Federal Form 944

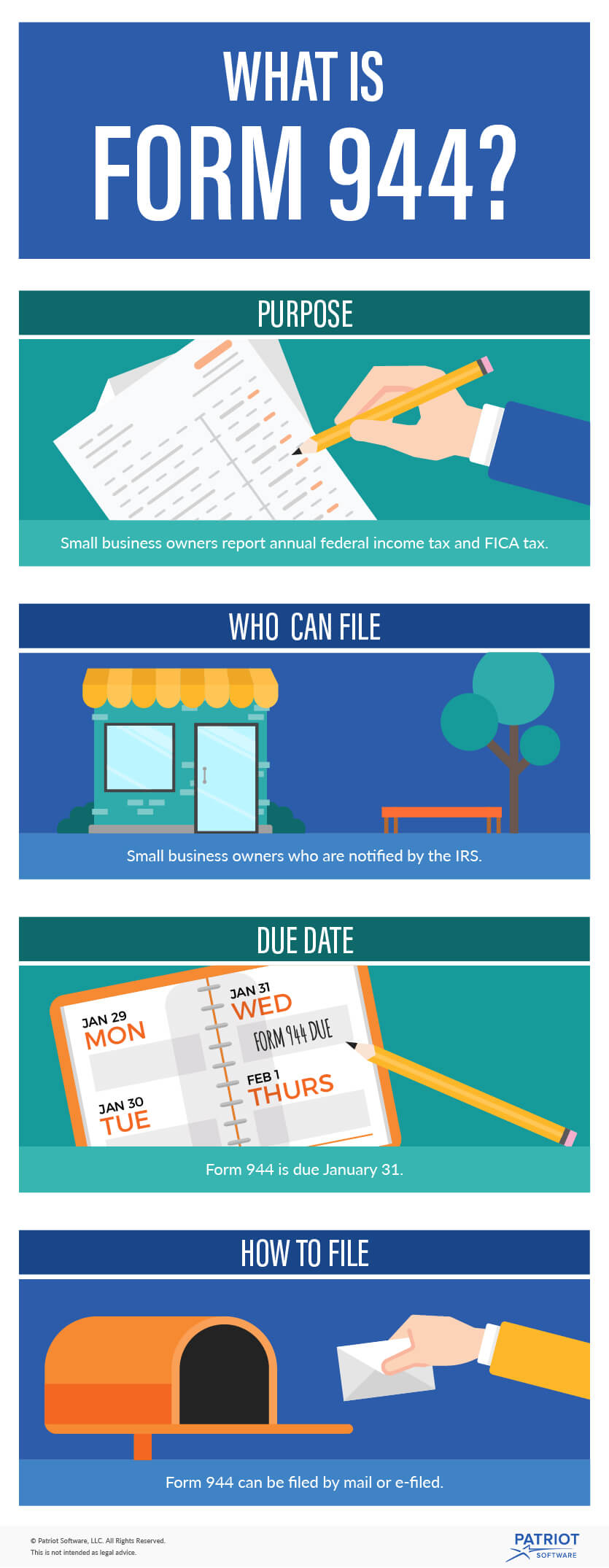

Federal Form 944 - Web each calendar quarter almost all employers who pay wages subject to tax withholding must file form 941, employer's quarterly federal tax return, unless you receive an irs. Web form 944, or the employer’s annual federal tax return, is an internal revenue services (irs) form that reports the taxes you’ve withheld from employee’s. Try it for free now! Who must file form 944? Web the irs revised form 941, employer's quarterly federal tax return, form 943, employer's annual federal tax return for agricultural employees, form 944,. Web form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve withheld from your. Web up to $40 cash back select irs 944 form employer’s annual federal tax return for a needed year and complete it online. How should you complete form 944? Web february 28, 2020 — if you're currently required to file form 944, employer's annual federal tax return, but estimate your tax liability to be more than $1,000, you. The other reason for form 944 is to save the irs man.

