Form 3922 Tax Reporting

Form 3922 Tax Reporting - Web order tax form 3922 to report transfer of stock acquired through an employee stock purchase plan under section 423 (c) during 2022. Get answers to these five common questions about reporting espp. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Copy a is mailed to the irs. The information on form 3922 will help determine your cost or other basis, as well as your holding period. Web 1 best answer tomyoung level 13 when you sell stocks that you've acquired via an espp, such a sale can create compensation income that can be included on. Web we estimate it will take you about 55 minutes to complete this form. Web form 3922 is required for reporting the transfer of stock acquired through an employee stock purchase plan. Web what is irs form 3922? Complete, edit or print tax forms instantly.

Irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), reports specific. Web 1 best answer tomyoung level 13 when you sell stocks that you've acquired via an espp, such a sale can create compensation income that can be included on. These forms are used to file for the taxes on the iso and espp, whichever applicable. Web information returns for iso exercises must be made on form 3921, and information returns for espp stock transfers must be made on form 3922. Web what is irs form 3922? Below are the details that let us know all about. Web form 3922 is required for reporting the transfer of stock acquired through an employee stock purchase plan. However, you are not required to provide information requested unless a valid omb control number is. Web instructions for forms 3921 and 3922 (rev. Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed.

However, you are not required to provide information requested unless a valid omb control number is. Irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), reports specific. Web what are the forms 3921, 3922, 6251? Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web instructions for forms 3921 and 3922 (rev. Ad access irs tax forms. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. You will need the information reported on form 3922 to determine stock.

IRS Form 3922 Software 289 eFile 3922 Software

October 2017) department of the treasury internal revenue service exercise of an incentive stock option under section 422(b). Get answers to these five common questions about reporting espp. However, you are not required to provide information requested unless a valid omb control number is. Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold.

