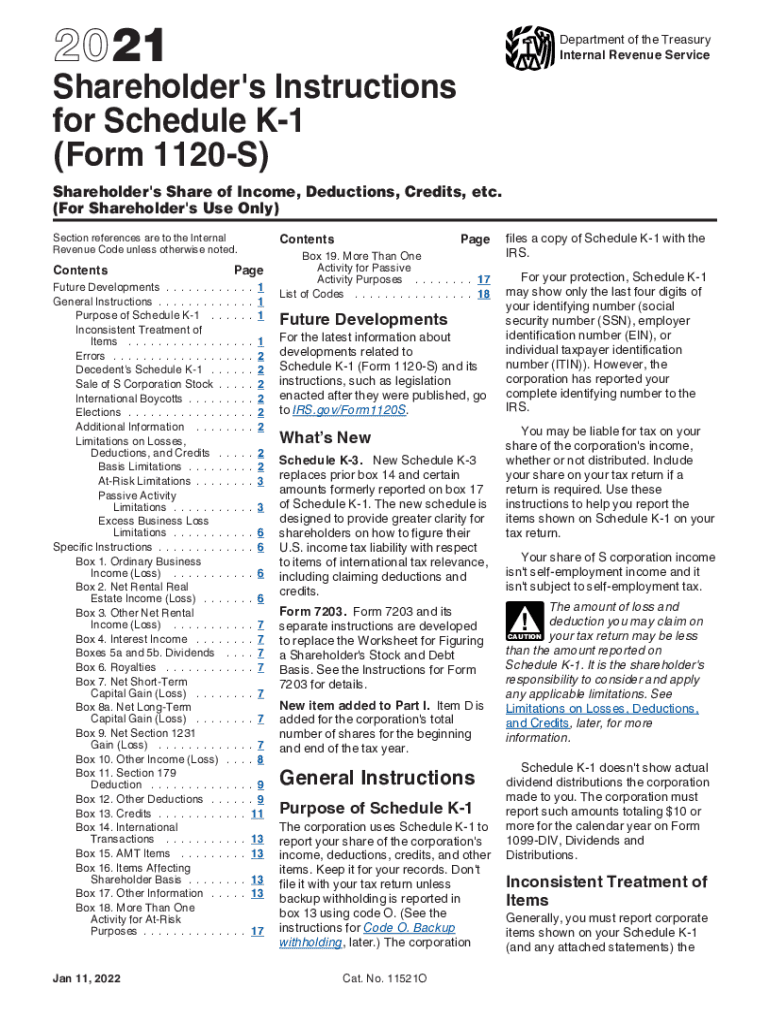

Form 1120S Schedule K-1 Instructions

Form 1120S Schedule K-1 Instructions - Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to treat the credit for. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. Department of the treasury internal revenue service for calendar year 2022, or tax year. Information from the schedule k. This article focuses solely on the entry of the credit and foreign transaction items which are found on boxes. This code will let you know if you should. Some items reported on your schedule k. Get ready for this year's tax season quickly and safely with pdffiller! Web federal form 1120s, schedule k, lines 12a, 12b, 12c(2) and 12d or federal form 1065, schedule k, line 13a, 13b, 13c(2) and 13d. 4 digit code used to identify the software developer whose application produced the bar code.

Click the button get form to open it and start editing. Get ready for this year's tax season quickly and safely with pdffiller! Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to treat the credit for. Information from the schedule k. Some items reported on your schedule k. Department of the treasury internal revenue service for calendar year 2022, or tax year. This article focuses solely on the entry of the credit and foreign transaction items which are found on boxes. 4 digit code used to identify the software developer whose application produced the bar code. This code will let you know if you should. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments.

This article focuses solely on the entry of the credit and foreign transaction items which are found on boxes. Click the button get form to open it and start editing. Some items reported on your schedule k. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. Fill in all required fields in the doc with our convenient. This code will let you know if you should. Get ready for this year's tax season quickly and safely with pdffiller! 4 digit code used to identify the software developer whose application produced the bar code. Department of the treasury internal revenue service for calendar year 2022, or tax year. Web federal form 1120s, schedule k, lines 12a, 12b, 12c(2) and 12d or federal form 1065, schedule k, line 13a, 13b, 13c(2) and 13d.

