Form 8288 Instructions

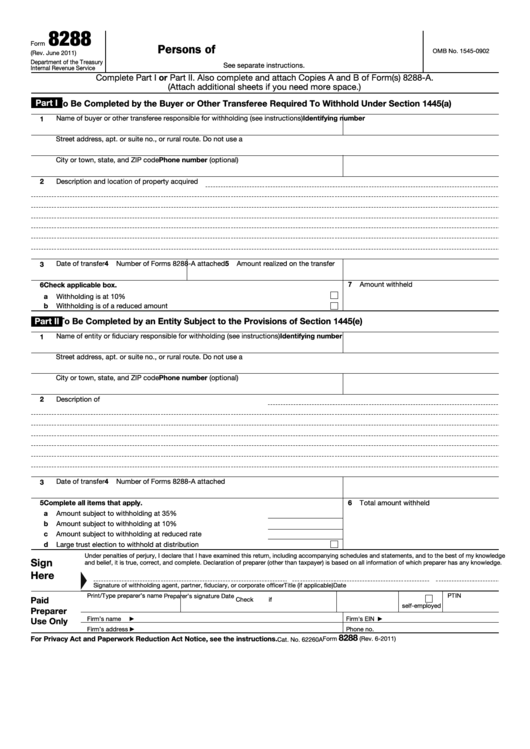

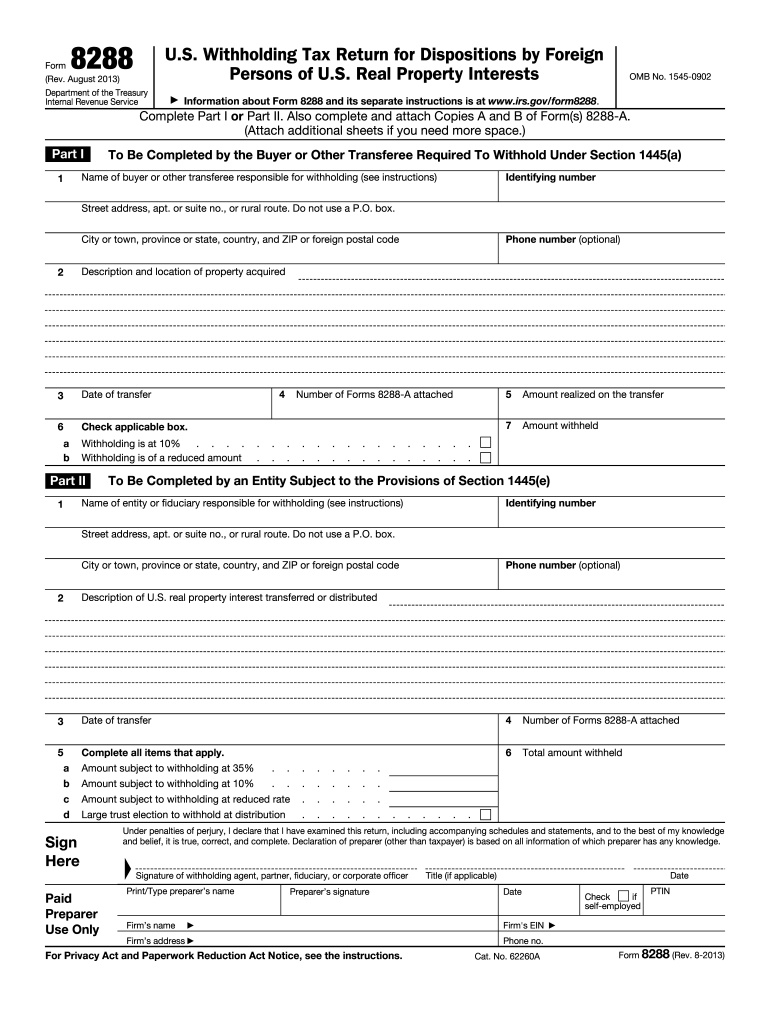

Form 8288 Instructions - Name of buyer or other party responsible for withholding. Tax that may be owed by the foreign person. Form 8288 is due within 20 days of the sale. Web instructions for form 8288 (rev. Next, write your city, town, province, state, and country name. This withholding serves to collect u.s. A buyer or other transferee of a u.s. In the second section, write your street number and address. Real property interests, to report and pay the firpta tax withholding. June 2011) department of the treasury internal revenue service u.s.

