Form 8857 Instructions

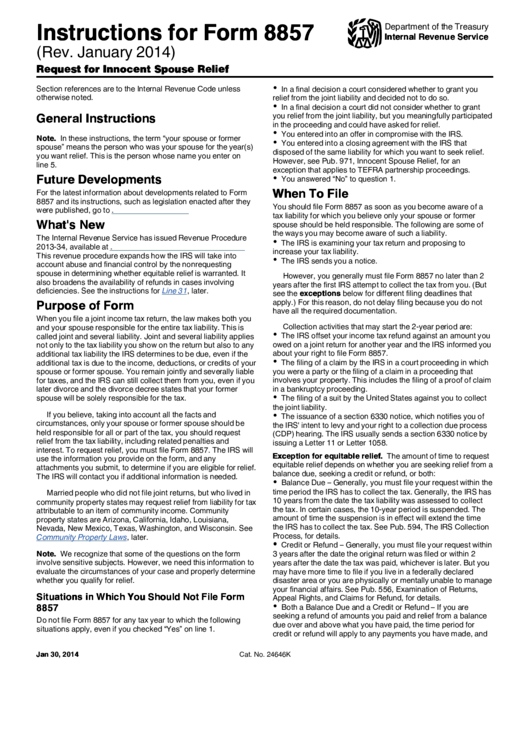

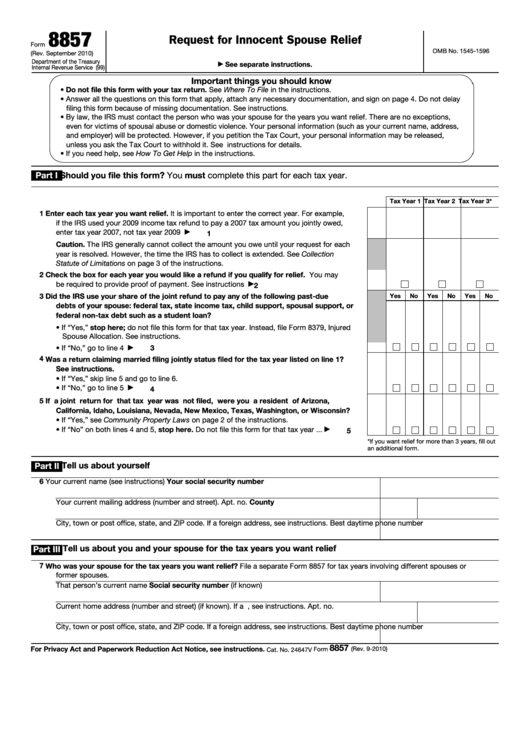

Form 8857 Instructions - Web information about form 8857, request for innocent spouse relief, including recent updates, related forms, and instructions on how to file. The instructions for form 8857 have helpful directions. Generally, the irs has 10 years to collect an amount you owe. The irs will use the information you provide on form 8857, and any additional documentation you submit, to determine if you’re eligible for relief. Web form 8857 instructions: You need to file form 8857 as soon as you find out that you are being held liable for taxes you believe should only be your spouse’s. June 2021) department of the treasury internal revenue service (99) request for innocent spouse relief. Web instructions for form 8857(rev. You have two years to file from the time the irs first tries to collect from you to do so, but there are some exceptions. What’s new however, you must file form 8857 no later than 2 years after form 8857 has been revised to reduce the number of mistakes the first irs attempt to collect the tax from you that occurs after

