Example Of Form 8829 Filled Out

Example Of Form 8829 Filled Out - Try it for free now! The home office deduction is a key tax deduction you want to be mindful of this tax season. Web learn about irs form 8829, including who qualifies and how to fill out this form to claim a home office deduction. Web go to www.irs.gov/form8829 for instructions and the latest information. Web if you are interested in claiming a home office deduction, you will need to fill out home office deduction form 8829. Eligible taxpayers can get a deduction of $5 per square foot of the home. Web taxpayers use form 8829, expenses for business use of your home, to claim expenses related to using the home for business purposes. The form then is added to the business owner’s schedule c as part of their personal tax return. Upload, modify or create forms. Web the simplified option.

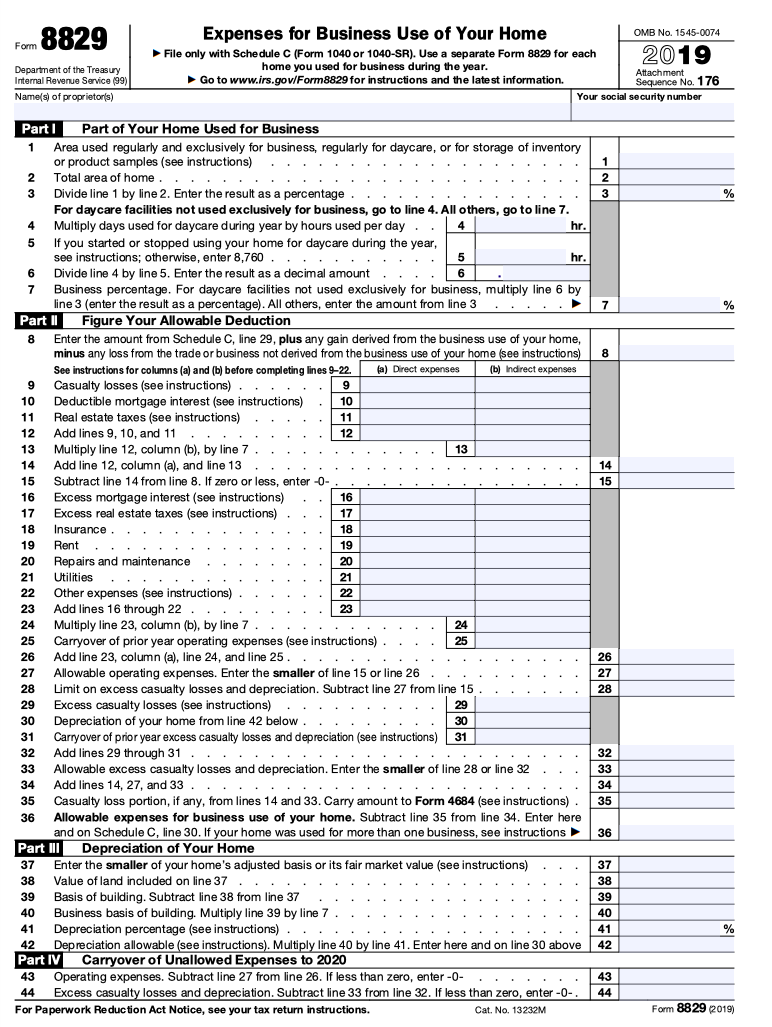

Web the simplified option. The form then is added to the business owner’s schedule c as part of their personal tax return. Upload, modify or create forms. Web learn about irs form 8829, including who qualifies and how to fill out this form to claim a home office deduction. 176 name(s) of proprietor(s) your social security. Web open your tax return in turbotax and search for this exact phrase: Business owners use irs form 8829 to claim tax deductions for the. Web form 8829 is the form used by sole proprietors to calculate and report expenses for business use of home (aka “the home office deduction“). Try it for free now! Web taxpayers use form 8829, expenses for business use of your home, to claim expenses related to using the home for business purposes.

