Form 1099 Misc Schedule C

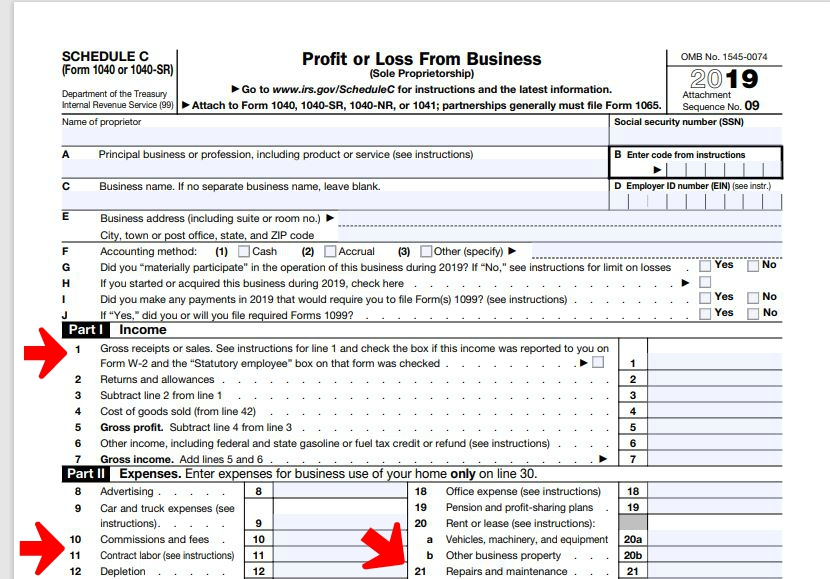

Form 1099 Misc Schedule C - The preparer should always ask the client if. If the payment is in box 1, rents, check the 100% check box if the taxpayer has 100% ownership over the property. Web a schedule c form is a tax document filed by independent workers in order to report their business earnings. It's important to note that this form is only necessary for people who. Also file schedule se (form. Web the intent is to determine if a taxpayer truly has a schedule c in which the income would then qualify them for the eitc. This article looks at the. Persons with a hearing or speech disability with access to. If it is associated with a schedule c (self. Shop a wide variety of 1099 tax forms from top brands at staples®.

Ad electronically file 1099 forms. If you had not yet completed schedule c (form 1040)profit or loss from businessor schedule e (form. Web answer independent contractors report their income on schedule c (form 1040), profit or loss from business (sole proprietorship). Ad discover a wide selection of 1099 tax forms at staples®. Get ready for tax season deadlines by completing any required tax forms today. Web a schedule c form is a tax document filed by independent workers in order to report their business earnings. Ad access irs tax forms. If it is associated with a schedule c (self. If the payment is in box 1, rents, check the 100% check box if the taxpayer has 100% ownership over the property. This article looks at the.

Also file schedule se (form. Get ready for tax season deadlines by completing any required tax forms today. Web independent contractors report their income on schedule c (form 1040), profit or loss from business (sole proprietorship). Web the intent is to determine if a taxpayer truly has a schedule c in which the income would then qualify them for the eitc. Persons with a hearing or speech disability with access to. If you manually create a schedule c also, you. Web answer independent contractors report their income on schedule c (form 1040), profit or loss from business (sole proprietorship). Ad access irs tax forms. Complete, edit or print tax forms instantly. If you had not yet completed schedule c (form 1040)profit or loss from businessor schedule e (form.

How to Report 1099 Miscellaneous on Schedule C Nina's Soap

This article looks at the. Persons with a hearing or speech disability with access to. Web the intent is to determine if a taxpayer truly has a schedule c in which the income would then qualify them for the eitc. Get ready for tax season deadlines by completing any required tax forms today. Web independent contractors report their income on.

