Form 4562 2020

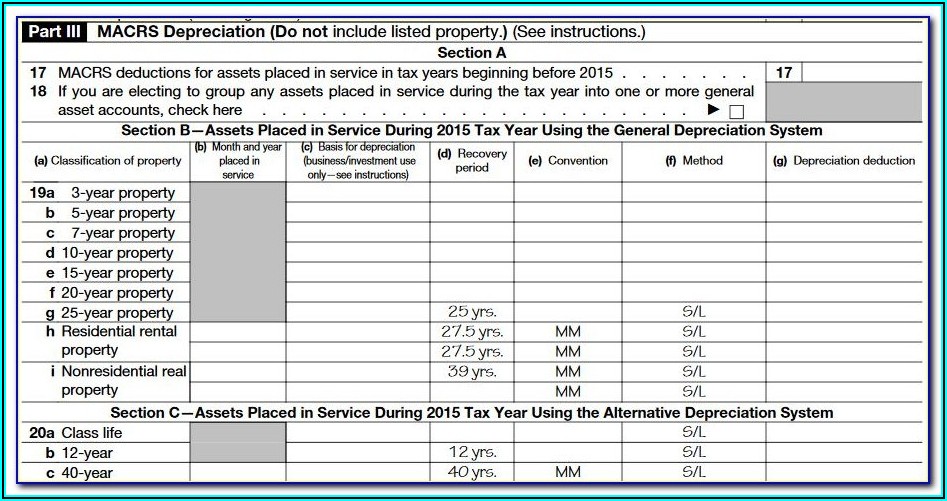

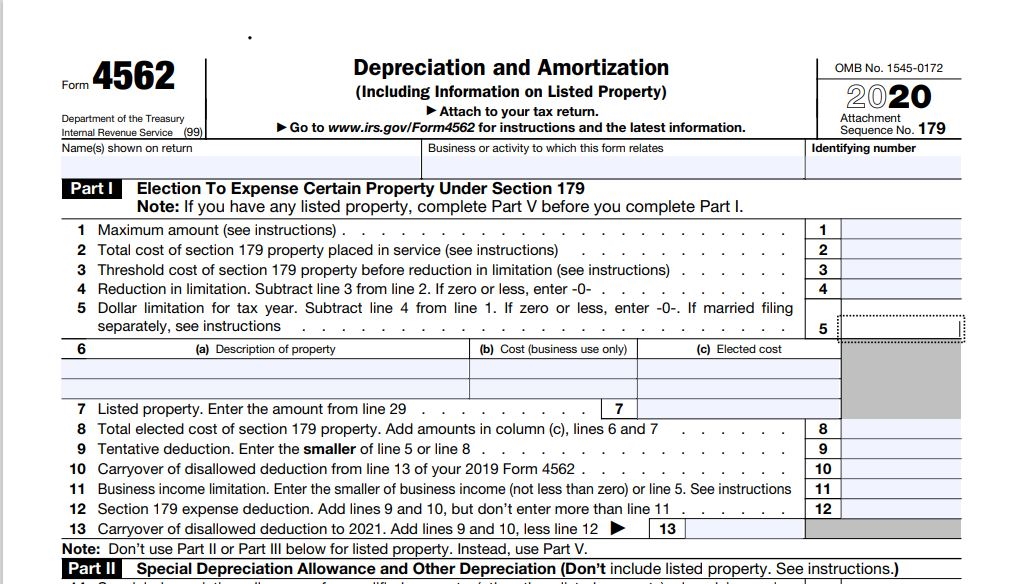

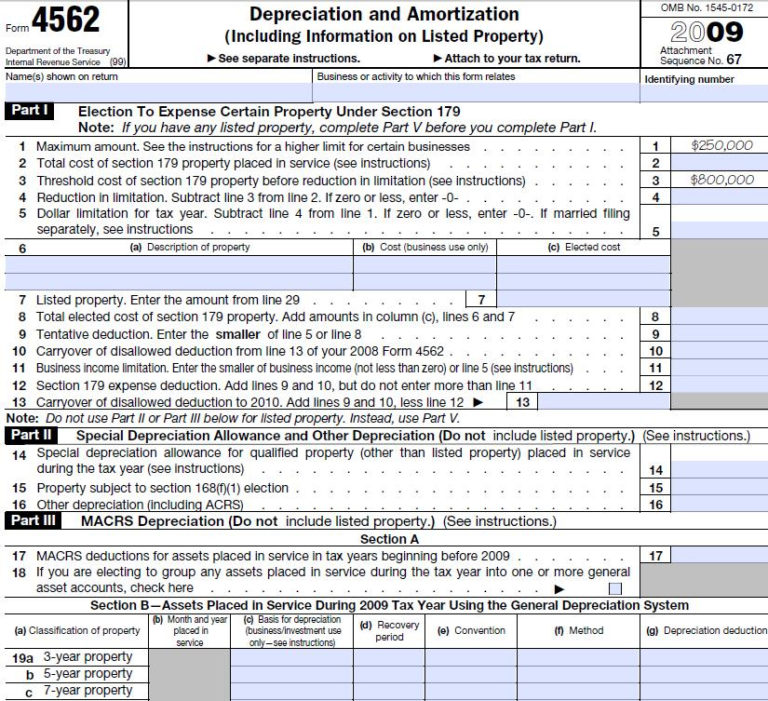

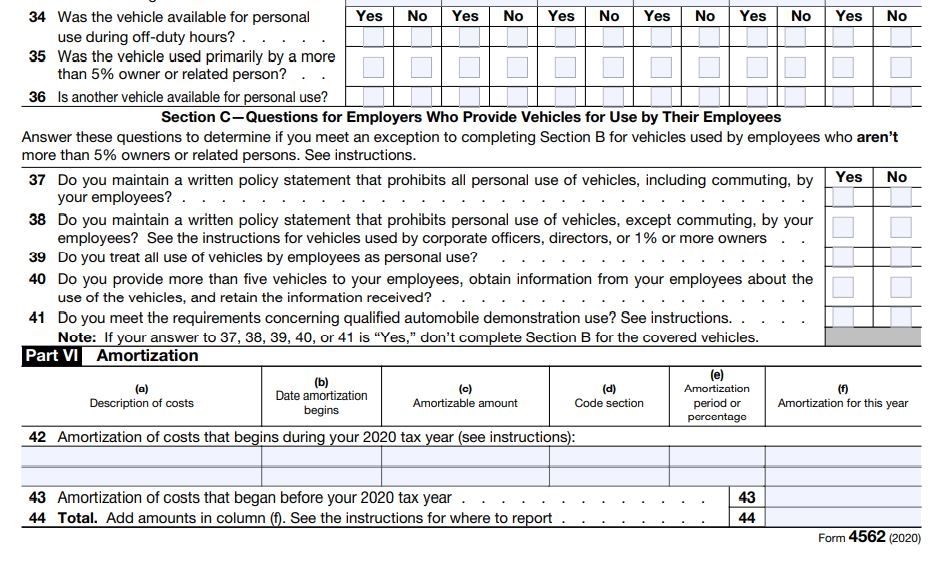

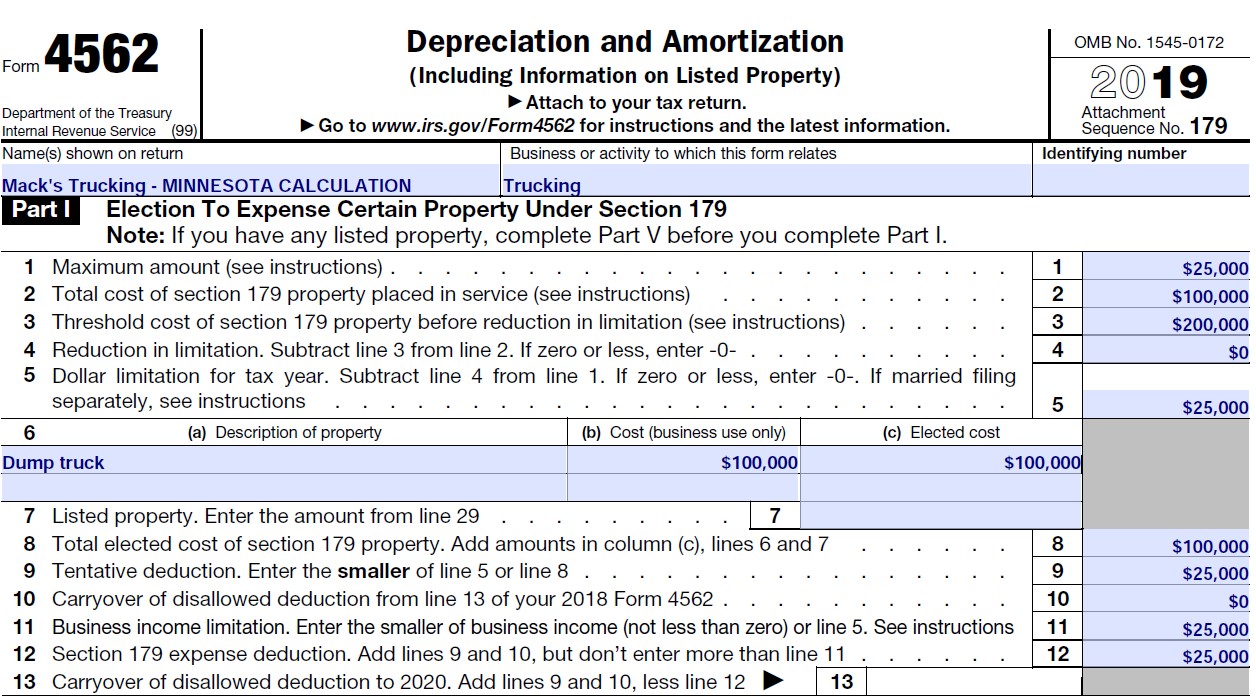

Form 4562 2020 - Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for tax year 2022. Web file form 4562 with your individual or business tax return for any year you are claiming a depreciation deduction or making a section 179 election. Web section 179 deduction dollar limits. For instructions and the latest information. 2020 form 4562 depreciation and amortization: Form 4562 is used to claim a depreciation/amortization deduction, to expense certain property, and to note the business use of cars/property. For tax years beginning in 2022, the maximum section 179 expense deduction is $1,080,000. Web form 4562 department of the treasury internal revenue service (99) depreciation and amortization (including information on listed property). Web purpose of form use form 4562 to: Web part 1 line 11 to 13 form 4562video playlist:

