Form 4562 Line 11

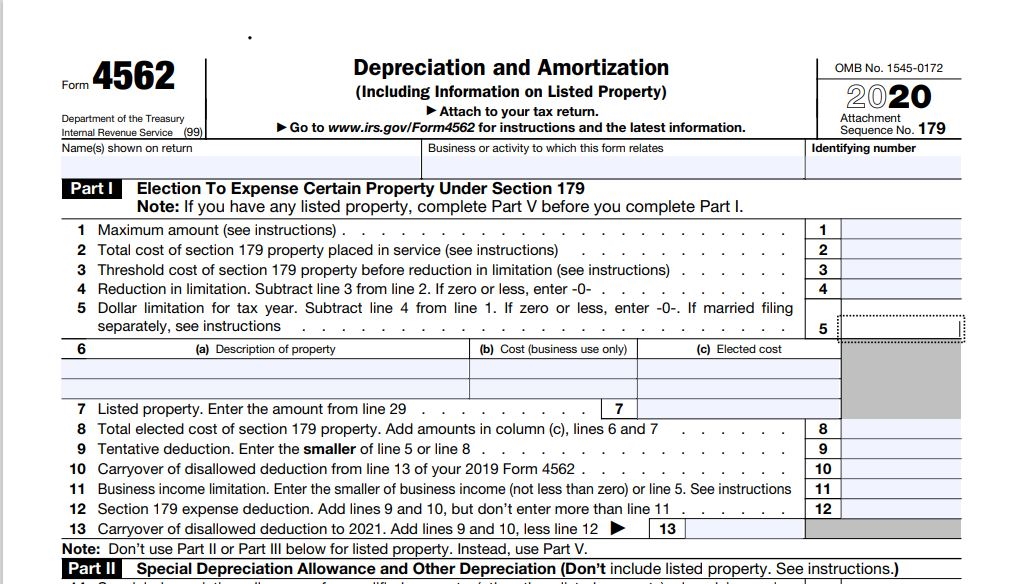

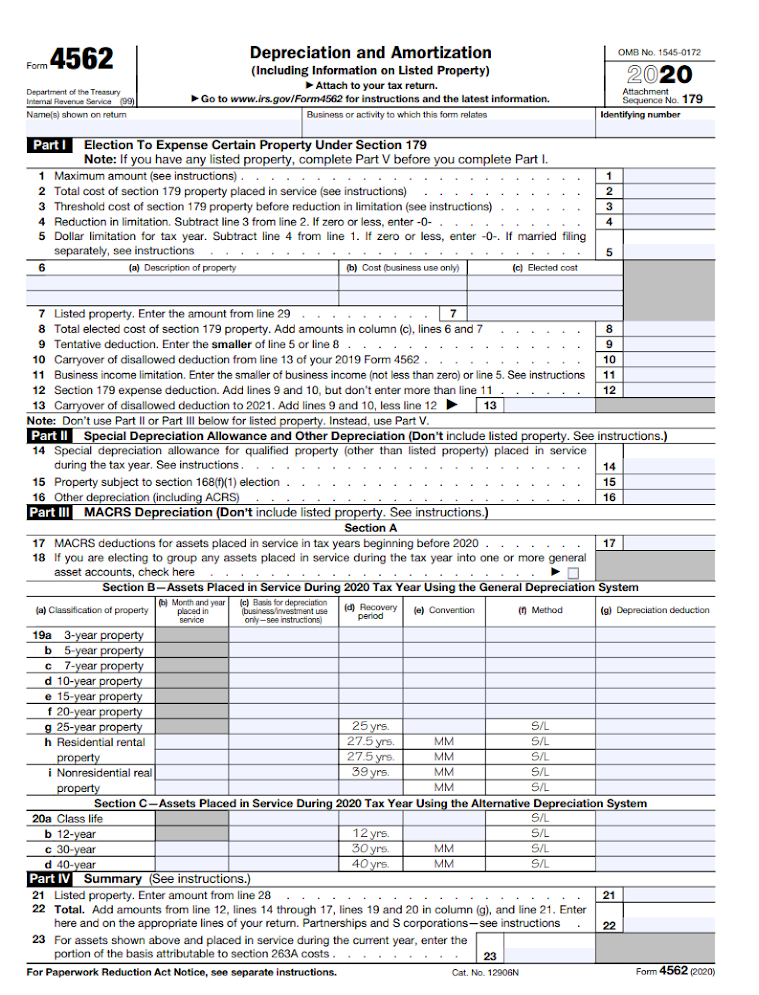

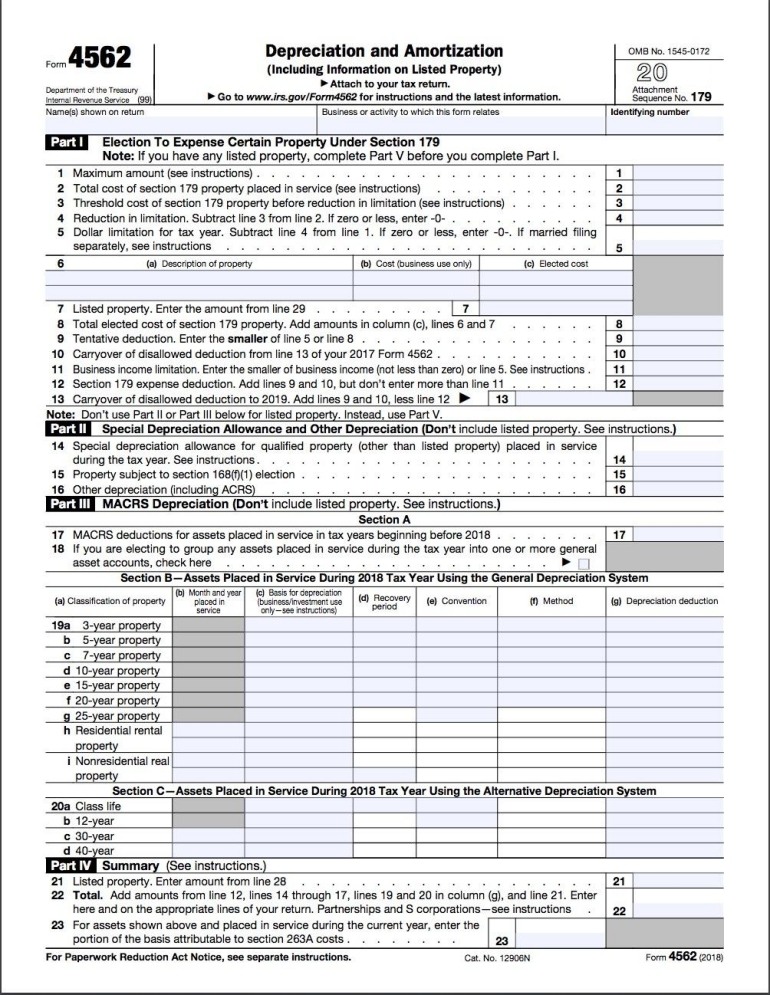

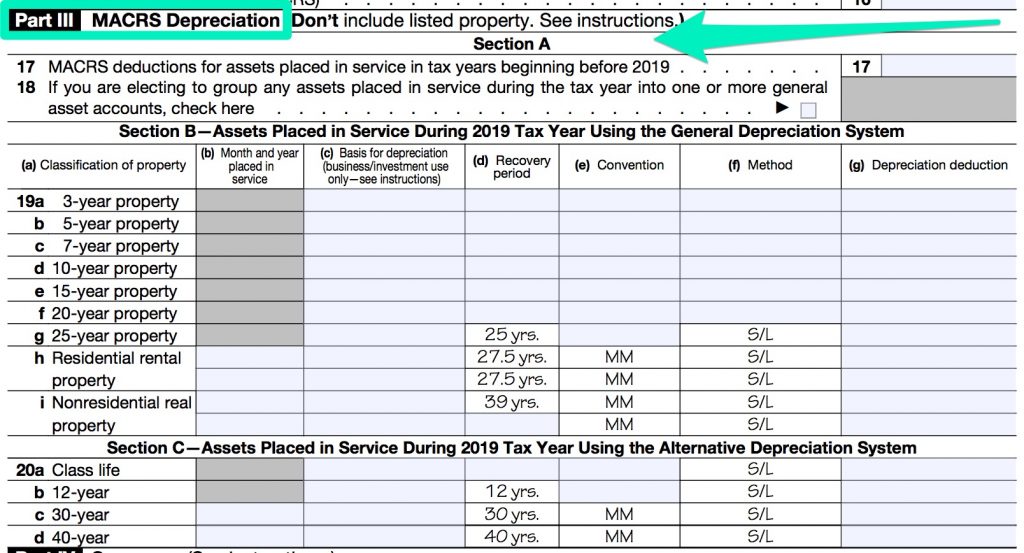

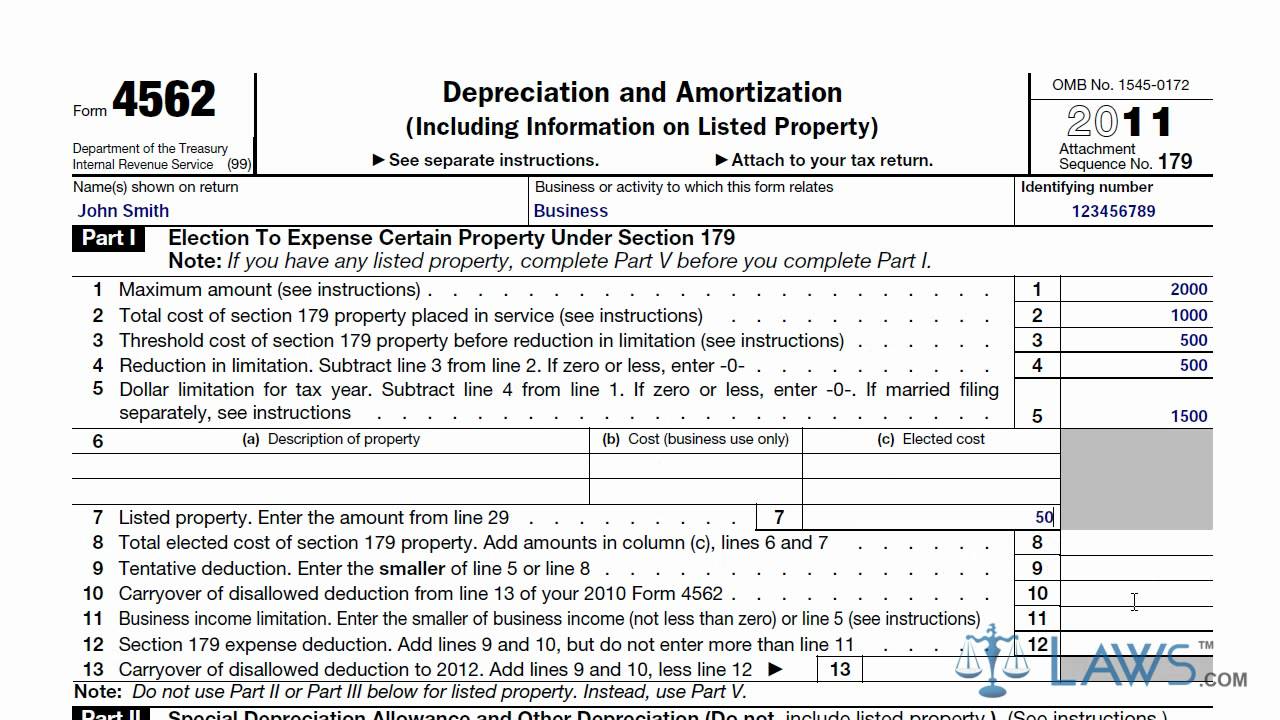

Form 4562 Line 11 - To complete form 4562, you'll need to know the cost of assets like. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. If you do not have form 4562 listed in the sidebar: Click the open form link at the top of the sidebar. The tax application calculates the amount of aggregate trade. Go to general > depreciation and depletion options and overrides. Net income or loss from trade or. Web why does form 4562 line 11 show as zero? Web type the amount from line 11 ( step 3) into column a row c; Web generally, the irs places an annual limit on the amount of purchases eligible for this accelerated deduction.