Withholding tax return for dispositions by foreign persons of u.s. In the second section, write your street number and address. Name of buyer or other party responsible for withholding. Web instructions for form 8288 (rev. Real property interests, where they will enter the amount subject to 10% or 15% withholding. Attach additional sheets if you need more space. Web foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s. Next, write your city, town, province, state, and country name. Report only one disposition on each form 8288 filed. Web you must withhold the full amount at the time of the first installment payment.

Tax that may be owed by the foreign person. Real property interests, where they will enter the amount subject to 10% or 15% withholding. Real property interests, including recent updates, related forms and instructions on how to file. Withholding tax return for dispositions by foreign persons of u.s. If you cannot because the payment does not involve sufficient cash or other liquid assets, you may obtain a withholding certificate from the irs. Real property interest, and a corporation, qualified investment entity, or fiduciary that is required to. Write your name in capital letters in the first section. Web information about form 8288, u.s. June 2011) department of the treasury internal revenue service u.s. Real property interests, to report and pay the firpta tax withholding.

Instructions For Form 8288 U.s. Withholding Tax Return For

If you cannot because the payment does not involve sufficient cash or other liquid assets, you may obtain a withholding certificate from the irs. Real property interests, to report and pay the firpta tax withholding. In the second section, write your street number and address. Web information about form 8288, u.s. General instructions purpose of form

Irs form 8288 b instructions

June 2011) department of the treasury internal revenue service u.s. This withholding serves to collect u.s. General instructions purpose of form If you cannot because the payment does not involve sufficient cash or other liquid assets, you may obtain a withholding certificate from the irs. Web information about form 8288, u.s.

Form 8288B FIRPTA and reduced withholding

Withholding tax return for dispositions by foreign persons of u.s. Web instructions for form 8288 (rev. Tax that may be owed by the foreign person. In the fourth section, describe. Real property interests, where they will enter the amount subject to 10% or 15% withholding.

