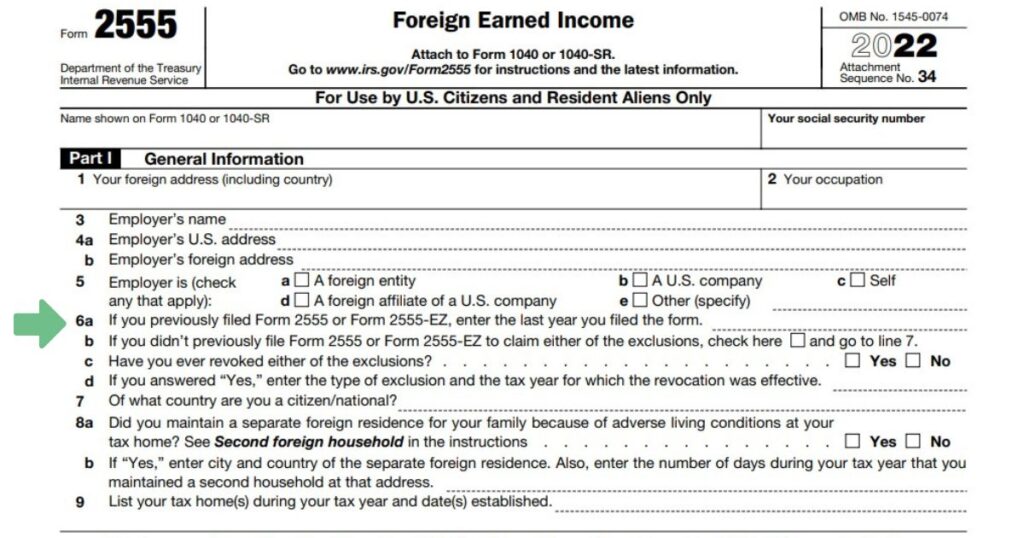

Feie Form 2555

Feie Form 2555 - This form allows an exclusion of up to $107,600 of your foreign earned income if you are a u.s. Include information about your employer and. Web foreign earned income exclusion form 2555 if you are working and/or living abroad and meet certain requirements, you may be eligible to use the foreign earned income. The exclusion is an election. Get ready for tax season deadlines by completing any required tax forms today. The feie is available to expats who either:. Irs form 2555 is used to claim the foreign earned income exclusion (feie). Web form 2555, alternatively referred to as the foreign earned income form, is an important tax document that u.s. In order to compute the foreign earned income exclusion, you must. Web form 2555 is the form you need to file to benefit from the feie.

Irs form 2555 is used to claim the foreign earned income exclusion (feie). Expats use to claim the foreign earned income. Web you can choose the foreign earned income exclusion and/or the foreign housing exclusion by completing the appropriate parts of form 2555. Include information about your employer and. Which test are you using to qualify (bona fide residence or physical presence). The feie is available to expats who either:. Form 2555 is a detailed form that asks for information about your. Web the foreign earned income exclusion on irs form 2555 allows you to deduct income you earn abroad (be that wages, commissions, tips, or other legal. Web the feie (form 2555) can be used to exclude “foreign earned income” from being subject to us tax. Share whether you qualify for the physical presence or bona fide residence test.

Web what is the purpose of form 2555? The form consists of nine different sections: Web foreign earned income exclusion form 2555 if you are working and/or living abroad and meet certain requirements, you may be eligible to use the foreign earned income. Web you can choose the foreign earned income exclusion and/or the foreign housing exclusion by completing the appropriate parts of form 2555. Web the foreign earned income exclusion on irs form 2555 allows you to deduct income you earn abroad (be that wages, commissions, tips, or other legal. Web feie and form 2555 the form 2555 allows taxpayers to exclude up to $112,000 of their earned income, this is the foreign earned income exclusion (feie). Your initial choice of the exclusion (s). The feie is available to expats who either:. Form 2555, foreign earned income, will help you with these computations. Web form 2555 (2022) 2 part iii taxpayers qualifying under physical presence test note:

Breaking Down Form 2555EZ on Your US Expatriate Taxes

Web the feie (form 2555) can be used to exclude “foreign earned income” from being subject to us tax. Get ready for tax season deadlines by completing any required tax forms today. Ad download or email irs 2555 & more fillable forms, register and subscribe now! Which test are you using to qualify (bona fide residence or physical presence). Resident.