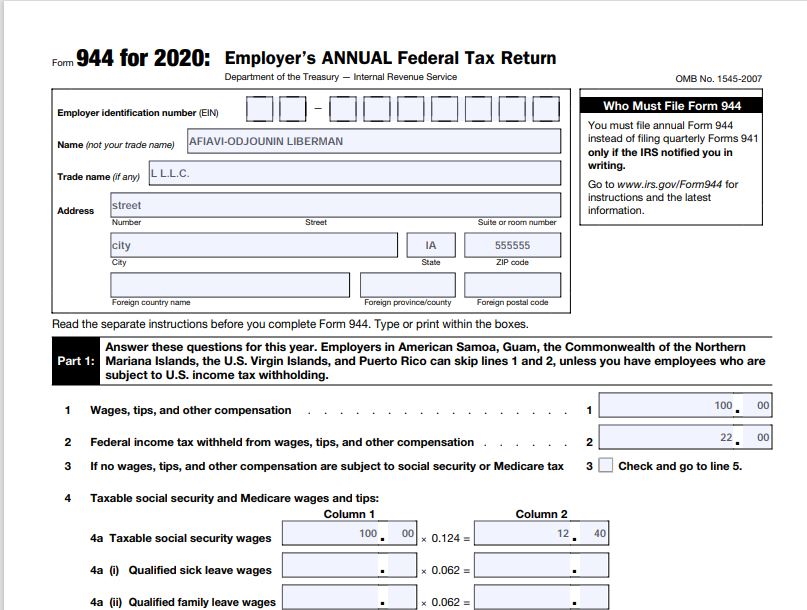

Web form 944 for 2020: Ad complete irs tax forms online or print government tax documents. Who must file form 944? The deadline for filing the form is feb. Web form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve withheld from your. Web form 944 was intended to give small business employers a break when it came to filing and paying federal payroll taxes. Small business employers with an. Web irs form 944 is the employer's annual federal tax return. Employer’s annual federal tax return department of the treasury — internal revenue service. Web up to $40 cash back select irs 944 form employer’s annual federal tax return for a needed year and complete it online.

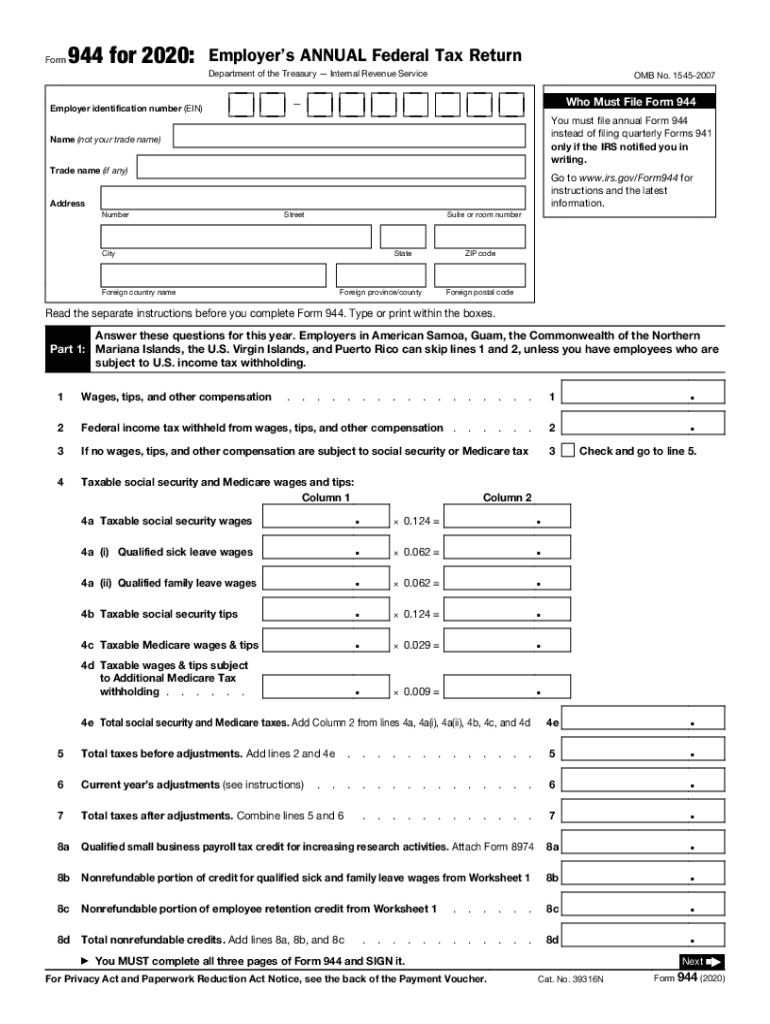

Use fillable and printable blanks in pdf and word. Complete, edit or print tax forms instantly. This module contains federal form 944, employer's annual federal. Employer’s annual federal tax return department of the treasury — internal revenue service. The finalized versions of the. Complete, edit or print tax forms instantly. Small business employers with an. Web irs form 944, (employer’s annual tax return) is designed for the small employers and is used to report employment taxes. The other reason for form 944 is to save the irs man. Who must file form 944?

