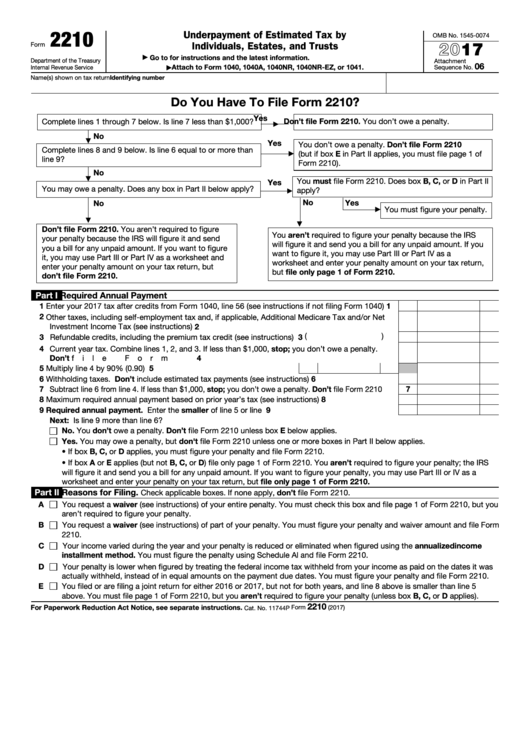

Form 2210 Line D

Form 2210 Line D - Yes a you don’t owe a penalty. Enter the penalty on form 2210, line 19, and on the “estimated tax penalty” line on your tax return. Is line 4 or line 7 less than $1,000? Is line 6 equal to or more than line 9? Your penalty is lower when figured by treating the federal income tax. You don’t owe a penalty. You must figure the penalty using schedule al and file form 2210. Web to complete form 2210, you must enter your prior year tax which is found on line 24 of your prior year 1040 and check any corresponding boxes if they relate to your situation. Don’t file form 2210 (but. Don’t file form 2210 (but if box e in part ii applies, you must file page 1 of form.

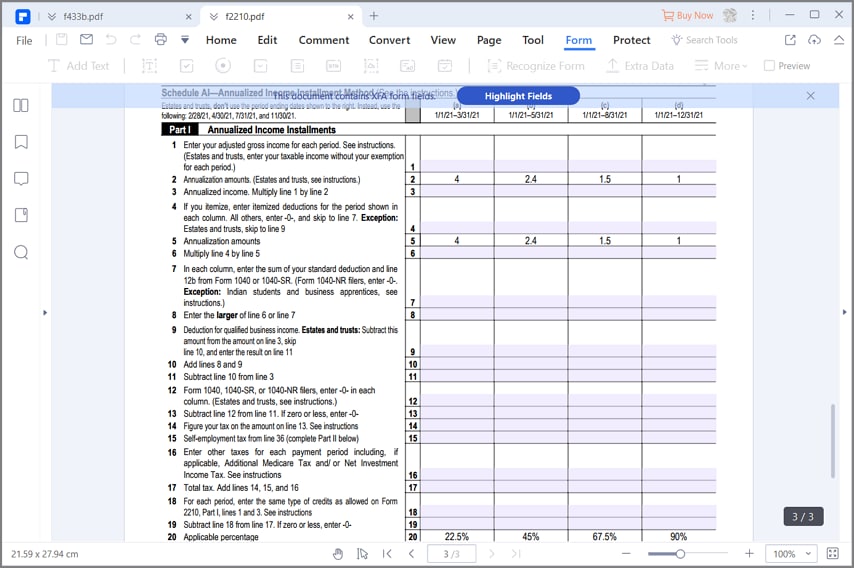

You must figure the penalty using schedule al and file form 2210. Yes a you don’t owe a penalty. Web 2021 form 2210 calculation error submitting via paper is an undesireable solution especially if you have a refund coming. When annualizing withholding you must. Yes you don’t owe a penalty. Web about the individual income tax the irs and most states collect a personal income tax, which is paid throughout the year via tax withholding or estimated income tax payments. Is line 4 or line 7 less than $1,000? Is line 6 equal to or more than line 9? Complete part iii to figure the. Web d don’t file form 2210.

