Form 3520 How To File

Form 3520 How To File - Note that the irs may recharacterize purported gifts from foreign corporations or foreign partnerships. Most fair market value (fmv). Web requested below and part iii of the form. Web anyone in the u.s. Ad register and subscribe now to work on your irs form 3520 & more fillable forms. Learn the filing process fill out form 3520 and file it separately from your income tax return. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Ad complete irs tax forms online or print government tax documents. Upload, modify or create forms.

Web form 3520 filing requirements. Ad complete irs tax forms online or print government tax documents. Try it for free now! Person who, during the current tax year, received certain gifts or bequests from a foreign person. Note that the irs may recharacterize purported gifts from foreign corporations or foreign partnerships. This information includes its u.s. Owner a foreign trust with at least one u.s. Upload, modify or create forms. The form provides information about the foreign trust, its u.s. Web form 3520, also known as th e annual return to report transactions with foreign trusts and receipt of certain foreign gifts, is an informational return used to report.

Ad complete irs tax forms online or print government tax documents. Persons (and executors of estates of u.s. Web form 3520, also known as th e annual return to report transactions with foreign trusts and receipt of certain foreign gifts, is an informational return used to report. 22, 2022, is eligible to receive a payment. The form provides information about the foreign trust, its u.s. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Web american citizens and resident aliens who receive a foreign inheritance valued at over $100,000 must report it using irs form 3520. Be aware of filing dates and deadlines for individuals, form 3520. Certain transactions with foreign trusts. Owner files this form annually to provide information.

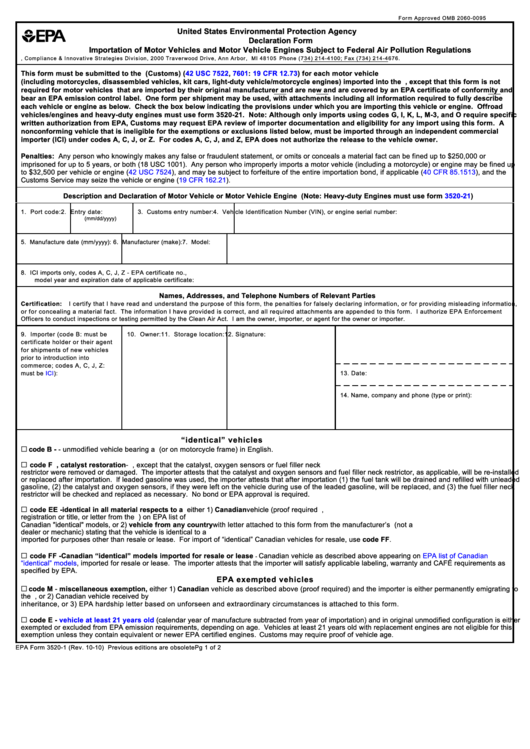

Form 3520 2013 Edit, Fill, Sign Online Handypdf

Web form 3520, also known as th e annual return to report transactions with foreign trusts and receipt of certain foreign gifts, is an informational return used to report. Ad register and subscribe now to work on your irs form 3520 & more fillable forms. Upload, modify or create forms. Web you must separately identify each gift and the identity.

Top Epa Form 35201 Templates free to download in PDF format

Web one example of a situation in which a taxpayer fails to file a form 3520 and probably should have a solid reasonable cause argument is this: Learn the filing process fill out form 3520 and file it separately from your income tax return. Transfers to foreign trusts described in section 402 (b), 404 (a) (4), or 404a. Web you.

Form 3520 Edit, Fill, Sign Online Handypdf

Note that the irs may recharacterize purported gifts from foreign corporations or foreign partnerships. Web form 3520, also known as th e annual return to report transactions with foreign trusts and receipt of certain foreign gifts, is an informational return used to report. Web american citizens and resident aliens who receive a foreign inheritance valued at over $100,000 must report.

