Form 8027 Instructions

Form 8027 Instructions - Web form 8027 instructions have really good guidance on requesting a lower tip rate. Number and street (don’t enter a p.o. Web see the separate instructions. They tell you who must file form 8027, when and where to file it, and how to fill it out line by line. Web employers use form 8027 to report that information. Lines 1 and 2 : At the top of form 8027, you enter information about your business, including: However, you cannot request a rate less than 2%two percent. City or town, state, and zip code. Number and street (don’t enter a p.o.

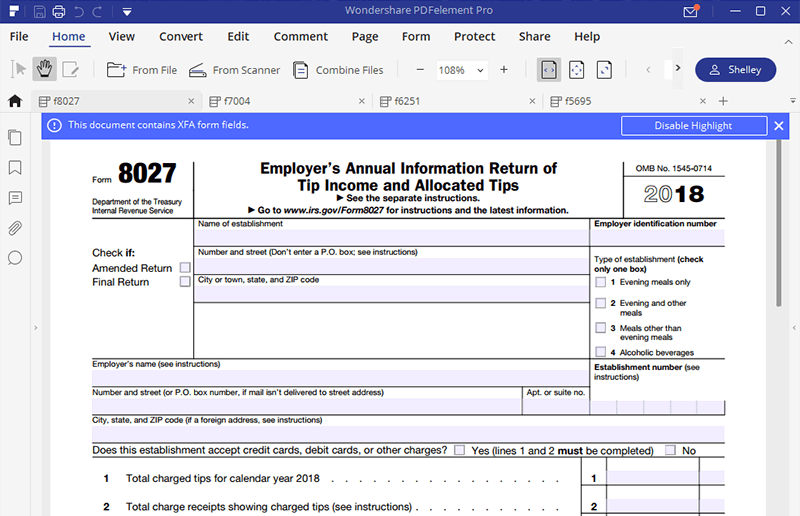

Go to www.irs.gov/form8027 for instructions and the latest information. Number and street (don’t enter a p.o. Employers use form 8027 to annually report to the irs receipts and tips from their large food or beverage establishments and to determine allocated tips for tipped employees. City or town, state, and zip code. Tipping of food or beverage employees by customers is customary. Lines 1 and 2 : When filling out form 8027, you need to provide information about your business, like your ein, whether you accept credit card payments, and what products you serve (e.g., evening meals). Enter any service charges of less than 10% that you paid to your employees. However, you cannot request a rate less than 2%two percent. At the top of form 8027, you enter information about your business, including:

Go to www.irs.gov/form8027 for instructions and the latest information. When filling out form 8027, you need to provide information about your business, like your ein, whether you accept credit card payments, and what products you serve (e.g., evening meals). Web see the separate instructions. In addition, employers use form 8027 to determine allocated tips for tipped employees. Web here’s an overview of the process. At the top of form 8027, you enter information about your business, including: Web see the separate instructions. Number and street (don’t enter a p.o. Go to www.irs.gov/form8027 for instructions and the latest information. The business name, address, and employer identification number.

Form 8027 Employer's Annual Information Return of Tip and

The business name, address, and employer identification number. Enter any service charges of less than 10% that you paid to your employees. Web employers use form 8027 to report that information. Now, if you operate an establishment whose employees consistently receive less than 8% of sales, a lower rate may be requested by submitting a petition to the irs. These.