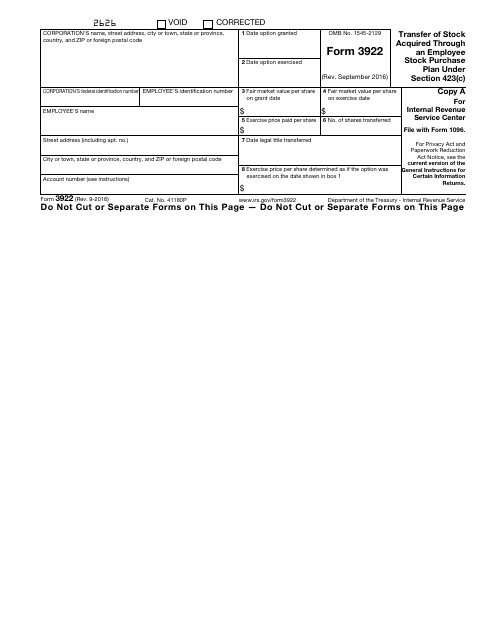

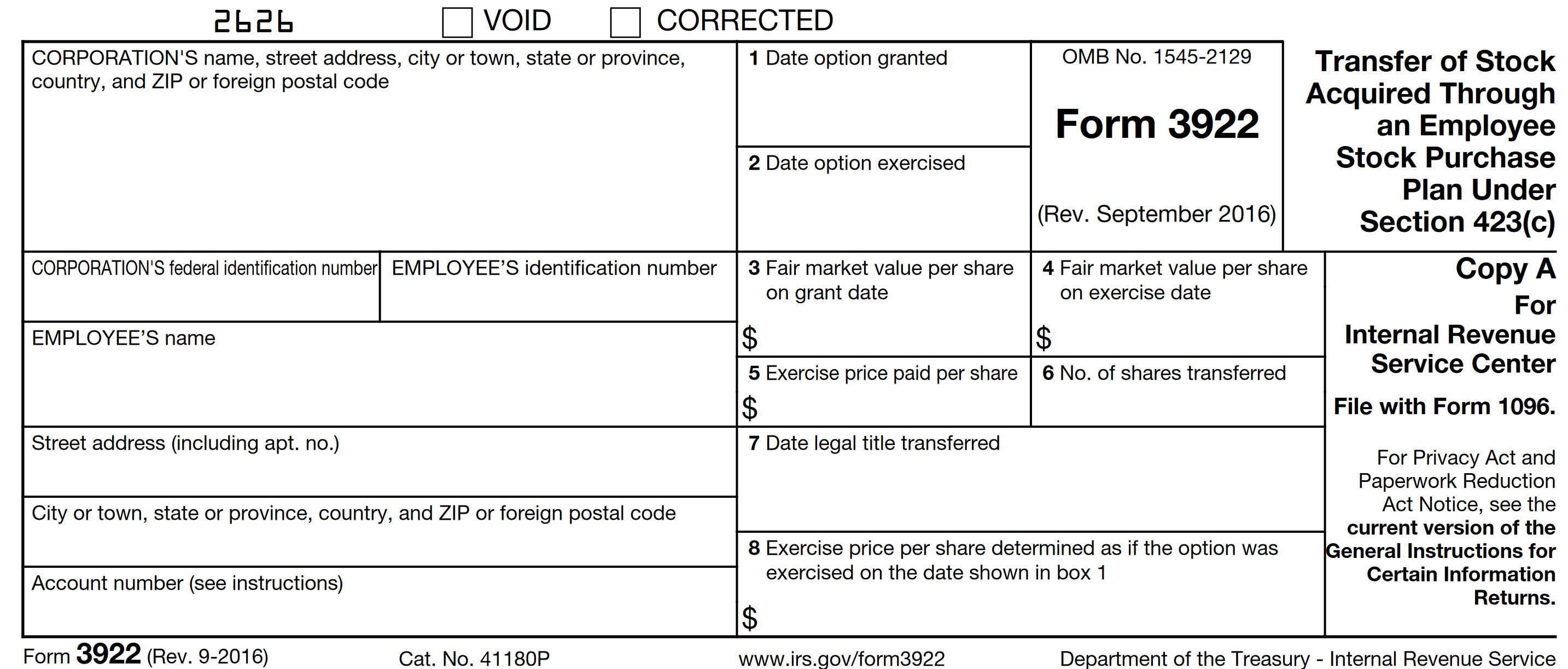

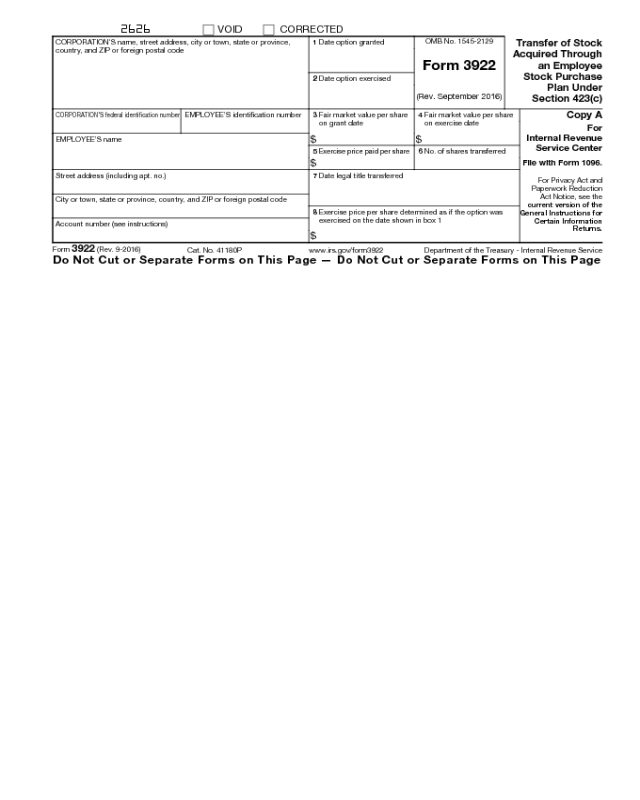

IRS Form 3922

Below are the details that let us know all about. Web order tax form 3922 to report transfer of stock acquired through an employee stock purchase plan under section 423 (c) during 2022. Copy a is mailed to the irs. Web this needs to be reported on your tax return. Web information about form 3922, transfer of stock acquired through.

