal. Form 941 is used by employers. Web get your form 941 (june 2022) in 3 easy steps. October, november, december go to www.irs.gov/form941 for instructions and the latest. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122.

Form 941

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web the deadline to file form 941 for 2023 will be the end of the month following the close of the quarter: However, if you pay an amount with form 941 that should’ve been deposited, you may be subject.

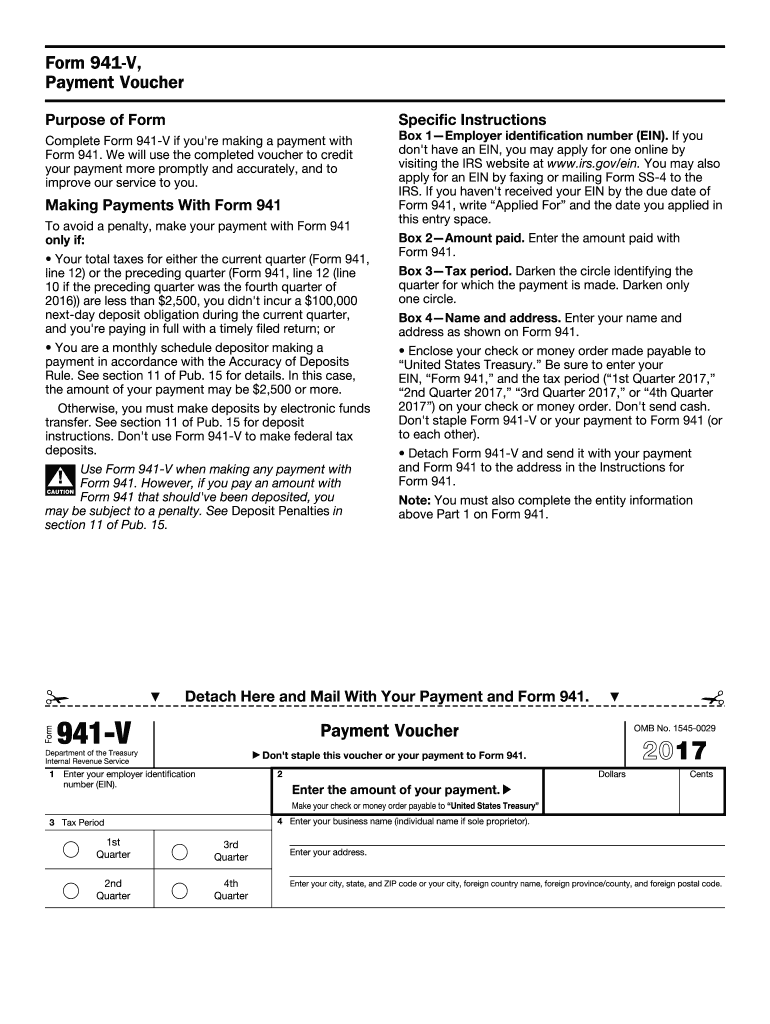

941 V Fill Out and Sign Printable PDF Template signNow

Web finalized versions of the 2022 form 941, its instructions, and schedules were issued feb. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Web we last updated the employer's quarterly federal tax return in july 2022, so this is the latest version of form 941, fully updated for.

Irs 941 Instructions Publication 15 All Are Here

You can download or print. Use the march 2022 revision of form 941 only to report taxes for the quarter ending march 31, 2022. October, november, december go to www.irs.gov/form941 for instructions and the latest. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Web form 941 for 2023:

Draft of Revised Form 941 Released by IRS Includes FFCRA and CARES

Web get your form 941 (june 2022) in 3 easy steps. October, november, december go to www.irs.gov/form941 for instructions and the latest. Web finalized versions of the 2022 form 941, its instructions, and schedules were issued feb. Web up to $32 cash back in february 2022, the irs issued a new version of form 941 that employers need to use.