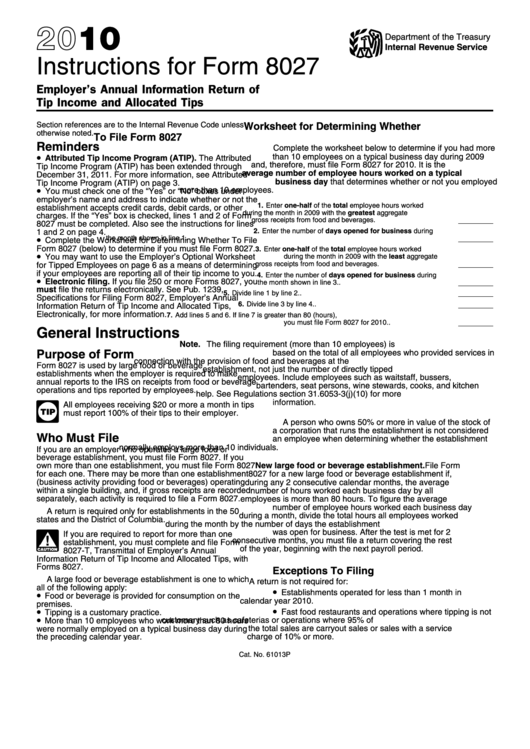

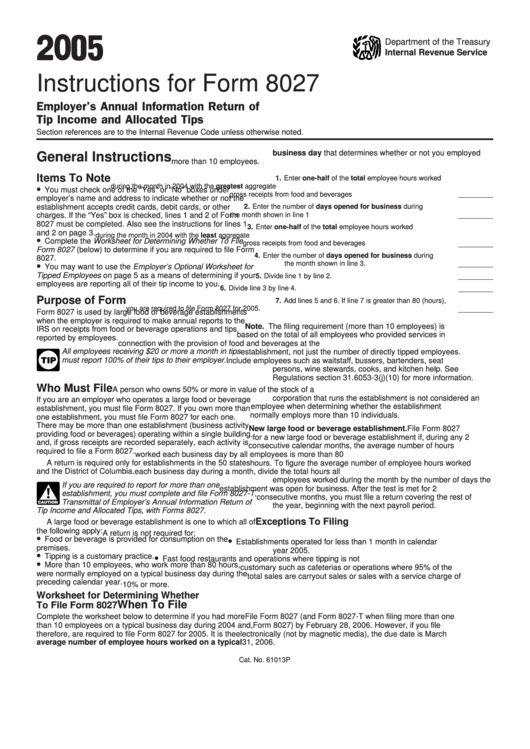

Instructions For Form 8027 printable pdf download

In addition, employers use form 8027 to determine allocated tips for tipped employees. These are for use if your establishment accepts credit cards, debit cards, or other types of charges. Go to www.irs.gov/form8027 for instructions and the latest information. Lines 1 and 2 : Worksheet for determining if you must file form 8027 for calendar year 2022;

How To Fill Out Verification Of Employment/Loss Of Form Florida

Now, if you operate an establishment whose employees consistently receive less than 8% of sales, a lower rate may be requested by submitting a petition to the irs. Enter any service charges of less than 10% that you paid to your employees. The business name, address, and employer identification number. Web see the separate instructions. Web employers use form 8027.

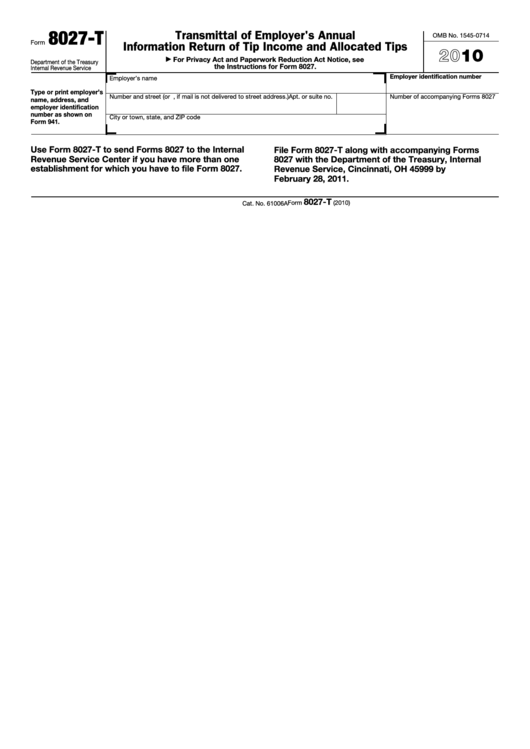

Fillable Form 8027T Transmittal Of Employer'S Annual Information

At the top of form 8027, you enter information about your business, including: City or town, state, and zip code. Number and street (don’t enter a p.o. In the main section of the form, you must report the total tips your business brought in. Lines 1 and 2 :

Form 8027T Transmittal of Employer's Annual Information Return (2015

City or town, state, and zip code. City or town, state, and zip code. Go to www.irs.gov/form8027 for instructions and the latest information. Follow the steps for your method of choice (outlined in the irs tax form instructions ), check the box next to the method you used in line 7 of form 8027, and add any details from your.