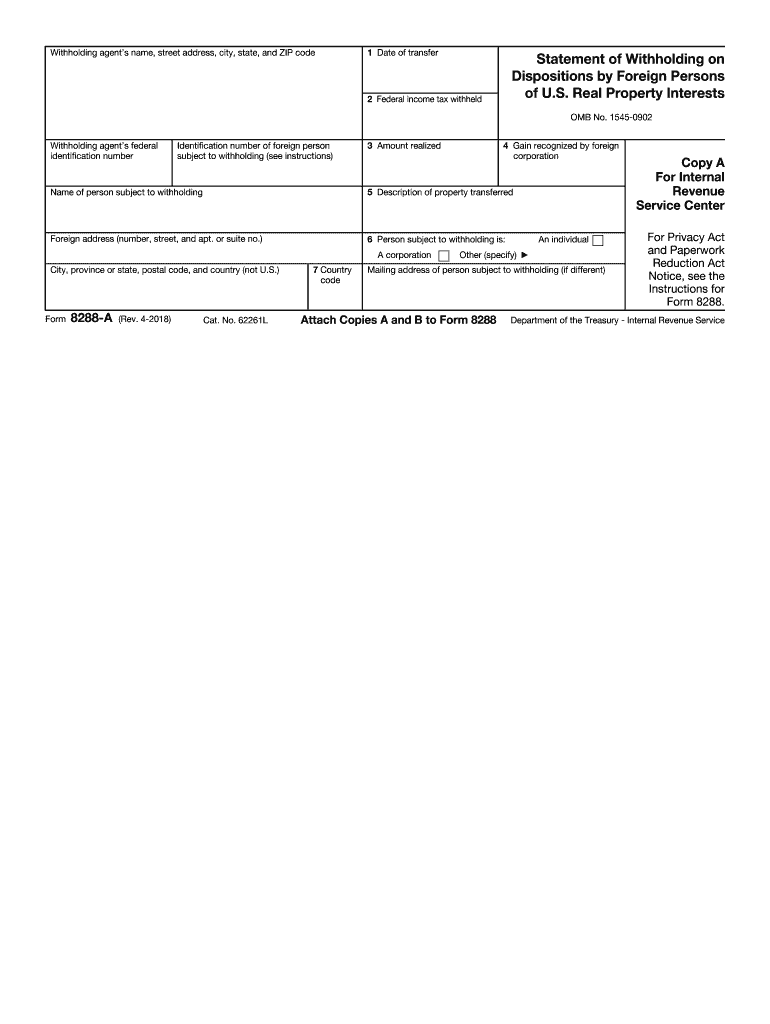

Form 8288A Statement of Withholding on Dispositions by Foreign

Real property interest, and a corporation, qualified investment entity, or fiduciary that is required to. Next, write your city, town, province, state, and country name. Real property interests, where they will enter the amount subject to 10% or 15% withholding. Web the withholding obligation also applies to foreign and domestic corporations, qualified investment entities, and the fiduciary of certain trusts.

Form 8288 U.S. Withholding Tax Return for Dispositions by Foreign

In the fourth section, describe. In the second section, write your street number and address. Do use a po box number in this part. Real property interests, including recent updates, related forms and instructions on how to file. Real property interests | internal revenue service

Fillable Form 8288 U.s. Withholding Tax Return For Dispositions By

Real property interests, including recent updates, related forms and instructions on how to file. Name of buyer or other party responsible for withholding. Withholding tax return for dispositions by foreign persons of u.s. This withholding serves to collect u.s. Withholding tax return for dispositions by foreign persons of u.s.

Form 8288B Application for Withholding Certificate for Dispositions

Form 8288 is due within 20 days of the sale. Real property interests, to report and pay the firpta tax withholding. If you cannot because the payment does not involve sufficient cash or other liquid assets, you may obtain a withholding certificate from the irs. In the fourth section, describe. Tax that may be owed by the foreign person.

2013 Form IRS 8288 Fill Online, Printable, Fillable, Blank pdfFiller

In the fourth section, describe. Next, write your city, town, province, state, and country name. June 2011) department of the treasury internal revenue service u.s. Real property interest, and a corporation, qualified investment entity, or fiduciary that is required to. Web the withholding obligation also applies to foreign and domestic corporations, qualified investment entities, and the fiduciary of certain trusts.

Irs form 8288 b instructions

Report only one disposition on each form 8288 filed. Real property interests, including recent updates, related forms and instructions on how to file. General instructions purpose of form A buyer or other transferee of a u.s. Web information about form 8288, u.s.

8288 A Fill Out and Sign Printable PDF Template signNow

Write your name in capital letters in the first section. Withholding tax return for dispositions by foreign persons of u.s. Do use a po box number in this part. Withholding tax return for dispositions by foreign persons of u.s. Next, write your city, town, province, state, and country name.

Web Foreign Persons Use This Form To Apply For A Withholding Certificate To Reduce Or Eliminate Withholding On Dispositions Of U.s.

Form 8288 is due within 20 days of the sale. Real property interests | internal revenue service Web to complete tax form 8188, follow these steps: Report only one disposition on each form 8288 filed.

Realproperty Interests Section References Are To The Internalrevenue Code Unless Otherwise Noted.

Tax that may be owed by the foreign person. Withholding tax return for dispositions by foreign persons of u.s. Real property interest, and a corporation, qualified investment entity, or fiduciary that is required to. Web in most cases, the buyer must complete form 8288, u.s.

Web Instructions For Form 8288 (Rev.

Withholding tax return for dispositions by foreign persons of u.s. In the second section, write your street number and address. Next, write your city, town, province, state, and country name. Web the withholding obligation also applies to foreign and domestic corporations, qualified investment entities, and the fiduciary of certain trusts and estates.

Do Use A Po Box Number In This Part.

Real property interests, including recent updates, related forms and instructions on how to file. If you cannot because the payment does not involve sufficient cash or other liquid assets, you may obtain a withholding certificate from the irs. Web you must withhold the full amount at the time of the first installment payment. Write your name in capital letters in the first section.