Form 1065 Instructions

Form 1065 Instructions - Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Or getting income from u.s. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. Fill in the other blanks in the “paid preparer use only” area of the return. A paid preparer cannot use a social security number in the “paid preparer use only” box. Web information about form 1065, u.s. Web form 1065 is the first step for paying taxes on income earned by the partnership. Reconciliation of income (loss) per books with analysis of net income (loss) per return. Name of partnership number, street, and room or suite no. Web where to file your taxes for form 1065.

And the total assets at the end of the tax year are: When to file form 1065 form 1065 must be filed by the 15th day of the third month following the date the tax year ended. Web form 1065 is the income tax return for partnerships. Sign the return in the space provided for the preparer's signature. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. If the partnership's principal business, office, or agency is located in: Return of partnership income, including recent updates, related forms and instructions on how to file. Web form 1065 is the first step for paying taxes on income earned by the partnership. Name of partnership number, street, and room or suite no. Fill in the other blanks in the “paid preparer use only” area of the return.

Web the irs form 1065 instructions have the complete details. Name of partnership number, street, and room or suite no. Changes from the inflation reduction act of 2022. And the total assets at the end of the tax year are: For calendar year 2022, or tax year beginning , 2022, ending , 20. Fill in the other blanks in the “paid preparer use only” area of the return. If the partnership's principal business, office, or agency is located in: Web form 1065 is the first step for paying taxes on income earned by the partnership. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts. Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s.

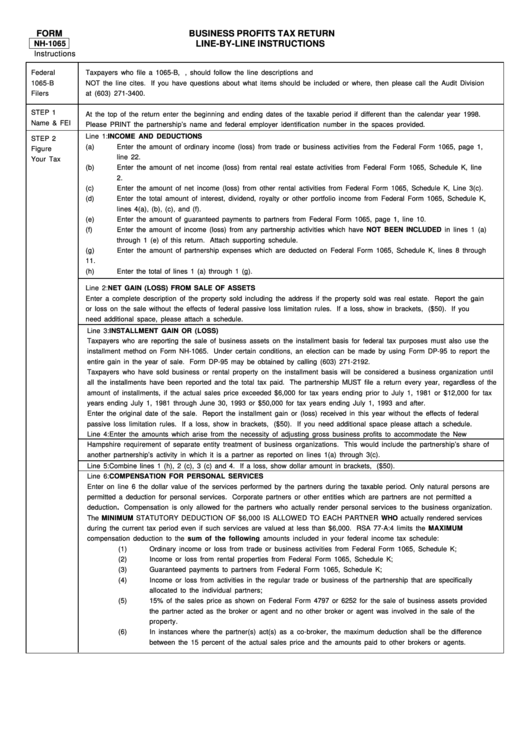

Form Nh1065 Instructions Business Profits Tax Return printable pdf

A paid preparer cannot use a social security number in the “paid preparer use only” box. Web the irs form 1065 instructions have the complete details. Web form 1065 2022 u.s. Web information about form 1065, u.s. Return of partnership income, including recent updates, related forms and instructions on how to file.