What Is K1 Form For Taxes Fill Out and Sign Printable PDF Template

Get ready for this year's tax season quickly and safely with pdffiller! Fill in all required fields in the doc with our convenient. 4 digit code used to identify the software developer whose application produced the bar code. Department of the treasury internal revenue service for calendar year 2022, or tax year. Web the partnership should use this code to.

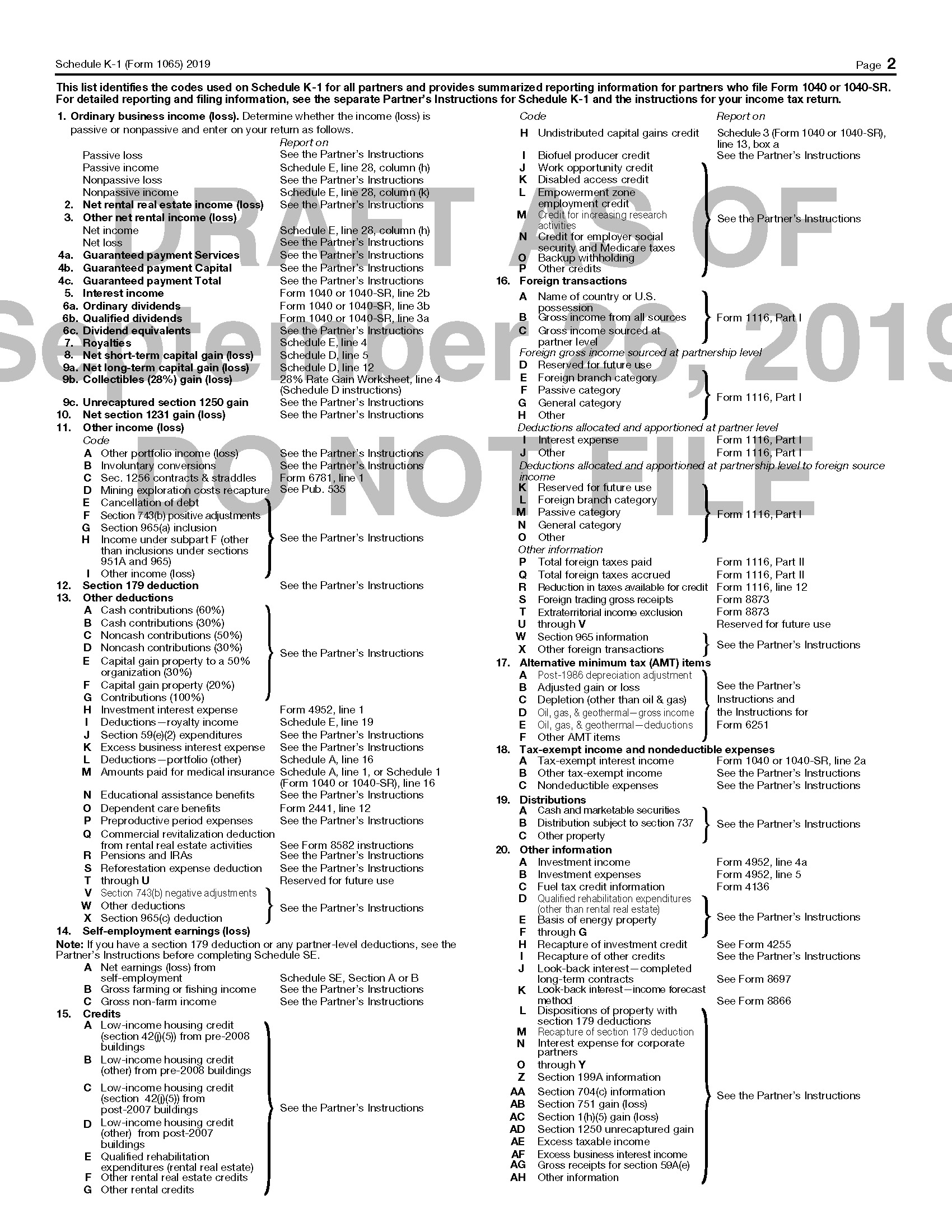

Drafts of 2019 Forms 1065 and 1120S, As Well As K1s, Issued by IRS

Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. This code will let you know if you should. This article focuses solely on the entry of the credit and foreign transaction items which are found on boxes. Click the button get form to open it.

