Etrade Form 3922

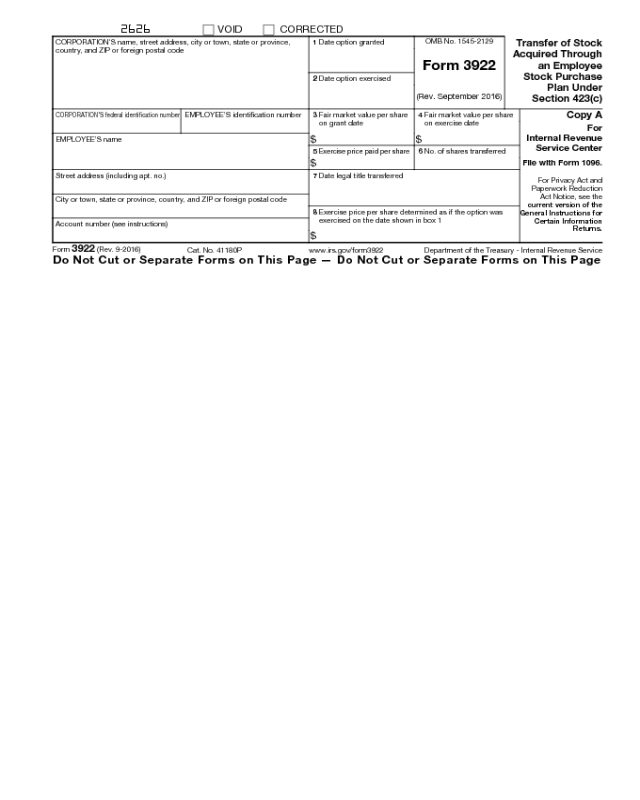

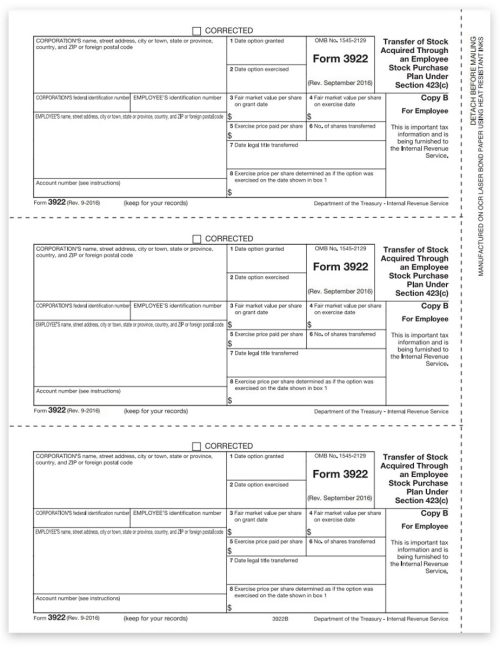

Etrade Form 3922 - Web form 3922 api overview. Check out the tax center here to find relevant tax documents and other resources. Web what is an employee stock purchase plan? Web taxes are a fact of life. Web form 3922 (redirected from 3922 forms) form 3922. Web transferring any exiting ir to e*trade is easy with you digital transmit service. Web form 3921 is required when an employee (or former employee) exercises an iso, and form 3922 is required when a corporation records a transfer of legal title of. Ad we’re all about helping you get more from your money. Please read the important disclosures below. Form 3922 is an informational statement and would not be entered into the tax return.

Ad we’re all about helping you get more from your money. Transfer an ira | transfer an existing ira | e*trade / about form 3922, transfer of stock. Form 3922 is an informational statement and would not be entered into the tax return. Web it sends two copies of form 3922—one to the employee and another to the irs—to document the transfer of the shares. Check out the tax center here to find relevant tax documents and other resources. A form a corporation files with the irs upon an employee's exercise of a stock option at a price less than 100% of the. Web connect your application to equity edge using our rest api. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Please read the important disclosures below. Web form 3922 (redirected from 3922 forms) form 3922.