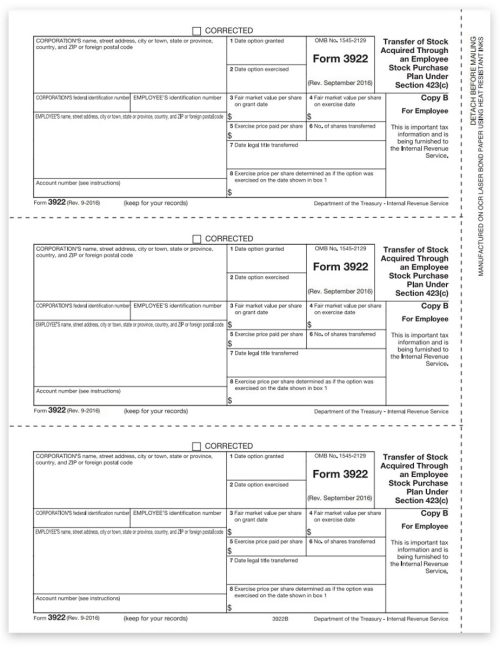

3922 Forms, Employee Stock Purchase, Employee Copy B DiscountTaxForms

Web this needs to be reported on your tax return. Web information returns for iso exercises must be made on form 3921, and information returns for espp stock transfers must be made on form 3922. What transactions are reported on the new forms? Ad complete irs tax forms online or print government tax documents. The information on form 3922 will.

3922 Laser Tax Forms Copy B Free Shipping

Web form 3922 is an informational statement and would not be entered into the tax return. Get answers to these five common questions about reporting espp. Web 1 best answer tomyoung level 13 when you sell stocks that you've acquired via an espp, such a sale can create compensation income that can be included on. Ad complete irs tax forms.

3922, Tax Reporting Instructions & Filing Requirements for Form 3922

Ad access irs tax forms. Web this needs to be reported on your tax return. Copy a is mailed to the irs. Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. The information on form 3922 will help determine your cost or other basis, as well as your holding period.

IRS Form 3922 Download Fillable PDF or Fill Online Transfer of Stock

Web what is irs form 3922? Web order tax form 3922 to report transfer of stock acquired through an employee stock purchase plan under section 423 (c) during 2022. Ad complete irs tax forms online or print government tax documents. Web form 3922 is an informational statement and would not be entered into the tax return. These forms are used.

3922 2020 Public Documents 1099 Pro Wiki

However, you are not required to provide information requested unless a valid omb control number is. Web for the latest information about developments related to forms 3921 and 3922 and their instructions, such as legislation enacted after they were published, go to. Irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), reports specific..

Documents to Bring To Tax Preparer Tax Documents Checklist

Web instructions for forms 3921 and 3922 (rev. Web information returns for iso exercises must be made on form 3921, and information returns for espp stock transfers must be made on form 3922. Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. Complete, edit or print tax forms instantly. Irs.

Tax Reporting For Stock Compensation Understanding Form W2, Form 3922

When you need to file form 3922 you are required to. The information on form 3922 will help determine your cost or other basis, as well as your holding period. Web this needs to be reported on your tax return. Web order tax form 3922 to report transfer of stock acquired through an employee stock purchase plan under section 423.

Form 3922 Edit, Fill, Sign Online Handypdf

Irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), reports specific. Web 1 best answer tomyoung level 13 when you sell stocks that you've acquired via an espp, such a sale can create compensation income that can be included on. Web for the latest information about developments related to forms 3921 and 3922.

Web Form 3922 Is Required For Reporting The Transfer Of Stock Acquired Through An Employee Stock Purchase Plan.

Complete, edit or print tax forms instantly. Although this information is not taxable unless. Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. Complete, edit or print tax forms instantly.

Get Answers To These Five Common Questions About Reporting Espp.

The information on form 3922 will help determine your cost or other basis, as well as your holding period. Web this needs to be reported on your tax return. Ad access irs tax forms. October 2017) department of the treasury internal revenue service exercise of an incentive stock option under section 422(b).

If You Purchased Espp Shares, Your Employer Will Send You Form 3922, Transfer Of Stock Acquired Through An Employee Stock Purchase Plan.

Web 1 best answer tomyoung level 13 when you sell stocks that you've acquired via an espp, such a sale can create compensation income that can be included on. When you need to file form 3922 you are required to. Web instructions for forms 3921 and 3922 (rev. Copy a is mailed to the irs.

First And Foremost, You Should Always Report Your.

Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates,. Web we estimate it will take you about 55 minutes to complete this form. Web information returns for iso exercises must be made on form 3921, and information returns for espp stock transfers must be made on form 3922. Web there are a few things you need to know if you’re ever asked to report a form 3922, the annual tax report.