When annualizing withholding you must. Enter the penalty on form 2210, line 19, and on the “estimated tax penalty” line on your tax return. Yes don’t file form 2210. D your penalty is lower when figured by treating the federal income tax withheld from your income as. The sum of the four columns is not equal to your total withholding of $xxxx for the year. Web enter the amounts from schedule ai, part i, line 27, columns (a) through (d), in the corresponding columns of form 2210, part iii, line 10. Web d don’t file form 2210. Web bug in form 2210 part ii line d an alternative is to pay the tax at irs.gov. Complete part iii to figure the. If you want to figure it, you may use part iii.

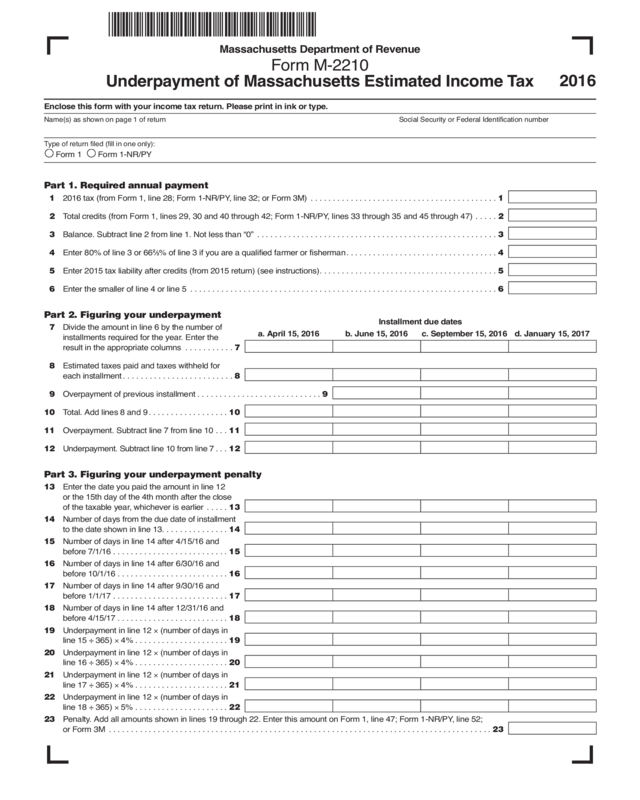

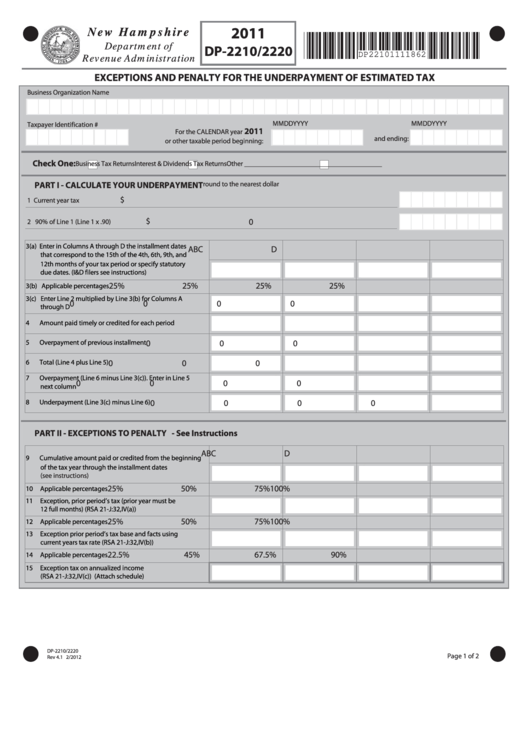

Form M2210 Edit, Fill, Sign Online Handypdf

Is line 4 or line 7 less than $1,000? A recent kiplinger tax letter reported. Is line 6 equal to or more than line 9? Web about the individual income tax the irs and most states collect a personal income tax, which is paid throughout the year via tax withholding or estimated income tax payments. Yes you don’t owe a.