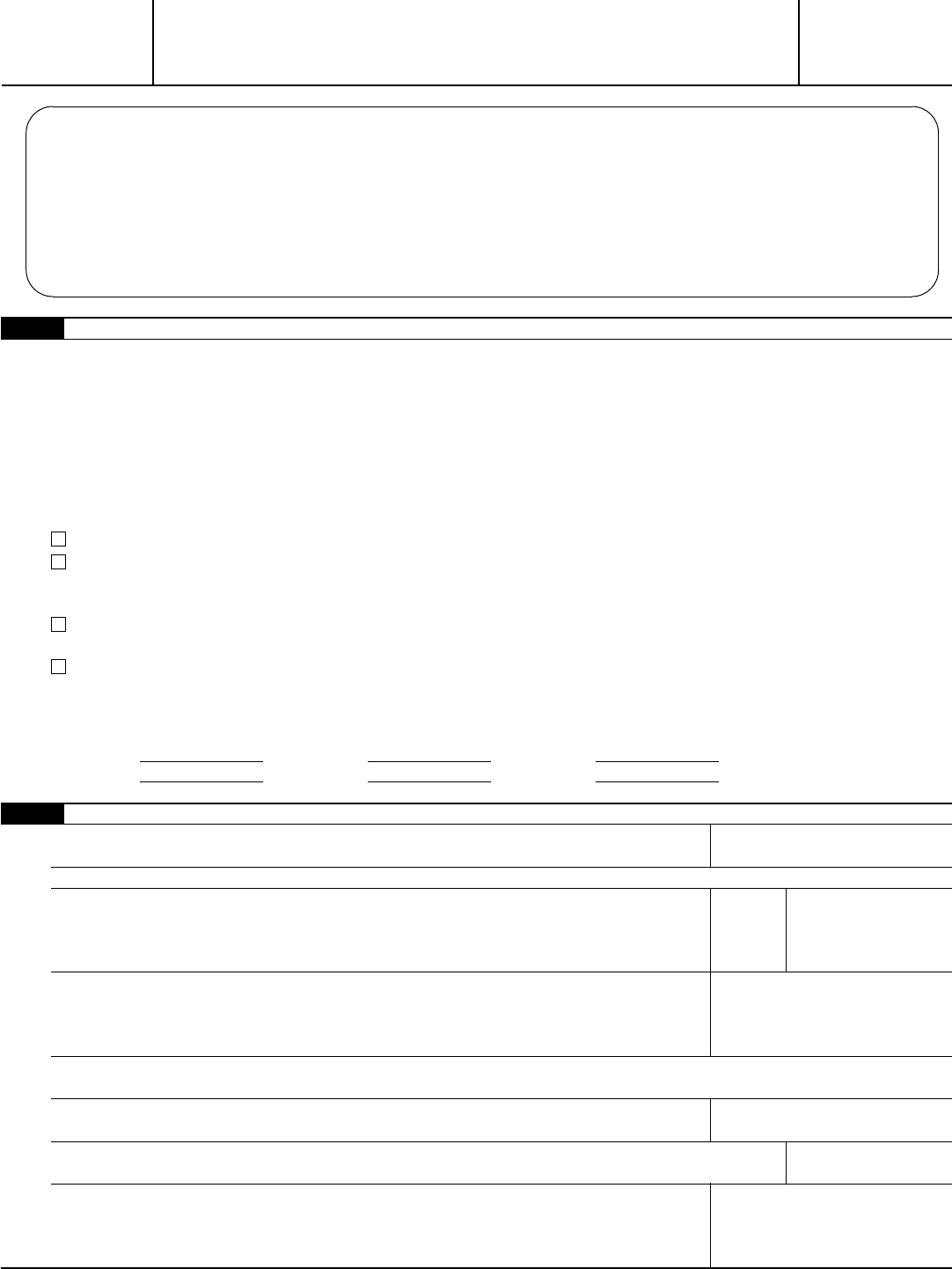

Web to request relief, file form 8857, request for innocent spouse relief. • the irs sends you a notice. Web file form 8857 at one of the addresses or send it to the fax number shown in the instructions for form 8857. In these instructions, the term “your spouse or former spouse” means the person who was your spouse for the. Web information about form 8857, request for innocent spouse relief, including recent updates, related forms, and instructions on how to file. Web to request relief, file irs form 8857, request for innocent spouse relief. Web general instructions • the irs is examining your tax return and proposing to increase your tax liability. You filed a joint return. You have two years to file from the time the irs first tries to collect from you to do so, but there are some exceptions. Form 8857 is used to request relief from tax liability when a spouse or former spouse should be.

What’s new however, you must file form 8857 no later than 2 years after form 8857 has been revised to reduce the number of mistakes the first irs attempt to collect the tax from you that occurs after Form 8857 is used to request relief from tax liability when a spouse or former spouse should be. You filed a joint return. Web file form 8857 at one of the addresses or send it to the fax number shown in the instructions for form 8857. Web to request relief, file irs form 8857, request for innocent spouse relief. You need to file form 8857 as soon as you find out that you are being held liable for taxes you believe should only be your spouse’s. Important things you should know • do not file this form with your tax return. The instructions for form 8857 have helpful directions. In these instructions, the term “your spouse or former spouse” means the person who was your spouse for the. June 2021) department of the treasury internal revenue service (99) request for innocent spouse relief.

Form 8857 Edit, Fill, Sign Online Handypdf

June 2021) department of the treasury internal revenue service (99) request for innocent spouse relief. Do not file it with the employee assigned to examine your return. The instructions for form 8857 have helpful directions. What’s new however, you must file form 8857 no later than 2 years after form 8857 has been revised to reduce the number of mistakes.

Form 8857 Request for Innocent Spouse Relief (2014) Free Download

Web to request relief, file irs form 8857, request for innocent spouse relief. Web instructions for form 8857(rev. The instructions for form 8857 have helpful directions. Web information about form 8857, request for innocent spouse relief, including recent updates, related forms, and instructions on how to file. You filed a joint return.

Instructions For Form 8857 (Rev. 2014) printable pdf download

• the irs sends you a notice. You have two years to file from the time the irs first tries to collect from you to do so, but there are some exceptions. Important things you should know • do not file this form with your tax return. Form 8857 is used to request relief from tax liability when a spouse.

Fillable Form 8857 Request For Innocent Spouse Relief printable pdf

The irs may grant innocent spouse relief if the requesting spouse meets the following criteria: Web information about form 8857, request for innocent spouse relief, including recent updates, related forms, and instructions on how to file. Web instructions for form 8857(rev. June 2021) request for innocent spouse relief department of the treasury internal revenue service section references are to the.