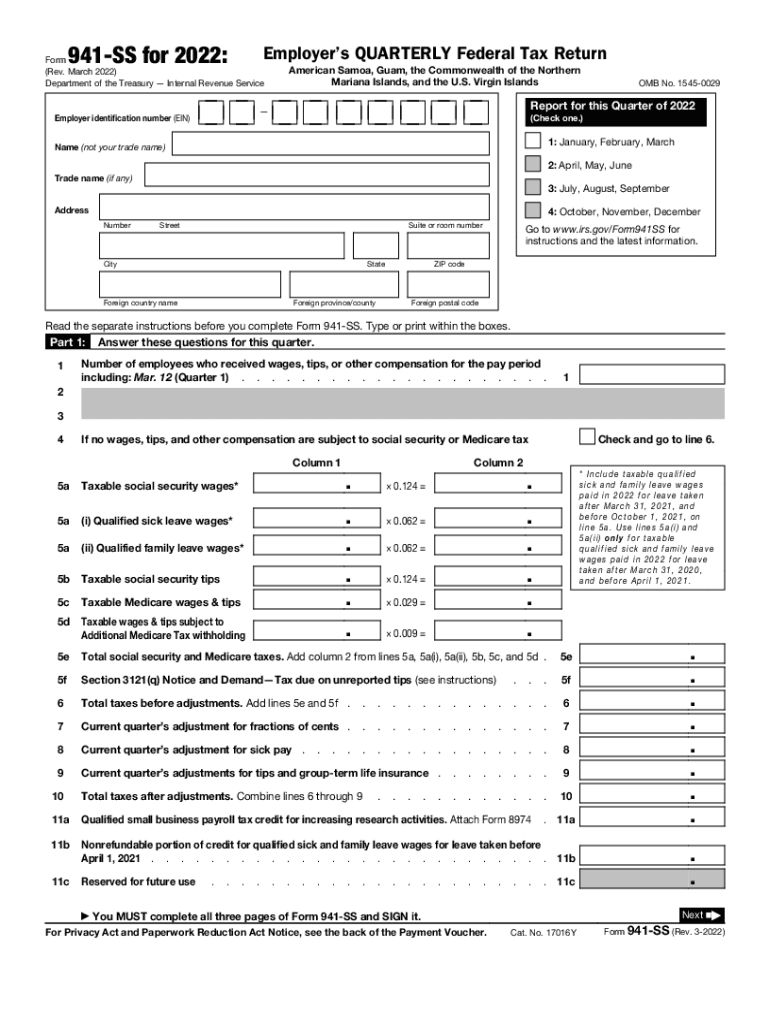

2022 Form IRS 941SS Fill Online, Printable, Fillable, Blank pdfFiller

Web the deadline to file form 941 for 2023 will be the end of the month following the close of the quarter: Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Form 941 , employer’s quarterly. However, if you pay an amount with form 941 that should’ve been.

