Form 140 Az

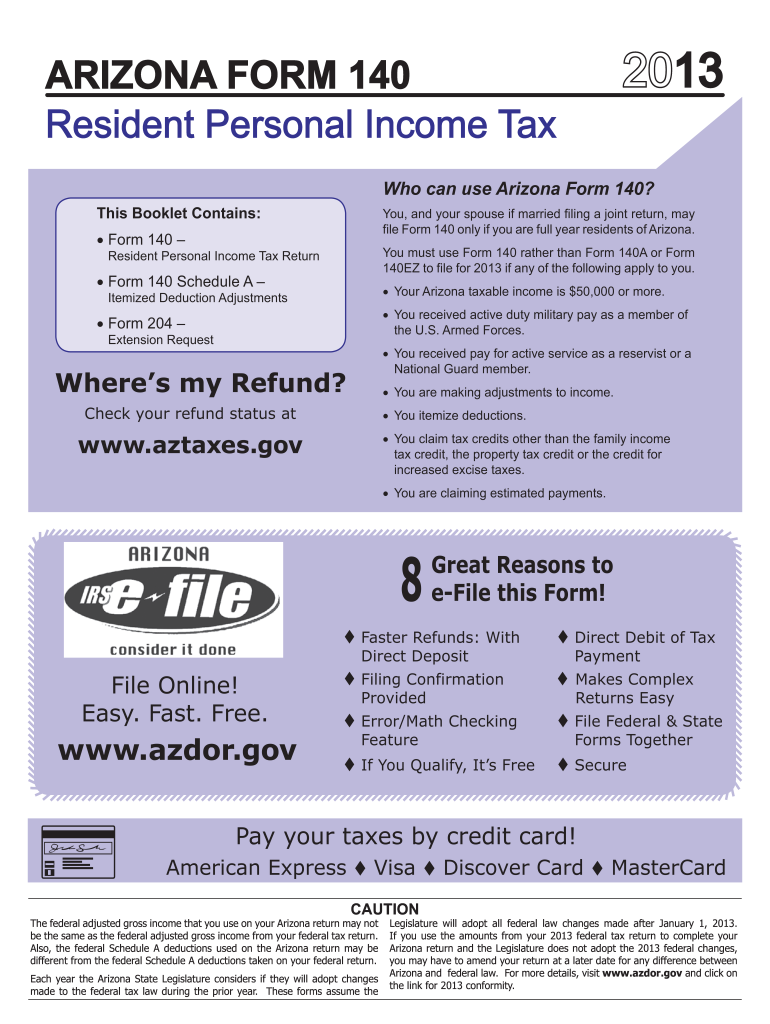

Form 140 Az - Create a blank & editable az form 140, fill it out and send it instantly to the irs. All arizona taxpayers must file a form 140 with the arizona department of revenue. If you pay someone else to prepare your return, that person must also include an id number where. Web place any required federal and az schedules or other documents after form 140. Get ready for this year's tax season quickly and safely with pdffiller! You must use form 140 rather than form 140a or form 140ez to file for 2013 if any of the following apply to you. This form should be completed after filing your federal taxes, using form 1040. File now with turbotax we last updated arizona form 140 in february 2023 from the arizona department of revenue. Web click on “make a payment” and select “140v” as the payment type. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax refund of excess withheld income or a tax payment if the withholding does not cover the taxpayer's entire liability.

