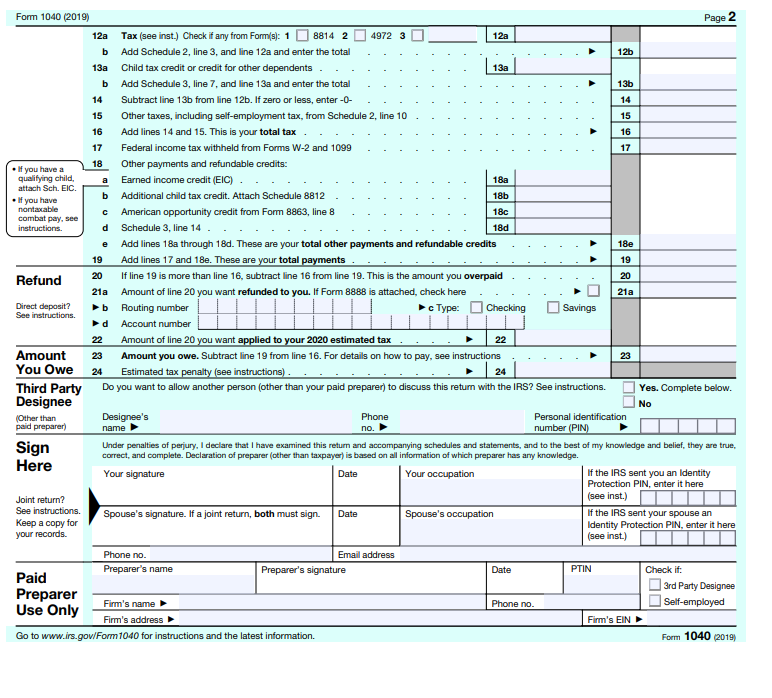

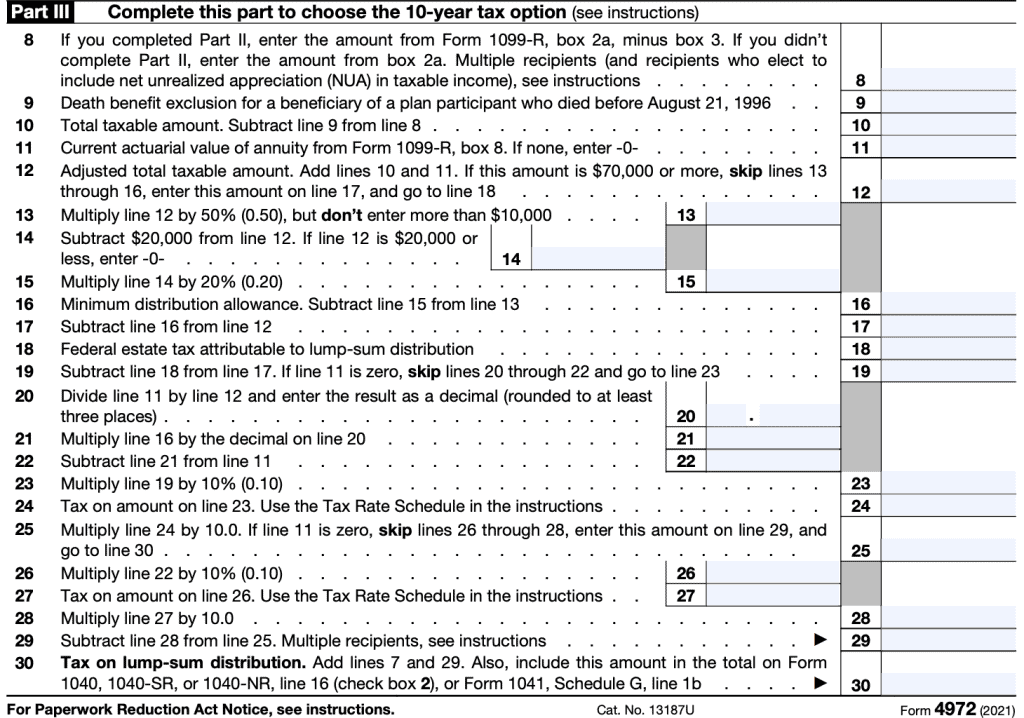

Form 4972 Tax Form

Form 4972 Tax Form - Web form 4972 1 form 4972 eligibility requirements. Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions. This may result in a smaller tax than you would pay by reporting the taxable amount of. The first part of form 4972 asks a series of questions to determine if you are eligible to use the form. This form is usually required when:. Multiply line 17 by 10%.21. Edit, sign and print tax forms on any device with uslegalforms. Web how to complete form 4972 in lacerte. You can download or print current. Complete, edit or print tax forms instantly.