E*trade does not provide tax advice. Web when would you need to file a 3922? If your corporation transfers the legal title of a share of stock, and the option is exercised under an employee stock purchase plan, you must file. Form 3922 is an informational statement and would not be entered into the tax return. Web if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web transferring any exiting ir to e*trade is easy with you digital transmit service. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates, related. Web solved • by intuit • 415 • updated july 14, 2022. Web form 3921 is required when an employee (or former employee) exercises an iso, and form 3922 is required when a corporation records a transfer of legal title of. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock.

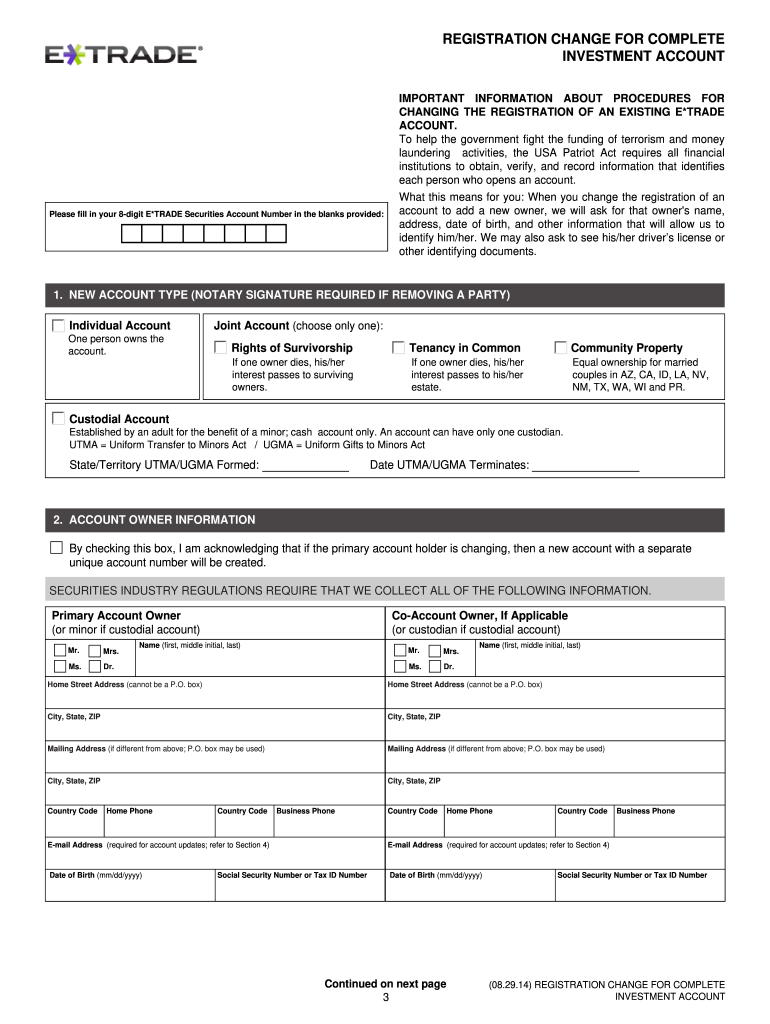

Etrade Registration Change Form 20202021 Fill and Sign Printable

If your corporation transfers the legal title of a share of stock, and the option is exercised under an employee stock purchase plan, you must file. Please read the important disclosures below. Web it sends two copies of form 3922—one to the employee and another to the irs—to document the transfer of the shares. Web the information on form 3922.