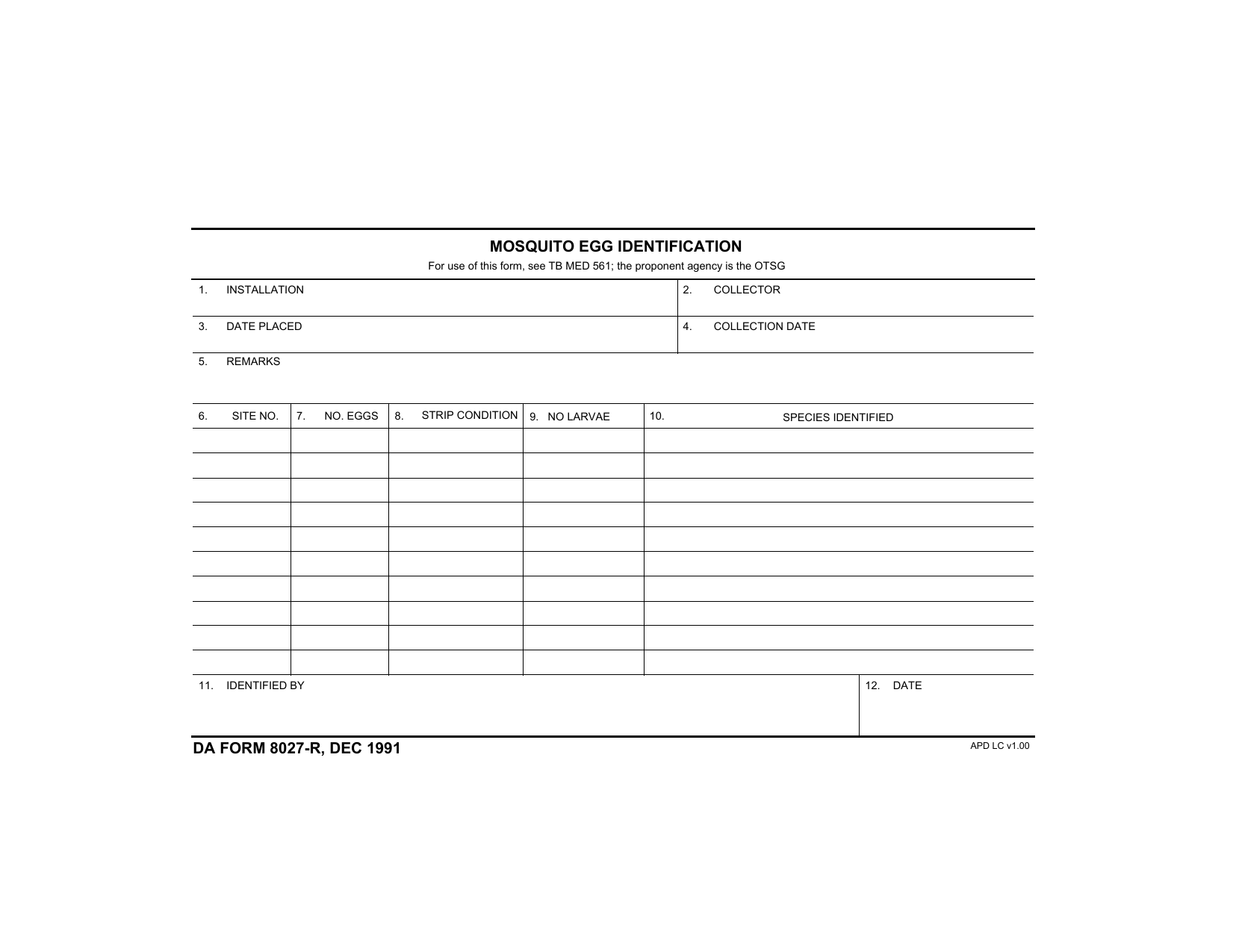

Download DA Form 8027R Mosquito Egg Identification PDF

In the main section of the form, you must report the total tips your business brought in. Tipping of food or beverage employees by customers is customary. Web employers use form 8027 to report that information. They tell you who must file form 8027, when and where to file it, and how to fill it out line by line. Web.

IRS Form 8027 Work it Right the First Time

Number and street (don’t enter a p.o. Web here’s an overview of the process. Follow the steps for your method of choice (outlined in the irs tax form instructions ), check the box next to the method you used in line 7 of form 8027, and add any details from your calculations to the document if needed. These are for.

3.11.180 Allocated Tips Internal Revenue Service

City or town, state, and zip code. Follow the steps for your method of choice (outlined in the irs tax form instructions ), check the box next to the method you used in line 7 of form 8027, and add any details from your calculations to the document if needed. When filling out form 8027, you need to provide information.

Instructions For Form 8027 printable pdf download

Employers use form 8027 to annually report to the irs receipts and tips from their large food or beverage establishments and to determine allocated tips for tipped employees. When filling out form 8027, you need to provide information about your business, like your ein, whether you accept credit card payments, and what products you serve (e.g., evening meals). These are.

Instructions For Form 8027 printable pdf download

City or town, state, and zip code. Number and street (don’t enter a p.o. These are for use if your establishment accepts credit cards, debit cards, or other types of charges. These instructions give you some background information about form 8027. Employers use form 8027 to annually report to the irs receipts and tips from their large food or beverage.

Worksheet For Determining If You Must File Form 8027 For Calendar Year 2022;

However, you cannot request a rate less than 2%two percent. At the top of form 8027, you enter information about your business, including: They tell you who must file form 8027, when and where to file it, and how to fill it out line by line. Web see the separate instructions.

Web See The Separate Instructions.

Enter any service charges of less than 10% that you paid to your employees. City or town, state, and zip code. Lines 1 and 2 : The business name, address, and employer identification number.

These Are For Use If Your Establishment Accepts Credit Cards, Debit Cards, Or Other Types Of Charges.

Go to www.irs.gov/form8027 for instructions and the latest information. In the main section of the form, you must report the total tips your business brought in. When filling out form 8027, you need to provide information about your business, like your ein, whether you accept credit card payments, and what products you serve (e.g., evening meals). Web employers use form 8027 to report that information.

Follow The Steps For Your Method Of Choice (Outlined In The Irs Tax Form Instructions ), Check The Box Next To The Method You Used In Line 7 Of Form 8027, And Add Any Details From Your Calculations To The Document If Needed.

Web information about form 8027, employer's annual information return of tip income and allocated tips, including recent updates, related forms, and instructions on how to file. Tipping of food or beverage employees by customers is customary. Go to www.irs.gov/form8027 for instructions and the latest information. These instructions give you some background information about form 8027.