Form 5558 Mailing Address

Form 5558 Mailing Address - Do not abbreviate the country name. Web follow the country's practice for entering the postal code. Review the form 5558 resources at form 5500 corner. Web late filings almost always incur penalties with the irs. Web be sure to mail your form 5558 on or before the normal due date of your return. The irs also provides information and instructions for those using a private delivery service. Go to www.irs.gov/pds for the current list of designated services. Web if your mailing address has changed since you filed your last return, use form 8822, change of address, to notify the irs of the change. Web the application is automatically approved to the date shown on line 1 (above) if: A new address shown on form 5558 will not update your record.

The irs also provides information and instructions for those using a private delivery service. Web be sure to mail your form 5558 on or before the normal due date of your return. A new address shown on form 5558 will not update your record. Web late filings almost always incur penalties with the irs. Web if your mailing address has changed since you filed your last return, use form 8822, change of address, to notify the irs of the change. Internal revenue submission processing center 1973 north rulon white blvd. Review the form 5558 resources at form 5500 corner. Go to www.irs.gov/pds for the current list of designated services. If your mailing address has changed since you filed your last return, use form 8822, change of address, to notify the irs of the change. Web follow the country's practice for entering the postal code.

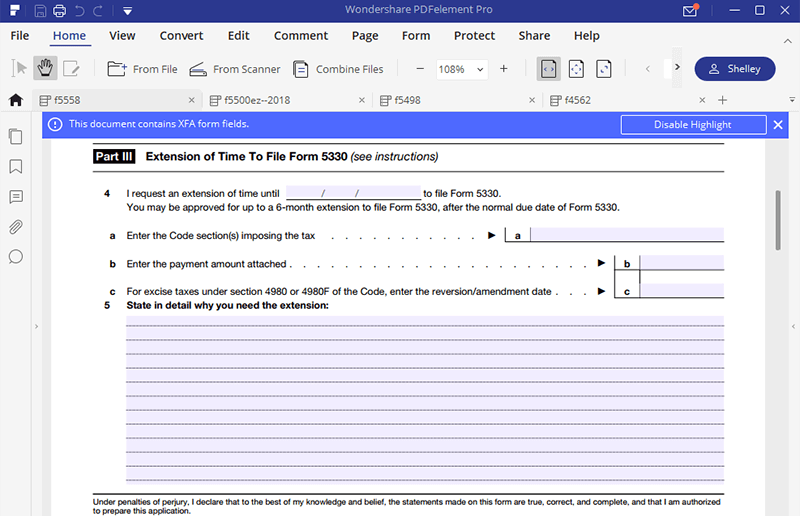

In this article, we discuss how to file for a filing extension with a form 5558, the limitations of this extension, and mistakes to avoid. Web late filings almost always incur penalties with the irs. Web if your mailing address has changed since you filed your last return, use form 8822, change of address, to notify the irs of the change. Web be sure to mail your form 5558 on or before the normal due date of your return. If your mailing address has changed since you filed your last return, use form 8822, change of address, to notify the irs of the change. A new address shown on form 5558 will not update your record. A new address shown on form 5558 will not update your record. Do not abbreviate the country name. The irs also provides information and instructions for those using a private delivery service. Web the application is automatically approved to the date shown on line 1 (above) if:

