Form 8880 Turbotax

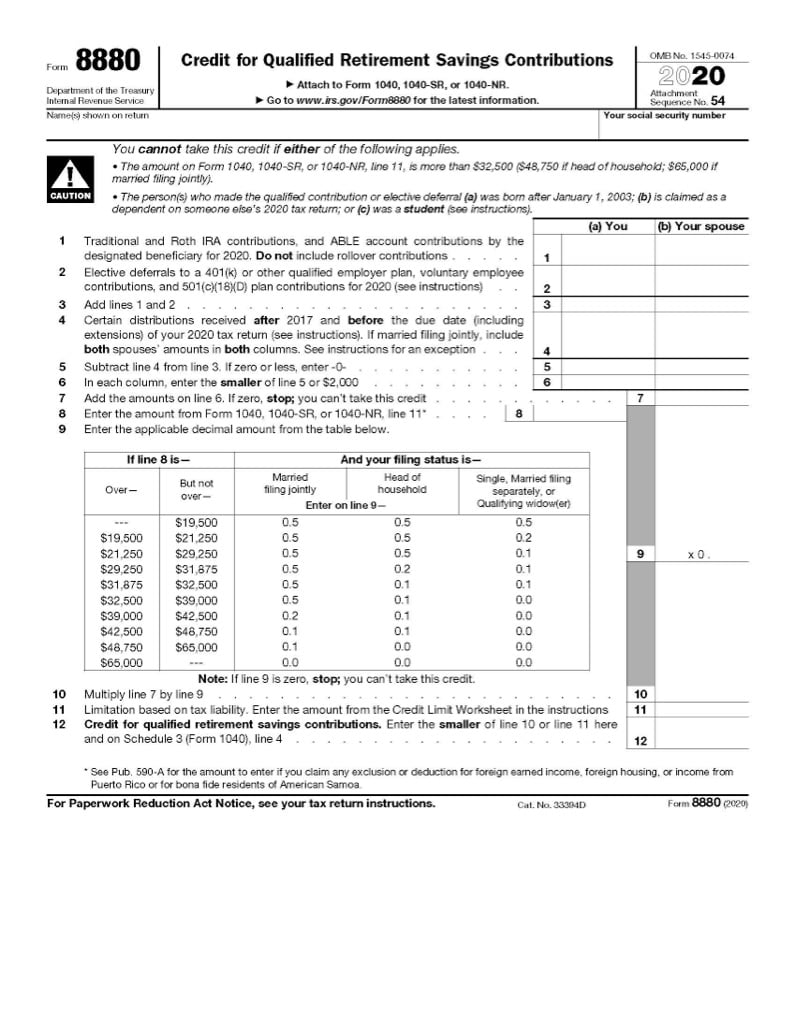

Form 8880 Turbotax - I believe i am entitled to claim a savings credit on form 8880. There is no worksheet to review or analyze. Turbotax says i do not qualify. Solved•by intuit•8•updated july 13, 2022. Web 8880 you cannot take this credit if either of the following applies. Web what are the retirement savings contributions credit (form 8880) requirements? Web irs form 8880 is used specifically for the retirement saver’s credit. Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. Web form 8880 i'm stumped. • the person(s) who made the.

• the person(s) who made the. Because of this i don't know how to even proceed. I'm not even sure if i qualify for it yet my turbo tax says i do. This is where you’ll report your income to determine eligibility and all of the contributions you. I believe i am entitled to claim a savings credit on form 8880. To claim the credit, you must complete irs form 8880 and include it with your tax return. Web beginning in 2018, as part of a provision contained in the tax cuts and jobs act of 2017, a retirement savings contribution credit may be claimed for the amount of contributions. Solved•by intuit•8•updated july 13, 2022. Web key takeaways irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan. Web • form 8880, credit for qualified retirement savings contributions, is used to claim this credit.

Web • form 8880, credit for qualified retirement savings contributions, is used to claim this credit. I'm not even sure if i qualify for it yet my turbo tax says i do. Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. Check box 12, code d , which displays amounts you. I believe i am entitled to claim a savings credit on form 8880. Generating qualified retirement savings contributions for form 8880. $65,000 if married filing jointly). The form is straightforward and will walk you through the steps needed (and. Web see form 8880, credit for qualified retirement savings contributions, for more information. In proconnect tax, when you.