US Taxes and Offshore Trusts Understanding Form 3520

Most fair market value (fmv). Person who, during the current tax year, received certain gifts or bequests from a foreign person. Certain transactions with foreign trusts. Transfers to foreign trusts described in section 402 (b), 404 (a) (4), or 404a. Upload, modify or create forms.

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Owner files this form annually to provide information. The form provides information about the foreign trust, its u.s. Completing this form requires the. Most fair market value (fmv). Send form 3520 to the.

Form 3520 Reporting Foreign Gifts and Distributions From a Foreign Trust

The due date for filing form 3520 is april and the due. The form provides information about the foreign trust, its u.s. Learn the filing process fill out form 3520 and file it separately from your income tax return. Person who, during the current tax year, received certain gifts or bequests from a foreign person. Web an income tax return,.

question about form 3520 TurboTax Support

Owner files this form annually to provide information. Note that the irs may recharacterize purported gifts from foreign corporations or foreign partnerships. Most fair market value (fmv). Persons (and executors of estates of u.s. Decedents) file form 3520 to report:

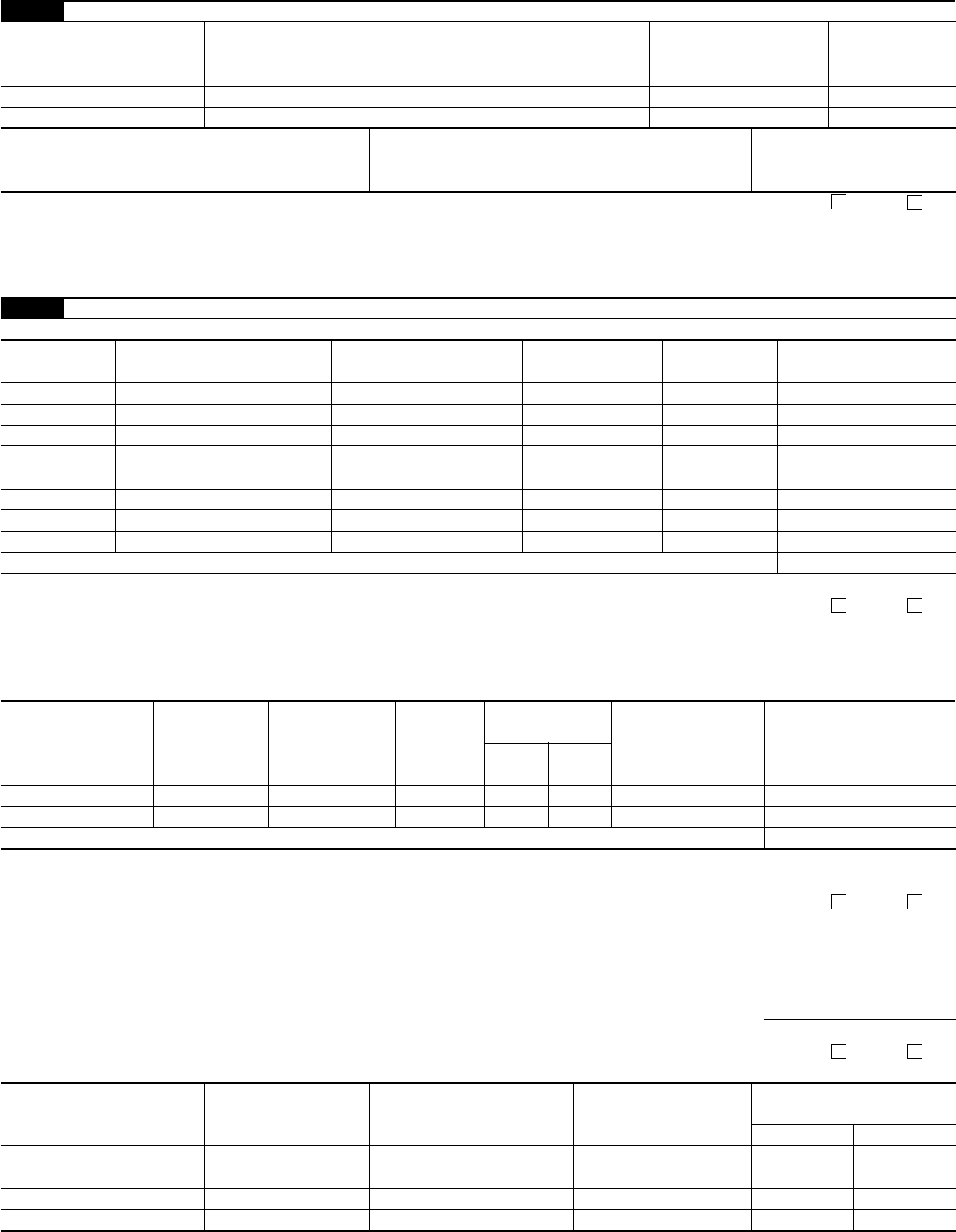

Fillable Form 3520A Foreign Grantor Trust Beneficiary Statement

Persons (and executors of estates of u.s. Complete, edit or print tax forms instantly. Completing this form requires the. Be aware of filing dates and deadlines for individuals, form 3520. Most fair market value (fmv).

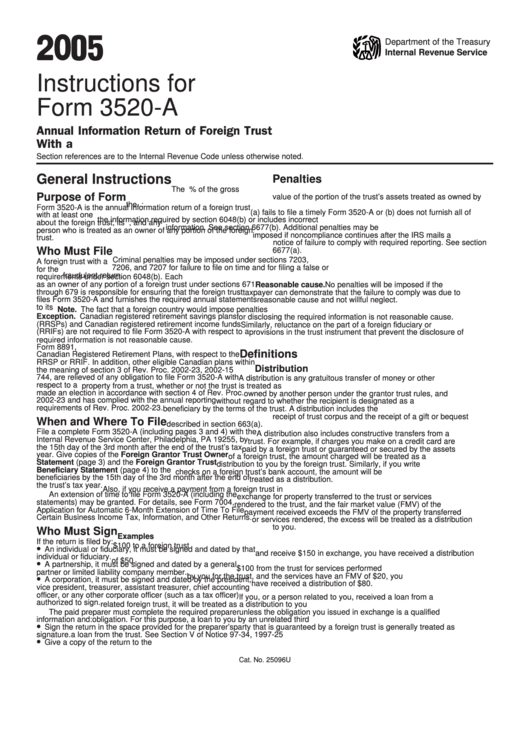

Instructions For Form 3520A Annual Information Return Of Foreign

