File Form 1096 Electronically

File Form 1096 Electronically - We encourage filers who have less than 250 information returns to file electronically as well. Web if you are filing your information returns electronically, you do not need to use form 1096. Irs filing information returns electronically (fire) system (visit irs affordable care act information returns (air) program (visit www.irs.gov/fire), or www.irs.gov/air). Web if you file these information forms electronically, either through the irs fire system or a tax preparation software, you do not need to complete irs form 1096. 1099 dollar amounts, due dates the dollar amount or maximum earnings to issue a 1099 vary based on the type of form. Another thing to keep in mind? Web any entity that needs to file information returns can file electronically via the fire system. Web to file electronically, you must have software, or a service provider, that will create the file in the proper format. Web can i file form 1096 electronically? If you’re a small business owner, chances are you’ll mainly be using form 1096 to submit some version of form 1099.

Also, see part f in the 2023 general instructions for certain information returns. 1099 dollar amounts, due dates the dollar amount or maximum earnings to issue a 1099 vary based on the type of form. Any corporation, partnership, employer, estate or trust that files 250 or more information returns for any calendar year must file electronically. According to the irs, individuals filing 1099s electronically do not need to submit an accompanying 1096. The due dates for these forms to be sent can be found below. Irs filing information returns electronically (fire) system (visit irs affordable care act information returns (air) program (visit www.irs.gov/fire), or www.irs.gov/air). Note if you have 250 or more of any type of information return, you must submit that type of return electronically, so you don't need a 1096 form in this case. There’s a limit to how many paper information returns you can file. We encourage filers who have less than 250 information returns to file electronically as well. Web can i file form 1096 electronically?