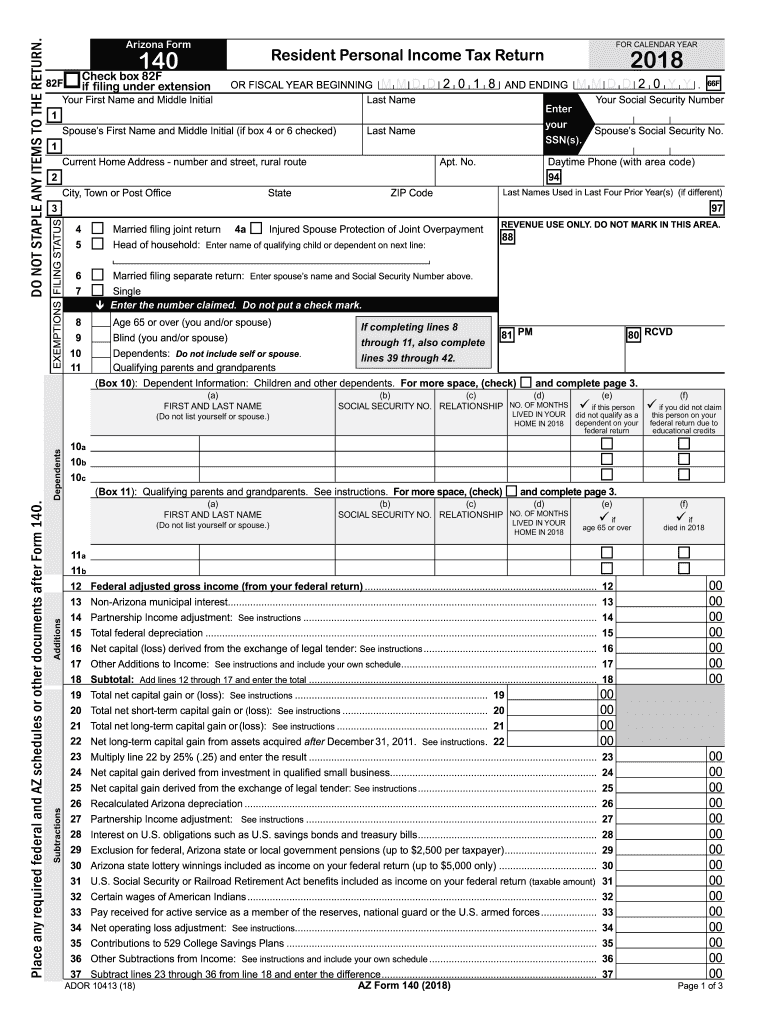

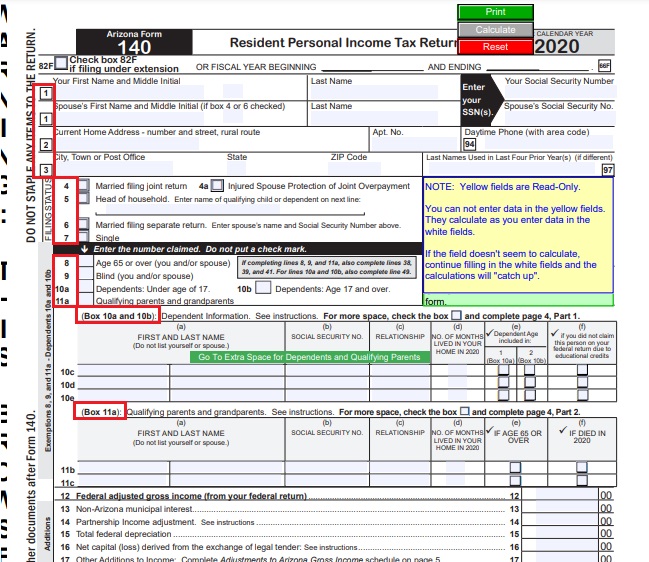

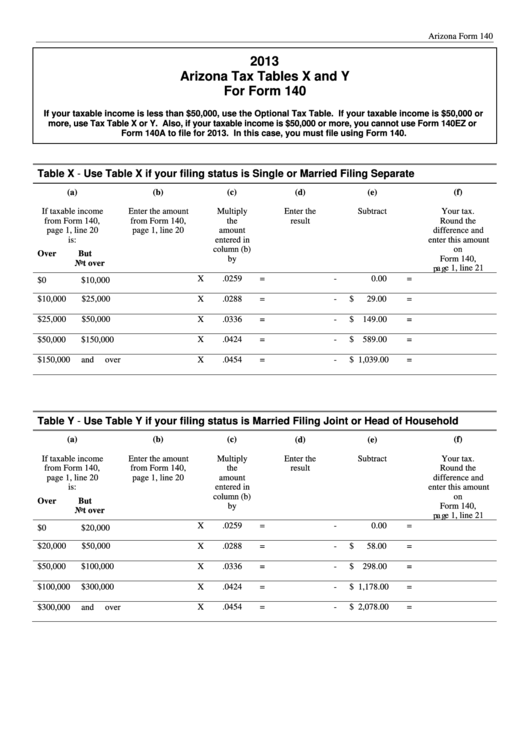

•our arizona taxable income is y $50,000 or more Do not staple any items to the return. We will apply this payment to your account. For more information about the arizona income tax, see the arizona income tax page. Please disregard the information provided in the worksheet's note section (note #2 on form 140; Web personal income tax return filed by resident taxpayers. Web arizona form 2020 resident personal income tax return 140 for information or help, call one of the numbers listed: Id numbers for paid preparers. Your arizona taxable income is $50,000 or more, regardless of filing status; You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona.