3.12.217 Error Resolution Instructions for Form 1120S Internal

Department of the treasury internal revenue service for calendar year 2022, or tax year. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. Get ready for this year's tax season quickly and safely with pdffiller! This code will let you know if you should. This.

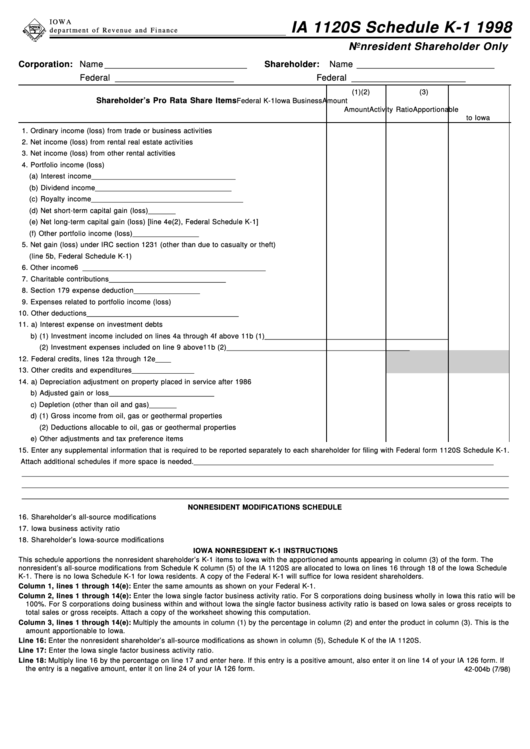

Fillable Form 1120s Schedule K1 Nonresident Shareholder Only 1998

Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to treat the credit for. Fill in all required fields in the doc with our convenient. Click the button get form to open it and start editing. Get ready for this year's tax season quickly and.

IRS Instruction 1120S Schedule K1 2020 Fill out Tax Template

Department of the treasury internal revenue service for calendar year 2022, or tax year. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022,.

Download Instructions for IRS Form 1120S Schedule K1 Shareholder's

Information from the schedule k. Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to treat the credit for. Department of the treasury internal revenue service for calendar year 2022, or tax year. Fill in all required fields in the doc with our convenient. Get.

41 1120s other deductions worksheet Worksheet Works

Some items reported on your schedule k. Get ready for this year's tax season quickly and safely with pdffiller! Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to treat the credit for. Web federal form 1120s, schedule k, lines 12a, 12b, 12c(2) and 12d.

What is Form 1120S and How Do I File It? Ask Gusto

Get ready for this year's tax season quickly and safely with pdffiller! Some items reported on your schedule k. Web federal form 1120s, schedule k, lines 12a, 12b, 12c(2) and 12d or federal form 1065, schedule k, line 13a, 13b, 13c(2) and 13d. Information from the schedule k. Click the button get form to open it and start editing.

IRS Form 1120S Definition, Download, & 1120S Instructions

Fill in all required fields in the doc with our convenient. Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to treat the credit for. Click the button get form to open it and start editing. Get ready for this year's tax season quickly and.

Form 1120S K 1 Instructions 2016 2018 Codes Line 17 —

This code will let you know if you should. Fill in all required fields in the doc with our convenient. Some items reported on your schedule k. Department of the treasury internal revenue service for calendar year 2022, or tax year. Get ready for this year's tax season quickly and safely with pdffiller!

This Code Will Let You Know If You Should.

Department of the treasury internal revenue service for calendar year 2022, or tax year. 4 digit code used to identify the software developer whose application produced the bar code. Fill in all required fields in the doc with our convenient. Some items reported on your schedule k.

Web The Partnership Should Use This Code To Report Your Share Of Income/Gain That Comes From Your Total Net Section 743 (B) Basis Adjustments.

Click the button get form to open it and start editing. Information from the schedule k. Web federal form 1120s, schedule k, lines 12a, 12b, 12c(2) and 12d or federal form 1065, schedule k, line 13a, 13b, 13c(2) and 13d. Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to treat the credit for.

This Article Focuses Solely On The Entry Of The Credit And Foreign Transaction Items Which Are Found On Boxes.

Get ready for this year's tax season quickly and safely with pdffiller!