Form 8886 Filing Threshold

Form 8886 Filing Threshold - Web any taxpayer, including an individual, trust, estate, partnership, s corporation, or other corporation, that participates in a reportable transaction and is. Web we last updated the reportable transaction disclosure statement in february 2023, so this is the latest version of form 8886, fully updated for tax year 2022. Web losses that must be reported on forms 8886 and 8918. Web if you are filing more than one form 8886 with your tax return, sequentially number each form 8886 and enter the statement number for this form 8886. If a taxpayer claims a loss under § 165 of at least one of the following amounts on a tax return, then the taxpayer has. Web the instructions to form 8886, reportable transaction disclosure statement. Web if you filed federal form 8886, reportable transaction disclosure statement, with the irs, enter an “x” in part 3. Any taxpayer participating in a multiple or single employer 419 plan or a 79 plan using. Web when and how to file. See form 8886, reportable transaction disclosure statement on.

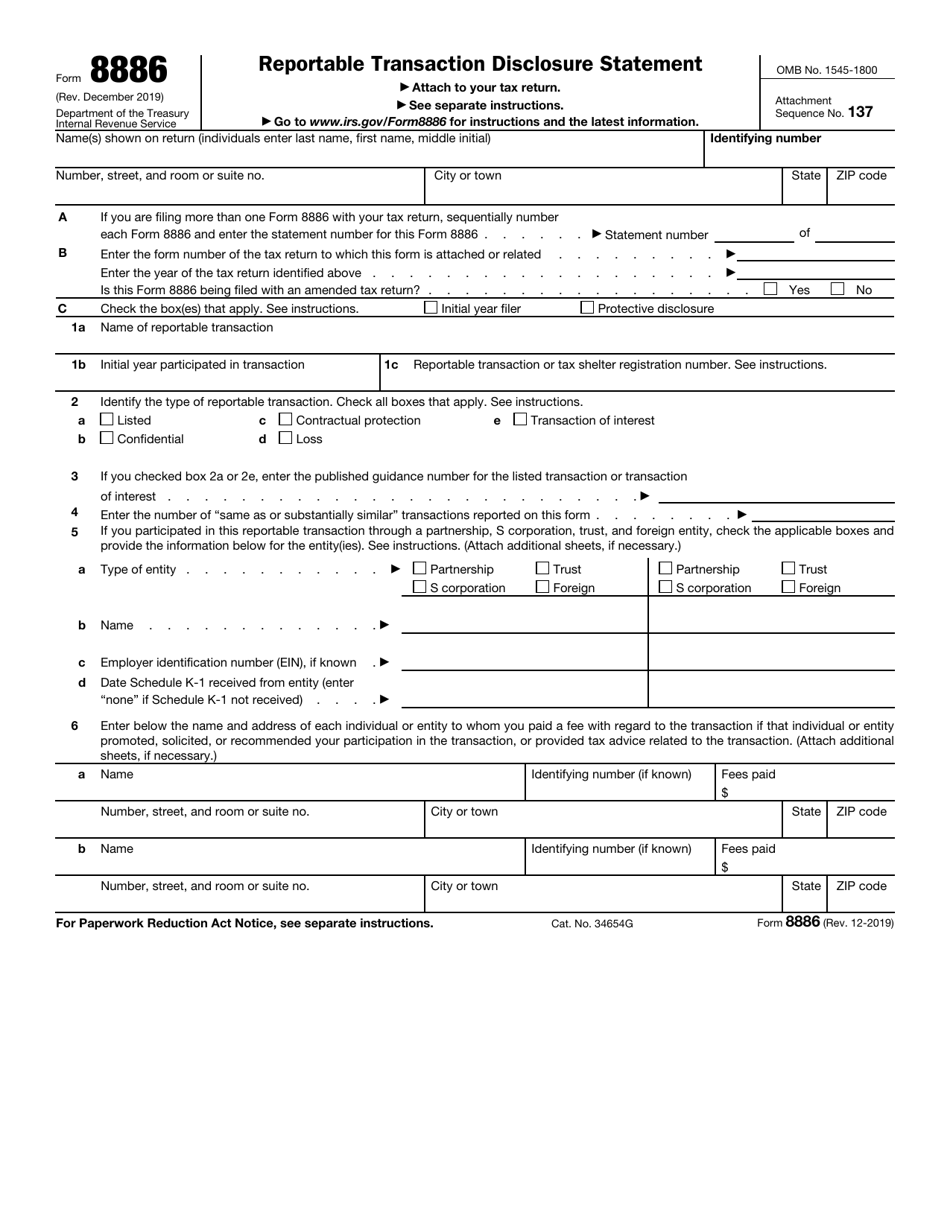

Form 8886 is used to. Web to file a federal tax return or information return must file form 8886. Web reportable transaction disclosure statement for paperwork reduction act notice, see separate instructions. Web form 8886 filing threshold for a loss transaction is $2 million in a single year or $4 million in a combination of years. Web if you are filing more than one form 8886 with your tax return, sequentially number each form 8886 and enter the statement number for this form 8886. Web attach the federal form 8886, reportable transaction disclosure statement, to the back of the california return along with any other supporting schedules. Web if you filed federal form 8886, reportable transaction disclosure statement, with the irs, enter an “x” in part 3. Attach form 8886 to your income tax return or information return (including a partnership, s corporation, or trust return), including amended. Web the ftb may impose penalties if the partnership fails to file federal form 8886, federal form 8918, material advisor disclosure statement, or any other required information. Web information about form 8886, reportable transaction disclosure statement, including recent updates, related forms and instructions on how to file.