Form 944 Employer's Annual Federal Tax Return (2015) Free Download

Ad complete irs tax forms online or print government tax documents. Updated 7 months ago by greg hatfield. The other reason for form 944 is to save the irs man. Web irs form 944 is the employer's annual federal tax return. Web form 944, or the employer’s annual federal tax return, is an internal revenue services (irs) form that reports.

Form 944SS Employer's Annual Federal Tax Return Form (2011) Free

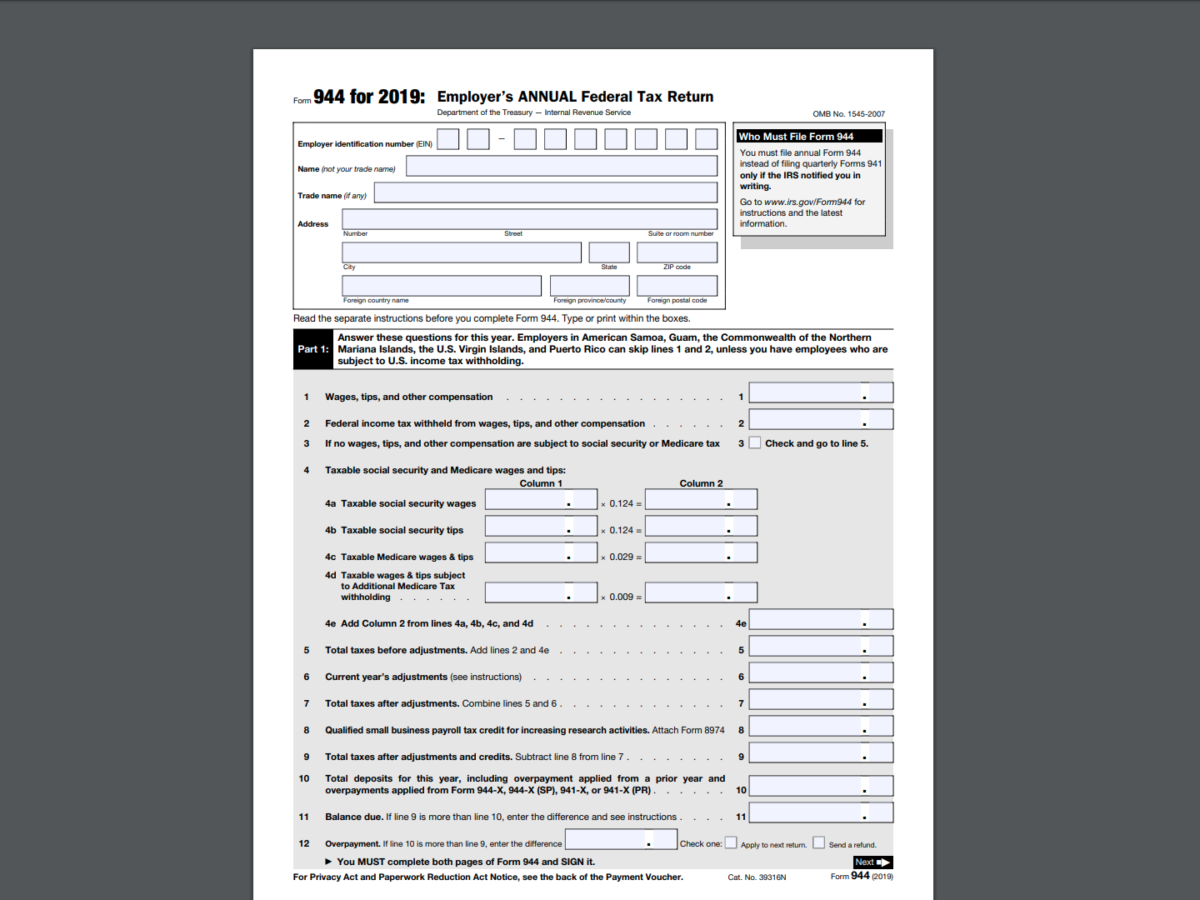

Web february 28, 2020 — if you're currently required to file form 944, employer's annual federal tax return, but estimate your tax liability to be more than $1,000, you. Web the irs revised form 941, employer's quarterly federal tax return, form 943, employer's annual federal tax return for agricultural employees, form 944,. Web simply put, form 944 is a document.