Web how to complete form 4972 in lacerte. Edit, sign and print tax forms on any device with uslegalforms. Web we last updated federal form 4972 in december 2022 from the federal internal revenue service. Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions. Tax form 4972 is used for reducing taxes. It asks if the entire. The first part of form 4972 asks a series of questions to determine if you are eligible to use the form. The following choices are available. Complete, edit or print tax forms instantly. Ad access irs tax forms.

Ad access irs tax forms. Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions. You can download or print current. To see if you qualify, you must first determine if your distribution is a. Edit, sign and print tax forms on any device with uslegalforms. It asks if the entire. The following choices are available. Web how to complete form 4972 in lacerte. Use distribution code a and answer all. Complete, edit or print tax forms instantly.

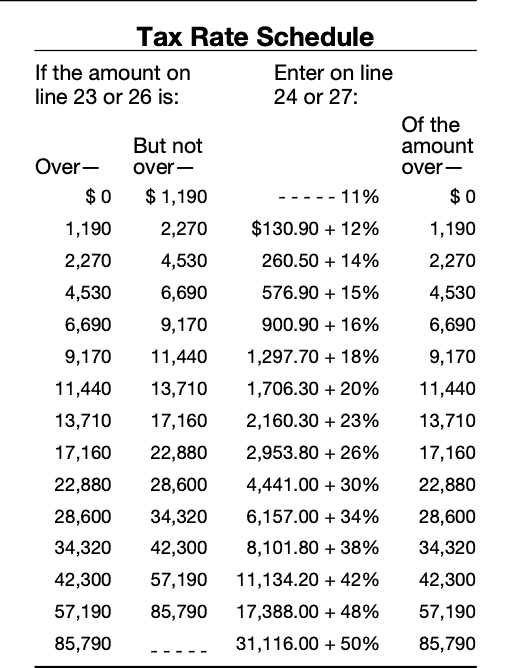

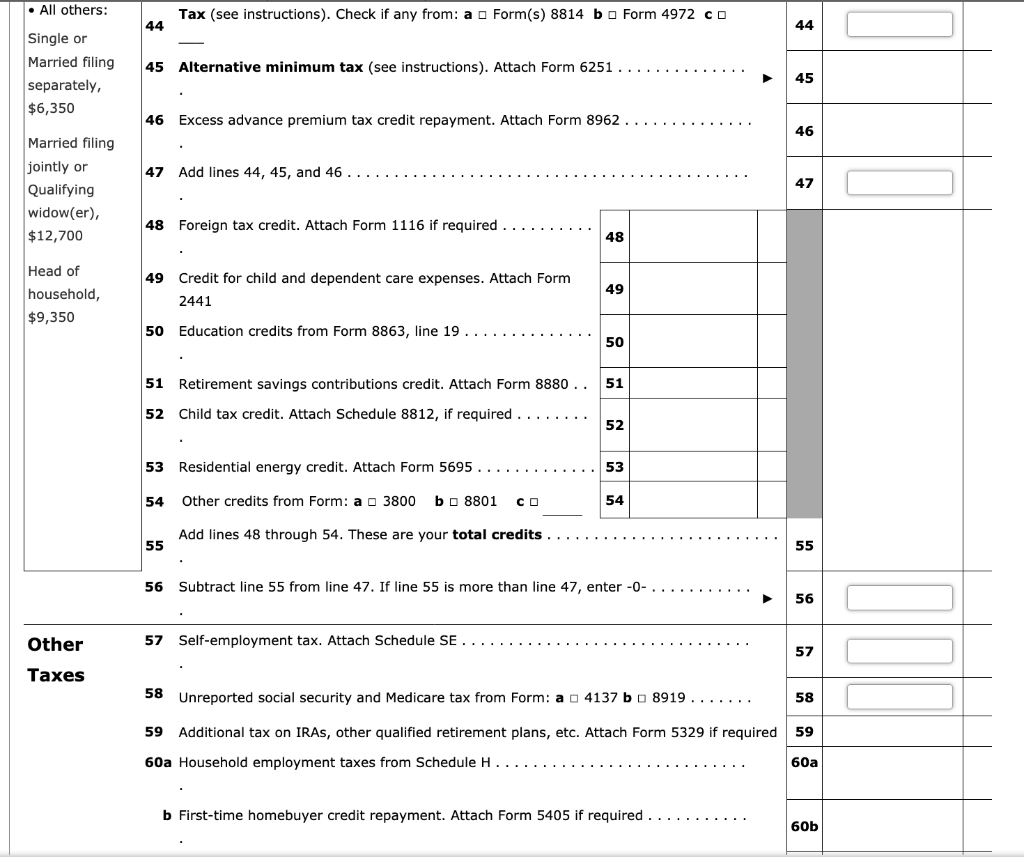

Solved USE 2020 TAX SCHEDULE, FILL OUT SPACES THAT APPLY ON

The following choices are available. Complete, edit or print tax forms instantly. It asks if the entire. To see if you qualify, you must first determine if your distribution is a. This may result in a smaller tax than you would pay by reporting the taxable amount of.