Any taxpayer participating in a multiple or single employer 419 plan or a 79 plan using. The form is two pages. The instructions to form 8886 (available at irs.gov ) provide a specific explanation of what. Additionally, they are required to send copies of all of the initial year filings of. Web reportable transaction disclosure statement for paperwork reduction act notice, see separate instructions. Attach form 8886 to your income tax return or information return (including a partnership, s corporation, or trust return), including amended. Web to file a federal tax return or information return must file form 8886. Form 8886 is used to. Web a taxpayer required to disclose their participation in a transaction of interest must file a form 8886, reportable transaction disclosure statement. If a taxpayer claims a loss under § 165 of at least one of the following amounts on a tax return, then the taxpayer has.

Why Taxes Are So High In Canada Post Spotwalls

Attach form 8886 to your income tax return or information return (including a partnership, s corporation, or trust return), including amended. Web the disclosures are made by filing a form 8886, reportable transaction disclosure statement, with the taxpayer’s original or amended return or application for a refund for. Web taxpayers must use the most current version of form 8886 as.

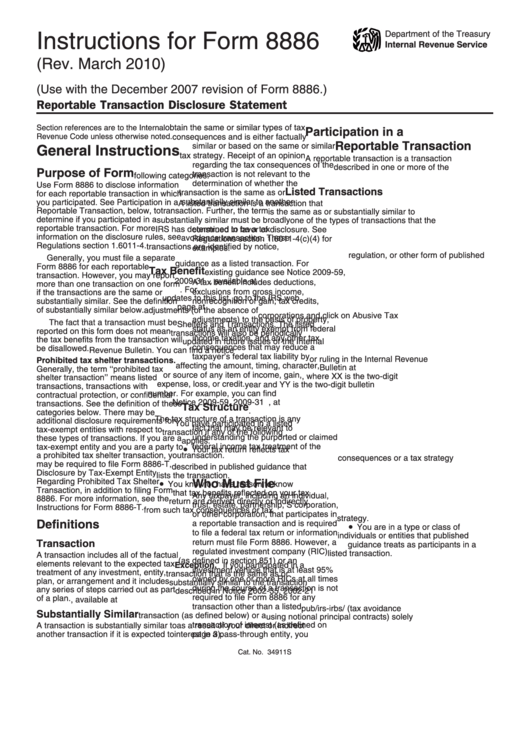

Instructions For Form 8886 Reportable Transaction Disclosure

Web losses that must be reported on forms 8886 and 8918. If this is the first time the. Web attach the federal form 8886, reportable transaction disclosure statement, to the back of the california return along with any other supporting schedules. Additionally, they are required to send copies of all of the initial year filings of. The form is two.