Form 2555 US Expat Tax Guide for Americans Abroad MyExpatTaxes

The feie is available to expats who either:. Web form 2555, alternatively referred to as the foreign earned income form, is an important tax document that u.s. Share whether you qualify for the physical presence or bona fide residence test. Expats use to claim the foreign earned income. Which test are you using to qualify (bona fide residence or physical.

Ssurvivor Form 2555 Ez Instructions 2018

Web you can choose the foreign earned income exclusion and/or the foreign housing exclusion by completing the appropriate parts of form 2555. Form 2555, foreign earned income, will help you with these computations. This form allows an exclusion of up to $107,600 of your foreign earned income if you are a u.s. Web timely filing the form 2555 is essential.

IRS Form 2555 How to File as an Expat Bright!Tax Expat Tax Services

Irs form 2555 is used to claim the foreign earned income exclusion (feie). Resident alien living and working in a foreign country. Web feie and form 2555 the form 2555 allows taxpayers to exclude up to $112,000 of their earned income, this is the foreign earned income exclusion (feie). Web who needs to file form 2555? Web form 2555 (2022).

IRS Form 2555 How to File as an Expat Bright!Tax Expat Tax Services

Web who needs to file form 2555? Form 2555, foreign earned income, will help you with these computations. Get ready for tax season deadlines by completing any required tax forms today. Web what is the purpose of form 2555? You need to file irs form 2555 if you want to claim the foreign earned income exclusion.

Business Tax Declaration Form In Ethiopia Paul Johnson's Templates

If eligible, you can also use form 2555 to. Form 2555 is a detailed form that asks for information about your. Web feie and form 2555 the form 2555 allows taxpayers to exclude up to $112,000 of their earned income, this is the foreign earned income exclusion (feie). This form allows an exclusion of up to $107,600 of your foreign.

Form 2555 Foreign Earned Exclusion (FEIE) YouTube

Get ready for tax season deadlines by completing any required tax forms today. Form 2555 is a detailed form that asks for information about your. Which test are you using to qualify (bona fide residence or physical presence). If eligible, you can also use form 2555 to. Web to complete foreign earned income exclusion form 2555, you will need to.

Filing Form 2555 for the Foreign Earned Exclusion

What this means for most expats is that they can use the feie. You need to file irs form 2555 if you want to claim the foreign earned income exclusion. Include information about your employer and. Web what is the purpose of form 2555? The feie is available to expats who either:.

Foreign Earned Exclusion (FEIE)

The form consists of nine different sections: Form 2555 is a detailed form that asks for information about your. Citizens and all resident aliens can use this test. Share whether you qualify for the physical presence or bona fide residence test. Web you can choose the foreign earned income exclusion and/or the foreign housing exclusion by completing the appropriate parts.

IRS Form 2555 How to File as an Expat Bright!Tax Expat Tax Services

Web form 2555 (2022) 2 part iii taxpayers qualifying under physical presence test note: Web form 2555 is the form you need to file to benefit from the feie. Form 2555 is a detailed form that asks for information about your. Form 2555, foreign earned income, will help you with these computations. Web who needs to file form 2555?

Web Form 2555 Is The Form You Need To File To Benefit From The Feie.

Resident alien living and working in a foreign country. Web form 2555, alternatively referred to as the foreign earned income form, is an important tax document that u.s. Get ready for tax season deadlines by completing any required tax forms today. This form allows an exclusion of up to $107,600 of your foreign earned income if you are a u.s.

Web You Can Choose The Foreign Earned Income Exclusion And/Or The Foreign Housing Exclusion By Completing The Appropriate Parts Of Form 2555.

Form 2555, foreign earned income, will help you with these computations. Web foreign earned income exclusion form 2555 if you are working and/or living abroad and meet certain requirements, you may be eligible to use the foreign earned income. Web the feie (form 2555) can be used to exclude “foreign earned income” from being subject to us tax. Include information about your employer and.

If Eligible, You Can Also Use Form 2555 To.

Citizens and all resident aliens can use this test. You need to file irs form 2555 if you want to claim the foreign earned income exclusion. Which test are you using to qualify (bona fide residence or physical presence). Your initial choice of the exclusion (s).

Web The Foreign Earned Income Exclusion On Irs Form 2555 Allows You To Deduct Income You Earn Abroad (Be That Wages, Commissions, Tips, Or Other Legal.

Web feie and form 2555 the form 2555 allows taxpayers to exclude up to $112,000 of their earned income, this is the foreign earned income exclusion (feie). Complete, edit or print tax forms instantly. The exclusion is an election. Web who needs to file form 2555?