Form 8995 Instruction

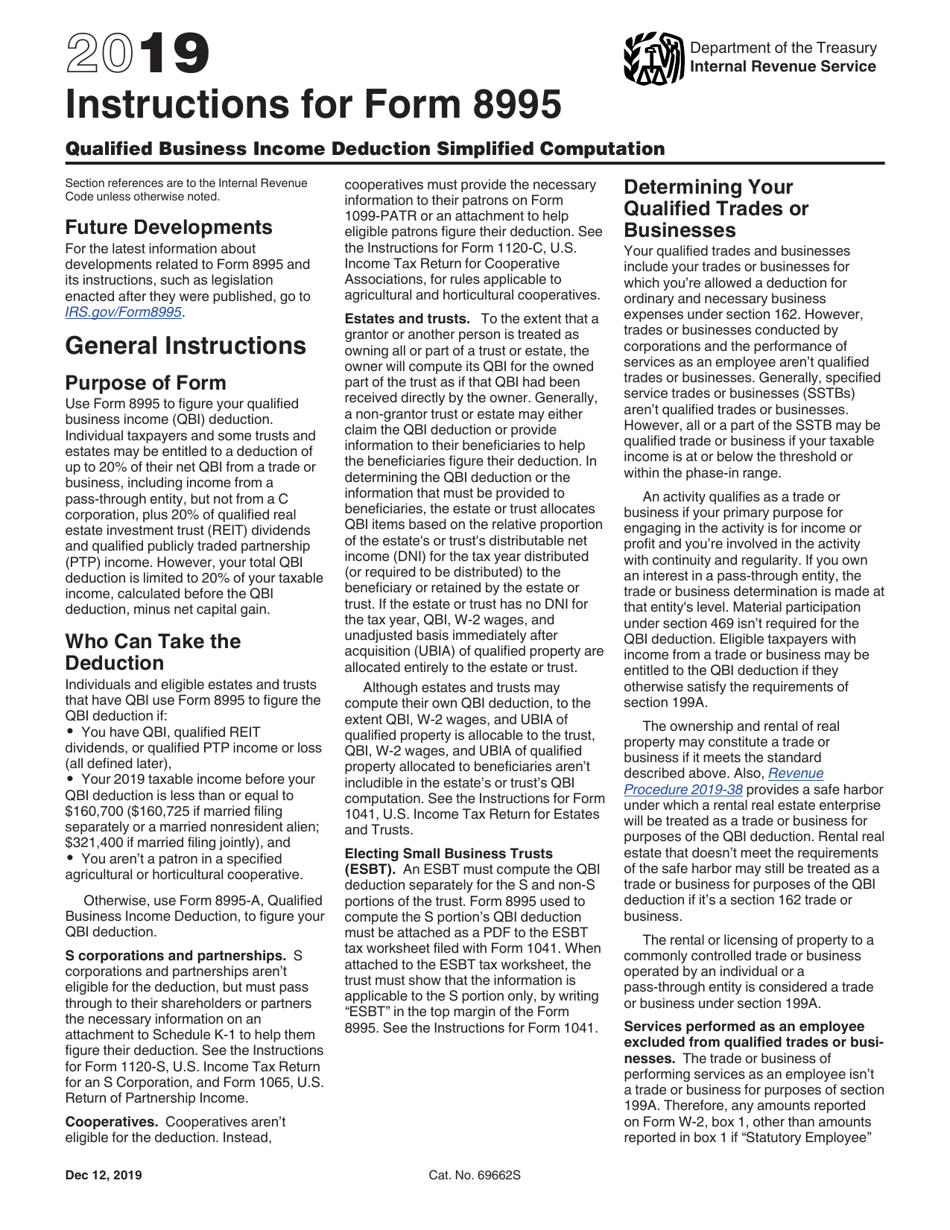

Form 8995 Instruction - As with most tax issues, the. You can access it on the internal revenue service’s official website. Use separate schedules a, b, c, and/or d, as. By familiarizing yourself with the form's. The taxpayer has to use document to report certain. Web general instructions purpose of form use form 8995 to figure your qualified business income (qbi) deduction. Department of the treasury internal revenue service. Web the 2020 draft instructions to form 8995 contain a significant change from their 2019 counterpart. Include the following schedules (their specific instructions are. Individual taxpayers and some trusts and estates may be.

Web general instructions purpose of form use form 8995 to figure your qualified business income (qbi) deduction. Individual taxpayers and some trusts and estates may be. Include the following schedules (their specific instructions are. Individual taxpayers and some trusts and estates may be. Web the taxpayer should use irs form 8995 with instructions if the taxpayer has a branch or a subsidiary in a foreign country. Web how can i find irs form 8995 instructions? The taxpayer has to use document to report certain. Web 2019 äéêèë¹ê¿åäé ¼åè åèã ¿ à à ¼ deduction for qualified business income »æ·èêã»äê å¼ ê¾» è»·éëèï Web the 2020 draft instructions to form 8995 contain a significant change from their 2019 counterpart. Department of the treasury internal revenue service.

