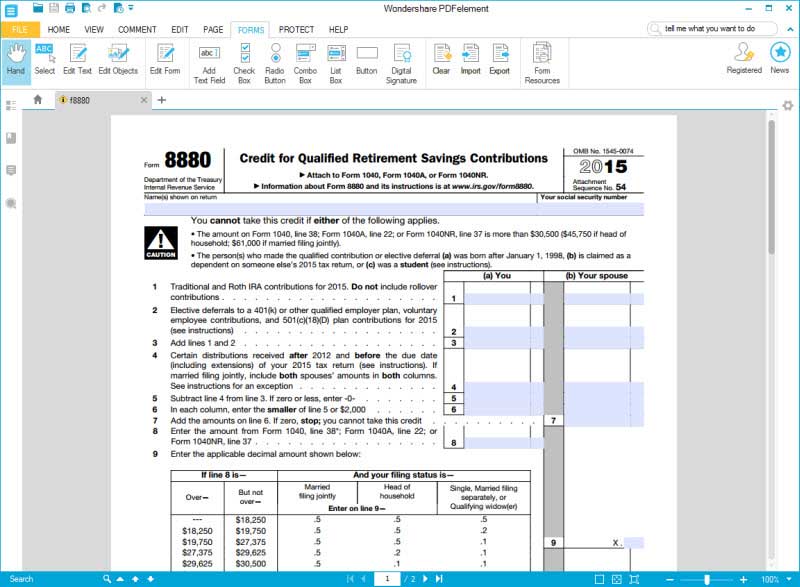

Form 8880 Pdf

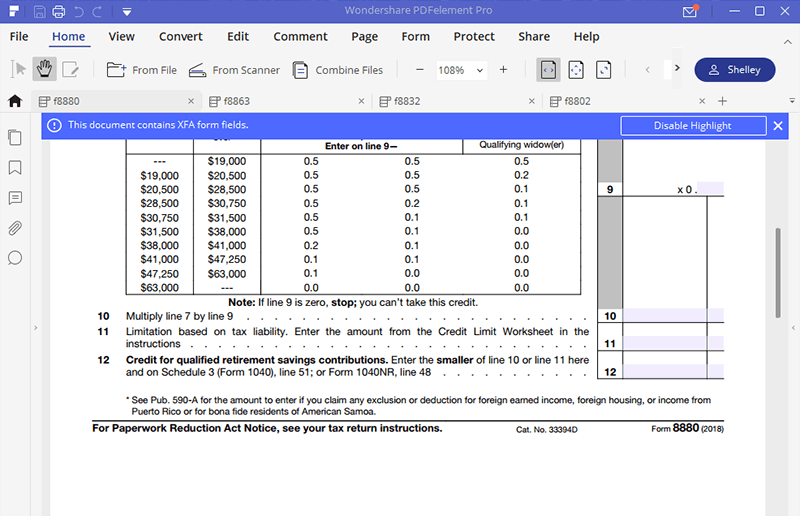

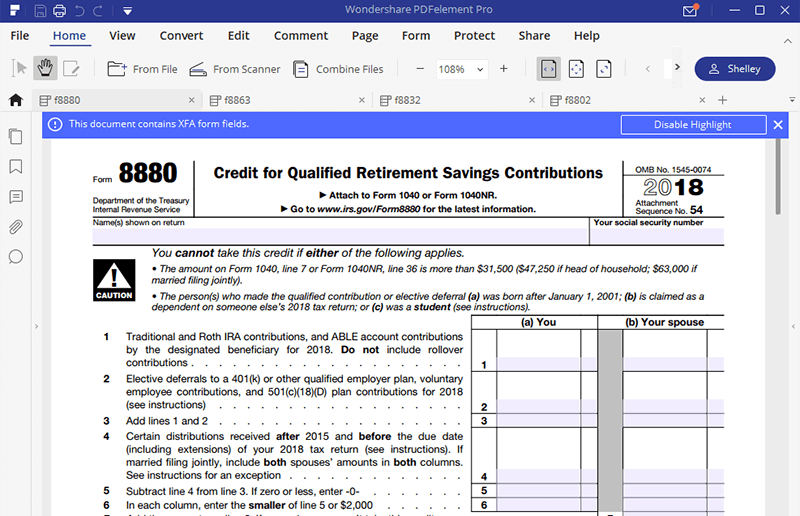

Form 8880 Pdf - Open the form fs 5396 in a pdfliner editor. Web irs form 8880 reports contributions made to qualified retirement savings accounts. Form 8880, credit for qualified retirement savings contributions form 8880, credit for qualified retirement. Web use form 8880 to figure the amount, if any, of your retirement savings. In order to claim the retirement savings. This is where you’ll report your income to determine eligibility and all of the contributions you. Web 12 credit for qualified retirement savings contributions. This credit can be claimed in. Credit for qualified retirement savings contributions: Complete, edit or print tax forms instantly.