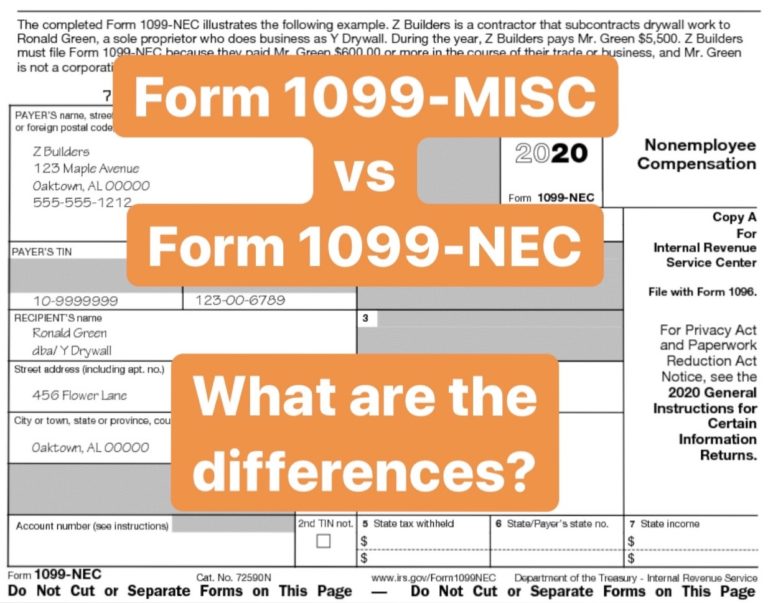

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Web answer independent contractors report their income on schedule c (form 1040), profit or loss from business (sole proprietorship). Web independent contractors report their income on schedule c (form 1040), profit or loss from business (sole proprietorship). It's important to note that this form is only necessary for people who. Ad electronically file 1099 forms. If you had not yet.

Form 1099MISC vs Form 1099NEC How are they Different?

Ad access irs tax forms. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web a schedule c form is a tax document filed by independent workers in order to report their business earnings. Web the intent is to determine if a taxpayer truly has a schedule c in.