American Rescue Plan Act (2021) lowers filing threshold for Form 1099K

Web reportable transaction disclosure statement for paperwork reduction act notice, see separate instructions. If this is the first time the. Web a taxpayer required to disclose their participation in a transaction of interest must file a form 8886, reportable transaction disclosure statement. Web we last updated the reportable transaction disclosure statement in february 2023, so this is the latest version.

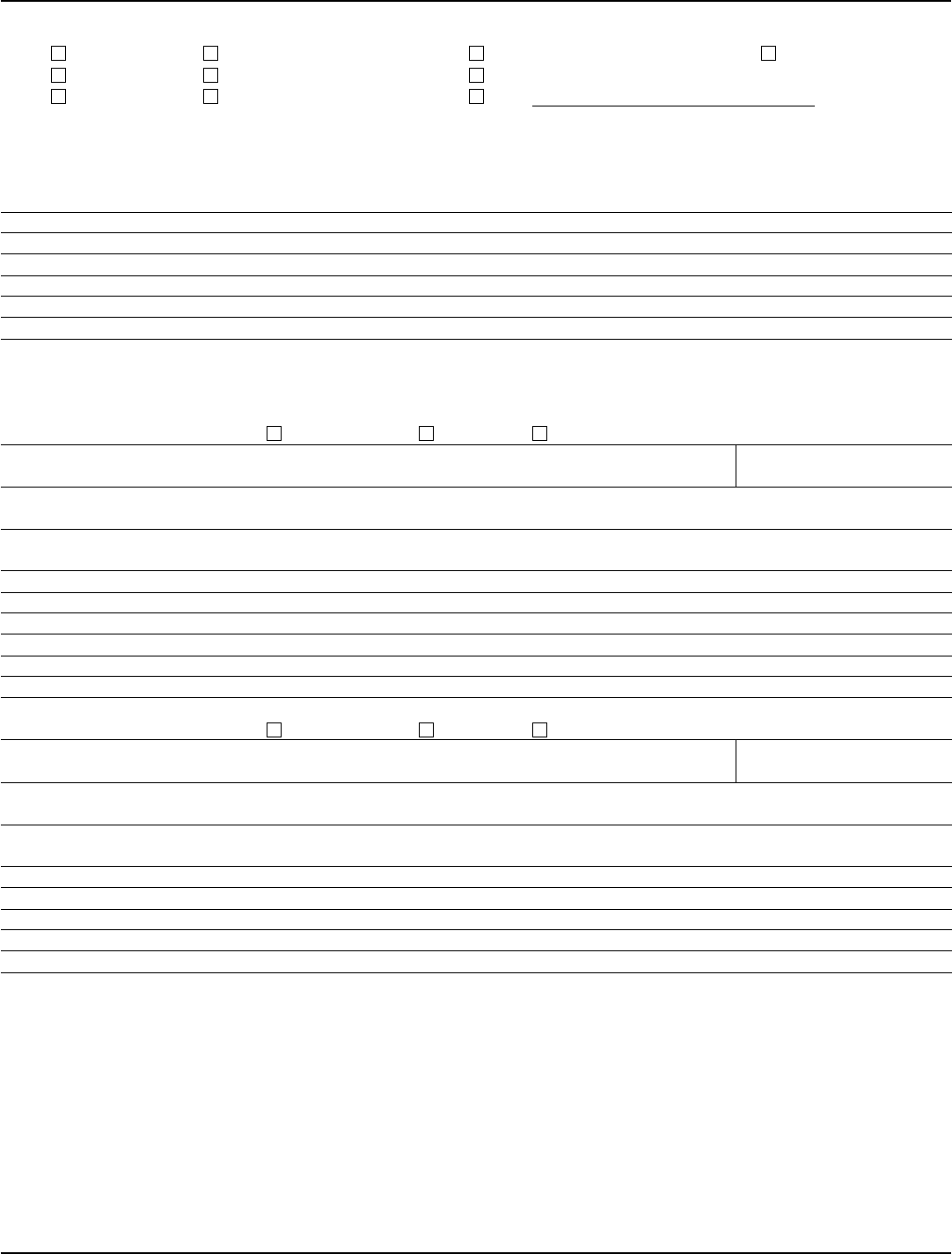

Form CT8886 Download Printable PDF or Fill Online Connecticut Listed

Web taxpayers must use the most current version of form 8886 as posted on irs.gov. Web if you filed federal form 8886, reportable transaction disclosure statement, with the irs, enter an “x” in part 3. Web the irs requires form 8886, reportable transaction disclosure statement, to be filed if a taxpayer has any reportable transactions during the taxable year. Web.