Web the way to fill out the get and sign form 8880 instructionsw on the internet: Web irs form 8880 is used specifically for the retirement saver’s credit. Get ready for tax season deadlines by completing any required tax forms today. Web 10 11 12 see pub. Fill out the form with. Open the form fs 5396 in a pdfliner editor. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Web form 8880 is used to figure the amount, if any, of your retirement savings contributions credit that can be claimed in the current year. Register and subscribe now to work on your irs form 8880 & more fillable forms. Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver's credit).

Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Cocodoc is the best place for you to go, offering you a convenient and. Web a tax credit directly reduces the amount of tax you owe, unlike a deduction, which only decreases your taxable income. Open the form fs 5396 in a pdfliner editor. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Register and subscribe now to work on your irs form 8880 & more fillable forms. Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver's credit). In order to claim the retirement savings.

Education credit form 2017 Fill out & sign online DocHub

Web irs form 8880 is used specifically for the retirement saver’s credit. Ad complete irs tax forms online or print government tax documents. This credit can be claimed in. To begin the document, utilize the fill camp; Obtain a digital copy of the form in pdf format.

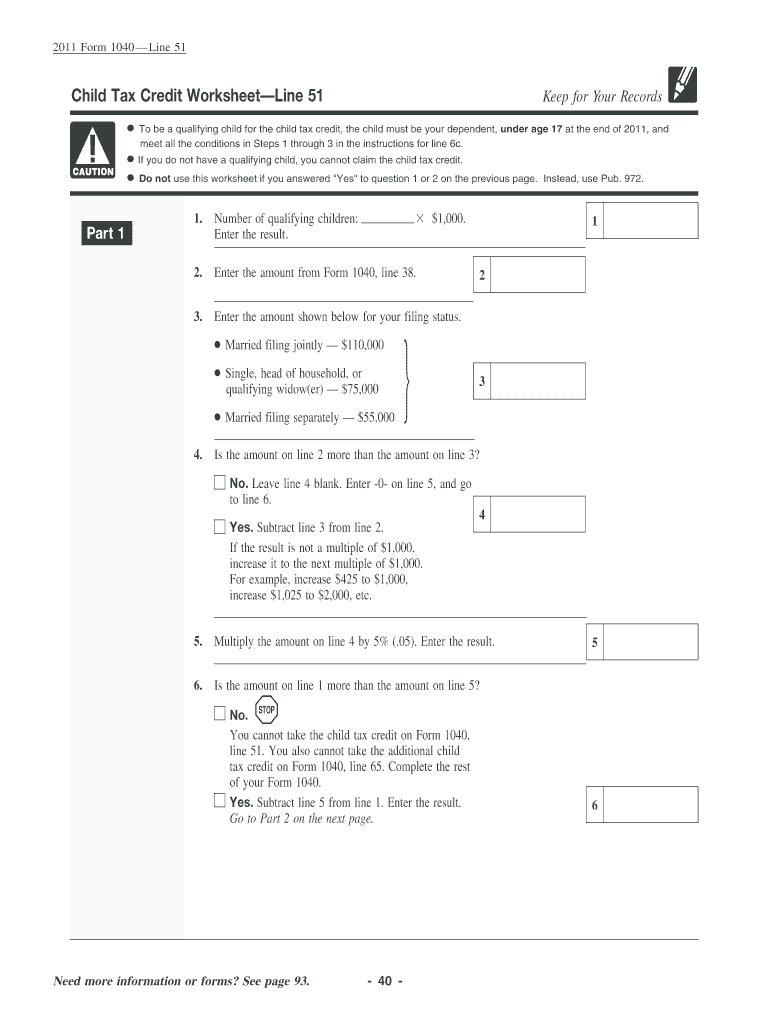

Child Tax Credit Worksheet Parents, this is what happens to your

Fill out the form with. Taxpayers may be eligible for. Credit for qualified retirement savings contributions: Web 12 credit for qualified retirement savings contributions. Complete, edit or print tax forms instantly.

Retirement plan 8880 Early Retirement

Web irs form 8880 is used specifically for the retirement saver’s credit. Web use form 8880 to figure the amount, if any, of your retirement savings. In order to claim the retirement savings. Credit for qualified retirement savings contributions: Web irs form 8880 reports contributions made to qualified retirement savings accounts.

Irs.gov 2014 Form 8880 Universal Network

Open the form fs 5396 in a pdfliner editor. Web purpose of form use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). In order to claim the retirement savings. Taxpayers may be eligible for. Use form 8880 to figure the amount, if any, of your retirement savings contributions.

