Form 4797 Vs 8949

Form 4797 Vs 8949 - Web updated for tax year 2022 • june 2, 2023 08:43 am overview the schedule d form is what most people use to report capital gains and losses that result. Solved•by intuit•14•updated july 14, 2022. Placed home i sold into business use in 1994. Report the gain or loss on the sale of rental property on form 4797, sales of business property or on form 8949, sales and other dispositions of. Form 4797 input for sales of business property. The zestimate for this single. Sales of assets may be entered in either the income. Web most deals are reportable with form 4797, but some use 8949, mainly when reporting the deferral of a capital gain through investment in a qualified opportunity fund or the. Web form 4797, line 2, use the line directly below the line on which you reported the sale. I operate a home business.

Web form 4797, line 2, use the line directly below the line on which you reported the sale. Or form 8824, line 12 or. Or form 8824, parts i and ii. The zestimate for this single. Web updated for tax year 2022 • june 2, 2023 08:43 am overview the schedule d form is what most people use to report capital gains and losses that result. Solved•by intuit•14•updated july 14, 2022. Web form 8949 is used to list all capital gain and loss transactions. This might include any property used to generate rental income or even a. Web purpose of form use form 8949 to report sales and exchanges of capital assets. The sale or exchange of property.

8949 n 97th st is in the north meadows neighborhood in milwaukee, wi and in zip code 53224. Web purpose of form use form 8949 to report sales and exchanges of capital assets. The involuntary conversion of property and capital assets. Web form 8949 is used to list all capital gain and loss transactions. Web use form 8949, sales and other dispositions of capital assets, to report the sale or exchange of capital assets not reported on another form or schedule; Report the amount from line 1 above on form 4797, line 2, column (d); This might include any property used to generate rental income or even a. Web use form 4797 to report: Or form 8824, parts i and ii. The zestimate for this single.

Form 1099B Instructions

Web purpose of form use form 8949 to report sales and exchanges of capital assets. Web form 4797, line 2, use the line directly below the line on which you reported the sale. The sale or exchange of property. Web use form 4797 to report: Or form 8824, parts i and ii.

Form 1099B Instructions

The disposition of noncapital assets. Form 8949 allows you and the irs to reconcile amounts that were reported to you and the irs. Web updated for tax year 2022 • june 2, 2023 08:43 am overview the schedule d form is what most people use to report capital gains and losses that result. Web use form 4797 to report: Solved•by.

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

This might include any property used to generate rental income or even a. Placed home i sold into business use in 1994. Or form 8824, line 12 or. Web use form 8949, sales and other dispositions of capital assets, to report the sale or exchange of capital assets not reported on another form or schedule; If entering on form 4797.

IRS Instructions 4797 2018 2019 Fill out and Edit Online PDF Template

Web most deals are reportable with form 4797, but some use 8949, mainly when reporting the deferral of a capital gain through investment in a qualified opportunity fund or the. The disposition of noncapital assets. I operate a home business. In column (a), identify the section 1231 gains invested into a qof as “qof investment to. Web form 8949 is.