Form 8857 Edit, Fill, Sign Online Handypdf

Someone who prepares form 8857 but does not charge you should not sign it. Generally, the irs has 10 years to collect an amount you owe. Web generally, anyone you pay to prepare form 8857 must sign it and include their preparer tax identification number (ptin) in the space provided. The irs may grant innocent spouse relief if the requesting.

Form 8857 Instructions Fill Out and Sign Printable PDF Template signNow

You have two years to file from the time the irs first tries to collect from you to do so, but there are some exceptions. Web file form 8857 at one of the addresses or send it to the fax number shown in the instructions for form 8857. Web instructions for form 8857(rev. The irs will use the information you.

Form 8857 Edit, Fill, Sign Online Handypdf

You have two years to file from the time the irs first tries to collect from you to do so, but there are some exceptions. Web instructions for form 8857(rev. Form 8857 is used to request relief from tax liability when a spouse or former spouse should be. June 2021) request for innocent spouse relief department of the treasury internal.

Be Free of Financial Responsibility After a Divorce with IRS Form 8857

Web information about form 8857, request for innocent spouse relief, including recent updates, related forms, and instructions on how to file. Form 8857 is used to request relief from tax liability when a spouse or former spouse should be. The instructions for form 8857 have helpful directions. June 2021) request for innocent spouse relief department of the treasury internal revenue.

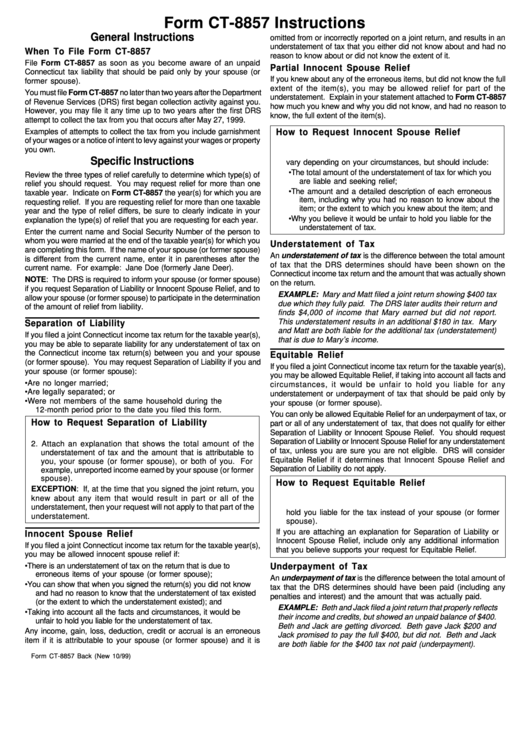

Form Ct8857 Instructions printable pdf download

You filed a joint return. The instructions for form 8857 have helpful directions. Web instructions for form 8857(rev. What’s new however, you must file form 8857 no later than 2 years after form 8857 has been revised to reduce the number of mistakes the first irs attempt to collect the tax from you that occurs after Web general instructions •.

IRS Form 8857 How to File

The irs will use the information you provide on irs form 8857, and any additional documentation you submit, to determine if you’re eligible for relief. Web to request relief, file irs form 8857, request for innocent spouse relief. • the irs sends you a notice. The irs may grant innocent spouse relief if the requesting spouse meets the following criteria:.

The Irs Will Use The Information You Provide On Form 8857, And Any Additional Documentation You Submit, To Determine If You’re Eligible For Relief.

You filed a joint return. The irs may grant innocent spouse relief if the requesting spouse meets the following criteria: You have two years to file from the time the irs first tries to collect from you to do so, but there are some exceptions. Form 8857 is used to request relief from tax liability when a spouse or former spouse should be.

Someone Who Prepares Form 8857 But Does Not Charge You Should Not Sign It.

Web general instructions • the irs is examining your tax return and proposing to increase your tax liability. Do not file it with the employee assigned to examine your return. Web file form 8857 at one of the addresses or send it to the fax number shown in the instructions for form 8857. The instructions for form 8857 have helpful directions.

June 2021) Request For Innocent Spouse Relief Department Of The Treasury Internal Revenue Service Section References Are To The Internal Revenue Code Unless Otherwise Noted.

What’s new however, you must file form 8857 no later than 2 years after form 8857 has been revised to reduce the number of mistakes the first irs attempt to collect the tax from you that occurs after Web instructions for form 8857(rev. In these instructions, the term “your spouse or former spouse” means the person who was your spouse for the. For instructions and the latest information.

You Need To File Form 8857 As Soon As You Find Out That You Are Being Held Liable For Taxes You Believe Should Only Be Your Spouse’s.

• the irs sends you a notice. Web to request relief, file form 8857, request for innocent spouse relief. The instructions for form 8857 have helpful directions. Web to request relief, file irs form 8857, request for innocent spouse relief.