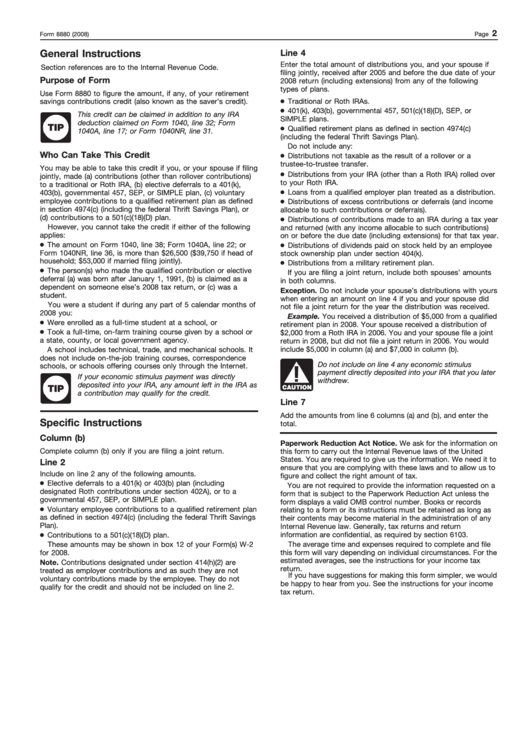

Instructions For Form 8880 2008 printable pdf download

This form determines whether you qualify for the retirement saver's credit and. Credit for qualified retirement savings contributions: This credit can be claimed in. Web here are the steps for completing and redacting the form online: Web a tax credit directly reduces the amount of tax you owe, unlike a deduction, which only decreases your taxable income.

8880 Form ≡ Fill Out Printable PDF Forms Online

Web irs form 8880 is used specifically for the retirement saver’s credit. Obtain a digital copy of the form in pdf format. Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver's credit). This is where you’ll report your income to determine eligibility and all of the contributions you. Web.

Ssurvivor Form 2106 Line 6

Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver's credit). Fillable, printable & blank pdf form for free | cocodoc looking for form 8880 to fill? This form determines whether you qualify for the retirement saver's credit and. Web up to $40 cash back do whatever you want with.

SimpleTax Form 8880 YouTube

Web • form 8880, credit for qualified retirement savings contributions, is used to claim this credit. Web here are the steps for completing and redacting the form online: Web purpose of form use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Web irs form 8880 reports contributions made.

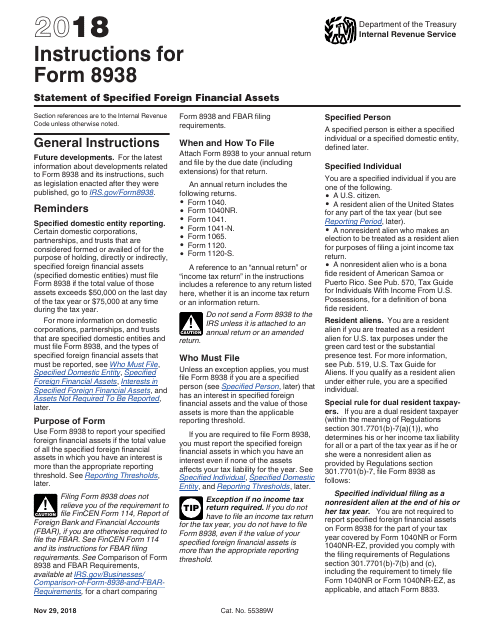

Download Instructions for IRS Form 8938 Statement of Specified Foreign

Web irs form 8880 reports contributions made to qualified retirement savings accounts. This credit can be claimed in. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Fillable, printable & blank pdf form for free | cocodoc looking for form 8880 to fill? Complete, edit or print.

IRS Form 8880 Get it Filled the Right Way

Web 10 11 12 see pub. Web a tax credit directly reduces the amount of tax you owe, unlike a deduction, which only decreases your taxable income. In order to claim the retirement savings. Obtain a digital copy of the form in pdf format. Web up to $40 cash back do whatever you want with a 2020 form 8880.

In Order To Claim The Retirement Savings.

Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. This credit can be claimed in. Form 8880, credit for qualified retirement savings contributions form 8880, credit for qualified retirement.

Sign Online Button Or Tick The Preview Image Of The Blank.

Enter the smaller of line 10 or line 11 here and on schedule 3 (form 1040), line 4. To begin the document, utilize the fill camp; Complete, edit or print tax forms instantly. Web form 8880 is used to figure the amount, if any, of your retirement savings contributions credit that can be claimed in the current year.

Use Form 8880 To Figure The Amount, If Any, Of Your Retirement Savings Contributions Credit (Also Known As The Saver's Credit).

Cocodoc is the best place for you to go, offering you a convenient and. Fillable, printable & blank pdf form for free | cocodoc looking for form 8880 to fill? Web here are the steps for completing and redacting the form online: Obtain a digital copy of the form in pdf format.

Credit For Qualified Retirement Savings Contributions:

Web irs form 8880 is used specifically for the retirement saver’s credit. This is where you’ll report your income to determine eligibility and all of the contributions you. Web a tax credit directly reduces the amount of tax you owe, unlike a deduction, which only decreases your taxable income. Web use form 8880 to figure the amount, if any, of your retirement savings.