7562 county road 11, delta, oh is a single family home that contains 1,490 sq ft and was built in 1900. Line 11 the section 179 expense. Depreciation and amortization is an internal revenue service (irs) form used to claim deductions for the depreciation or amortization of an asset,. Net income or loss from trade or. 14562 state route 511, oberlin, oh is a single family home that contains 2,210 sq ft and was built in 1966. To complete form 4562, you'll need to know the cost of assets like. Go to general > depreciation and depletion options and overrides. If you do not have form 4562 listed in the sidebar: Web line 11 of form 4562 is calculated by totaling the net income and losses from all trades and businesses you actively conducted during the year. The tax application calculates the amount of aggregate trade.

Web to see the details of the calculation of form 4562, line 11, go to print > preview and view the not required statements. Click the open form link at the top of the sidebar. Form 4562 is used to. It contains 3 bedrooms and 1.5. For example, in 2022 you can elect to deduct up to. 7562 county road 11, delta, oh is a single family home that contains 1,490 sq ft and was built in 1900. Business income calculated for form 4562, line 11 and the amount of section 179 deduction allowed for the current year (faq) question. Go to general > depreciation and depletion options and overrides. This article will assist you with calculating section 179 business income limitation in the individual module of proconnect tax. Line 11 the section 179 expense.

Form 4562 YouTube

If you do not have form 4562 listed in the sidebar: For additional information, see pub. Click the open form link at the top of the sidebar. Complete, edit or print tax forms instantly. Web form 4562 reflects changes made by the •a section 179 expense deduction business or for the production of income.

How To File Irs Form 4562 Ethel Hernandez's Templates

Web solved•by intuit•6•updated july 13, 2022. I am trying to use section 179 to expense appliances i replaced in four of my rentals in 2020, but i'm getting business. To complete form 4562, you'll need to know the cost of assets like. Web generally, the irs places an annual limit on the amount of purchases eligible for this accelerated deduction..

Form 4562 Depreciation and Amortization Definition

7562 county road 11, delta, oh is a single family home that contains 1,490 sq ft and was built in 1900. If you filed form 4562 for 1993, enter the amount from line 13 of your 1993 form 4562. Web solved•by intuit•6•updated july 13, 2022. Form 4562 is used to. This article will assist you with calculating section 179 business.

2020 Form 4562 Depreciation and Amortization6 Nina's Soap

It contains 3 bedrooms and 1.5. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Job creation and worker assistance act (which may include a. To complete form 4562, you'll need to know the cost of assets like. Business income calculated for form 4562, line 11 and the amount of section 179 deduction.

IRS Form 4562 Explained A StepbyStep Guide The Blueprint

Complete, edit or print tax forms instantly. For additional information, see pub. Web generally, the irs places an annual limit on the amount of purchases eligible for this accelerated deduction. If you filed form 4562 for 1993, enter the amount from line 13 of your 1993 form 4562. I am trying to use section 179 to expense appliances i replaced.

Section 179 Addback Example 2 Partnership Flow Through Minnesota

Web solved•by intuit•6•updated july 13, 2022. Web why does form 4562 line 11 show as zero? Complete, edit or print tax forms instantly. Web to see the details of the calculation of form 4562, line 11, go to print > preview and view the not required statements. Web line 11 of form 4562 is calculated by totaling the net income.

Form 4562, Depreciation Expense

If you do not have form 4562 listed in the sidebar: Line 11 the section 179 expense. Web line 11 of form 4562 is calculated by totaling the net income and losses from all trades and businesses you actively conducted during the year. Click the open form link at the top of the sidebar. Form 4562 is used to.