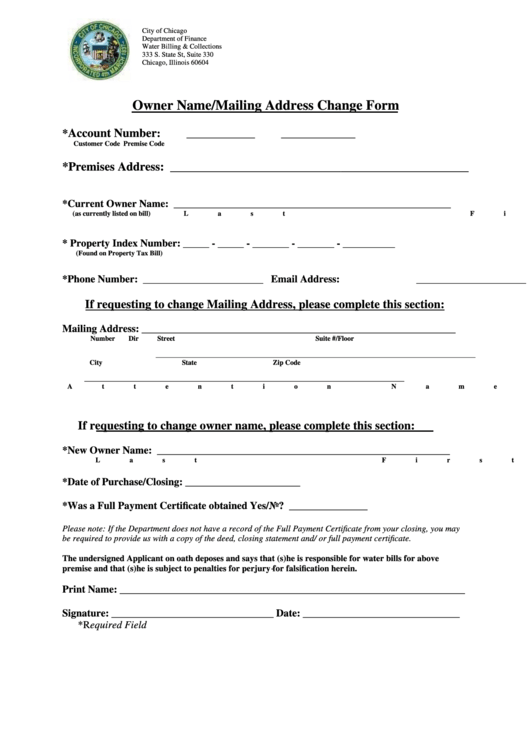

Fillable Owner Name Mailing Address Change Form printable pdf download

Web the application is automatically approved to the date shown on line 1 (above) if: A new address shown on form 5558 will not update your record. Web late filings almost always incur penalties with the irs. Internal revenue submission processing center 1973 north rulon white blvd. Do not abbreviate the country name.