Form 944 Employer's Annual Federal Tax Return (2015) Free Download

Web irs form 944 is the employer's annual federal tax return. The deadline for filing the form is feb. Web form 944 was intended to give small business employers a break when it came to filing and paying federal payroll taxes. Web federal form 944 federal employer's annual federal tax return form 944 pdf form content report error it appears.

IRS Form 944 Download Printable PDF 2019, Employer's ANNUAL Federal Tax

Try it for free now! Who must file form 944? Web form 944, or the employer’s annual federal tax return, is an internal revenue services (irs) form that reports the taxes you’ve withheld from employee’s. Web irs form 944 is the employer's annual federal tax return. Complete, edit or print tax forms instantly.

How to Complete Form 944 for 2020 Employer’s Annual Federal Tax

Who must file form 944? Web up to $40 cash back select irs 944 form employer’s annual federal tax return for a needed year and complete it online. Small business employers with an. Try it for free now! Web irs form 944 is the employer's annual federal tax return.

2020 Form IRS 944 Fill Online, Printable, Fillable, Blank pdfFiller

Web the irs revised form 941, employer's quarterly federal tax return, form 943, employer's annual federal tax return for agricultural employees, form 944,. Complete, edit or print tax forms instantly. Web irs form 944, (employer’s annual tax return) is designed for the small employers and is used to report employment taxes. The form was introduced by the irs to give.

Form 944 Employer's Annual Federal Tax Return (2015) Free Download

Web form 944 was intended to give small business employers a break when it came to filing and paying federal payroll taxes. Web the irs revised form 941, employer's quarterly federal tax return, form 943, employer's annual federal tax return for agricultural employees, form 944,. Web purpose of form 944. Web federal form 944 federal employer's annual federal tax return.

What Is Form 944 What Is Federal Form 944 For Employers How To

Finalized versions of the 2020 form 944 and its instructions are available. Web form 944 for 2020: Complete, edit or print tax forms instantly. Web february 28, 2020 — if you're currently required to file form 944, employer's annual federal tax return, but estimate your tax liability to be more than $1,000, you. Web form 944 is an irs tax.

What is Form 944? Reporting Federal & FICA Taxes

Web irs form 944, (employer’s annual tax return) is designed for the small employers and is used to report employment taxes. This module contains federal form 944, employer's annual federal. The deadline for filing the form is feb. Web form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare.

IRS Form 944 Employer's Annual Federal Tax Return

The form helps both the employer and the irs keep track of how much income tax and. Web form 944, employer’s annual federal tax return, reports federal income and fica (social security and medicare) tax on employee wages. Ad complete irs tax forms online or print government tax documents. Web simply put, form 944 is a document the irs requires.

Who Must File Form 944?

Web each calendar quarter almost all employers who pay wages subject to tax withholding must file form 941, employer's quarterly federal tax return, unless you receive an irs. Complete, edit or print tax forms instantly. Try it for free now! Employer’s annual federal tax return department of the treasury — internal revenue service.

Small Business Employers With An.

Web form 944 for 2020: Web form 944, employer’s annual federal tax return, reports federal income and fica (social security and medicare) tax on employee wages. Web form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve withheld from your. Web up to $40 cash back select irs 944 form employer’s annual federal tax return for a needed year and complete it online.

Web Simply Put, Form 944 Is A Document The Irs Requires Some Employers To File Annually.

Who must file form 944. The form was introduced by the irs to give smaller employers a break in filing and paying federal. Complete, edit or print tax forms instantly. Web purpose of form 944.

Finalized Versions Of The 2020 Form 944 And Its Instructions Are Available.

Web february 28, 2020 — if you're currently required to file form 944, employer's annual federal tax return, but estimate your tax liability to be more than $1,000, you. Use fillable and printable blanks in pdf and word. Web irs form 944 is the employer's annual federal tax return. The deadline for filing the form is feb.

/GettyImages-182660354-577bfcf95f9b585875bcac41.jpg)