Federal Form 7004

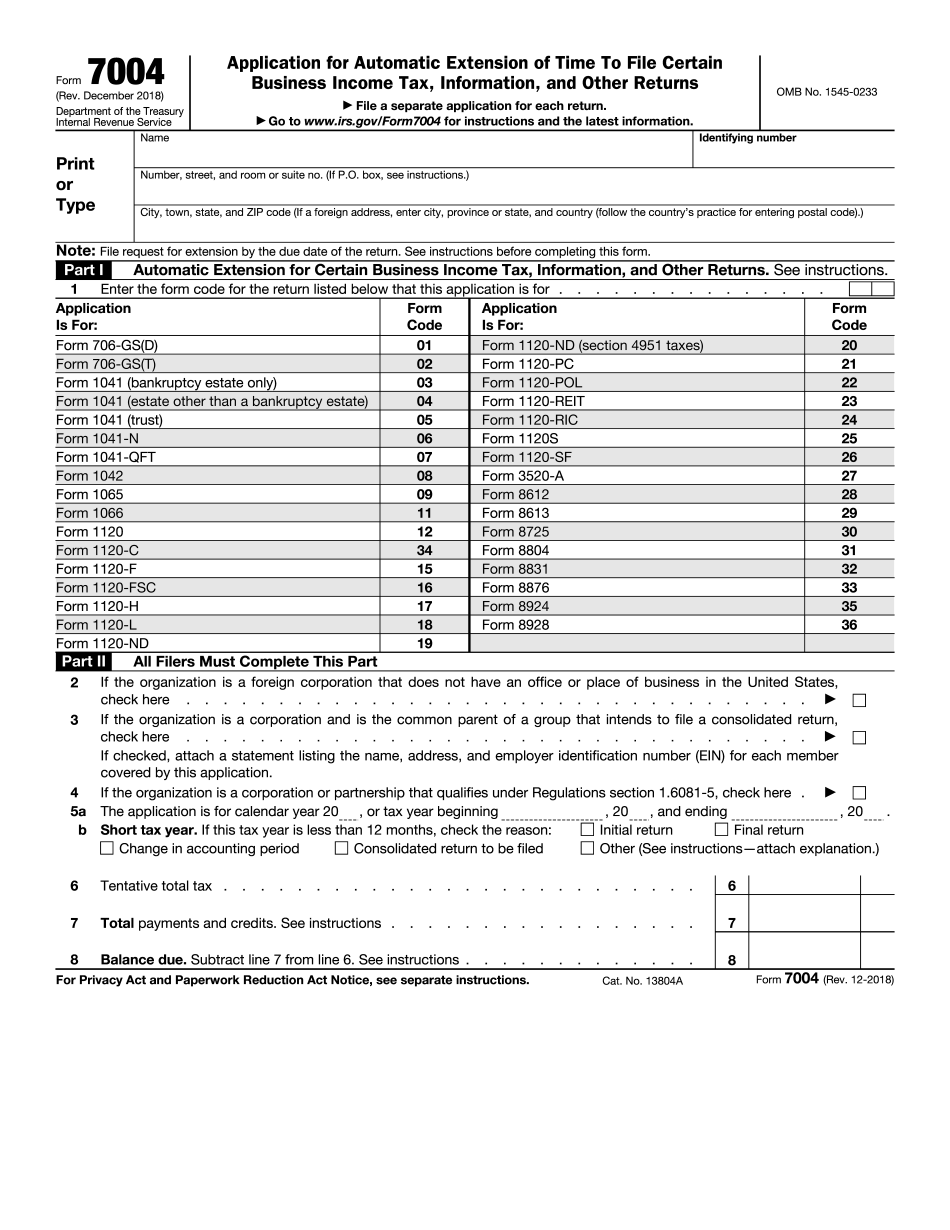

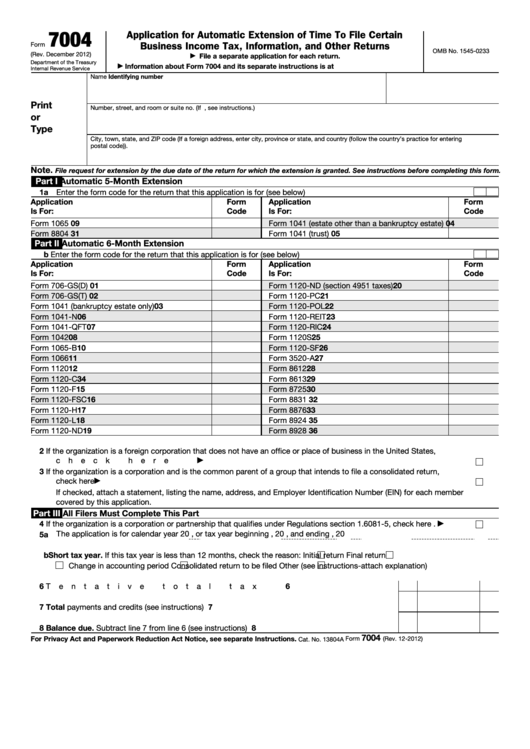

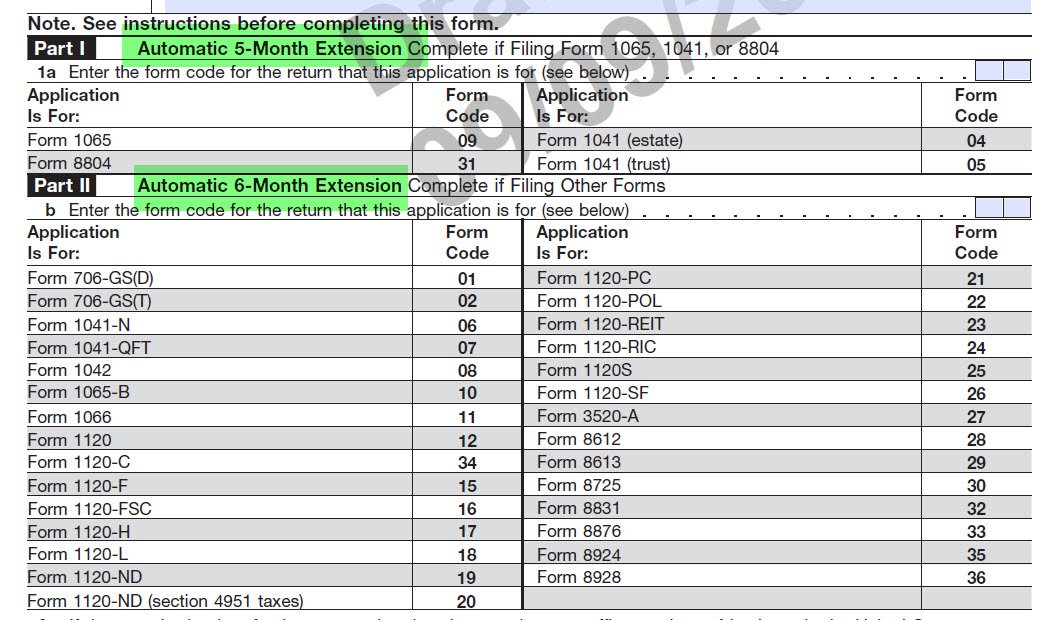

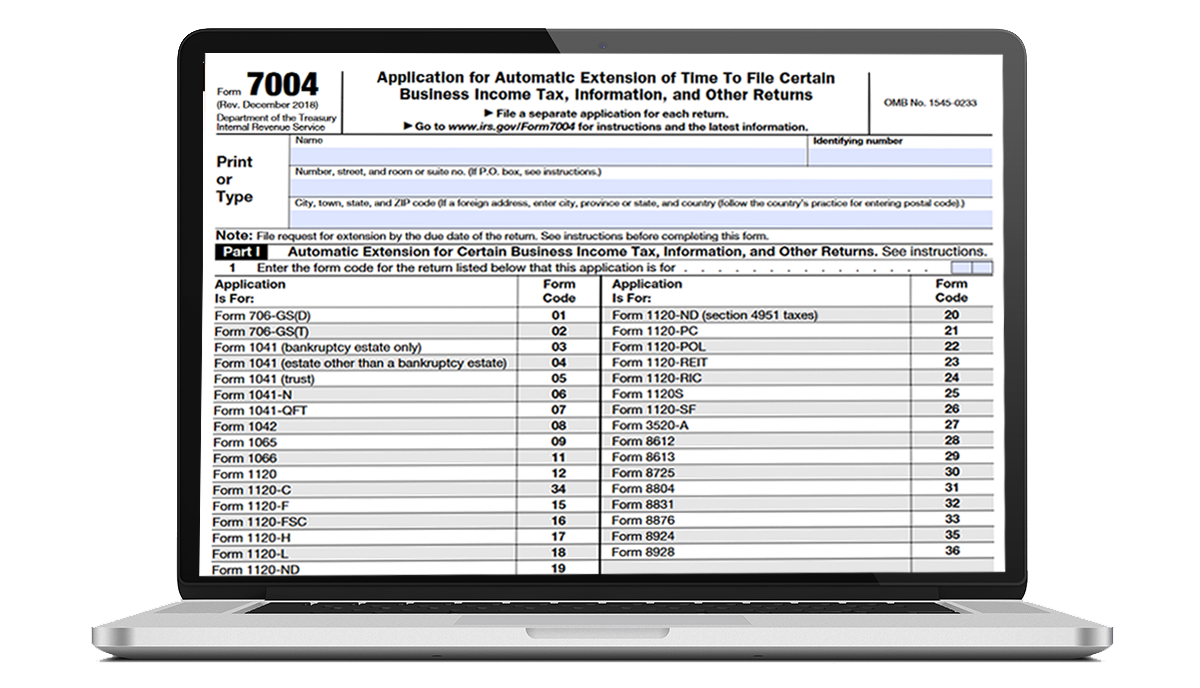

Federal Form 7004 - All the returns shown on form 7004 are eligible for an automatic extension of time to file from the due date of the return. Web about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. File a separate application for each return. Businesses use this irs extension form to ask for more time to submit one of their business tax forms. Web purpose of form. Web federal tax extension form 7004, the “application for automatic extension of time to file certain business income tax, information, and other returns” ( pdf ), is a one page irs form that looks like this: For instructions and the latest information. Select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business income tax, information, and other returns Web use the chart to determine where to file form 7004 based on the tax form you complete.

All the returns shown on form 7004 are eligible for an automatic extension of time to file from the due date of the return. The extension will be granted if you complete form 7004 properly, make a proper estimate of the tax (if applicable), file form 7004 by the due date of the return for which the extension is. Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Web purpose of form. December 2018) department of the treasury internal revenue service. Application for automatic extension of time to file certain business income tax, information, and other returns. File a separate application for each return. For instructions and the latest information. Web form 7004 is a federal corporate income tax form. Payment of tax line 1a—extension date.

Select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business income tax, information, and other returns Web file form 7004 by the 15th day of the 6th month following the close of the tax year. Application for automatic extension of time to file certain business income tax, information, and other returns. Web we last updated the irs automatic business extension instructions in february 2023, so this is the latest version of form 7004 instructions, fully updated for tax year 2022. Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. File a separate application for each return. Web form 7004 is a federal corporate income tax form. Web federal tax extension form 7004, the “application for automatic extension of time to file certain business income tax, information, and other returns” ( pdf ), is a one page irs form that looks like this: December 2018) department of the treasury internal revenue service. Web about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns.

