Dividend Balance Sheet Example

Dividend Balance Sheet Example - For example, say a company earned $100 million in a given year. Web impact of dividends. Web when a company is first formed, shareholders will typically put in cash. Cash (an asset) rises by $10m, and share capital (an equity. It started with $50 million in retained earnings and ended the year. Will reduce the balance in the cash and retained. Web the answer represents the total amount of dividends paid. Large stock dividends, of more than 20% or 25%, could also be considered to be. Web for example, a company that pays a 2% cash dividend, should experience a 2% decline in the price of its stock. The total value of the dividend is $0.50 x 500,000, or.

Web when a company is first formed, shareholders will typically put in cash. Web for example, a company that pays a 2% cash dividend, should experience a 2% decline in the price of its stock. Large stock dividends, of more than 20% or 25%, could also be considered to be. Web the answer represents the total amount of dividends paid. For example, an investor starts a company and seeds it with $10m. Will reduce the balance in the cash and retained. It started with $50 million in retained earnings and ended the year. The total value of the dividend is $0.50 x 500,000, or. Web impact of dividends. Cash (an asset) rises by $10m, and share capital (an equity.

Will reduce the balance in the cash and retained. The total value of the dividend is $0.50 x 500,000, or. It started with $50 million in retained earnings and ended the year. Web impact of dividends. Web for example, a company that pays a 2% cash dividend, should experience a 2% decline in the price of its stock. For example, say a company earned $100 million in a given year. For example, an investor starts a company and seeds it with $10m. Large stock dividends, of more than 20% or 25%, could also be considered to be. Web the answer represents the total amount of dividends paid. Web when a company is first formed, shareholders will typically put in cash.

What Is The Best Free Stock Trading App Declaration Of Common Stock

It started with $50 million in retained earnings and ended the year. Large stock dividends, of more than 20% or 25%, could also be considered to be. Web for example, a company that pays a 2% cash dividend, should experience a 2% decline in the price of its stock. Web the answer represents the total amount of dividends paid. Web.