IRS Form 4972A Guide to Tax on LumpSum Distributions

Web how to complete form 4972 in lacerte. To see if you qualify, you must first determine if your distribution is a. This form is for income earned in tax year 2022, with tax returns due in april. Web we last updated federal form 4972 in december 2022 from the federal internal revenue service. Web who can use the form,.

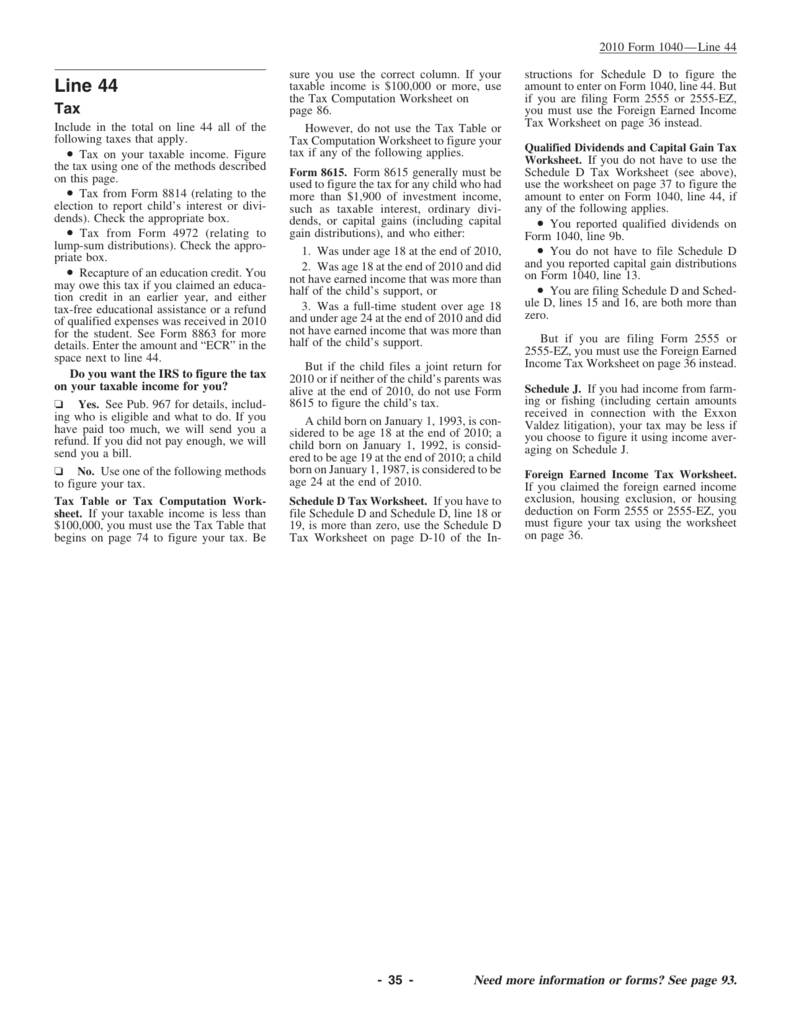

instructions for line 44

Web who can use the form, you can use form 4972 to figure your tax by special methods. Edit, sign and print tax forms on any device with uslegalforms. Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions. Tax form 4972 is used for reducing taxes. The first.

IRS Form 4972A Guide to Tax on LumpSum Distributions

It asks if the entire. Multiply line 17 by 10%.21. To see if you qualify, you must first determine if your distribution is a. Web who can use the form, you can use form 4972 to figure your tax by special methods. You can download or print current.