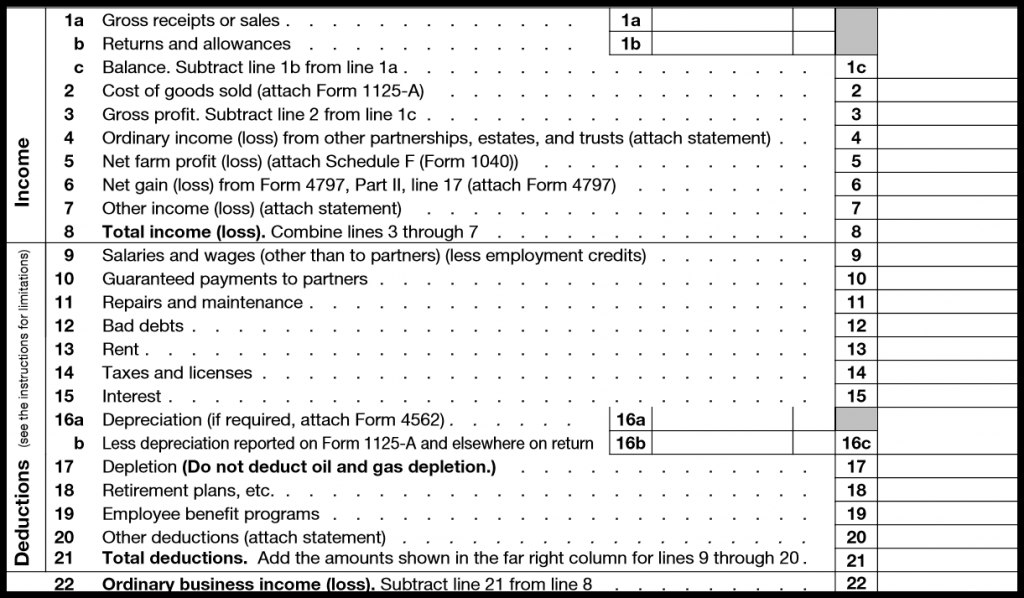

2019 IRS Instructions 1065 Fill Out Digital PDF Sample

Fill in the other blanks in the “paid preparer use only” area of the return. Possession, including for regulated investment companies. Form 1065 includes information about the partnership income, expenses, credits, and partnership distributions. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. Return of partnership income, including recent.

Llc Tax Form 1065 Universal Network

Fill in the other blanks in the “paid preparer use only” area of the return. Web form 1065 is the income tax return for partnerships. Web the irs form 1065 instructions have the complete details. A paid preparer cannot use a social security number in the “paid preparer use only” box. Or getting income from u.s.

Form 1065 Instructions in 8 Steps (+ Free Checklist)

A paid preparer cannot use a social security number in the “paid preparer use only” box. Or getting income from u.s. Possession, including for regulated investment companies. Web form 1065 2022 u.s. Web form 1065 is the first step for paying taxes on income earned by the partnership.

Irs Form 1065 K 1 Instructions Universal Network

If the partnership's principal business, office, or agency is located in: Or getting income from u.s. Form 1065 includes information about the partnership income, expenses, credits, and partnership distributions. Sign the return in the space provided for the preparer's signature. Fill in the other blanks in the “paid preparer use only” area of the return.

Inst 1065Instructions for Form 1065, U.S. Return of Partnership Inco…

Changes from the inflation reduction act of 2022. Web where to file your taxes for form 1065. Web form 1065 2022 u.s. Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Web the irs form 1065 instructions have the complete details.

Form 1065 Instructions & Information for Partnership Tax Returns

Web form 1065 is the income tax return for partnerships. Possession, including for regulated investment companies. Return of partnership income, including recent updates, related forms and instructions on how to file. A paid preparer cannot use a social security number in the “paid preparer use only” box. Web form 1065 is the first step for paying taxes on income earned.

How To Complete Form 1065 With Instructions

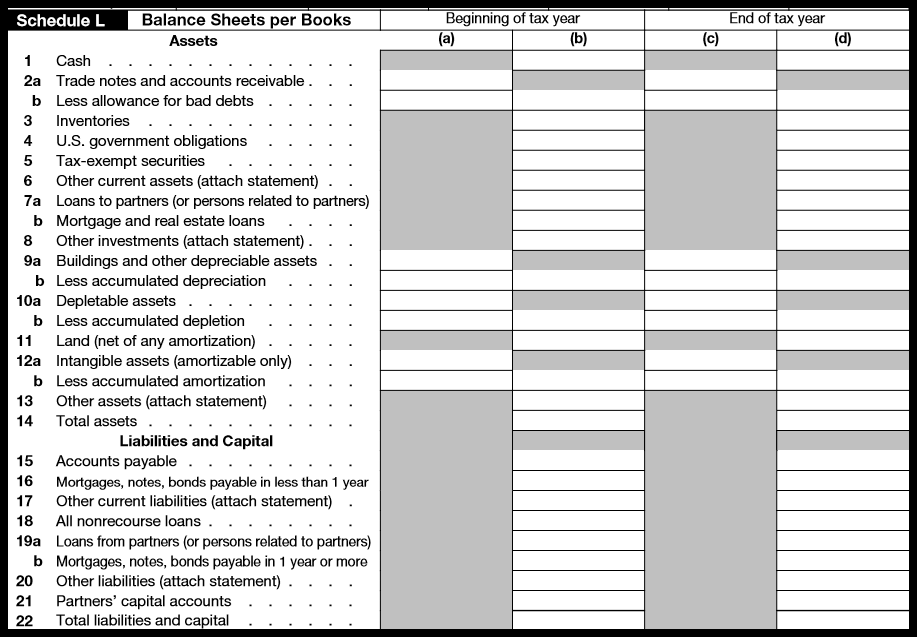

A paid preparer cannot use a social security number in the “paid preparer use only” box. Web form 1065 2022 u.s. Return of partnership income, including recent updates, related forms and instructions on how to file. Reconciliation of income (loss) per books with analysis of net income (loss) per return. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine,.