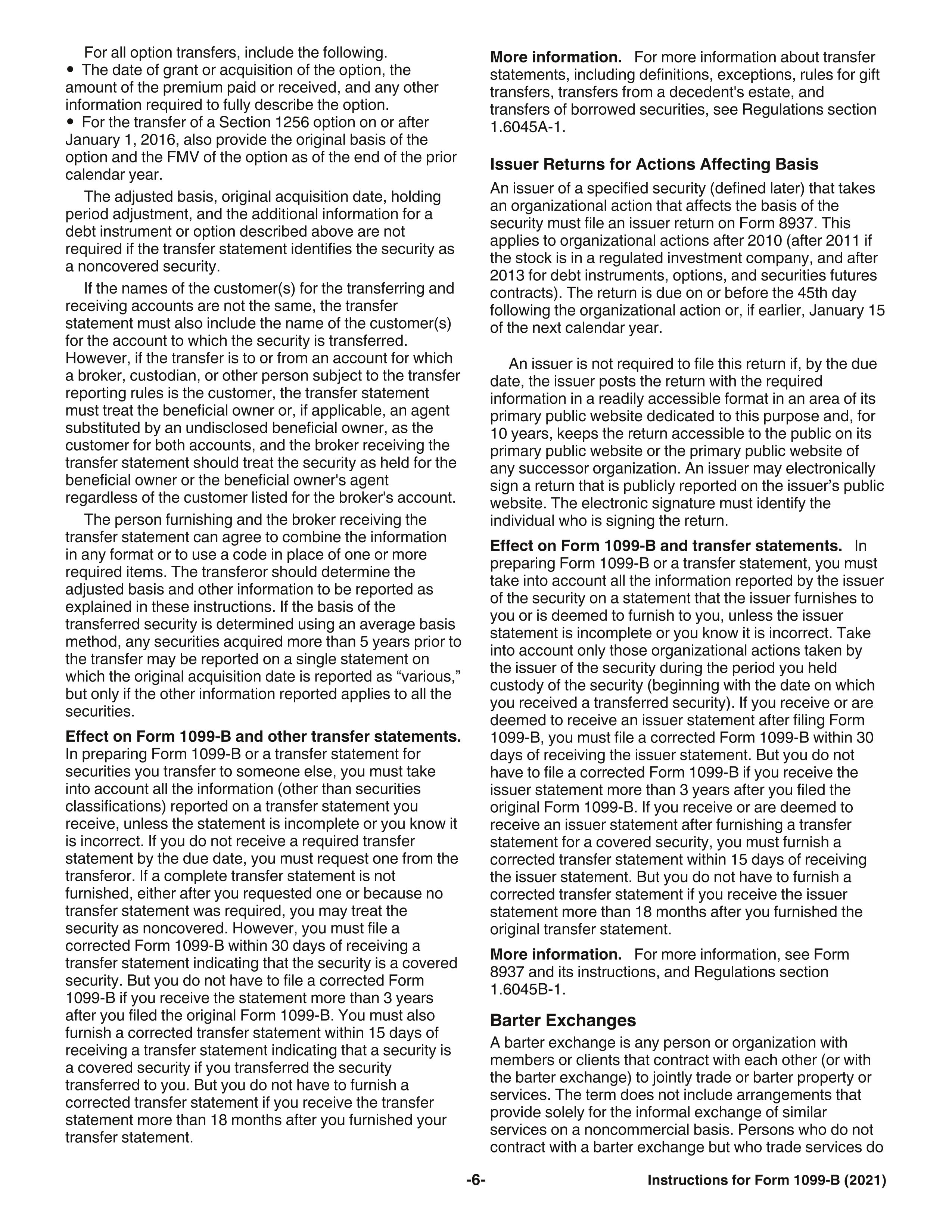

Tax Act Import

Web form 4797, line 2, use the line directly below the line on which you reported the sale. Web form 8949 is used to list all capital gain and loss transactions. Web if entering through fixed assets, the only acceptable date acquired and date of disposition entries are actual dates. Or form 8824, line 12 or. Solved•by intuit•14•updated july 14,.

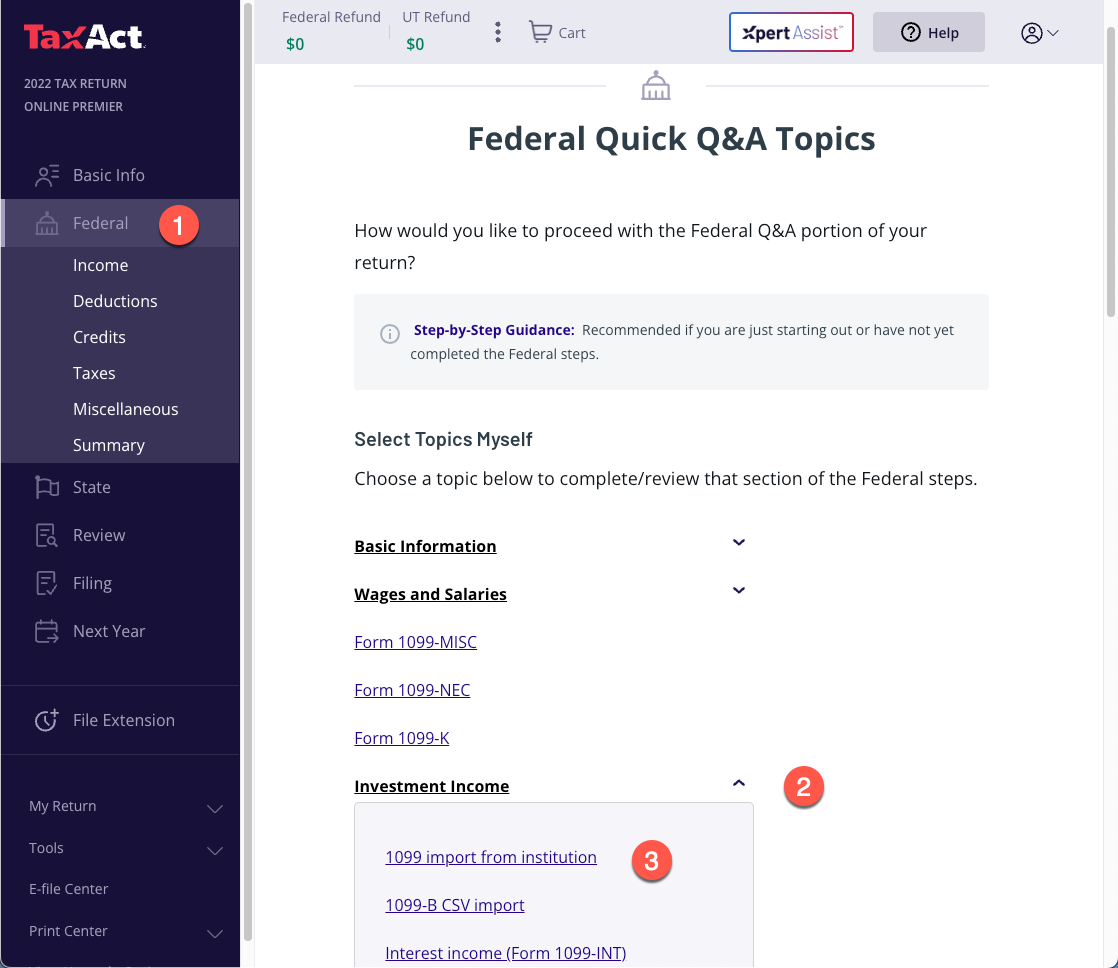

IRS Form 8949 Instructions

Web use form 8949, sales and other dispositions of capital assets, to report the sale or exchange of capital assets not reported on another form or schedule; Solved•by intuit•14•updated july 14, 2022. Web form 8949 is used to list all capital gain and loss transactions. Placed home i sold into business use in 1994. Form 8949 allows you and the.

Form 1099B

Sales of assets may be entered in either the income. Web trying to fill out 4797, schedule d and 8949 for the sale of primary residence. Web updated for tax year 2022 • june 2, 2023 08:43 am overview the schedule d form is what most people use to report capital gains and losses that result. Web use form 8949,.

Tax Form 8949 Instructions for Reporting Capital Gains and Losses

Report the gain or loss on the sale of rental property on form 4797, sales of business property or on form 8949, sales and other dispositions of. If entering on form 4797 input sheet or detail schedule,. The disposition of noncapital assets. Or form 8824, line 12 or. Web trying to fill out 4797, schedule d and 8949 for the.

2016 Form 8949 Fill Online, Printable, Fillable, Blank pdfFiller

Web form 4797 is strictly used to report the sale and gains of business property real estate transactions. Web form 8949 is used to list all capital gain and loss transactions. The zestimate for this single. Or form 8824, parts i and ii. Web most deals are reportable with form 4797, but some use 8949, mainly when reporting the deferral.

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

Web use form 8949, sales and other dispositions of capital assets, to report the sale or exchange of capital assets not reported on another form or schedule; Web if entering through fixed assets, the only acceptable date acquired and date of disposition entries are actual dates. The sale or exchange of property. Web complete form 4797, line 2, columns (a),.

Report The Gain Or Loss On The Sale Of Rental Property On Form 4797, Sales Of Business Property Or On Form 8949, Sales And Other Dispositions Of.

Form 4797 input for sales of business property. Web updated for tax year 2022 • june 2, 2023 08:43 am overview the schedule d form is what most people use to report capital gains and losses that result. Web form 4797, line 2, use the line directly below the line on which you reported the sale. Web if entering through fixed assets, the only acceptable date acquired and date of disposition entries are actual dates.

Web Purpose Of Form Use Form 8949 To Report Sales And Exchanges Of Capital Assets.

Web trying to fill out 4797, schedule d and 8949 for the sale of primary residence. Web form 4797 is strictly used to report the sale and gains of business property real estate transactions. The involuntary conversion of property and capital assets. Web use form 8949, sales and other dispositions of capital assets, to report the sale or exchange of capital assets not reported on another form or schedule;

Or Form 8824, Line 12 Or.

Placed home i sold into business use in 1994. In column (a), identify the section 1231 gains invested into a qof as “qof investment to. Web use form 4797 to report: Web most deals are reportable with form 4797, but some use 8949, mainly when reporting the deferral of a capital gain through investment in a qualified opportunity fund or the.

The Sale Or Exchange Of Property.

This might include any property used to generate rental income or even a. 8949 n 97th st is in the north meadows neighborhood in milwaukee, wi and in zip code 53224. Web form 8949 is used to list all capital gain and loss transactions. Sales of assets may be entered in either the income.

![[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797](https://i0.wp.com/millerfsllc.com/wp-content/uploads/Form-4797.jpg?fit=521%2C647&ssl=1)

![[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797](https://proconnect.intuit.com/community/image/serverpage/image-id/1455i57DF454B42459DE0?v=v2)