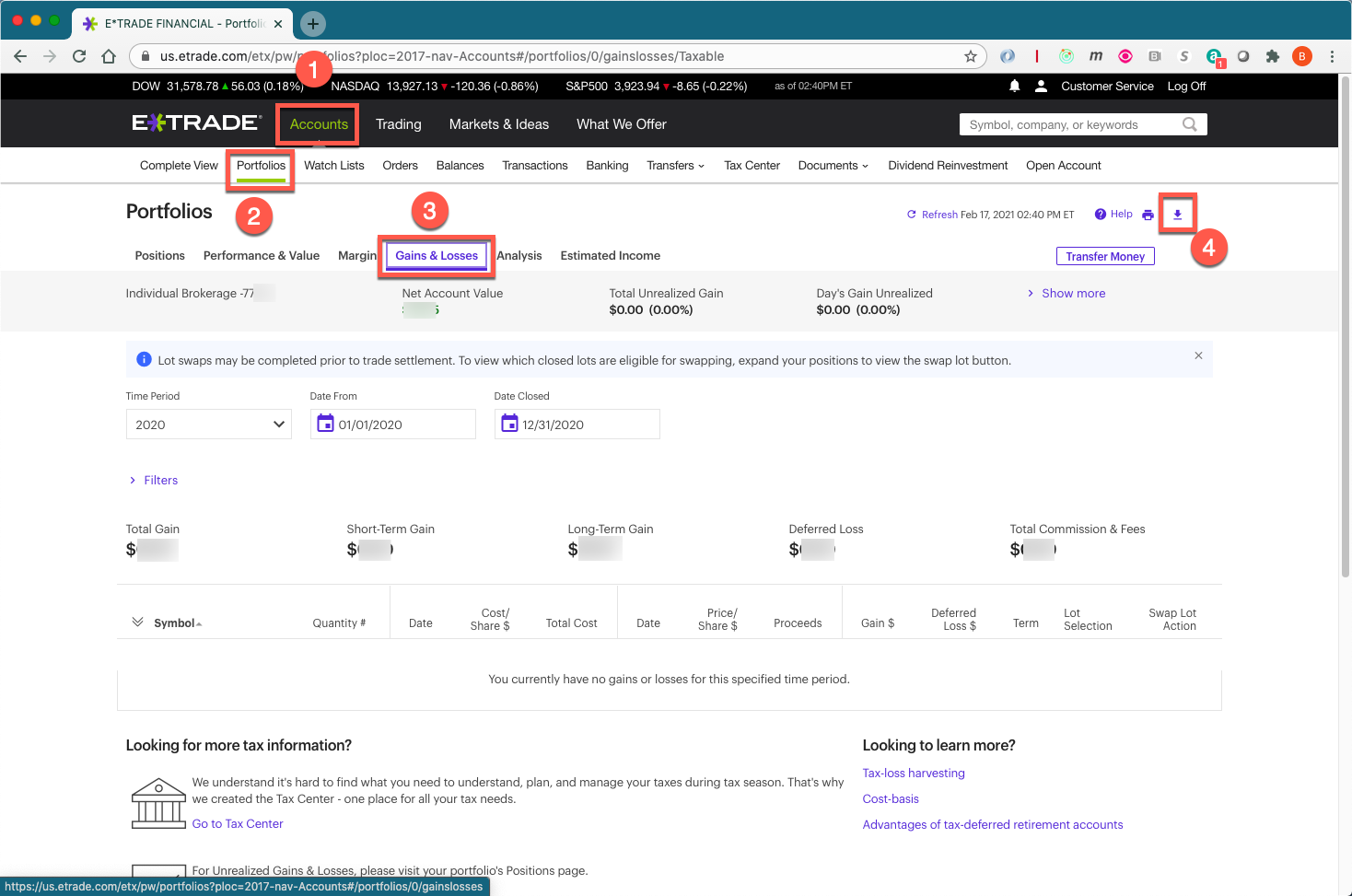

Online generation of Schedule D and Form 8949 for clients of E*Trade

Web when would you need to file a 3922? Form 3922 is an informational statement and would not be entered into the tax return. Please read the important disclosures below. If your corporation transfers the legal title of a share of stock, and the option is exercised under an employee stock purchase plan, you must file. Web form 3922 (redirected.

Form 3922 Transfer of Stock Acquired Through An Employee Stock

Web form 3922 api overview. Web solved • by intuit • 415 • updated july 14, 2022. Web your are a fact of life. Web form 3921 is required when an employee (or former employee) exercises an iso, and form 3922 is required when a corporation records a transfer of legal title of. E*trade does not provide tax advice.

