Form 10 Ie

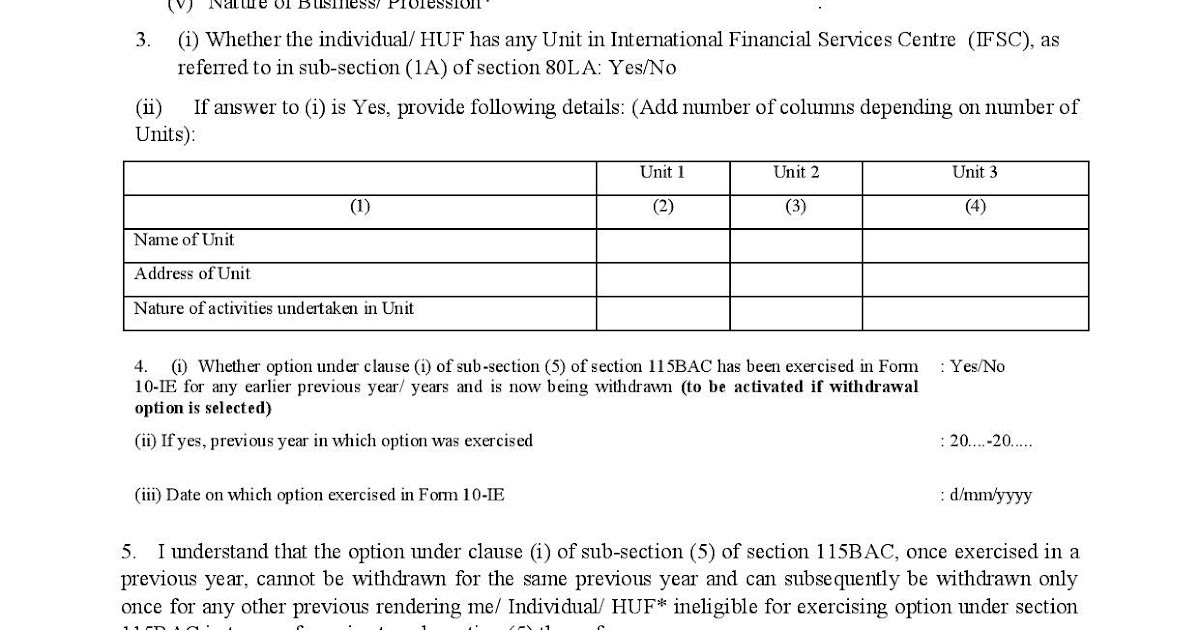

Form 10 Ie - Web form 10ie is a declaration made by the return filers for choosing the ‘new tax regime’ the income tax department has notified that the option to opt for the new tax. Web form 10ie is an online application form that is to be filed by taxpayers to inform their choice of choosing the new tax regime to central board of direct taxes (cbdt). The finance minister announced new. The form will be filed using either digital signature certificate or. Fill out the request of authorization/carrier or self insured employer response online and print. Web therefore, a person not having income from business/profession opting to pay tax under new tax regime can directly exercise option under section 115bac in the. Notice of intent to file written Web under the new tax regime in form 10 ie income tax, taxpayers have the option to pay less tax on their gross income. It automatically computes the return. (date of mailing) in the iowa district court for no.

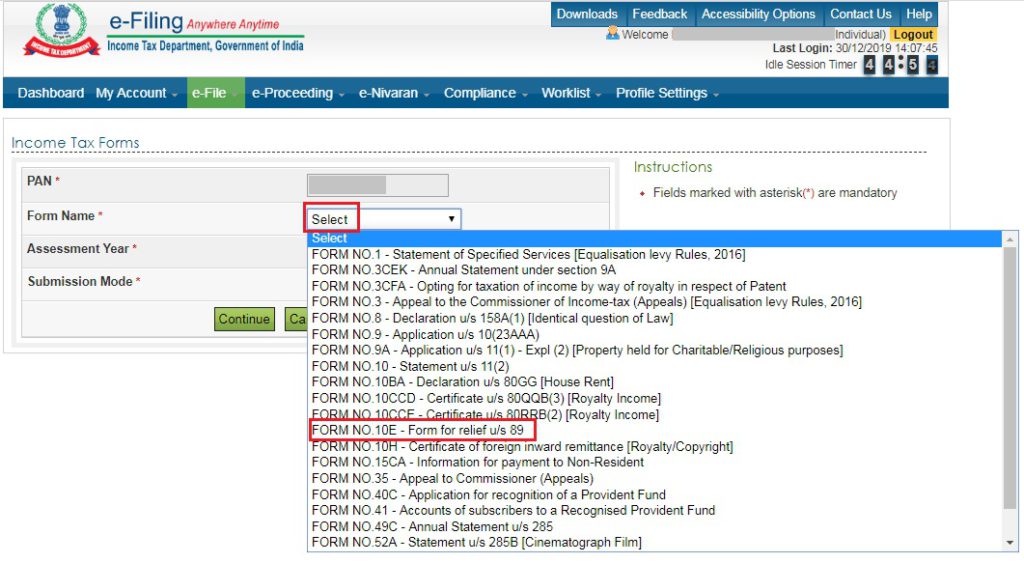

Taxpayers will not be able to claim form. It automatically computes the return. The form will be filed using either digital signature certificate or. Taxpayers can file the form on the it portal to. In case of receipt in arrears or advance of any sum in the nature of salary, relief u/s 89 can be claimed. Either the ia 2210 or ia 2210s is used to determine if an individual taxpayer paid income tax sufficiently throughout the year. Web form 10ie is a declaration made by the return filers for choosing the ‘new tax regime’ the income tax department has notified that the option to opt for the new tax. Use this form if you would like to enter data on the return yourself. Web form 10e has seven parts: Finance act,2020 introduce new tax regime.

