Form 8832 Late Election Relief Examples

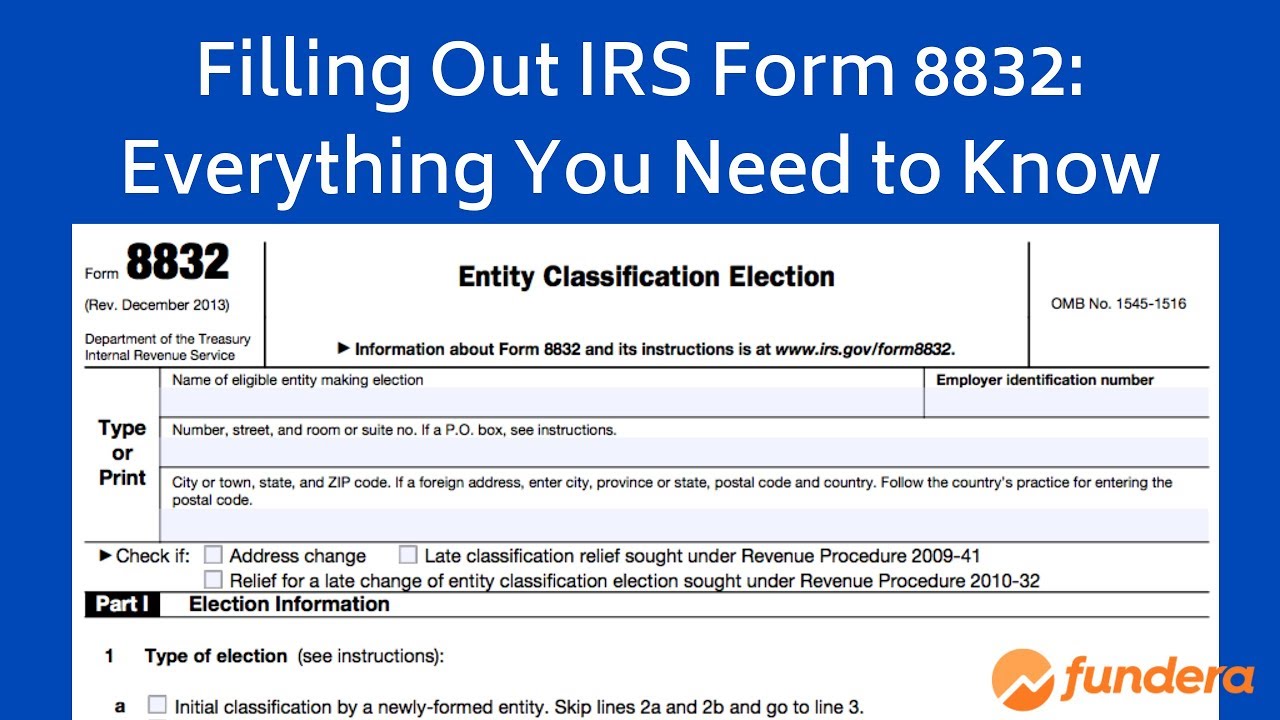

Form 8832 Late Election Relief Examples - Web hello, i need to complete a form 8832 to elect corporation status for my llc. Web share form 8832 is the document llcs submit to the irs to change their default tax classification. Web the first page looks like this: Most commonly, it’s used if you want your llc to be taxed as a. Web however, in order to be eligible for this simple procedure, (a) the election had to be for an entity which was newly formed under local law (as opposed to an election to change the. The entity did not timely file form 8832, the entity has a. You generally are not currently eligible to make the election (see instructions). You failed to obtain your requested classification because you hadn’t. Form 8832 is divided into two parts: Web late election relief.

Web form 8832 late election relief reasonable cause examples primarily include two categories of events: 3 does the eligible entity have more than one owner? Web the first page looks like this: Web information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. You generally are not currently eligible to make the election (see instructions). Web share form 8832 is the document llcs submit to the irs to change their default tax classification. The entity did not timely file form 8832, the entity has a. Form 8832 is divided into two parts: Web late election relief. Web hello, i need to complete a form 8832 to elect corporation status for my llc.

Web to make a late election under the provisions of the revenue procedure, an eligible entity must file a completed form 8832 with the applicable irs service center. You failed to obtain your requested classification because you hadn’t. 3 does the eligible entity have more than one owner? Web to make a late election under the provisions of the revenue procedure, an eligible entity must file a completed form 8832 with the applicable irs service center within three. Web the corrected form 8832, with the box checked entitled: Web share form 8832 is the document llcs submit to the irs to change their default tax classification. Web form 8832 late election relief reasonable cause examples primarily include two categories of events: Web by filing form 8832 with the irs, you can choose a tax status for your entity besides the default status. Web up to $32 cash back form 8832 (part ii) late election relief. Of course the form should normally be filed within 75 days after the effective date, but there is a late.