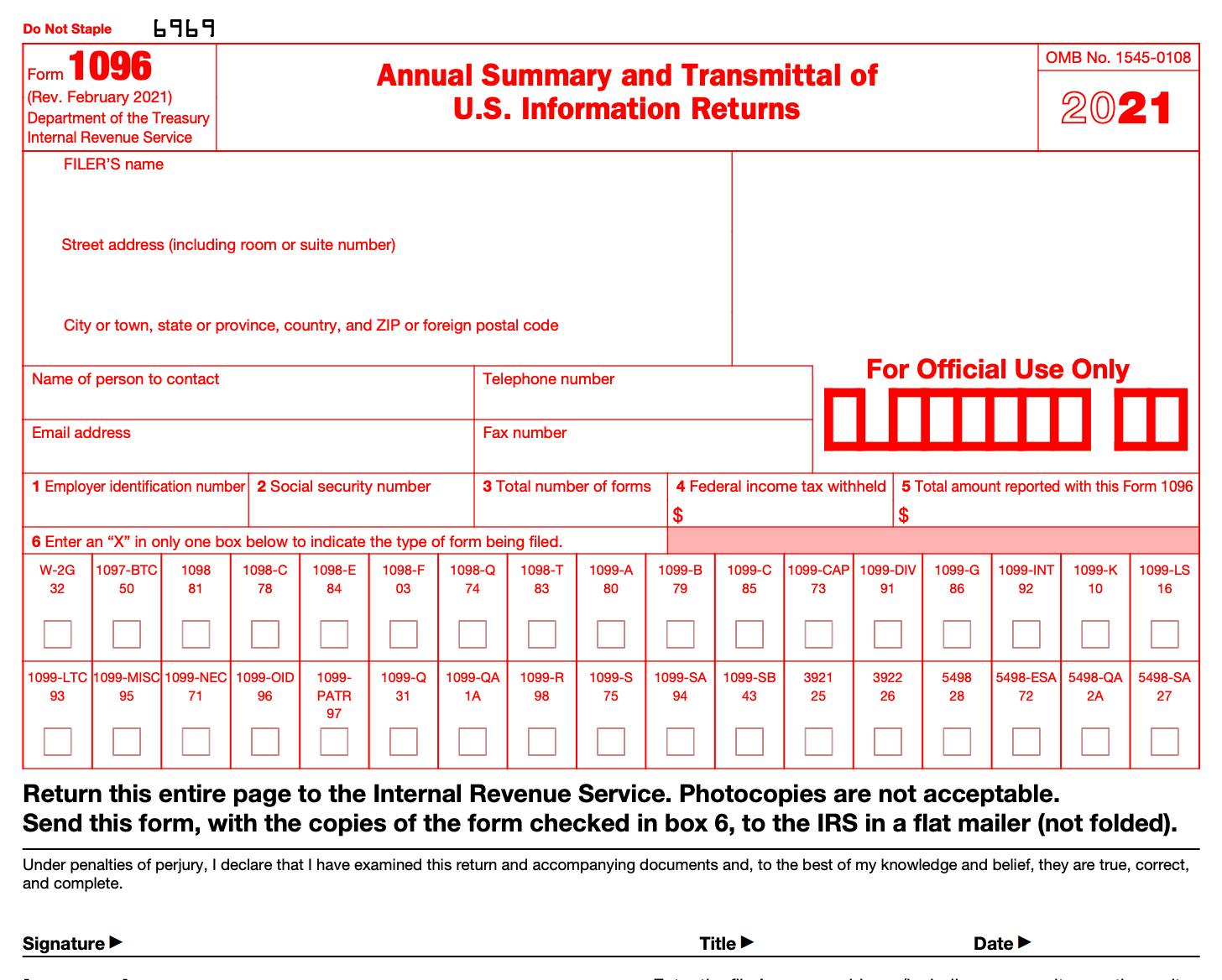

If you’re a small business owner, chances are you’ll mainly be using form 1096 to submit some version of form 1099. Web to file electronically, you must have software, or a service provider, that will create the file in the proper format. According to the irs, individuals filing 1099s electronically do not need to submit an accompanying 1096. 1099 dollar amounts, due dates the dollar amount or maximum earnings to issue a 1099 vary based on the type of form. Another thing to keep in mind? Web any entity that needs to file information returns can file electronically via the fire system. The due dates for these forms to be sent can be found below. Web form 1096 summarizes all of your 1099 forms and is filed with the irs. We encourage filers who have less than 250 information returns to file electronically as well. You cannot file form 1096 or copy a of forms 1099 or 3921 that you print from the irs website.

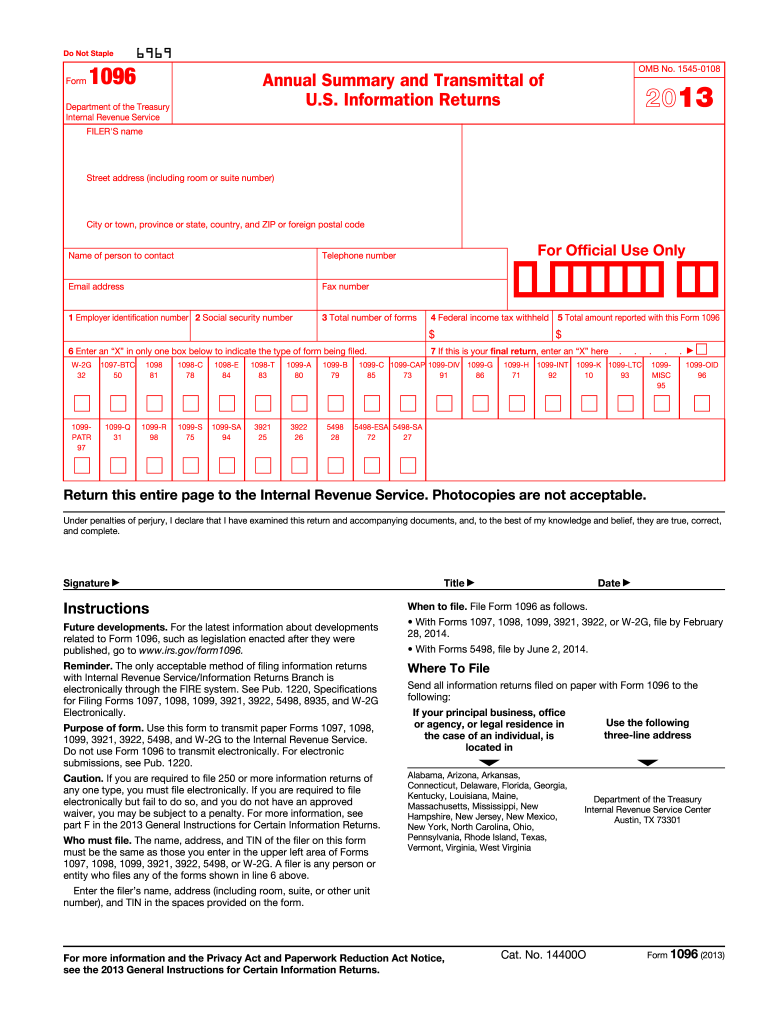

2013 Form IRS 1096 Fill Online, Printable, Fillable, Blank pdfFiller

Web form 1096 summarizes all of your 1099 forms and is filed with the irs. Web you cannot download form 1096 from the irs website. The mailing address is on the last page of the form 1096 instructions. Any corporation, partnership, employer, estate or trust that files 250 or more information returns for any calendar year must file electronically. Irs.