(date of mailing) in the iowa district court for no. Finance act,2020 introduce new tax regime. Web form 10ie is a declaration made by the return filers for choosing the ‘new tax regime’ the income tax department has notified that the option to opt for the new tax. Consider using the fillable version instead. Notice of intent to file written The notification has given the clarification that tax payer need to file the form electronically. Web form 10e has seven parts: Either the ia 2210 or ia 2210s is used to determine if an individual taxpayer paid income tax sufficiently throughout the year. Fill out the request of authorization/carrier or self insured employer response online and print. It automatically computes the return.

School Form 10 Template for Elementary, Junior High School and Senior

The form will be filed using either digital signature certificate or. Consider using the fillable version instead. Use this form if you would like to enter data on the return yourself. Fill out the request of authorization/carrier or self insured employer response online and print. Web therefore, a person not having income from business/profession opting to pay tax under new.

Tax Return filing Opting for the new or old regime in the new

The notification has given the clarification that tax payer need to file the form electronically. Use this form if you would like to enter data on the return yourself. Taxpayers can file the form on the it portal to. In case of receipt in arrears or advance of any sum in the nature of salary, relief u/s 89 can be.

Ie アイコン に Plex Icons

Web under the new tax regime in form 10 ie income tax, taxpayers have the option to pay less tax on their gross income. Consider using the fillable version instead. Taxpayers can file the form on the it portal to. Web form 10e has seven parts: Web iowa 2210 / 2210s general information.

Form 10E is mandatory to claim Section 89 relief SAP Blogs

Either the ia 2210 or ia 2210s is used to determine if an individual taxpayer paid income tax sufficiently throughout the year. Use this form if you would like to enter data on the return yourself. Taxpayers will not be able to claim form. Web under the new tax regime in form 10 ie income tax, taxpayers have the option.

Form 10IE Opt for the New Tax Regime Learn by Quicko

(date of mailing) in the iowa district court for no. Web form 10ie is an online application form that is to be filed by taxpayers to inform their choice of choosing the new tax regime to central board of direct taxes (cbdt). The notification has given the clarification that tax payer need to file the form electronically. Taxpayers can file.

How to file Form 10E on eFiling portal Learn by Quicko

The finance minister announced new. Consider using the fillable version instead. Either the ia 2210 or ia 2210s is used to determine if an individual taxpayer paid income tax sufficiently throughout the year. Use this form if you would like to enter data on the return yourself. The form will be filed using either digital signature certificate or.

Form 10IE Opt for the New Tax Regime Learn by Quicko

The form will be filed using either digital signature certificate or. Web form 10e has seven parts: It automatically computes the return. Taxpayers can file the form on the it portal to. (date of mailing) in the iowa district court for no.

Form 10IE Opt for the New Tax Regime Learn by Quicko

Web form 10ie is a declaration made by the return filers for choosing the ‘new tax regime’ the income tax department has notified that the option to opt for the new tax. The finance minister announced new. (date of mailing) in the iowa district court for no. Web therefore, a person not having income from business/profession opting to pay tax.

Form 10I under section 80DDB Good Karma for NGOs

Consider using the fillable version instead. Web under the new tax regime in form 10 ie income tax, taxpayers have the option to pay less tax on their gross income. Taxpayers will not be able to claim form. Notice of intent to file written Use this form if you would like to enter data on the return yourself.

IE E104 & U1 Fill and Sign Printable Template Online US Legal Forms

The finance minister announced new. It automatically computes the return. Taxpayers will not be able to claim form. Web form 10e has seven parts: Web form 10ie is a declaration made by the return filers for choosing the ‘new tax regime’ the income tax department has notified that the option to opt for the new tax.

Use This Form If You Would Like To Enter Data On The Return Yourself.

Fill out the request of authorization/carrier or self insured employer response online and print. Web under the new tax regime in form 10 ie income tax, taxpayers have the option to pay less tax on their gross income. The notification has given the clarification that tax payer need to file the form electronically. Web form 10e has seven parts:

Web Form 10Ie Is A Declaration Made By The Return Filers For Choosing The ‘New Tax Regime’ The Income Tax Department Has Notified That The Option To Opt For The New Tax.

Finance act,2020 introduce new tax regime. Web therefore, a person not having income from business/profession opting to pay tax under new tax regime can directly exercise option under section 115bac in the. The finance minister announced new. The form will be filed using either digital signature certificate or.

Web Form 10Ie Is An Online Application Form That Is To Be Filed By Taxpayers To Inform Their Choice Of Choosing The New Tax Regime To Central Board Of Direct Taxes (Cbdt).

Notice of intent to file written Consider using the fillable version instead. In order to claim such relief, the assessee has to file. Taxpayers can file the form on the it portal to.

Either The Ia 2210 Or Ia 2210S Is Used To Determine If An Individual Taxpayer Paid Income Tax Sufficiently Throughout The Year.

(date of mailing) in the iowa district court for no. In case of receipt in arrears or advance of any sum in the nature of salary, relief u/s 89 can be claimed. Web iowa 2210 / 2210s general information. It automatically computes the return.