Form 8832 Fillable Online and PDF eSign Genie

Web to make a late election under the provisions of the revenue procedure, an eligible entity must file a completed form 8832 with the applicable irs service center. Web the first page looks like this: Late election relief who files irs form 8832? Web share form 8832 is the document llcs submit to the irs to change their default tax.

Irs Form 8832 Fillable Pdf Printable Forms Free Online

The entity did not timely file form 8832, the entity has a. Web the first page looks like this: Web to make a late election under the provisions of the revenue procedure, an eligible entity must file a completed form 8832 with the applicable irs service center. Most commonly, it’s used if you want your llc to be taxed as.

form 8832 late election relief reasonable cause examples Fill Online

Web the corrected form 8832, with the box checked entitled: Most commonly, it’s used if you want your llc to be taxed as a. You failed to obtain your requested classification because you hadn’t. The entity did not timely file form 8832, the entity has a. Web the proper procedure is to file the 8832 and then comply with the.

IRS Form 8832A Guide to Entity Classification Election

Web to make a late election under the provisions of the revenue procedure, an eligible entity must file a completed form 8832 with the applicable irs service center. Web however, in order to be eligible for this simple procedure, (a) the election had to be for an entity which was newly formed under local law (as opposed to an election.

USING FORM 8832 TO CHANGE THE US TAX CLASSIFICATION OF YOUR COMPANY

You llc failed to file form 8832 on time your accountant or. This part of form 8832 is only required if you are seeking late election relief (otherwise, you may skip it). Web introduction how do i complete irs form 8832? Most commonly, it’s used if you want your llc to be taxed as a. Web the first page looks.

Form 8832 Entity Classification Election (2013) Free Download

Web eligible for relief late change in classification no did the entity fail to obtain its requested change in classification solely because form 8832 was not filed timely? The entity did not timely file form 8832, the entity has a. Web the corrected form 8832, with the box checked entitled: Web to make a late election under the provisions of.

Using Form 8832 to Change Your LLC’s Tax Classification

Web hello, i need to complete a form 8832 to elect corporation status for my llc. You failed to obtain your requested classification because you hadn’t. Web however, in order to be eligible for this simple procedure, (a) the election had to be for an entity which was newly formed under local law (as opposed to an election to change.

What Is IRS Form 8832? Definition, Deadline, & More

Web eligible for relief late change in classification no did the entity fail to obtain its requested change in classification solely because form 8832 was not filed timely? Form 8832 is used by eligible. Form 8832 is divided into two parts: 3 does the eligible entity have more than one owner? Of course the form should normally be filed within.

What Is Form 8832 and How Do I Fill It Out? Ask Gusto

Web to be eligible for late election relief, you need to fulfill all of the following circumstances: Web late election relief. Web the corrected form 8832, with the box checked entitled: The entity did not timely file form 8832, the entity has a. Web introduction how do i complete irs form 8832?

Delaware Llc Uk Tax Treatment Eayan

You failed to obtain your requested classification because you hadn’t. Web information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. According to your objectives, you can elect to have your llc taxed as a. You llc failed to file form 8832 on time your accountant or. You generally are not currently.

Web Form 8832 Late Election Relief Reasonable Cause Examples Primarily Include Two Categories Of Events:

Web up to $32 cash back form 8832 (part ii) late election relief. Form 8832 is divided into two parts: Web the proper procedure is to file the 8832 and then comply with the requirements of the entity you elected to be on the 8832 until your election is approved. Web to be eligible for late election relief, you need to fulfill all of the following circumstances:

Web Share Form 8832 Is The Document Llcs Submit To The Irs To Change Their Default Tax Classification.

The entity did not timely file form 8832, the entity has a. Web to make a late election under the provisions of the revenue procedure, an eligible entity must file a completed form 8832 with the applicable irs service center within three. Web to make a late election under the provisions of the revenue procedure, an eligible entity must file a completed form 8832 with the applicable irs service center. Web by filing form 8832 with the irs, you can choose a tax status for your entity besides the default status.

You Failed To Obtain Your Requested Classification Because You Hadn’t.

Web the first page looks like this: Web however, in order to be eligible for this simple procedure, (a) the election had to be for an entity which was newly formed under local law (as opposed to an election to change the. Web introduction how do i complete irs form 8832? You generally are not currently eligible to make the election (see instructions).

According To Your Objectives, You Can Elect To Have Your Llc Taxed As A.

3 does the eligible entity have more than one owner? Web hello, i need to complete a form 8832 to elect corporation status for my llc. This part of form 8832 is only required if you are seeking late election relief (otherwise, you may skip it). Web eligible for relief late change in classification no did the entity fail to obtain its requested change in classification solely because form 8832 was not filed timely?