To avoid interest and penalties you must pay the full amount of your tax by april 18, 2022. Dependents additions subtractions 82f check box 82f if filing under extension arizona form 140resident personal income tax return for calendar year 2021 You (and your spouse, if married filing a joint return) may file form 140 only if you are full year residents of arizona. Note #3 on forms 140nr, 140py and 140x). You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. Arizona also provides two additional forms taxpayers can use to file state tax returns: Web arizona form 2022 nonresident personal income tax return 140nr for information or help, call one of the numbers listed: Web who must use form 140? Here are links to common arizona tax forms for individual filers, along with instructions: Web printable 140 tax return form for arizona residents.

Printable Az 140 Tax Form Printable Form 2022

You must use form 140 rather than form 140a or form 140ez to file for 2020 if any of the following apply to you. •our arizona taxable income is y $50,000 or more Download & print with other fillable us tax forms in pdf. File now with turbotax we last updated arizona form 140 in february 2023 from the arizona.

Az 140 Fillable Form Fill Online, Printable, Fillable, Blank pdfFiller

Your arizona taxable income is $50,000 or more, regardless of filing status; You can print other arizona tax forms here. Web arizona resident personal income tax booklet update to the 2020 increase standard deduction worksheet for taxpayers electing to take the standard deduction on their arizona tax return: Web place any required federal and az schedules or other documents after.

Az 140 Form Fill Online, Printable, Fillable, Blank pdfFiller

Dependents additions subtractions 82f check box 82f if filing under extension arizona form 140resident personal income tax return for calendar year 2021 Do not mail this form. Arizona also provides two additional forms taxpayers can use to file state tax returns: Your arizona taxable income is $50,000 or more, regardless of filing status; Web click on “make a payment” and.

AZ DoR 140 Instructions 20202021 Fill out Tax Template Online US

You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. Web the most common arizona income tax form is the arizona form 140. Form 140ez (easy form), and form 140a (short form). Note #3 on forms 140nr, 140py and 140x). To avoid interest and penalties you must.

Instructions and Download of Arizona Form 140 Unemployment Gov

Dependents additions subtractions 82f check box 82f if filing under extension arizona form 140resident personal income tax return for calendar year 2021 Form 140ez (easy form), and form 140a (short form). Web personal income tax return filed by resident taxpayers. File now with turbotax we last updated arizona form 140 in february 2023 from the arizona department of revenue. Arizona.

Fillable Arizona Tax Tables X And Y For Form 140 2013 printable pdf

Arizona also provides two additional forms taxpayers can use to file state tax returns: Do not mail this form. Web who must use form 140? Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax refund of excess.

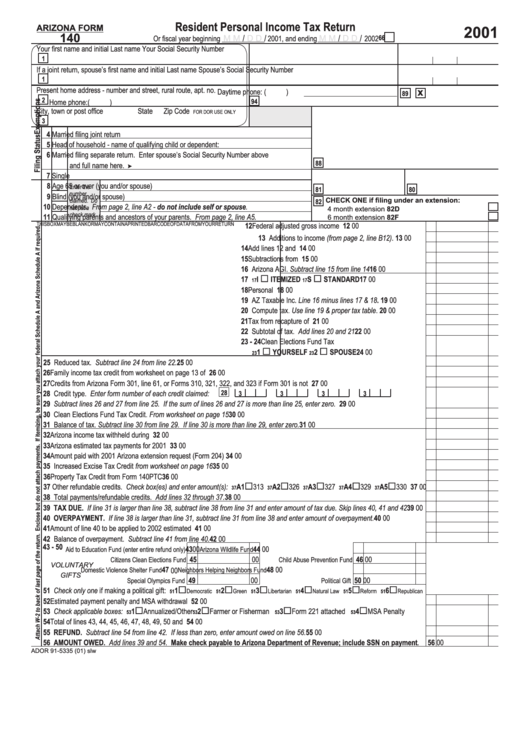

Arizona Form 140 Resident Personal Tax Return 2001 printable

Form 140ez (easy form), and form 140a (short form). Web printable 140 tax return form for arizona residents. Your arizona taxable income is $50,000 or more, regardless of filing status. To avoid interest and penalties you must pay the full amount of your tax by april 18, 2022. Web the most common arizona income tax form is the arizona form.