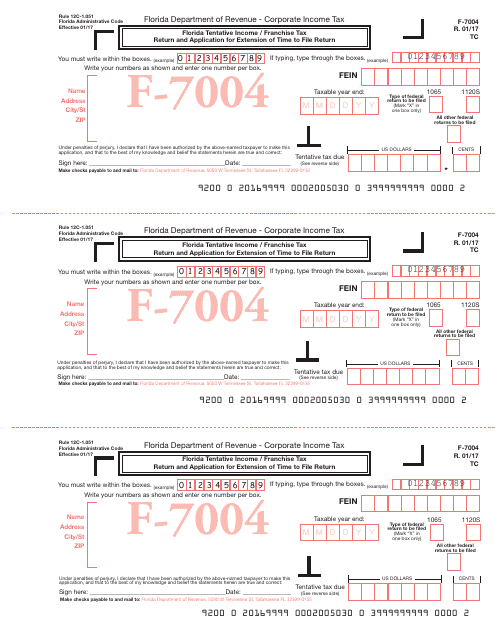

Form F7004 Download Printable PDF, Florida Tentative

Web about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. The extension will be granted if you complete form 7004 properly, make a proper estimate of the tax (if applicable), file form 7004 by the due date of the return for which the extension is. December 2018) department of the.

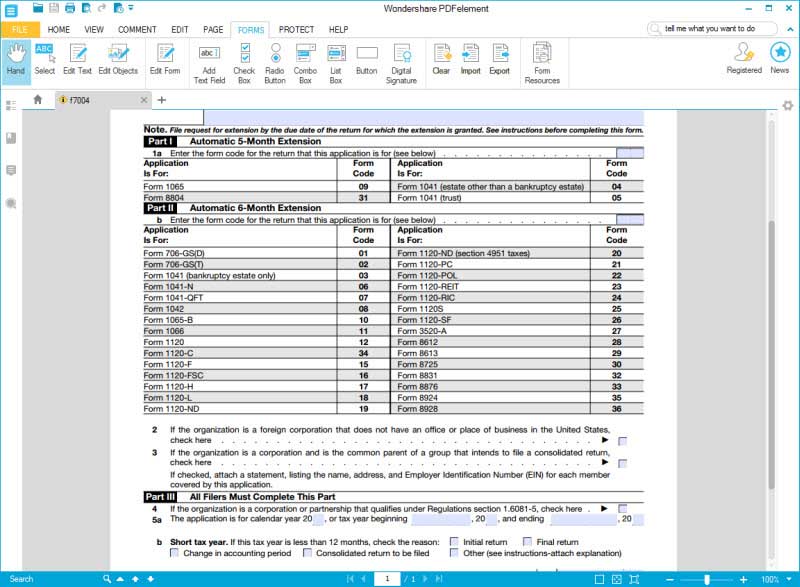

Instructions for How to Fill in IRS Form 7004

Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Web purpose of form. Web we last updated the irs automatic business extension instructions in february 2023, so this is the latest version of form 7004 instructions, fully updated for tax year 2022. Payment of tax line 1a—extension date. Web.