Web general instructions purpose of form use form 4562 to: Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for tax year 2022. It’s also used to expense certain types of property using an accelerated depreciation deduction under section 179 of the internal revenue code. For tax years beginning in 2022, the maximum section 179 expense deduction is $1,080,000. Web file form 4562 with your individual or business tax return for any year you are claiming a depreciation deduction or making a section 179 election. 2020 form 4562 depreciation and amortization: For instructions and the latest information. • claim your deduction for depreciation and amortization, • make the election under section 179 to expense certain property, and • provide information on the business/ investment use of automobiles and other listed property. Depreciation and amortization is an internal revenue service (irs) form used to claim deductions for the depreciation or amortization of an asset, expense certain property, and. Attach to your tax return.

Form 4562 is used to claim a depreciation/amortization deduction, to expense certain property, and to note the business use of cars/property. 2020 form 4562 depreciation and amortization: Web form 4562 department of the treasury internal revenue service (99) depreciation and amortization (including information on listed property). Claim your deduction for depreciation and amortization, make the election under section 179 to expense certain property, and. Provide information on the business/investment use of automobiles and other listed property. Attach to your tax return. When you claim depreciation, it’s incredibly important that you retain copies of all 4562's so you can track your prior deductions and claim the appropriate amount in future years. Web part 1 line 11 to 13 form 4562video playlist: Depreciation and amortization is an internal revenue service (irs) form used to claim deductions for the depreciation or amortization of an asset, expense certain property, and. This limit is reduced by the amount by which the cost of section 179 property placed.