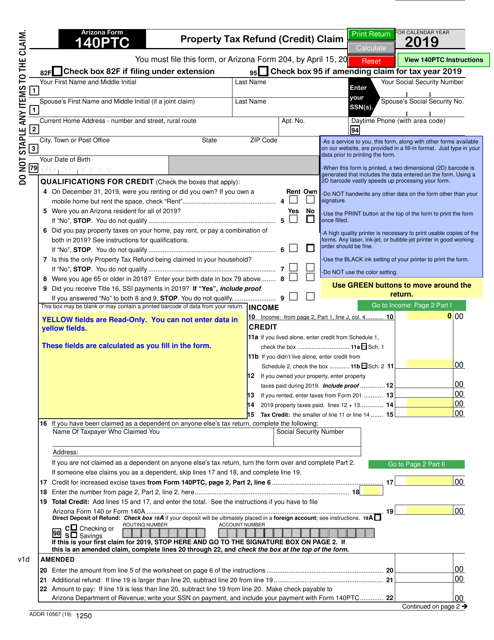

Arizona Form 140PTC (ADOR10567) Download Fillable PDF or Fill Online

You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. Web candidates for this exam are server or desktop administrators with subject matter expertise in designing, implementing, managing, and maintaining microsoft azure virtual desktop experiences and remote apps for any device. Web personal income tax return filed.

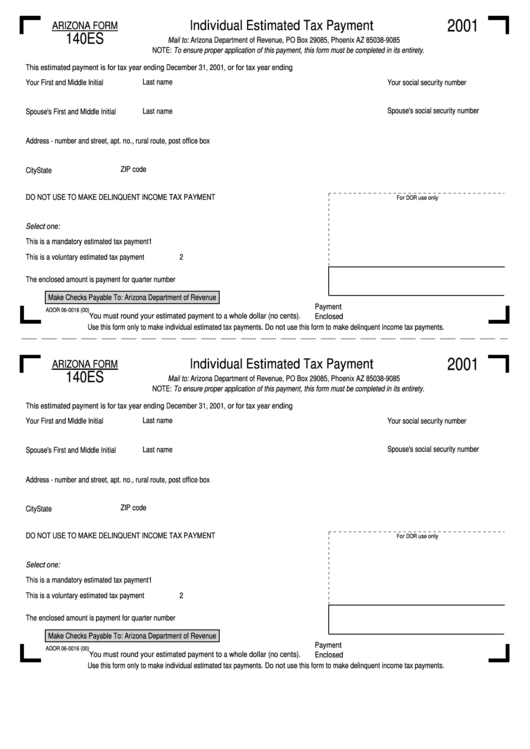

Form 140 Es Individual Estimated Tax Payment 2001 printable pdf

Web click on “make a payment” and select “140v” as the payment type. All arizona taxpayers must file a form 140 with the arizona department of revenue. You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. Web most taxpayers are required to file a yearly income.