22, 2022, is eligible to receive a payment. Who has had a facebook account at any time between may 24, 2007, and dec. Web form 3520 filing requirements. Taxpayers may attach a reasonable cause. Decedents) file form 3520 to report:

Form 3520 Examples and a HowTo Guide to Filing for Americans Living Abroad

The form provides information about the foreign trust, its u.s. Try it for free now! Ad register and subscribe now to work on your irs form 3520 & more fillable forms. Web you must separately identify each gift and the identity of the donor. Transfers to foreign trusts described in section 402 (b), 404 (a) (4), or 404a.

Who Has Had A Facebook Account At Any Time Between May 24, 2007, And Dec.

Completing this form requires the. Try it for free now! Note that the irs may recharacterize purported gifts from foreign corporations or foreign partnerships. Taxpayers may attach a reasonable cause.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Send form 3520 to the. Web the penalty for filing a delinquent form 3520 is 5% of the value of the unreported gift for each month that passes after its due date. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Be aware of filing dates and deadlines for individuals, form 3520.

Web Form 3520 Does Not Have To Be Filed To Report The Following Transactions.

Web anyone in the u.s. Ownership of foreign trusts under the. Owner a foreign trust with at least one u.s. Form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign gifts.

Ad Complete Irs Tax Forms Online Or Print Government Tax Documents.

Decedents) file form 3520 to report: The due date for filing form 3520 is april and the due. Owner files this form annually to provide information. 22, 2022, is eligible to receive a payment.