Irs Form 4562 Year 2014 Form Resume Examples l6YN7007V3

Web section 179 deduction dollar limits. Attach to your tax return. Web form 4562 department of the treasury internal revenue service (99) depreciation and amortization (including information on listed property). Form 4562 is used to claim a depreciation/amortization deduction, to expense certain property, and to note the business use of cars/property. Web irs form 4562 is used to claim deductions.

2020 Form 4562 Depreciation and Amortization1 YouTube

This limit is reduced by the amount by which the cost of section 179 property placed. Web section 179 deduction dollar limits. Web general instructions purpose of form use form 4562 to: It’s also used to expense certain types of property using an accelerated depreciation deduction under section 179 of the internal revenue code. Web purpose of form use form.

2020 Form 4562 Depreciation and Amortization6 Nina's Soap

Web part 1 line 11 to 13 form 4562video playlist: This limit is reduced by the amount by which the cost of section 179 property placed. Web irs form 4562 is used to claim deductions for depreciation and amortization. Attach to your tax return. For tax years beginning in 2022, the maximum section 179 expense deduction is $1,080,000.

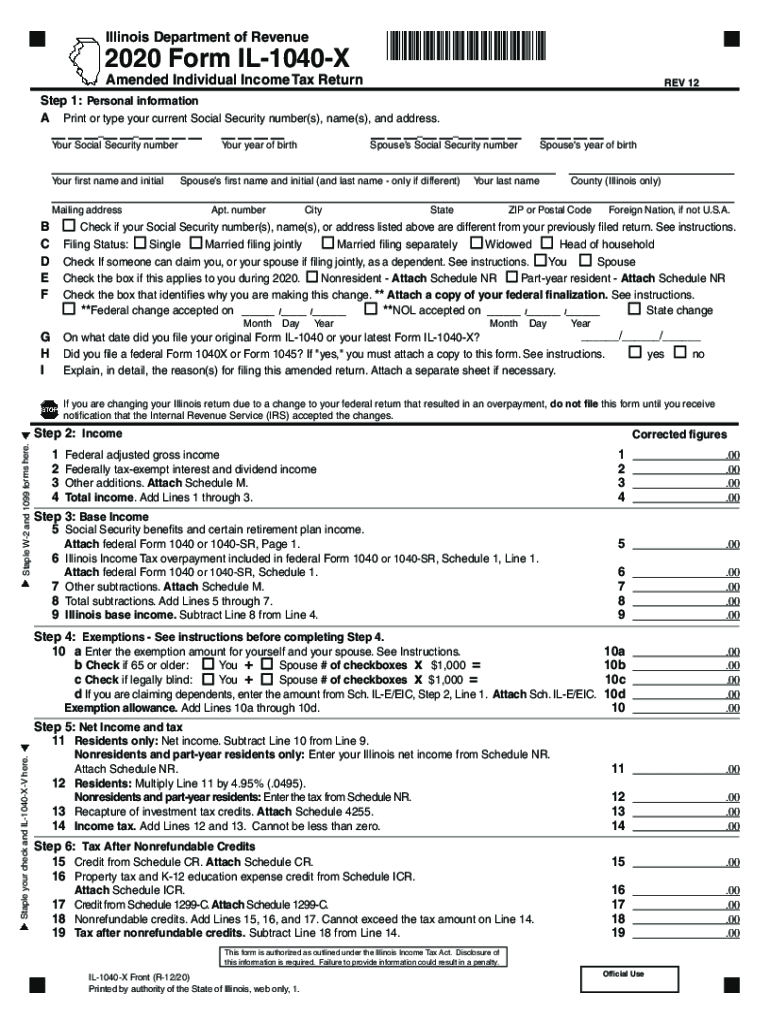

Il 1040 Fill Out and Sign Printable PDF Template signNow

Web irs form 4562 is used to claim deductions for depreciation and amortization. For tax years beginning in 2022, the maximum section 179 expense deduction is $1,080,000. Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for tax year 2022. Web purpose.