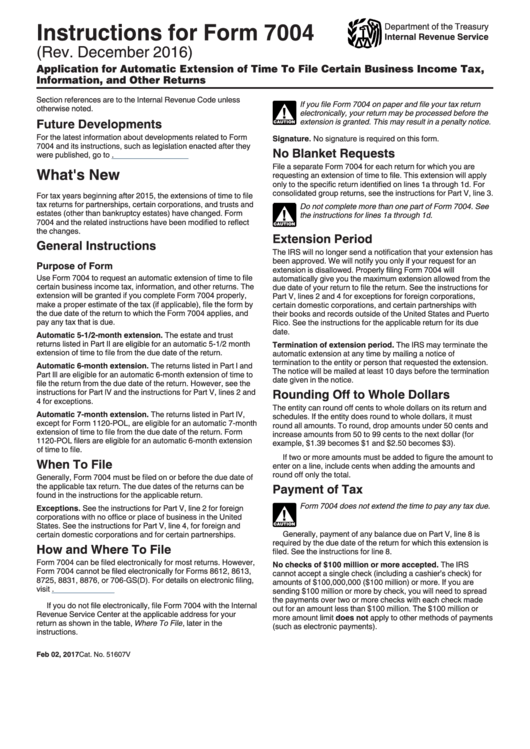

Instructions For Form 7004 Application For Automatic Extension Of

Application for automatic extension of time to file certain business income tax, information, and other returns. For instructions and the latest information. Web file form 7004 by the 15th day of the 6th month following the close of the tax year. File a separate application for each return. December 2018) department of the treasury internal revenue service.

Irs Fillable Form 7004 Fill online, Printable, Fillable Blank

Web use the chart to determine where to file form 7004 based on the tax form you complete. Web form 7004 is a federal corporate income tax form. File a separate application for each return. Payment of tax line 1a—extension date. Businesses use this irs extension form to ask for more time to submit one of their business tax forms.

Tax extension form 7004

For instructions and the latest information. Web purpose of form. December 2018) department of the treasury internal revenue service. Select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business income tax, information, and other returns The extension will be granted if you complete form.

Fillable Form 7004 Application For Automatic Extension Of Time To

The extension will be granted if you complete form 7004 properly, make a proper estimate of the tax (if applicable), file form 7004 by the due date of the return for which the extension is. Web we last updated the irs automatic business extension instructions in february 2023, so this is the latest version of form 7004 instructions, fully updated.

Where to file Form 7004 Federal Tax TaxUni

Web form 7004 is a federal corporate income tax form. Select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business income tax, information, and other returns All the returns shown on form 7004 are eligible for an automatic extension of time to file from.

Form 7004 Application for Automatic Extension of Time To File Certain

Application for automatic extension of time to file certain business income tax, information, and other returns. Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Web purpose of form. Web federal tax extension form 7004, the “application for automatic extension of time to file certain business income tax, information,.

Irs Form 7004 amulette

For instructions and the latest information. Web purpose of form. Web file form 7004 by the 15th day of the 6th month following the close of the tax year. Application for automatic extension of time to file certain business income tax, information, and other returns. Use form 7004 to request an automatic extension of time to file certain business income.

EFile 7004 Online 2022 File Business Tax extension Form

Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Web about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. December 2018) department of the treasury internal revenue service. Web we last updated the irs automatic business extension instructions in.

Select The Appropriate Form From The Table Below To Determine Where To Send The Form 7004, Application For Automatic Extension Of Time To File Certain Business Income Tax, Information, And Other Returns

Businesses use this irs extension form to ask for more time to submit one of their business tax forms. Web federal tax extension form 7004, the “application for automatic extension of time to file certain business income tax, information, and other returns” ( pdf ), is a one page irs form that looks like this: Web about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. Application for automatic extension of time to file certain business income tax, information, and other returns.

Payment Of Tax Line 1A—Extension Date.

For instructions and the latest information. Web use the chart to determine where to file form 7004 based on the tax form you complete. Web we last updated the irs automatic business extension instructions in february 2023, so this is the latest version of form 7004 instructions, fully updated for tax year 2022. Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns.

The Extension Will Be Granted If You Complete Form 7004 Properly, Make A Proper Estimate Of The Tax (If Applicable), File Form 7004 By The Due Date Of The Return For Which The Extension Is.

Web file form 7004 by the 15th day of the 6th month following the close of the tax year. File a separate application for each return. Web form 7004 is a federal corporate income tax form. Web purpose of form.

December 2018) Department Of The Treasury Internal Revenue Service.

All the returns shown on form 7004 are eligible for an automatic extension of time to file from the due date of the return.