With this method of calculating the home office deduction. Web form 8829 is the form used by sole proprietors to calculate and report expenses for business use of home (aka “the home office deduction“). Click the jump to home office deduction link in the search results. Web if you are interested in claiming a home office deduction, you will need to fill out home office deduction form 8829. 176 name(s) of proprietor(s) your social security. Web complete and download form 8829 to claim a tax deduction on home office expenses. Web the simplified option. Claiming expenses for the business use of your home. Try it for free now! Web open your tax return in turbotax and search for this exact phrase:

The New York Times > Business > Image > Form 8829

Business expenses incurred in the home can be. Upload, modify or create forms. The form then is added to the business owner’s schedule c as part of their personal tax return. Web form 8829 is used to calculate the allowed expenses related to the taxpayer using their home space for business purposes. Click the jump to home office deduction link.

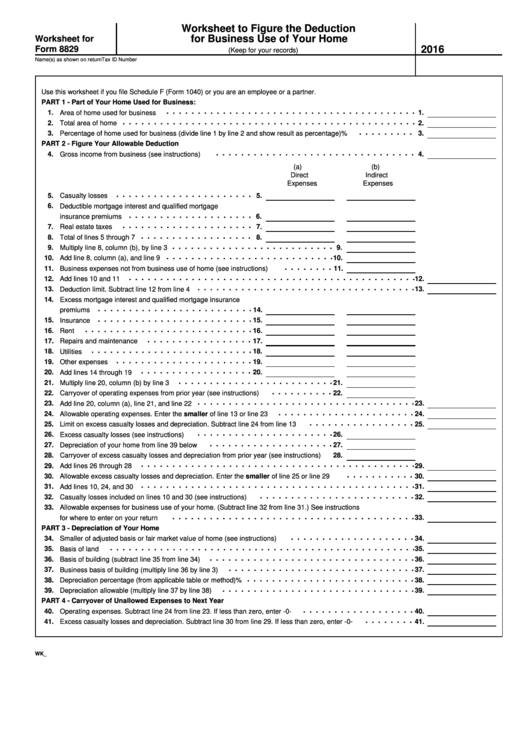

Worksheet For Form 8829 Worksheet To Figure The Deduction For

Eligible taxpayers can get a deduction of $5 per square foot of the home. Web form 8829 is the form used by sole proprietors to calculate and report expenses for business use of home (aka “the home office deduction“). With this method of calculating the home office deduction. Web if you are interested in claiming a home office deduction, you.