Form 8886 Edit, Fill, Sign Online Handypdf

Web to file a federal tax return or information return must file form 8886. Web reportable transaction disclosure statement for paperwork reduction act notice, see separate instructions. The form is two pages. Web contact filing form 8886 do i have to file irs form 8886 with my tax return? Web when and how to file.

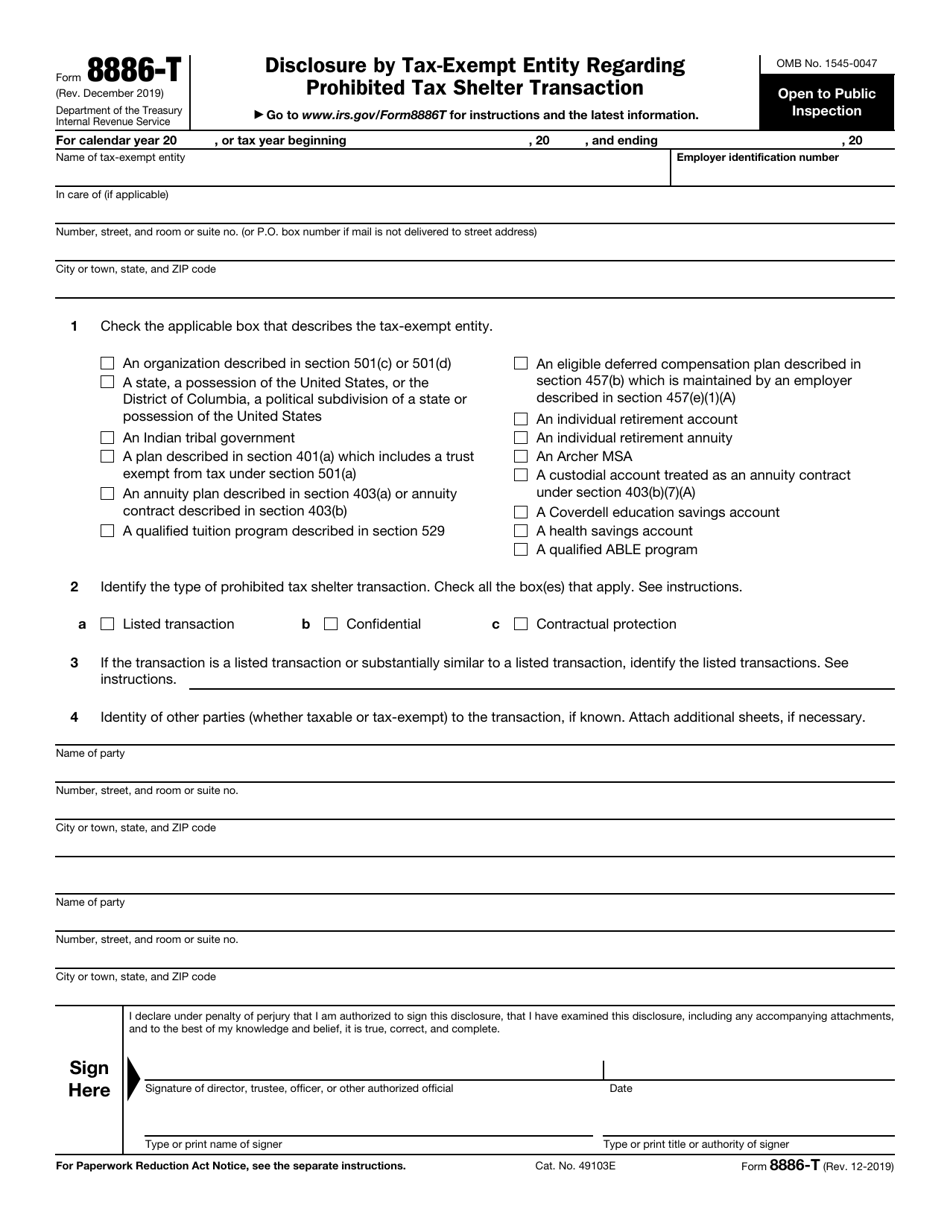

Form 8886T Disclosure by Tax Exempt Entity Regarding Prohibited Tax

If this is the first time the. Web information about form 8886, reportable transaction disclosure statement, including recent updates, related forms and instructions on how to file. Web contact filing form 8886 do i have to file irs form 8886 with my tax return? Web if you are filing more than one form 8886 with your tax return, sequentially number.

Fill Free fillable F8886 Form 8886 (Rev. December 2019) PDF form

Web the ftb may impose penalties if the partnership fails to file federal form 8886, federal form 8918, material advisor disclosure statement, or any other required information. Web a taxpayer required to disclose their participation in a transaction of interest must file a form 8886, reportable transaction disclosure statement. If this is the first time the. Any taxpayer participating in.

Form 8886 Reportable Transaction Disclosure Statement (2011) Free

Any taxpayer participating in a multiple or single employer 419 plan or a 79 plan using. Web if you are filing more than one form 8886 with your tax return, sequentially number each form 8886 and enter the statement number for this form 8886. Web the disclosures are made by filing a form 8886, reportable transaction disclosure statement, with the.

IRS Form 8886T Download Fillable PDF or Fill Online Disclosure by Tax

Web the ftb may impose penalties if the partnership fails to file federal form 8886, federal form 8918, material advisor disclosure statement, or any other required information. However, a regulated investment company (ric) (as defined in section 851) or an investment vehicle that is at. Web if you are filing more than one form 8886 with your tax return, sequentially.

IRS Form 8886 Download Fillable PDF or Fill Online Reportable

Web contact filing form 8886 do i have to file irs form 8886 with my tax return? Web form 8886 filing threshold for a loss transaction is $2 million in a single year or $4 million in a combination of years. Web reportable transaction disclosure statement for paperwork reduction act notice, see separate instructions. Web information about form 8886, reportable.