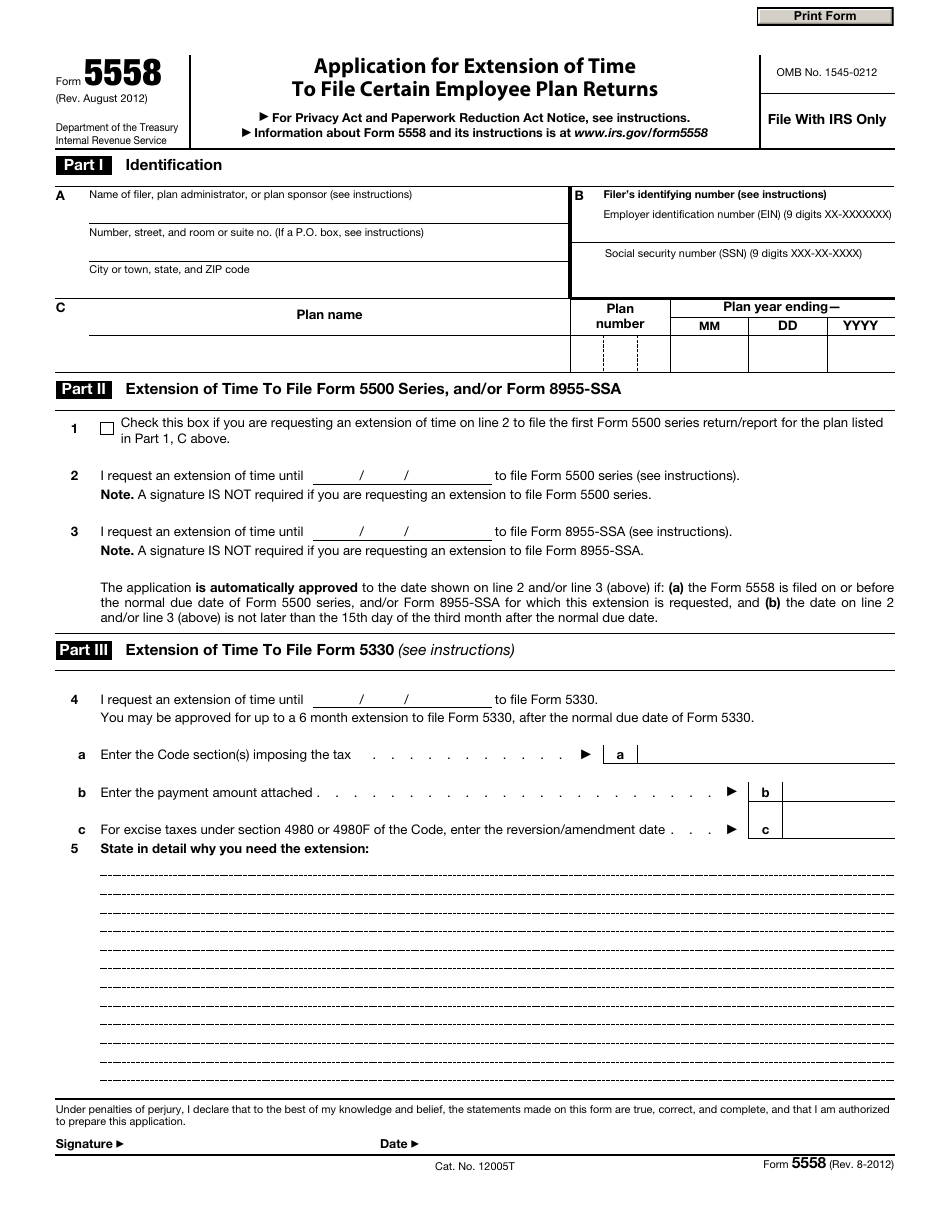

Fill Free fillable Form 5558 2018 Application for Extension of Time

The irs also provides information and instructions for those using a private delivery service. Web the application is automatically approved to the date shown on line 1 (above) if: Web if your mailing address has changed since you filed your last return, use form 8822, change of address, to notify the irs of the change. Go to www.irs.gov/pds for the.

Form 5558 Application for Extension of Time to File Certain Employee

If your mailing address has changed since you filed your last return, use form 8822, change of address, to notify the irs of the change. You can use certain private delivery services (pds) designated by the irs to meet the “timely mailing as timely filing” rule for tax returns. Web the application is automatically approved to the date shown on.