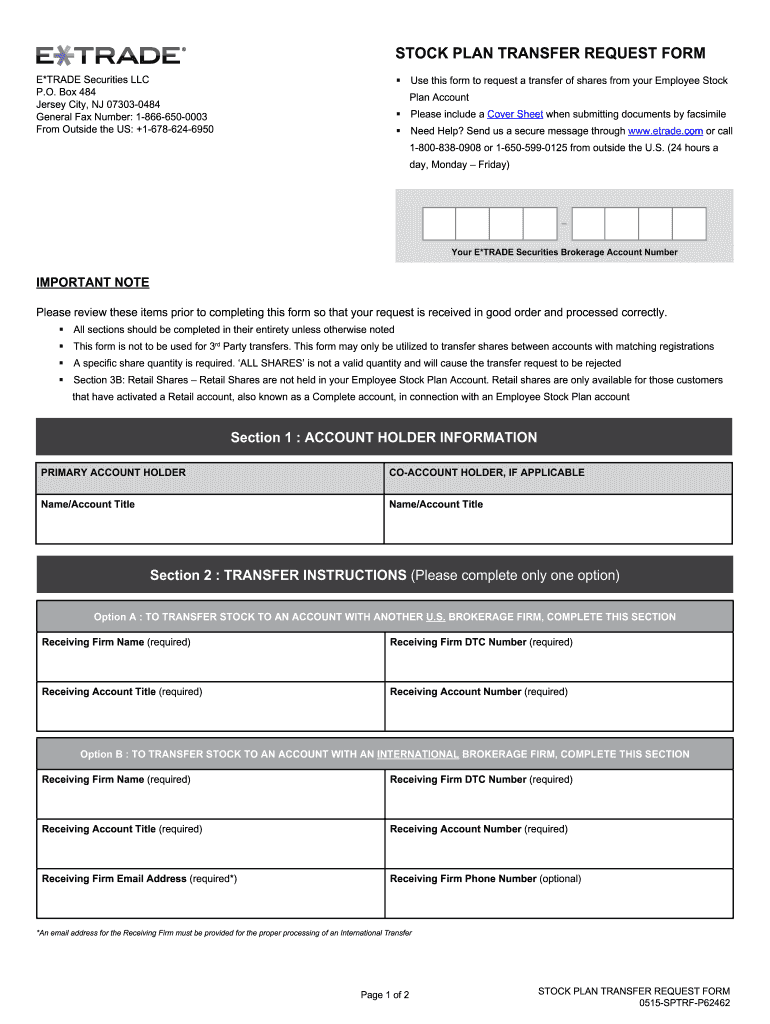

Etrade Stock Plan Transfer Request Form Fill Online, Printable

Web form 3922 (redirected from 3922 forms) form 3922. A form a corporation files with the irs upon an employee's exercise of a stock option at a price less than 100% of the. Web solved • by intuit • 415 • updated july 14, 2022. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan.

3922, Tax Reporting Instructions & Filing Requirements for Form 3922

Web form 3922 (redirected from 3922 forms) form 3922. Web taxes are a fact of life. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. A form a corporation files with the irs upon an employee's exercise of a stock option at.

Form 3922 Edit, Fill, Sign Online Handypdf

Web g) yes i have form 3922 h) enter all the info from from 3922 in the screen let's get some purchase info about this espp sale from form 3922) j) i get the screen. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates, related. Transfer an ira.