Web When And How To File.

Web if you are filing more than one form 8886 with your tax return, sequentially number each form 8886 and enter the statement number for this form 8886. If a taxpayer claims a loss under § 165 of at least one of the following amounts on a tax return, then the taxpayer has. Web any taxpayer, including an individual, trust, estate, partnership, s corporation, or other corporation, that participates in a reportable transaction and is. If this is the first time the.

Web Losses That Must Be Reported On Forms 8886 And 8918.

The form is two pages. Web the instructions to form 8886, reportable transaction disclosure statement. Web we last updated the reportable transaction disclosure statement in february 2023, so this is the latest version of form 8886, fully updated for tax year 2022. Web the ftb may impose penalties if the partnership fails to file federal form 8886, federal form 8918, material advisor disclosure statement, or any other required information.

Web Reportable Transaction Disclosure Statement For Paperwork Reduction Act Notice, See Separate Instructions.

However, a regulated investment company (ric) (as defined in section 851) or an investment vehicle that is at. Web form 8886 filing threshold for a loss transaction is $2 million in a single year or $4 million in a combination of years. The instructions to form 8886 (available at irs.gov ) provide a specific explanation of what. Web a taxpayer required to disclose their participation in a transaction of interest must file a form 8886, reportable transaction disclosure statement.

Any Taxpayer Participating In A Multiple Or Single Employer 419 Plan Or A 79 Plan Using.

Web attach the federal form 8886, reportable transaction disclosure statement, to the back of the california return along with any other supporting schedules. Web the irs requires form 8886, reportable transaction disclosure statement, to be filed if a taxpayer has any reportable transactions during the taxable year. Web taxpayers must use the most current version of form 8886 as posted on irs.gov. Web the disclosures are made by filing a form 8886, reportable transaction disclosure statement, with the taxpayer’s original or amended return or application for a refund for.