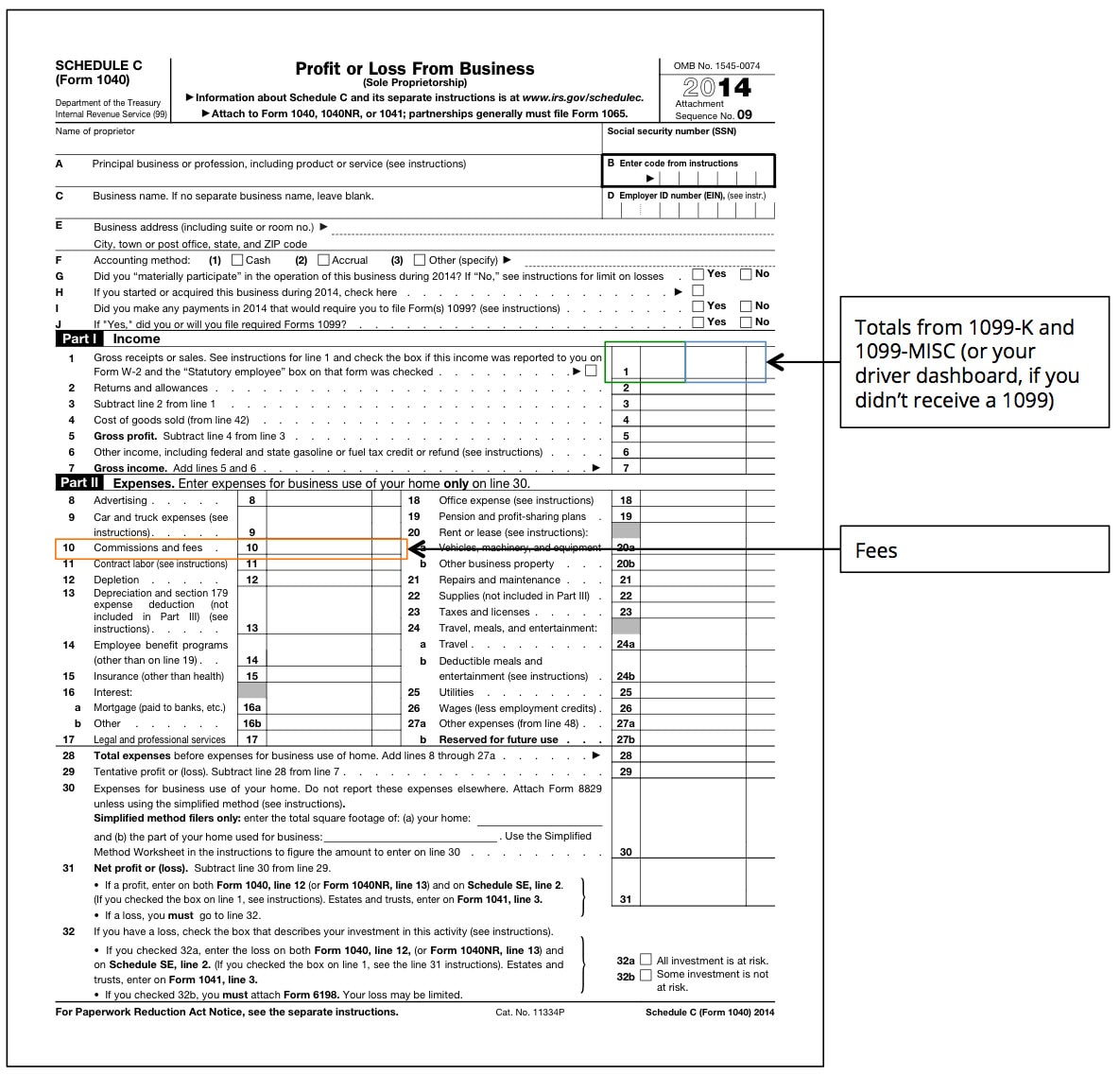

How to Use Your Lyft 1099 Tax Help for Lyft Drivers TurboTax Tax

Also file schedule se (form 1040),. The preparer should always ask the client if. Web the intent is to determine if a taxpayer truly has a schedule c in which the income would then qualify them for the eitc. Web a schedule c form is a tax document filed by independent workers in order to report their business earnings. Ad.

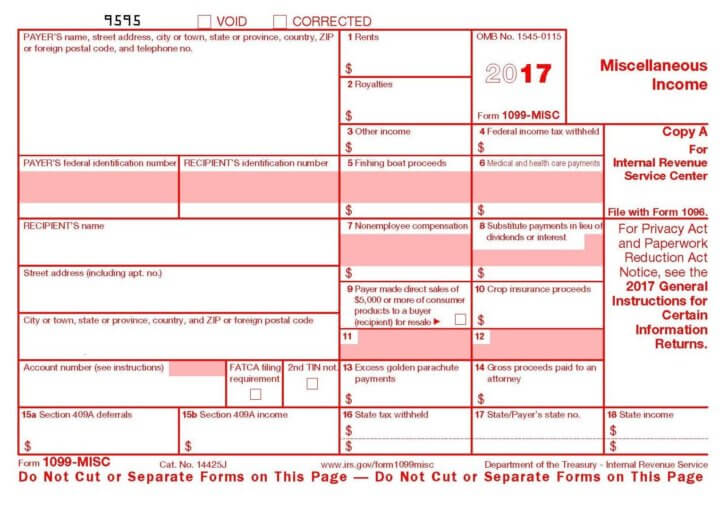

How To Fill Out 1099 Misc Form 2019 Paul Johnson's Templates

If you manually create a schedule c also, you. Also file schedule se (form 1040),. If you had not yet completed schedule c (form 1040)profit or loss from businessor schedule e (form. Web independent contractors report their income on schedule c (form 1040), profit or loss from business (sole proprietorship). If it is associated with a schedule c (self.

Form 1040 With Schedule C I Will Tell You The Truth About Form 1040

Complete, edit or print tax forms instantly. Web answer independent contractors report their income on schedule c (form 1040), profit or loss from business (sole proprietorship). Ad access irs tax forms. Ad electronically file 1099 forms. It's important to note that this form is only necessary for people who.

Free Printable 1099 Misc Forms Free Printable

If it is associated with a schedule c (self. Ad access irs tax forms. It's important to note that this form is only necessary for people who. This article looks at the. If you manually create a schedule c also, you.

1099 misc and schedule C Tax Pro Community

The preparer should always ask the client if. Ad access irs tax forms. Also file schedule se (form 1040),. Also file schedule se (form. If you manually create a schedule c also, you.