Form 4562 Do I Need to File Form 4562? (with Instructions)

Web why does form 4562 line 11 show as zero? Web generally, the irs places an annual limit on the amount of purchases eligible for this accelerated deduction. It contains 3 bedrooms and 1.5. Web therefore, the amount on line 11 of the summary form 4562 will include all of the above income. If you do not have form 4562.

Form 4562 Do I Need to File Form 4562? (with Instructions)

Web type the amount from line 11 ( step 3) into column a row c; Web to see the details of the calculation of form 4562, line 11, go to print > preview and view the not required statements. Web why does form 4562 line 11 show as zero? Web line 11 the total cost you can deduct is limited.

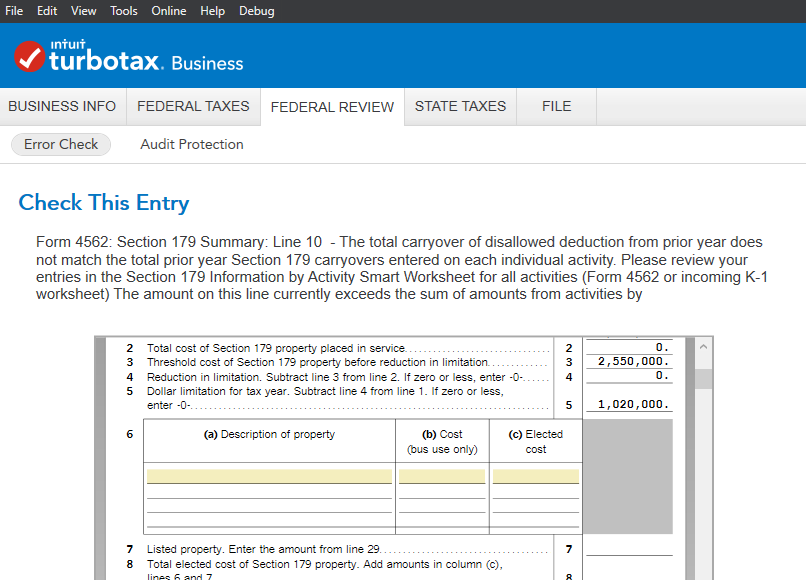

Check This Entry Form 4562 Section 179 Summary L...

Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Web solved•by intuit•6•updated july 13, 2022. For additional information, see pub. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Go to general > depreciation and depletion options and overrides.

14562 State Route 511, Oberlin, Oh Is A Single Family Home That Contains 2,210 Sq Ft And Was Built In 1966.

Web line 11 of form 4562 is calculated by totaling the net income and losses from all trades and businesses you actively conducted during the year. Net income or loss from trade or. If you do not have form 4562 listed in the sidebar: Depreciation and amortization is an internal revenue service (irs) form used to claim deductions for the depreciation or amortization of an asset,.

I Am Trying To Use Section 179 To Expense Appliances I Replaced In Four Of My Rentals In 2020, But I'm Getting Business.

This article will assist you with calculating section 179 business income limitation in the individual module of proconnect tax. Web if the amount on form 4562, line 11 is less than the amount on line 5, ultratax cs prints a not required statement that details the calculation of the business income limitation for. It contains 3 bedrooms and 1.5. Business income calculated for form 4562, line 11 and the amount of section 179 deduction allowed for the current year (faq) question.

Form 4562 Is Used To.

If you filed form 4562 for 1993, enter the amount from line 13 of your 1993 form 4562. Web therefore, the amount on line 11 of the summary form 4562 will include all of the above income. Go to general > depreciation and depletion options and overrides. Web why does form 4562 line 11 show as zero?

Complete, Edit Or Print Tax Forms Instantly.

Line 11 the section 179 expense. You are considered to actively conduct a. Web type the amount from line 11 ( step 3) into column a row c; Web solved•by intuit•6•updated july 13, 2022.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at9.35.53AM-18b6615f7bd449e6a035c8e074b14521.png)