Irs Form 1096 What Is It

Web to file electronically, you must have software, or a service provider, that will create the file in the proper format. There’s a limit to how many paper information returns you can file. Also, see part f in the 2023 general instructions for certain information returns. Web form 1096 summarizes all of your 1099 forms and is filed with the.

What You Need to Know About 1096 Forms Blue Summit Supplies

We encourage filers who have less than 250 information returns to file electronically as well. Also, see part f in the 2023 general instructions for certain information returns. You cannot file form 1096 or copy a of forms 1099 or 3921 that you print from the irs website. The official printed version of form 1096 is scannable and read by.

IRS Form 1096 Instructions How and When to File It NerdWallet

Web can i file form 1096 electronically? More information can be found at: Web if you are filing your information returns electronically, you do not need to use form 1096. Any corporation, partnership, employer, estate or trust that files 250 or more information returns for any calendar year must file electronically. Web keep in mind irs form 1096 is only.

1096 Form Editable Online Blank in PDF

We encourage filers who have less than 250 information returns to file electronically as well. Note if you have 250 or more of any type of information return, you must submit that type of return electronically, so you don't need a 1096 form in this case. Irs filing information returns electronically (fire) system (visit irs affordable care act information returns.

Form 1096 Annual Summary and Transmittal of U.S. Information Returns

Web keep in mind irs form 1096 is only necessary for the mail transmittal of u.s. Web if you are filing your information returns electronically, you do not need to use form 1096. According to the irs, individuals filing 1099s electronically do not need to submit an accompanying 1096. The due dates for these forms to be sent can be.

Printable Form 1096 / 1096 Tax Form Due Date Universal Network

Note if you have 250 or more of any type of information return, you must submit that type of return electronically, so you don't need a 1096 form in this case. Web if you are filing your information returns electronically, you do not need to use form 1096. According to the irs, individuals filing 1099s electronically do not need to.

What is a 1096 Form? A Guide for US Employers Remote

Web if you are filing your information returns electronically, you do not need to use form 1096. If you’re a small business owner, chances are you’ll mainly be using form 1096 to submit some version of form 1099. Web if you file these information forms electronically, either through the irs fire system or a tax preparation software, you do not.

Printable Form 1096 1096 Tax Form Due Date Universal Network What

We encourage filers who have less than 250 information returns to file electronically as well. Web you cannot download form 1096 from the irs website. There’s a limit to how many paper information returns you can file. Web form 1096 summarizes all of your 1099 forms and is filed with the irs. Note if you have 250 or more of.

1096 Form 2021

According to the irs, individuals filing 1099s electronically do not need to submit an accompanying 1096. Web can i file form 1096 electronically? Web keep in mind irs form 1096 is only necessary for the mail transmittal of u.s. Also, see part f in the 2023 general instructions for certain information returns. There’s a limit to how many paper information.

Web Keep In Mind Irs Form 1096 Is Only Necessary For The Mail Transmittal Of U.s.

Any corporation, partnership, employer, estate or trust that files 250 or more information returns for any calendar year must file electronically. Web to file electronically, you must have software, or a service provider, that will create the file in the proper format. Web if you file these information forms electronically, either through the irs fire system or a tax preparation software, you do not need to complete irs form 1096. The due dates for these forms to be sent can be found below.

If You’re A Small Business Owner, Chances Are You’ll Mainly Be Using Form 1096 To Submit Some Version Of Form 1099.

1099 dollar amounts, due dates the dollar amount or maximum earnings to issue a 1099 vary based on the type of form. Irs filing information returns electronically (fire) system (visit irs affordable care act information returns (air) program (visit www.irs.gov/fire), or www.irs.gov/air). More information can be found at: You cannot file form 1096 or copy a of forms 1099 or 3921 that you print from the irs website.

According To The Irs, Individuals Filing 1099S Electronically Do Not Need To Submit An Accompanying 1096.

We encourage filers who have less than 250 information returns to file electronically as well. Note if you have 250 or more of any type of information return, you must submit that type of return electronically, so you don't need a 1096 form in this case. Another thing to keep in mind? Web if you are filing your information returns electronically, you do not need to use form 1096.

There’s A Limit To How Many Paper Information Returns You Can File.

Also, see part f in the 2023 general instructions for certain information returns. The mailing address is on the last page of the form 1096 instructions. Web you cannot download form 1096 from the irs website. Web can i file form 1096 electronically?

/ScreenShot2019-08-22at3.01.28PM-c37afe883a89422880a6d0b275375967.png)