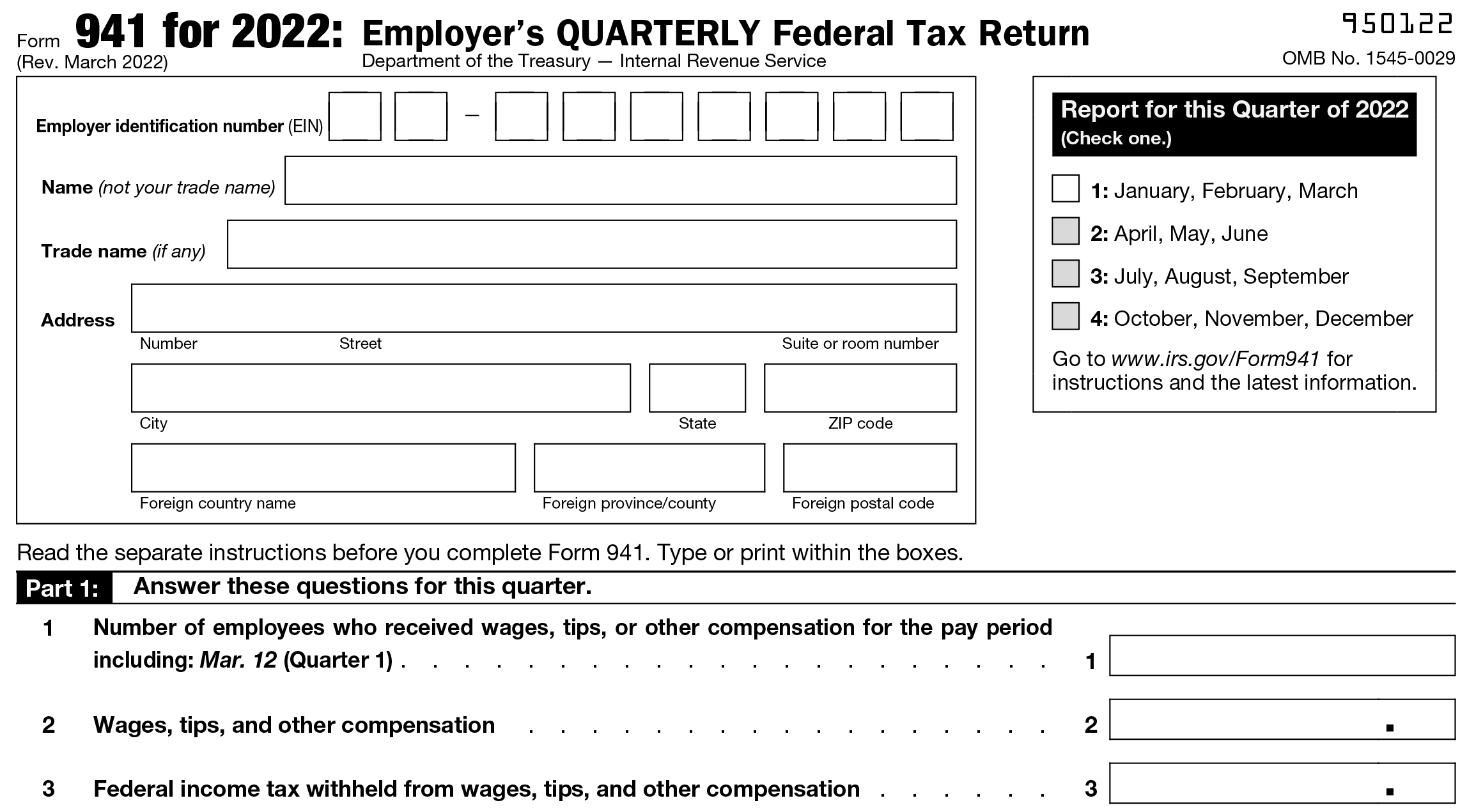

File 941 Online Efile 941 for 4.95 IRS Form 941 for 2022

A new address shown on form 5558 will not update your record. In this article, we discuss how to file for a filing extension with a form 5558, the limitations of this extension, and mistakes to avoid. Web follow the country's practice for entering the postal code. Web the application is automatically approved to the date shown on line 1.

IRS Form 5558 Download Fillable PDF or Fill Online Application for

Web late filings almost always incur penalties with the irs. Review the form 5558 resources at form 5500 corner. You can use certain private delivery services (pds) designated by the irs to meet the “timely mailing as timely filing” rule for tax returns. If your mailing address has changed since you filed your last return, use form 8822, change of.

Form 5558 Application for Extension of Time to File Certain Employee

Internal revenue submission processing center 1973 north rulon white blvd. A new address shown on form 5558 will not update your record. Web the application is automatically approved to the date shown on line 1 (above) if: Web if your mailing address has changed since you filed your last return, use form 8822, change of address, to notify the irs.

IRS Extends the Form 5500 Due Dates for Some Employee Benefit Plans

Web the application is automatically approved to the date shown on line 1 (above) if: Web follow the country's practice for entering the postal code. A new address shown on form 5558 will not update your record. If your mailing address has changed since you filed your last return, use form 8822, change of address, to notify the irs of.

Form 5558 Application for Extension of Time to File Certain Employee

Web late filings almost always incur penalties with the irs. Do not abbreviate the country name. In this article, we discuss how to file for a filing extension with a form 5558, the limitations of this extension, and mistakes to avoid. A new address shown on form 5558 will not update your record. Review the form 5558 resources at form.

IRS Forms 5500 and 5558 Update

Web if your mailing address has changed since you filed your last return, use form 8822, change of address, to notify the irs of the change. Web the application is automatically approved to the date shown on line 1 (above) if: Web be sure to mail your form 5558 on or before the normal due date of your return. Go.

Form 10 Due Date 10 10 Ugly Truth About Form 1010108 Due Date 10 AH

Go to www.irs.gov/pds for the current list of designated services. Internal revenue submission processing center 1973 north rulon white blvd. Web if your mailing address has changed since you filed your last return, use form 8822, change of address, to notify the irs of the change. The irs also provides information and instructions for those using a private delivery service..

A New Address Shown On Form 5558 Will Not Update Your Record.

Go to www.irs.gov/pds for the current list of designated services. In this article, we discuss how to file for a filing extension with a form 5558, the limitations of this extension, and mistakes to avoid. The irs also provides information and instructions for those using a private delivery service. A new address shown on form 5558 will not update your record.

Web Late Filings Almost Always Incur Penalties With The Irs.

Web if your mailing address has changed since you filed your last return, use form 8822, change of address, to notify the irs of the change. Web the application is automatically approved to the date shown on line 1 (above) if: Do not abbreviate the country name. Web follow the country's practice for entering the postal code.

Review The Form 5558 Resources At Form 5500 Corner.

Web be sure to mail your form 5558 on or before the normal due date of your return. If your mailing address has changed since you filed your last return, use form 8822, change of address, to notify the irs of the change. Internal revenue submission processing center 1973 north rulon white blvd. You can use certain private delivery services (pds) designated by the irs to meet the “timely mailing as timely filing” rule for tax returns.