2022 Form IRS 4562 Fill Online, Printable, Fillable, Blank pdfFiller

This limit is reduced by the amount by which the cost of section 179 property placed. Web part 1 line 11 to 13 form 4562video playlist: Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for tax year 2022. Claim your deduction.

IRS Form 4562 Information And Instructions 2021 Tax Forms 1040 Printable

Web irs form 4562 is used to claim deductions for depreciation and amortization. Web part 1 line 11 to 13 form 4562video playlist: Form 4562 is used to claim a depreciation/amortization deduction, to expense certain property, and to note the business use of cars/property. It’s also used to expense certain types of property using an accelerated depreciation deduction under section.

2020 Form IRS 4562 Instructions Fill Online, Printable, Fillable, Blank

Claim your deduction for depreciation and amortization, make the election under section 179 to expense certain property, and. For tax years beginning in 2022, the maximum section 179 expense deduction is $1,080,000. Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for.

2020 Form 4562 Depreciation and Amortization22 Nina's Soap

This limit is reduced by the amount by which the cost of section 179 property placed. It’s also used to expense certain types of property using an accelerated depreciation deduction under section 179 of the internal revenue code. Web irs form 4562 is used to claim deductions for depreciation and amortization. • claim your deduction for depreciation and amortization, •.

Mn Revenue Recapture Login REVNEUS

Web purpose of form use form 4562 to: Web part 1 line 11 to 13 form 4562video playlist: When you claim depreciation, it’s incredibly important that you retain copies of all 4562's so you can track your prior deductions and claim the appropriate amount in future years. Web irs form 4562 is used to claim deductions for depreciation and amortization..

Form 4562 Do I Need to File Form 4562? (with Instructions)

Web form 4562 department of the treasury internal revenue service (99) depreciation and amortization (including information on listed property). Web general instructions purpose of form use form 4562 to: For instructions and the latest information. Form 4562 is used to claim a depreciation/amortization deduction, to expense certain property, and to note the business use of cars/property. Web irs form 4562.

Web Purpose Of Form Use Form 4562 To:

Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Depreciation and amortization is an internal revenue service (irs) form used to claim deductions for the depreciation or amortization of an asset, expense certain property, and. Web general instructions purpose of form use form 4562 to: Web irs form 4562 is used to claim deductions for depreciation and amortization.

For Instructions And The Latest Information.

Web part 1 line 11 to 13 form 4562video playlist: For tax years beginning in 2022, the maximum section 179 expense deduction is $1,080,000. Provide information on the business/investment use of automobiles and other listed property. This limit is reduced by the amount by which the cost of section 179 property placed.

It’s Also Used To Expense Certain Types Of Property Using An Accelerated Depreciation Deduction Under Section 179 Of The Internal Revenue Code.

When you claim depreciation, it’s incredibly important that you retain copies of all 4562's so you can track your prior deductions and claim the appropriate amount in future years. • claim your deduction for depreciation and amortization, • make the election under section 179 to expense certain property, and • provide information on the business/ investment use of automobiles and other listed property. Attach to your tax return. Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for tax year 2022.

Form 4562 Is Used To Claim A Depreciation/Amortization Deduction, To Expense Certain Property, And To Note The Business Use Of Cars/Property.

Web section 179 deduction dollar limits. Web form 4562 department of the treasury internal revenue service (99) depreciation and amortization (including information on listed property). 2020 form 4562 depreciation and amortization: Web file form 4562 with your individual or business tax return for any year you are claiming a depreciation deduction or making a section 179 election.