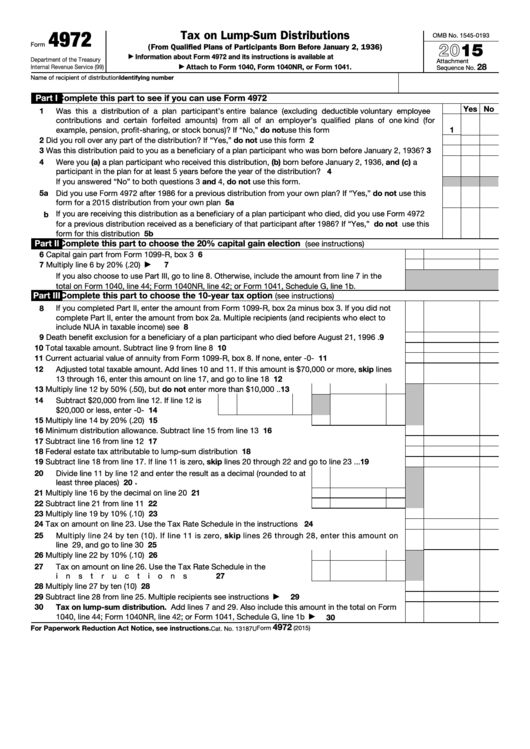

Form 4972 Tax on LumpSum Distributions (2015) Free Download

Complete, edit or print tax forms instantly. Ad access irs tax forms. The first part of form 4972 asks a series of questions to determine if you are eligible to use the form. Use screen 1099r in the income folder to complete form 4972. Web form 4972 1 form 4972 eligibility requirements.

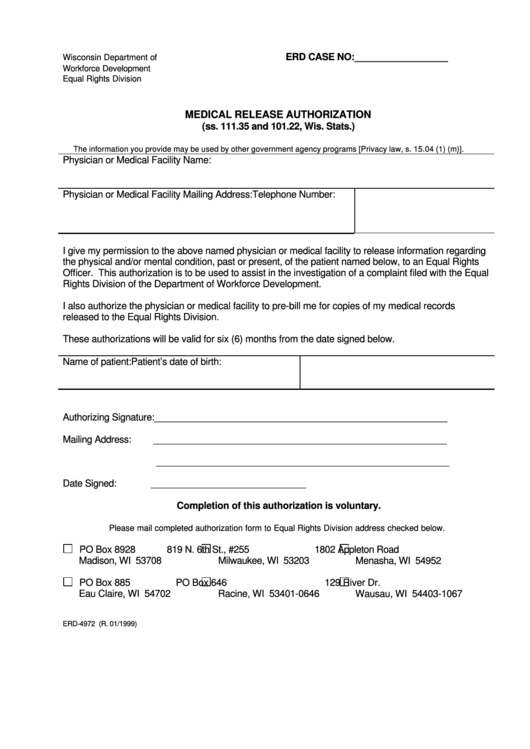

Form Erd4972 Medical Release Authorization printable pdf download

Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions. You can download or print current. The first part of form 4972 asks a series of questions to determine if you are eligible to use the form. Web who can use the form, you can use form 4972 to.

Note This Problem Is For The 2017 Tax Year. Janic...

To see if you qualify, you must first determine if your distribution is a. Web how to complete form 4972 in lacerte. Web who can use the form, you can use form 4972 to figure your tax by special methods. Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous.

Fillable Form 4972 Tax On LumpSum Distributions 2015 printable pdf

Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions. Multiply line 17 by 10%.21. Complete, edit or print tax forms instantly. Ad access irs tax forms. Web we last updated federal form 4972 in december 2022 from the federal internal revenue service.

Irs form 8814 instructions

Use screen 1099r in the income folder to complete form 4972. Complete, edit or print tax forms instantly. Web form 4972 1 form 4972 eligibility requirements. Tax form 4972 is used for reducing taxes. Web we last updated federal form 4972 in december 2022 from the federal internal revenue service.

Form 4972 Tax on LumpSum Distributions (2015) Free Download

Complete, edit or print tax forms instantly. Web how to complete form 4972 in lacerte. This form is usually required when:. To see if you qualify, you must first determine if your distribution is a. Web form 4972 1 form 4972 eligibility requirements.

The First Part Of Form 4972 Asks A Series Of Questions To Determine If You Are Eligible To Use The Form.

To see if you qualify, you must first determine if your distribution is a. This may result in a smaller tax than you would pay by reporting the taxable amount of. Web how to complete form 4972 in lacerte. Edit, sign and print tax forms on any device with uslegalforms.

Ad Access Irs Tax Forms.

Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. This form is usually required when:. Use screen 1099r in the income folder to complete form 4972.

Use Distribution Code A And Answer All.

Use this form to figure the. Tax form 4972 is used for reducing taxes. Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions. This form is for income earned in tax year 2022, with tax returns due in april.

The Following Choices Are Available.

Web we last updated federal form 4972 in december 2022 from the federal internal revenue service. Multiply line 17 by 10%.21. You can download or print current. It asks if the entire.