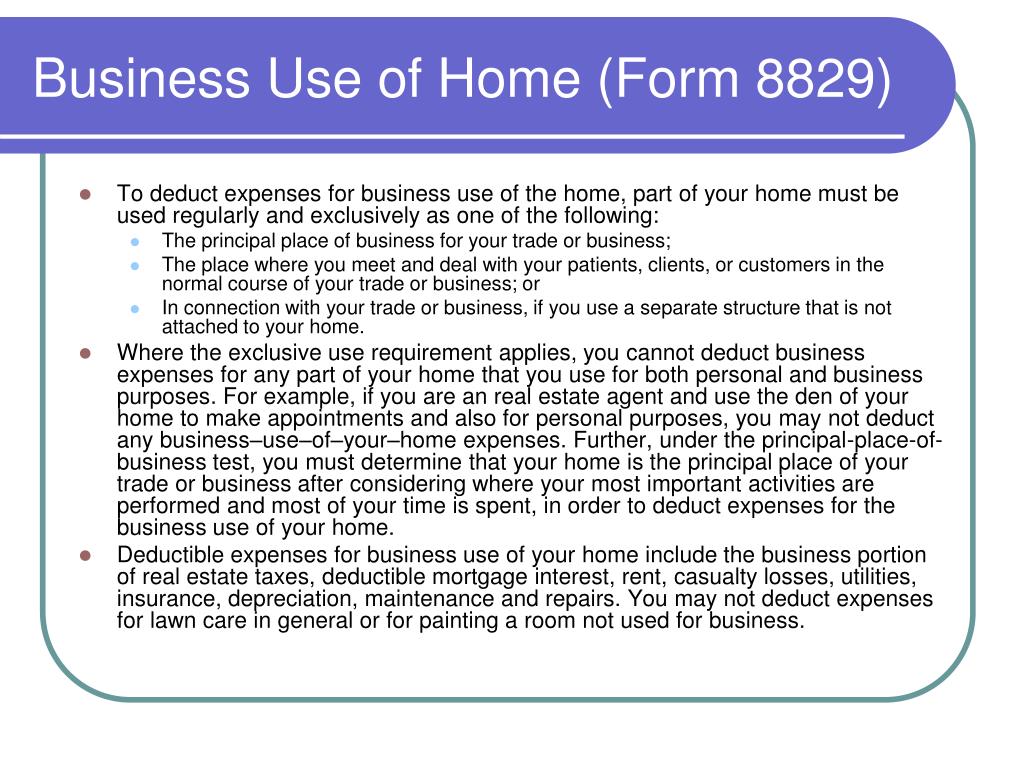

PPT Tax Tips for Real Estate Agents PowerPoint Presentation, free

Web for example, if only 10% of the square footage of your house is reserved exclusively for business use, you can only use 10% of your home expenses as a. Claiming expenses for the business use of your home. Web taxpayers use form 8829, expenses for business use of your home, to claim expenses related to using the home for.

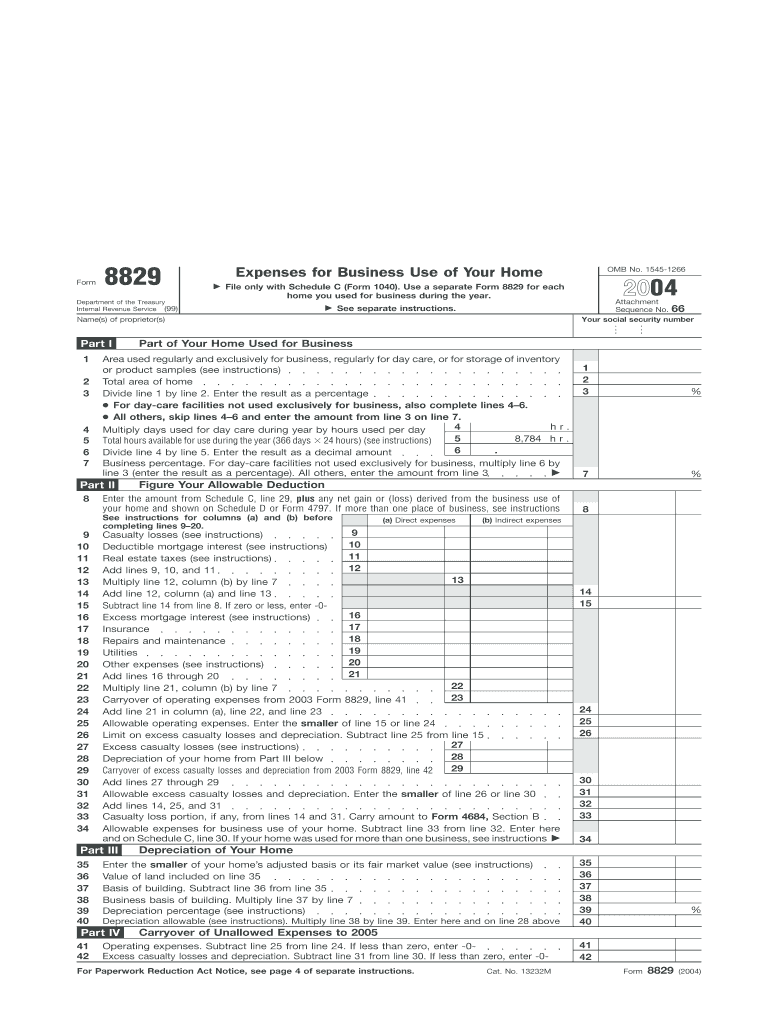

Form 8829 Fill Out and Sign Printable PDF Template signNow

Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. Complete and download irs forms in minutes. Here is how to fill out the form line by line. Eligible taxpayers can get a deduction of $5 per square foot.

Sample Example Of W9 Form Filled Out Fill Online, Printable, Fillable

Web open your tax return in turbotax and search for this exact phrase: Web form 8829 is used to calculate the allowed expenses related to the taxpayer using their home space for business purposes. Here is how to fill out the form line by line. The form then is added to the business owner’s schedule c as part of their.

How to Fill out Form 8829 Bench Accounting

Web learn about irs form 8829, including who qualifies and how to fill out this form to claim a home office deduction. The form then is added to the business owner’s schedule c as part of their personal tax return. With this method of calculating the home office deduction. Complete, edit or print tax forms instantly. Web if you are.