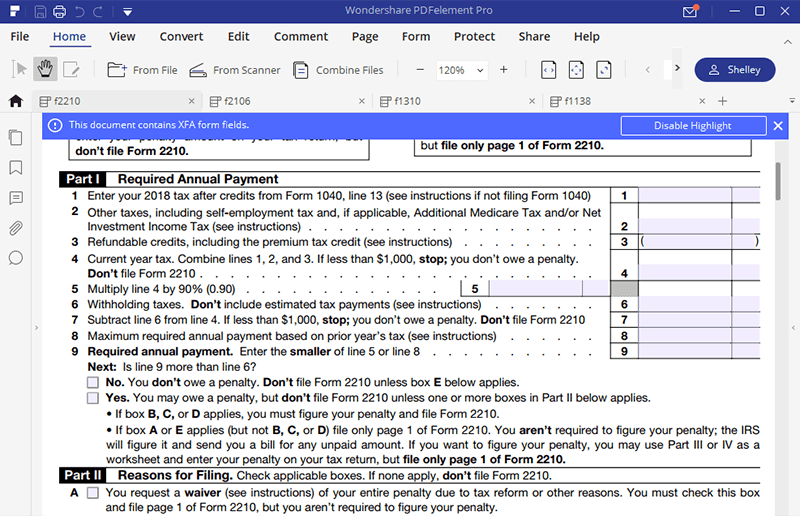

Form 2210 Edit, Fill, Sign Online Handypdf

Web adon’t file form 2210. Web enter the amounts from schedule ai, part i, line 27, columns (a) through (d), in the corresponding columns of form 2210, part iii, line 10. If you want to figure it, you may use part iii. Enter the penalty on form 2210, line 19, and on the “estimated tax penalty” line on your tax.

Form 2210 Edit, Fill, Sign Online Handypdf

You can pay the amount owed so that you don't incur additional interest. Is line 6 equal to or more than line 9? D your penalty is lower when figured by treating the federal income tax withheld from your income as. Web bug in form 2210 part ii line d an alternative is to pay the tax at irs.gov. Web.

IRS Form 2210Fill it with the Best Form Filler

A recent kiplinger tax letter reported. Web about the individual income tax the irs and most states collect a personal income tax, which is paid throughout the year via tax withholding or estimated income tax payments. Web step by step instructions if you’re filing an income tax return and haven’t paid enough in income taxes throughout the tax year, you.

Form Dp2210/2220 Exceptions And Penalty For The Underpayment Of

Web adon’t file form 2210. The sum of the four columns is not equal to your total withholding of $xxxx for the year. Web you must figure the penalty using schedule al and file form 2210. Is line 6 equal to or more than line 9? A recent kiplinger tax letter reported.

IRS Form 2210Fill it with the Best Form Filler

You can pay the amount owed so that you don't incur additional interest. Is line 4 or line 7 less than $1,000? Your penalty is lower when figured by treating the federal income tax. Web complete lines 1 through 7 below. When annualizing withholding you must.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Web complete lines 8 and 9 below. Complete part iii to figure the. Web you must figure the penalty using schedule al and file form 2210. Enter the penalty on form 2210, line 19, and on the “estimated tax penalty” line on your tax return. Web bug in form 2210 part ii line d an alternative is to pay the.

Top 18 Form 2210 Templates free to download in PDF format

Complete part iii to figure the. 18 19 estimated tax paid and tax withheld (see page 3 of the instructions). Is line 6 equal to or. When annualizing withholding you must. A recent kiplinger tax letter reported.

Ssurvivor Form 2210 Instructions 2018

Not sure what this means/ what to correct?. Your penalty is lower when figured by treating the federal income tax. Is line 4 or line 7 less than $1,000? Don’t file form 2210 (but. You don’t owe a penalty.

You Aren’t Required To Figure Your Penalty Because The Irs Will Figure It And Send You A Bill For Any Unpaid Amount.

Enter the penalty on form 2210, line 19, and on the “estimated tax penalty” line on your tax return. Web complete lines 1 through 7 below. When annualizing withholding you must. Web about the individual income tax the irs and most states collect a personal income tax, which is paid throughout the year via tax withholding or estimated income tax payments.

Web Adon’t File Form 2210.

You don’t owe a penalty. Your penalty is lower when figured by treating the federal income tax. You can pay the amount owed so that you don't incur additional interest. Web annualized income installment method.

Yes You Don’t Owe A Penalty.

Is line 6 equal to or more than line 9? Is line 4 or line 7 less than $1,000? If you want to figure it, you may use part iii. Web 2021 form 2210 calculation error submitting via paper is an undesireable solution especially if you have a refund coming.

The Sum Of The Four Columns Is Not Equal To Your Total Withholding Of $Xxxx For The Year.

No complete lines 8 and 9 below. Don’t file form 2210 (but if box e in part ii applies, you must file page 1 of form. You don’t owe a penalty. Is line 6 equal to or more than line 9?