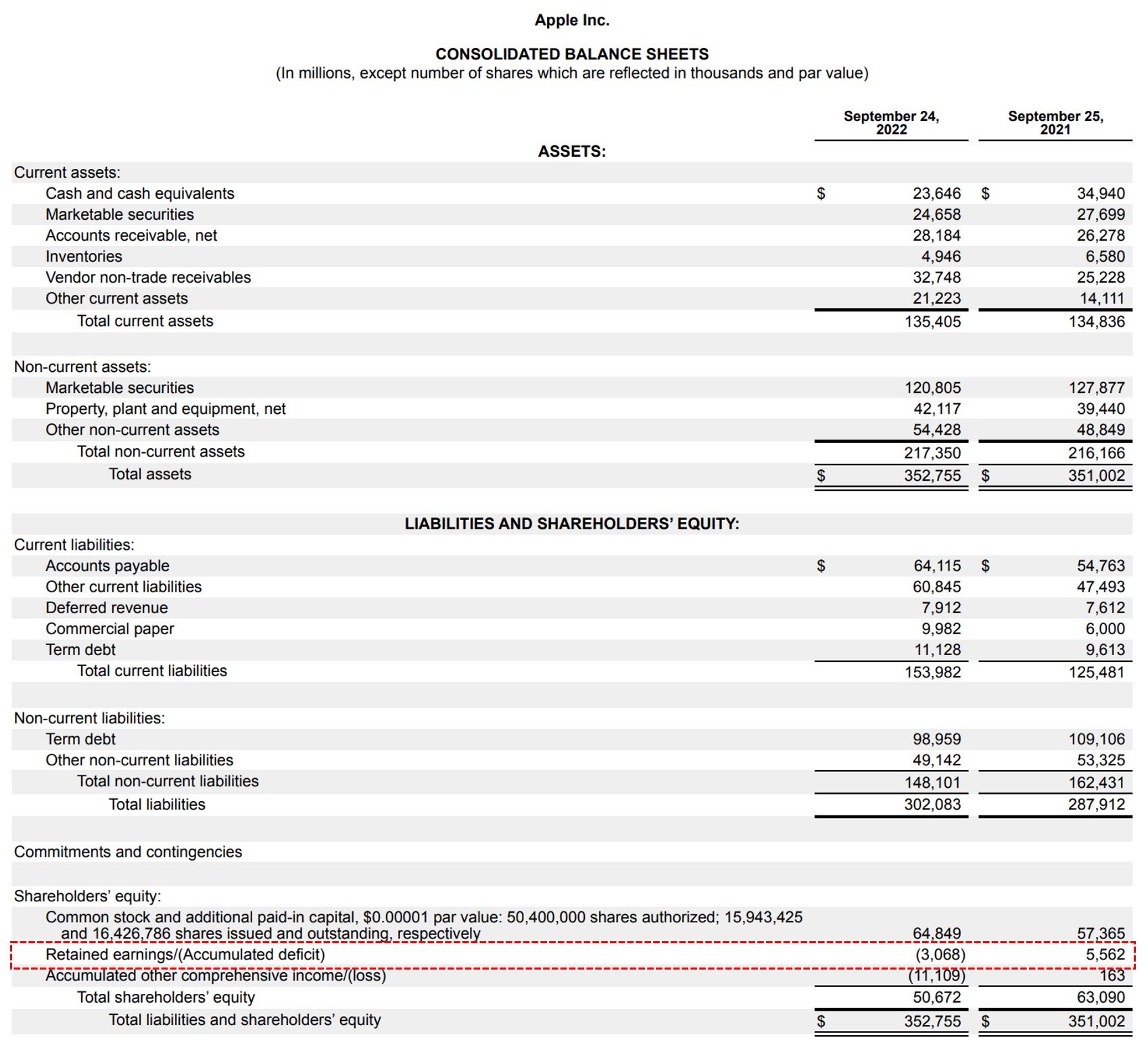

Retained Earnings Formula + Calculator

It started with $50 million in retained earnings and ended the year. Cash (an asset) rises by $10m, and share capital (an equity. For example, say a company earned $100 million in a given year. Web impact of dividends. Web for example, a company that pays a 2% cash dividend, should experience a 2% decline in the price of its.

27 Advanced Accounting Dividend Balance Sheet

Large stock dividends, of more than 20% or 25%, could also be considered to be. Web impact of dividends. For example, an investor starts a company and seeds it with $10m. The total value of the dividend is $0.50 x 500,000, or. It started with $50 million in retained earnings and ended the year.

Retained Earnings in Accounting and What They Can Tell You

Will reduce the balance in the cash and retained. Web for example, a company that pays a 2% cash dividend, should experience a 2% decline in the price of its stock. For example, say a company earned $100 million in a given year. Cash (an asset) rises by $10m, and share capital (an equity. For example, an investor starts a.

Dividend Recap LBO Tutorial With Excel Examples

For example, an investor starts a company and seeds it with $10m. Web for example, a company that pays a 2% cash dividend, should experience a 2% decline in the price of its stock. Web when a company is first formed, shareholders will typically put in cash. Large stock dividends, of more than 20% or 25%, could also be considered.

Balance Sheet Items

Web for example, a company that pays a 2% cash dividend, should experience a 2% decline in the price of its stock. Large stock dividends, of more than 20% or 25%, could also be considered to be. Web when a company is first formed, shareholders will typically put in cash. Will reduce the balance in the cash and retained. Web.

SG Young Investment The Power Of Dividend Investing [Part 2

It started with $50 million in retained earnings and ended the year. Web when a company is first formed, shareholders will typically put in cash. For example, an investor starts a company and seeds it with $10m. Web impact of dividends. Cash (an asset) rises by $10m, and share capital (an equity.

5 Percent Stock Dividend On Balance Sheet Best Moving Stocks FullQuick

For example, an investor starts a company and seeds it with $10m. Web for example, a company that pays a 2% cash dividend, should experience a 2% decline in the price of its stock. Web when a company is first formed, shareholders will typically put in cash. It started with $50 million in retained earnings and ended the year. For.

Dividend Recap LBO Tutorial With Excel Examples

It started with $50 million in retained earnings and ended the year. Web for example, a company that pays a 2% cash dividend, should experience a 2% decline in the price of its stock. Cash (an asset) rises by $10m, and share capital (an equity. Web the answer represents the total amount of dividends paid. The total value of the.

Stockholders' Equity What It Is, How To Calculate It, Examples

Will reduce the balance in the cash and retained. Web when a company is first formed, shareholders will typically put in cash. For example, an investor starts a company and seeds it with $10m. Cash (an asset) rises by $10m, and share capital (an equity. Large stock dividends, of more than 20% or 25%, could also be considered to be.

Web Impact Of Dividends.

Cash (an asset) rises by $10m, and share capital (an equity. It started with $50 million in retained earnings and ended the year. Will reduce the balance in the cash and retained. For example, an investor starts a company and seeds it with $10m.

For Example, Say A Company Earned $100 Million In A Given Year.

Web for example, a company that pays a 2% cash dividend, should experience a 2% decline in the price of its stock. The total value of the dividend is $0.50 x 500,000, or. Web when a company is first formed, shareholders will typically put in cash. Web the answer represents the total amount of dividends paid.

:max_bytes(150000):strip_icc()/FacebookbalancesheetREDec2018-5c73549b46e0fb00014ef630.jpg)

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)