What Is the IRS Form 8880? TurboTax Tax Tips & Videos

The form is straightforward and will walk you through the steps needed (and. Web 8880 you cannot take this credit if either of the following applies. Easily sort by irs forms to find the product that best fits your tax. Select not applicable to clear out any selection made. Depending on your adjusted gross income.

TurboTax Deluxe 2014 Fed + State + Fed Efile Tax Software

Web form 8880 i'm stumped. Web beginning in 2018, as part of a provision contained in the tax cuts and jobs act of 2017, a retirement savings contribution credit may be claimed for the amount of contributions. Turbotax says i do not qualify. Web we last updated the credit for qualified retirement savings contributions in december 2022, so this is.

Turbotax Form / Breanna Form 2106 Expense Type Must Be Entered

Solved•by intuit•8•updated july 13, 2022. Two key pieces of information you need before preparing form 8880 is the agi you calculate on your income tax return and documentation that reports your total retirement account contributions for the year. Web form 8880 i'm stumped. To claim the credit, you must complete irs form 8880 and include it with your tax return..

Tax Center Forms, FAQ and TurboTax Discounts USAA

Web how do i fill out a form 8880? For tax years prior to 2018, you can only claim the savers. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Web what are the retirement savings contributions credit (form 8880) requirements? Solved•by intuit•8•updated july 13, 2022.

TurboTax 2022 Form 1040 Credits for Retirement Savings Contributions

There is no worksheet to review or analyze. Web use form 8880. Web see form 8880, credit for qualified retirement savings contributions, for more information. Web 8880 you cannot take this credit if either of the following applies. To claim the credit, you must complete irs form 8880 and include it with your tax return.

Form 8880 Tax Incentives For Retirement Account —

Depending on your adjusted gross income. Solved•by intuit•8•updated july 13, 2022. Web form 8880 i'm stumped. Web • form 8880, credit for qualified retirement savings contributions, is used to claim this credit. I believe i am entitled to claim a savings credit on form 8880.

SimpleTax Form 8880 YouTube

Web 8880 you cannot take this credit if either of the following applies. Web • form 8880, credit for qualified retirement savings contributions, is used to claim this credit. Web what are the retirement savings contributions credit (form 8880) requirements? Select not applicable to clear out any selection made. You may be eligible to claim the retirement savings contributions credit,.

Form 8880 Claiming the Saver’s Credit Jackson Hewitt

There is no worksheet to review or analyze. For tax years prior to 2018, you can only claim the savers. The irs tax form needed to file for the saver's credit is form 8880. Web 8880 you cannot take this credit if either of the following applies. Check box 12, code d , which displays amounts you.

turbotax报税 form 2441 line 2c 税务 美卡论坛

Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. $65,000 if married filing jointly). Because of this i don't know how to even proceed. Solved•by intuit•8•updated july 13, 2022. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software.

Solved Form 8880 Line 4 Certain distributions Is TurboTax Doing It

Select not applicable to clear out any selection made. Easily sort by irs forms to find the product that best fits your tax. $65,000 if married filing jointly). Generating qualified retirement savings contributions for form 8880. Web key takeaways irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement.

Depending On Your Adjusted Gross Income.

I believe i am entitled to claim a savings credit on form 8880. Check box 12, code d , which displays amounts you. You may be eligible to claim the retirement savings contributions credit, also known as the. This is where you’ll report your income to determine eligibility and all of the contributions you.

Web Form 8880 I'm Stumped.

Web what are the retirement savings contributions credit (form 8880) requirements? $65,000 if married filing jointly). Web how do i fill out a form 8880? • the person(s) who made the.

Web Irs Form 8880 Is Used Specifically For The Retirement Saver’s Credit.

Solved•by intuit•8•updated july 13, 2022. Generating qualified retirement savings contributions for form 8880. Web • form 8880, credit for qualified retirement savings contributions, is used to claim this credit. The irs tax form needed to file for the saver's credit is form 8880.

Web 8880 You Cannot Take This Credit If Either Of The Following Applies.

Select not applicable to clear out any selection made. There is no worksheet to review or analyze. Because of this i don't know how to even proceed. Web use form 8880.