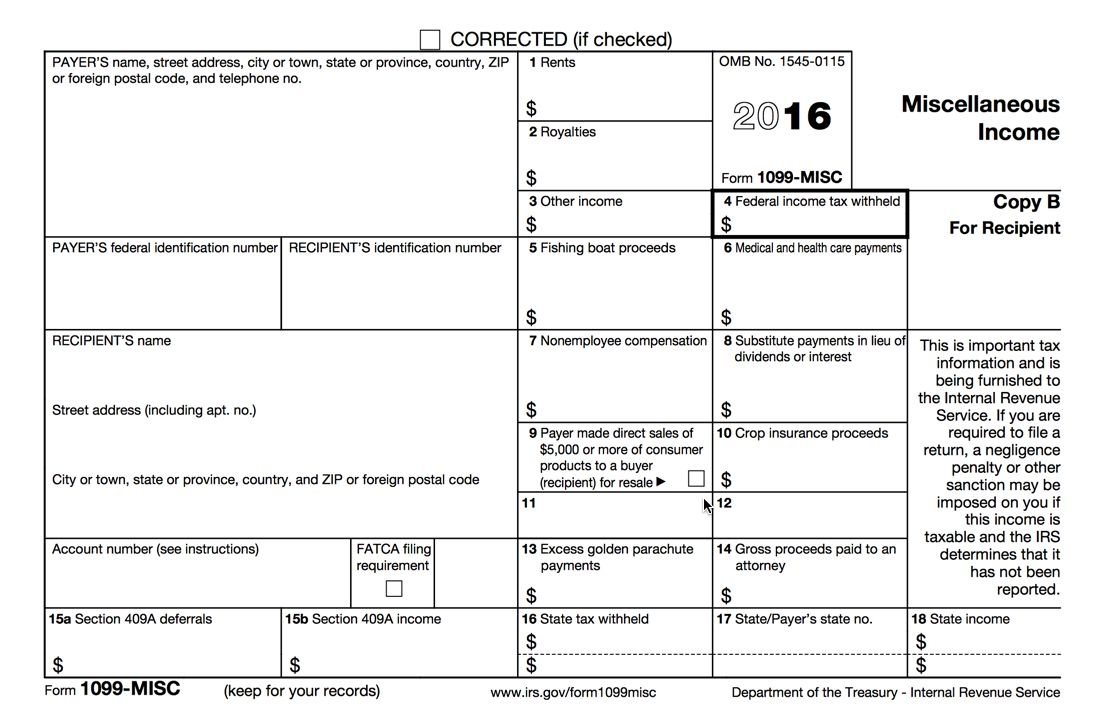

What Is Form 1099MISC? When Do I Need to File a 1099MISC? Gusto

Shop a wide variety of 1099 tax forms from top brands at staples®. If you manually create a schedule c also, you. Web independent contractors report their income on schedule c (form 1040), profit or loss from business (sole proprietorship). Also file schedule se (form. If you had not yet completed schedule c (form 1040)profit or loss from businessor schedule.

√100以上 1099 schedule c tax form 315657What is a schedule c 1099 form

If you had not yet completed schedule c (form 1040)profit or loss from businessor schedule e (form. Complete, edit or print tax forms instantly. Ad access irs tax forms. If you manually create a schedule c also, you. Web the intent is to determine if a taxpayer truly has a schedule c in which the income would then qualify them.

It's Important To Note That This Form Is Only Necessary For People Who.

If it is associated with a schedule c (self. If you had not yet completed schedule c (form 1040)profit or loss from businessor schedule e (form. If the payment is in box 1, rents, check the 100% check box if the taxpayer has 100% ownership over the property. Shop a wide variety of 1099 tax forms from top brands at staples®.

Ad Electronically File 1099 Forms.

Ad access irs tax forms. Web independent contractors report their income on schedule c (form 1040), profit or loss from business (sole proprietorship). Web a schedule c form is a tax document filed by independent workers in order to report their business earnings. Persons with a hearing or speech disability with access to.

Also File Schedule Se (Form.

If you manually create a schedule c also, you. Get ready for tax season deadlines by completing any required tax forms today. Ad discover a wide selection of 1099 tax forms at staples®. Complete, edit or print tax forms instantly.

The Preparer Should Always Ask The Client If.

Web the intent is to determine if a taxpayer truly has a schedule c in which the income would then qualify them for the eitc. Web answer independent contractors report their income on schedule c (form 1040), profit or loss from business (sole proprietorship). This article looks at the. Also file schedule se (form 1040),.

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://formswift.com/seo-pages-assets/images/1099-forms/image-8-box3-2x.png)