Publication 947 Practice Before the IRS and Power of Attorney

Complete, edit or print tax forms instantly. Web form 8829 is used to calculate the allowed expenses related to the taxpayer using their home space for business purposes. The home office deduction is a key tax deduction you want to be mindful of this tax season. Business expenses incurred in the home can be. The form then is added to.

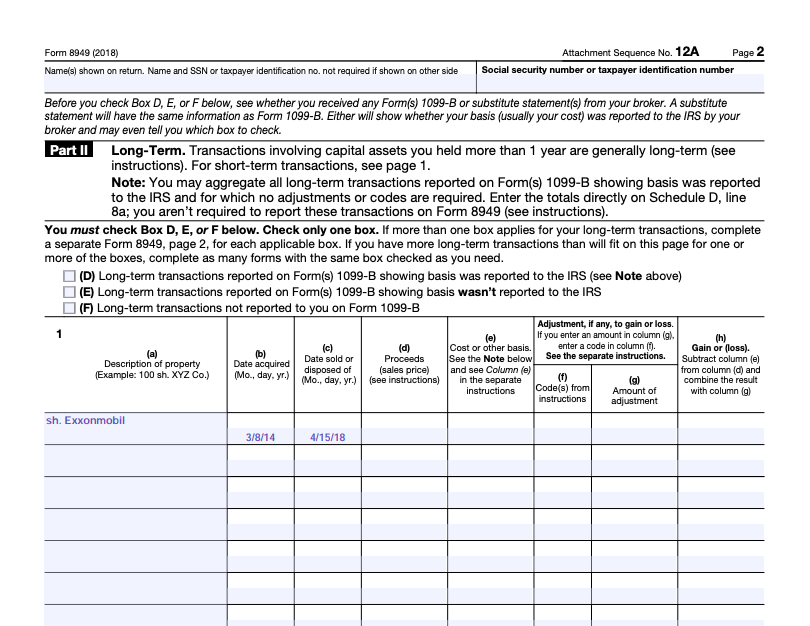

Can You Please Help Me Fill Out Form 8949? So I Kn...

Web complete and download form 8829 to claim a tax deduction on home office expenses. Click the jump to home office deduction link in the search results. Upload, modify or create forms. Try it for free now! 176 name(s) of proprietor(s) your social security.

Home office tax deduction still available, just not for COVIDdisplaced

176 name(s) of proprietor(s) your social security. Claiming expenses for the business use of your home. The home office deduction is a key tax deduction you want to be mindful of this tax season. With this method of calculating the home office deduction. Web if you are interested in claiming a home office deduction, you will need to fill out.

How to do Form 1040 Part 2 YouTube

Web the simplified option. Web open your tax return in turbotax and search for this exact phrase: Web for example, if only 10% of the square footage of your house is reserved exclusively for business use, you can only use 10% of your home expenses as a. Business owners use irs form 8829 to claim tax deductions for the. Web.

Upload, Modify Or Create Forms.

Eligible taxpayers can get a deduction of $5 per square foot of the home. Web taxpayers use form 8829, expenses for business use of your home, to claim expenses related to using the home for business purposes. With this method of calculating the home office deduction. Web go to www.irs.gov/form8829 for instructions and the latest information.

Web Form 8829 Is The Form Used By Sole Proprietors To Calculate And Report Expenses For Business Use Of Home (Aka “The Home Office Deduction“).

Web open your tax return in turbotax and search for this exact phrase: Try it for free now! Complete, edit or print tax forms instantly. The form then is added to the business owner’s schedule c as part of their personal tax return.

Business Owners Use Irs Form 8829 To Claim Tax Deductions For The.

Web if you are interested in claiming a home office deduction, you will need to fill out home office deduction form 8829. Complete and download irs forms in minutes. Click the jump to home office deduction link in the search results. Web form 8829 is used to calculate the allowed expenses related to the taxpayer using their home space for business purposes.

Web Information About Form 8829, Expenses For Business Use Of Your Home, Including Recent Updates, Related Forms And Instructions On How To File.

Business expenses incurred in the home can be. Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. The home office deduction is a key tax deduction you want to be mindful of this tax season. Irs form 8829 is used by small business owners to calculate the allowable expenses for business use of their home or apartment and total the amount of allowable deductions for operating expenses and losses.