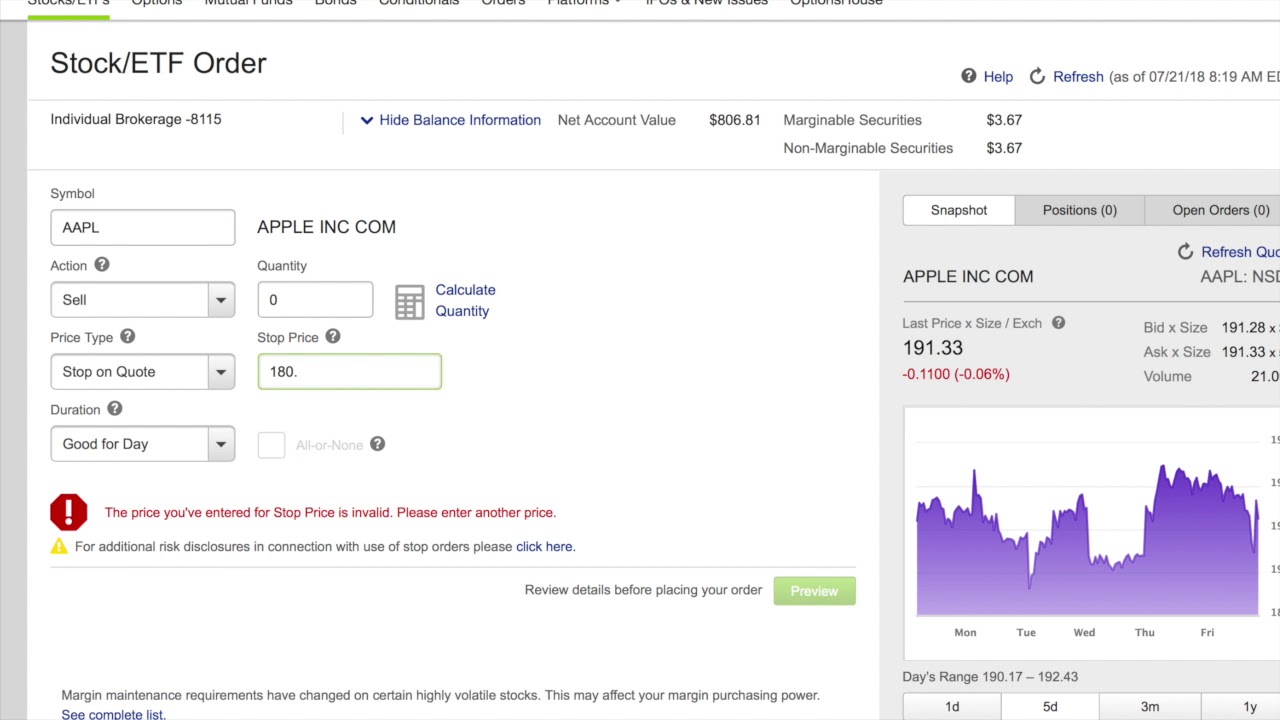

Price Types W/ Etrade YouTube

Transfer an ira | transfer an existing ira | e*trade / about form 3922, transfer of stock. Web the information on form 3922 would be helpful to insure that you account for your employee stock purchase plan (espp) share sales properly. Web taxes are a fact of life. Web when would you need to file a 3922? Please read the.

3922 Forms, Employee Stock Purchase, Employee Copy B DiscountTaxForms

Web form 3922 (redirected from 3922 forms) form 3922. Web filers are required to file forms 3921 and 3922 electronically if there are 250 or more returns to file with the irs. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return. Please.

Tax Reporting For Stock Compensation Understanding Form W2, Form 3922

A form a corporation files with the irs upon an employee's exercise of a stock option at a price less than 100% of the. Web solved • by intuit • 415 • updated july 14, 2022. Form 3922 is an informational statement and would not be entered into the tax return. Web when would you need to file a 3922?.

Web Form 3922 (Redirected From 3922 Forms) Form 3922.

Web transferring any exiting ir to e*trade is easy with you digital transmit service. Web the information on form 3922 would be helpful to insure that you account for your employee stock purchase plan (espp) share sales properly. Transfer an ira | transfer an existing ira | e*trade / about form 3922, transfer of stock. Web form 3921 is required when an employee (or former employee) exercises an iso, and form 3922 is required when a corporation records a transfer of legal title of.

Web When Would You Need To File A 3922?

If your corporation transfers the legal title of a share of stock, and the option is exercised under an employee stock purchase plan, you must file. Web filers are required to file forms 3921 and 3922 electronically if there are 250 or more returns to file with the irs. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Form 3922 is an informational statement and would not be entered into the tax return.

Web G) Yes I Have Form 3922 H) Enter All The Info From From 3922 In The Screen Let's Get Some Purchase Info About This Espp Sale From Form 3922) J) I Get The Screen.

Web if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates, related. Web connect your application to equity edge using our rest api. Check out the tax center here to find relevant tax documents and other resources.

Web Taxes Are A Fact Of Life.

The portfolios, watchlists, gains &. Web it sends two copies of form 3922—one to the employee and another to the irs—to document the transfer of the shares. E*trade does not provide tax advice. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return.