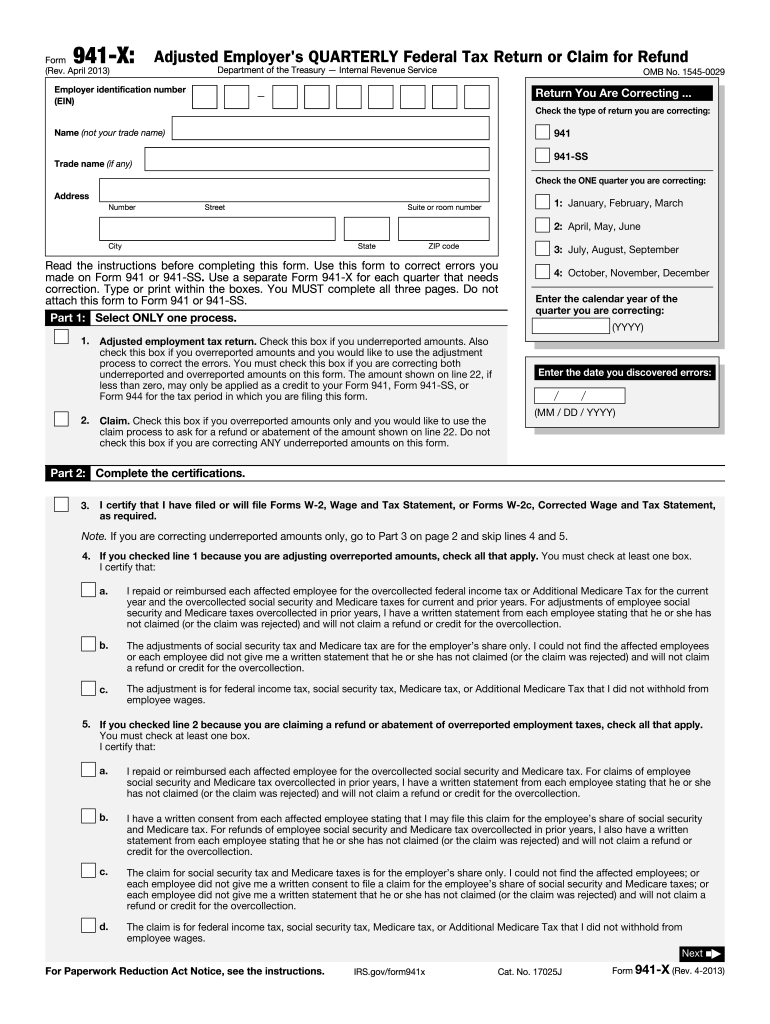

About Form 941 XInternal Revenue Service IRS Gov Fill Out and Sign

Web get your form 941 (june 2022) in 3 easy steps. Web up to $32 cash back in february 2022, the irs issued a new version of form 941 that employers need to use beginning with q1’s tax filings. 03 export or print immediately. All employers that are required to report the federal. Ad get ready for tax season deadlines.

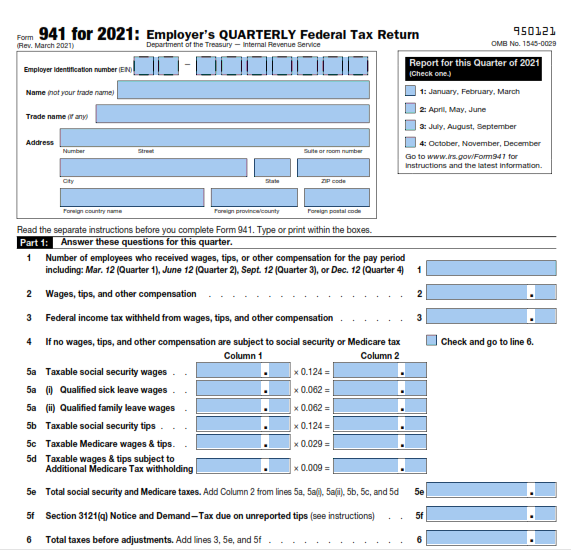

Sample 11 Form Completed 11 Common Misconceptions About Sample 11 Form

A form 941 is a tax form used by employers to report their quarterly federal tax liability. Web up to $32 cash back in february 2022, the irs issued a new version of form 941 that employers need to use beginning with q1’s tax filings. If changes in law require additional changes to form 941, the. Web finalized versions of.

IRS Form 941X Complete & Print 941X for 2021

April, may, june read the separate instructions before completing this form. Web get your form 941 (june 2022) in 3 easy steps. Web can i still fill out form 941 for 2021? Use the march 2022 revision of form 941 only to report taxes for the quarter ending march 31, 2022. You can still fill out form 941 for tax.

Fillable Schedule B Form 941 Schedule Printable

Use the march 2022 revision of form 941 only to report taxes for the quarter ending march 31, 2022. October, november, december go to www.irs.gov/form941 for instructions and the latest. Form 941 , employer’s quarterly. Web up to $32 cash back in february 2022, the irs issued a new version of form 941 that employers need to use beginning with.

Top10 US Tax Forms in 2022 Explained PDF.co

Web the irs recently released a revised form 941 for the first quarter of 2022, complete with proposed changes. October, november, december go to www.irs.gov/form941 for instructions and the latest. October, november, december go to www.irs.gov/form941 for instructions and the latest. Web we last updated the employer's quarterly federal tax return in july 2022, so this is the latest version.

Use The March 2022 Revision Of Form 941 Only To Report Taxes For The Quarter Ending March 31, 2022.

Form 941 , employer’s quarterly. April, may, june read the separate instructions before completing this form. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web report for this quarter of 2022 (check one.) 1:

October, November, December Name (Not Your Trade Name) Calendar Year (Also Check Quarter).

If changes in law require additional changes to form 941, the. Web can i still fill out form 941 for 2021? Web up to $32 cash back in february 2022, the irs issued a new version of form 941 that employers need to use beginning with q1’s tax filings. A form 941 is a tax form used by employers to report their quarterly federal tax liability.

However, If You Pay An Amount With Form 941 That Should’ve Been Deposited, You May Be Subject To A Penalty.

March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. October, november, december go to www.irs.gov/form941 for instructions and the latest. Web form 941 for 2023: 03 export or print immediately.

Web Get Your Form 941 (June 2022) In 3 Easy Steps.

Form 941 is used by employers. Web finalized versions of the 2022 form 941, its instructions, and schedules were issued feb. You can download or print. It was revised to account for.