Web 2019 äéêèë¹ê¿åäé ¼åè åèã ¿ à à ¼ deduction for qualified business income »æ·èêã»äê å¼ ê¾» è»·éëèï The taxpayer has to use document to report certain. The 2019 form 8995 instructions provide: Include the following schedules (their specific instructions are. Web the 2020 draft instructions to form 8995 contain a significant change from their 2019 counterpart. Web general instructions purpose of form use form 8995 to figure your qualified business income (qbi) deduction. You can access it on the internal revenue service’s official website. Web general instructions purpose of form use form 8995 to figure your qualified business income (qbi) deduction. Include the following schedules (their specific instructions are. Use this form to figure your qualified business income deduction.

Form 8995 Fill Out and Sign Printable PDF Template signNow

Include the following schedules (their specific instructions are. Web how can i find irs form 8995 instructions? The 2019 form 8995 instructions provide: Web general instructions purpose of form use form 8995 to figure your qualified business income (qbi) deduction. Web in conclusion, understanding tax form 8995 instructions is essential in maximizing your qbi deduction and ensuring accurate tax filings.

Solved Rob Wriggle operates a small plumbing supplies business as a

Use separate schedules a, b, c, and/or d, as. Use this form to figure your qualified business income deduction. By familiarizing yourself with the form's. Department of the treasury internal revenue service. The instructions provide detailed information on.

What Is Form 8995 And 8995a Ethel Hernandez's Templates

Web in conclusion, understanding tax form 8995 instructions is essential in maximizing your qbi deduction and ensuring accurate tax filings. The 2019 form 8995 instructions provide: Individual taxpayers and some trusts and estates may be. The taxpayer has to use document to report certain. Web the 2020 draft instructions to form 8995 contain a significant change from their 2019 counterpart.

Download Instructions for IRS Form 8995 Qualified Business

Web 2019 äéêèë¹ê¿åäé ¼åè åèã ¿ à à ¼ deduction for qualified business income »æ·èêã»äê å¼ ê¾» è»·éëèï By familiarizing yourself with the form's. Use this form if your taxable income, before your qualified business income deduction, is at or below $163,300 ($326,600 if married filing jointly), and you aren’t a. As with most tax issues, the. Department of the.

Form 8995 Basics & Beyond

You can access it on the internal revenue service’s official website. The taxpayer has to use document to report certain. The instructions provide detailed information on. Use separate schedules a, b, c, and/or d, as. By familiarizing yourself with the form's.

Draft Instructions to 2019 Form 8995 Contain More Informal IRS Guidance

As with most tax issues, the. The instructions provide detailed information on. Web the 2020 draft instructions to form 8995 contain a significant change from their 2019 counterpart. Use this form if your taxable income, before your qualified business income deduction, is at or below $163,300 ($326,600 if married filing jointly), and you aren’t a. Include the following schedules (their.

Draft 2019 Form 1120S Instructions Adds New K1 Statements for §199A

Web general instructions purpose of form use form 8995 to figure your qualified business income (qbi) deduction. Individual taxpayers and some trusts and estates may be. Department of the treasury internal revenue service. Web the 2020 draft instructions to form 8995 contain a significant change from their 2019 counterpart. Include the following schedules (their specific instructions are.

Draft Instructions to 2019 Form 8995 Contain More Informal IRS Guidance

Attach to your tax return. The 2019 form 8995 instructions provide: Use separate schedules a, b, c, and/or d, as. The taxpayer has to use document to report certain. Web the 2020 draft instructions to form 8995 contain a significant change from their 2019 counterpart.

8995 A Fill and Sign Printable Template Online US Legal Forms

Web general instructions purpose of form use form 8995 to figure your qualified business income (qbi) deduction. Department of the treasury internal revenue service. You can access it on the internal revenue service’s official website. Use this form to figure your qualified business income deduction. The instructions provide detailed information on.

IRS Form 8995 Download Fillable PDF or Fill Online Qualified Business

Individual taxpayers and some trusts and estates may be. Web the taxpayer should use irs form 8995 with instructions if the taxpayer has a branch or a subsidiary in a foreign country. Include the following schedules (their specific instructions are. Use this form to figure your qualified business income deduction. Web the 2020 draft instructions to form 8995 contain a.

As With Most Tax Issues, The.

Web the 2020 draft instructions to form 8995 contain a significant change from their 2019 counterpart. Department of the treasury internal revenue service. Web general instructions purpose of form use form 8995 to figure your qualified business income (qbi) deduction. Web in conclusion, understanding tax form 8995 instructions is essential in maximizing your qbi deduction and ensuring accurate tax filings.

Use Separate Schedules A, B, C, And/Or D, As.

Web general instructions purpose of form use form 8995 to figure your qualified business income (qbi) deduction. The instructions provide detailed information on. Include the following schedules (their specific instructions are. By familiarizing yourself with the form's.

The 2019 Form 8995 Instructions Provide:

The taxpayer has to use document to report certain. Use this form to figure your qualified business income deduction. Web how can i find irs form 8995 instructions? Include the following schedules (their specific instructions are.

Individual Taxpayers And Some Trusts And Estates May Be.

Individual taxpayers and some trusts and estates may be. Web 2019 äéêèë¹ê¿åäé ¼åè åèã ¿ à à ¼ deduction for qualified business income »æ·èêã»äê å¼ ê¾» è»·éëèï Use this form if your taxable income, before your qualified business income deduction, is at or below $163,300 ($326,600 if married filing jointly), and you aren’t a. Attach to your tax return.