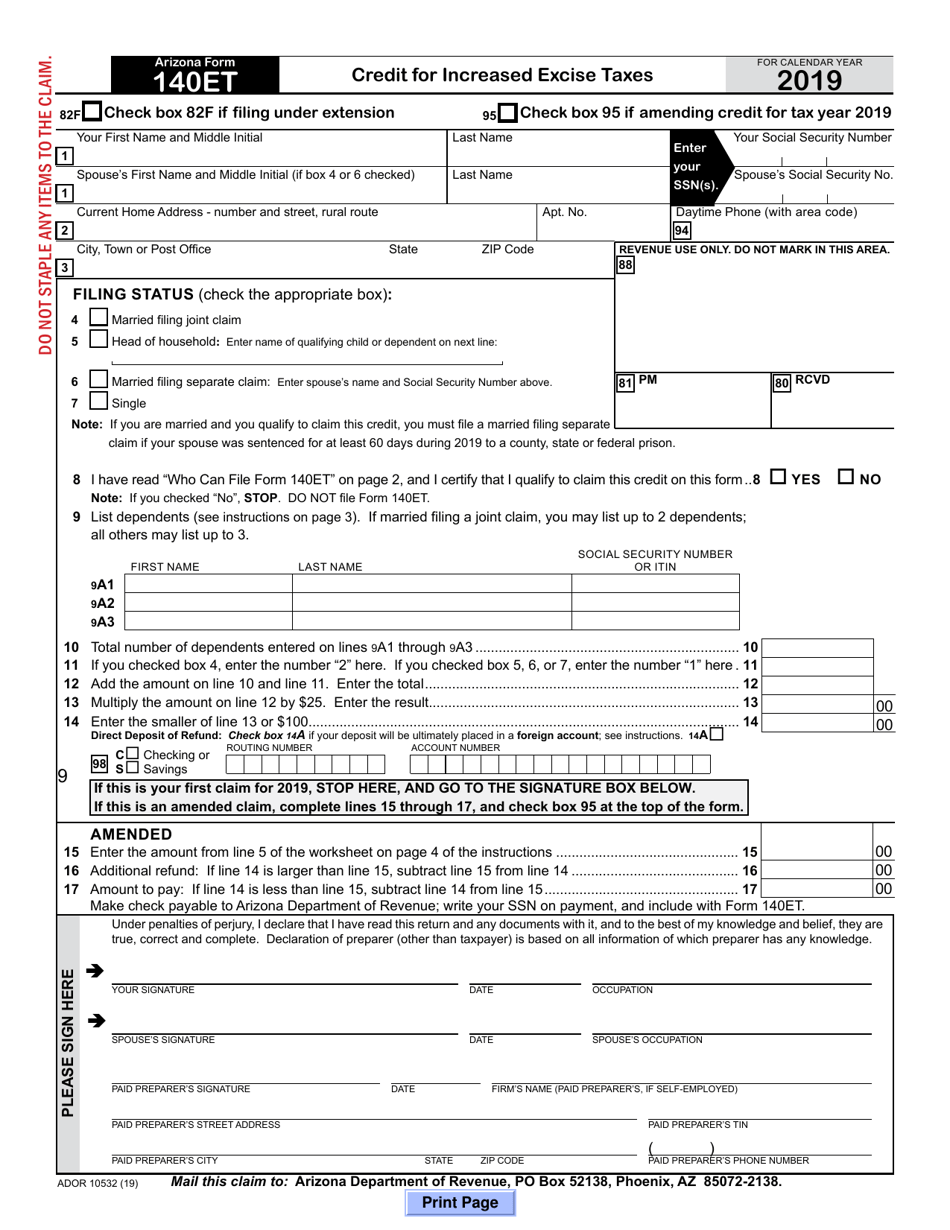

Arizona Form 140ET (ADOR10532) Download Fillable PDF or Fill Online

Do not mail this form. Dependents additions subtractions 82f check box 82f if filing under extension arizona form 140resident personal income tax return for calendar year 2021 Web who must use form 140? Easily fill out pdf blank, edit, and sign them. Web printable 140 tax return form for arizona residents.

For More Information About The Arizona Income Tax, See The Arizona Income Tax Page.

You, and your spouse if married filing a joint return, may file form 140 only if you are full year residents of arizona. Create a blank & editable az form 140, fill it out and send it instantly to the irs. You (and your spouse, if married filing a joint return) may file form 140 only if you are full year residents of arizona. Your arizona taxable income is $50,000 or more, regardless of filing status.

Web An Individual Is Filing An Who Individual Income Tax Form (140 Or 140A) And Claims A Property Tax Credit On That Return Is Required To Complete Form 140Ptc And Include It With Their Tax.

Web personal income tax return filed by resident taxpayers. File now with turbotax we last updated arizona form 140 in february 2023 from the arizona department of revenue. Web click on “make a payment” and select “140v” as the payment type. You must use form 140 rather than form 140a or form 140ez to file for 2013 if any of the following apply to you.

Web Printable 140 Tax Return Form For Arizona Residents.

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax refund of excess withheld income or a tax payment if the withholding does not cover the taxpayer's entire liability. Form 140ez (easy form), and form 140a (short form). Easily fill out pdf blank, edit, and sign them. Web arizona form 2022 nonresident personal income tax return 140nr for information or help, call one of the numbers listed:

We Will Apply This Payment To Your Account.

This form should be completed after filing your federal taxes, using form 1040. You can print other arizona tax forms here. Web who must use form 140? Web file your arizona and federal tax returns online with turbotax in minutes.