IRS Instructions 1065 (Schedule K1) 2018 2019 Printable & Fillable

Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. Changes from the inflation reduction act of 2022. Web information about form 1065, u.s. Reconciliation of income (loss) per books with analysis of net income (loss) per return. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts.

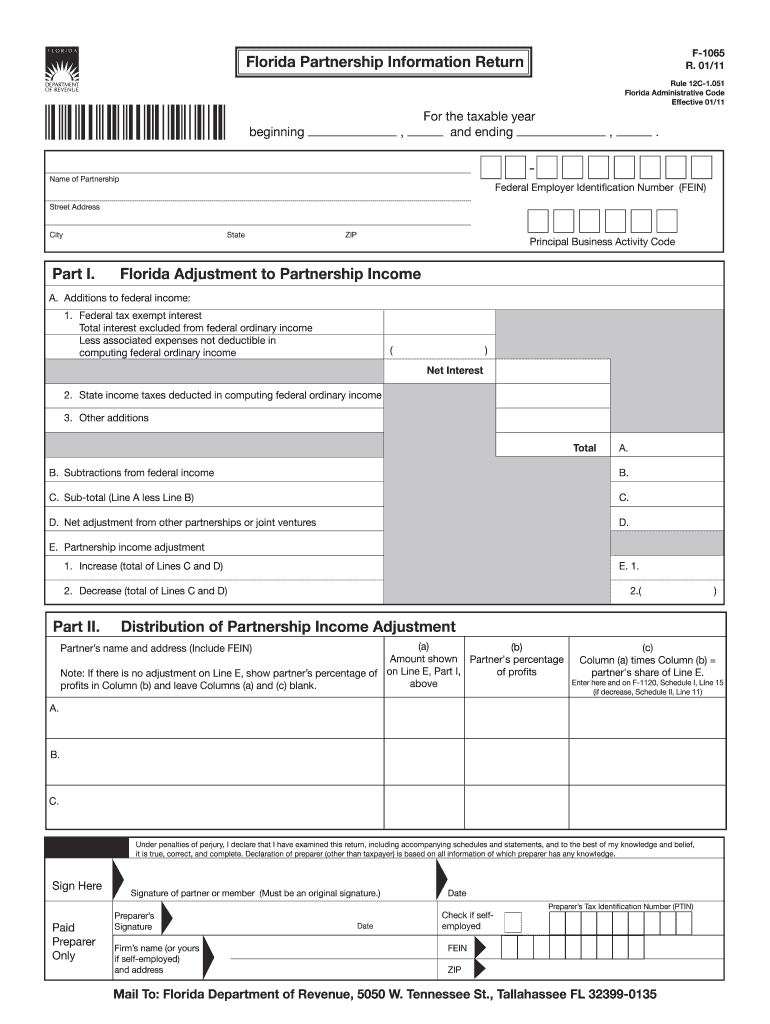

Florida Form F 1065 Instructions Fill Out and Sign Printable PDF

Form 1065 includes information about the partnership income, expenses, credits, and partnership distributions. Fill in the other blanks in the “paid preparer use only” area of the return. Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland,.

Possession, Including For Regulated Investment Companies.

Web form 1065 is the first step for paying taxes on income earned by the partnership. Fill in the other blanks in the “paid preparer use only” area of the return. When to file form 1065 form 1065 must be filed by the 15th day of the third month following the date the tax year ended. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts.

For Calendar Year 2022, Or Tax Year Beginning , 2022, Ending , 20.

Web form 1065 2022 u.s. Return of partnership income, including recent updates, related forms and instructions on how to file. A paid preparer cannot use a social security number in the “paid preparer use only” box. Form 1065 includes information about the partnership income, expenses, credits, and partnership distributions.

Return Of Partnership Income Department Of The Treasury Internal Revenue Service Go To Www.irs.gov/Form1065 For Instructions And The Latest Information.

Web where to file your taxes for form 1065. Sign the return in the space provided for the preparer's signature. Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Use the following internal revenue service center address:

Web The Irs Form 1065 Instructions Have The Complete Details.

Web information about form 1065, u.s. Reconciliation of income (loss) per books with analysis of net income (loss) per return. Name of partnership number, street, and room or suite no. If the partnership's principal business, office, or agency is located in: