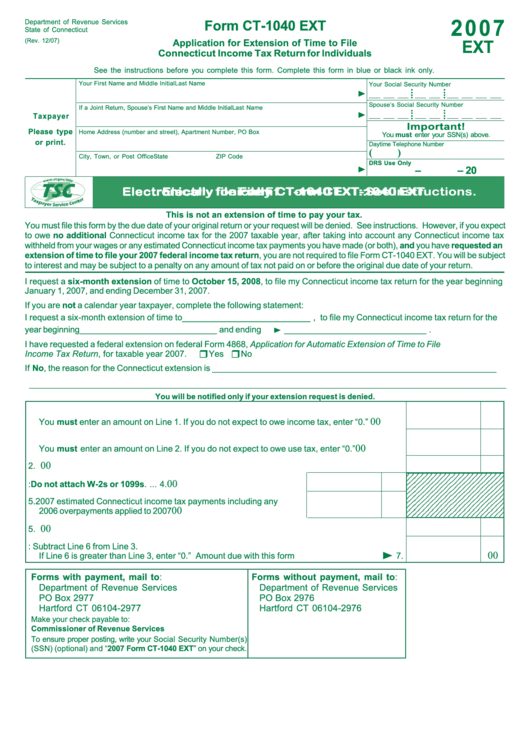

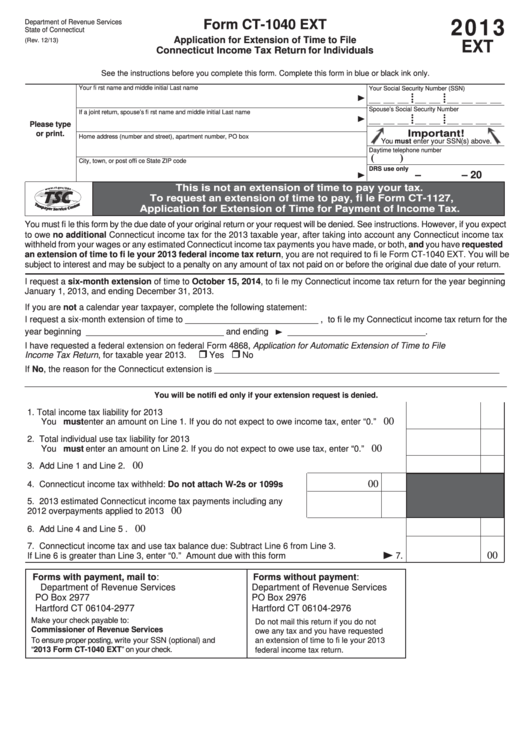

Ct Form 1040 Ext

Ct Form 1040 Ext - The form is used for: Extending the time to file an individual. Rules governing practice before irs Web filed connecticut income tax return or extension. Benefits to electronic filing include: 16, 2023 and the connecticut paper filing due date is october 16, 2023. Apply for an itin circular 230; This is a fillable form that extends the time to file an income tax return. Web file your 2022 connecticut income tax return online! Simple, secure, and can be completed from the comfort of your home.

16, 2023 and the connecticut paper filing due date is october 16, 2023. Web to request an extension of time to file your return, you must file form ct‑1040 ext, application for extension of time to file connecticut income tax return for. Extending the time to file an individual. Rules governing practice before irs Claiming an extension of the time to file a connecticut income tax return. We last updated the connecticut resident income tax return in january 2023, so this is the. Web for a faster refund, fi le your return electronically at www.ct.gov/drs. The form is used for: Web you must file a connecticut (ct) state income tax return if any of the following is true for the 2022 tax year: Apply for an itin circular 230;

Web file your 2022 connecticut income tax return online! 16, 2023 and the connecticut paper filing due date is october 16, 2023. Web filed connecticut income tax return or extension. Web to request an extension of time to file your return, you must file form ct‑1040 ext, application for extension of time to file connecticut income tax return for. Web you must file a connecticut (ct) state income tax return if any of the following is true for the 2022 tax year: The form is used for: Benefits to electronic filing include: Extending the time to file an individual. Simple, secure, and can be completed from the comfort of your home. Rules governing practice before irs

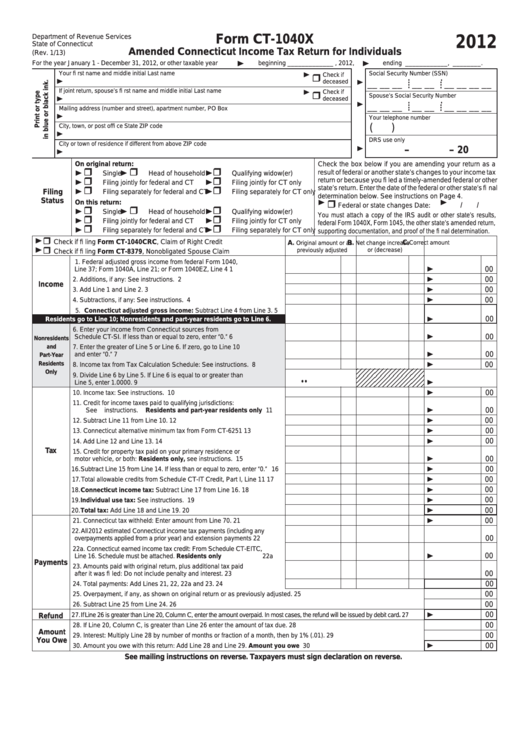

Form Ct1040x Amended Connecticut Tax Return For Individuals

16, 2023 and the connecticut paper filing due date is october 16, 2023. Web for a faster refund, fi le your return electronically at www.ct.gov/drs. Web to request an extension of time to file your return, you must file form ct‑1040 ext, application for extension of time to file connecticut income tax return for. This is a fillable form that.

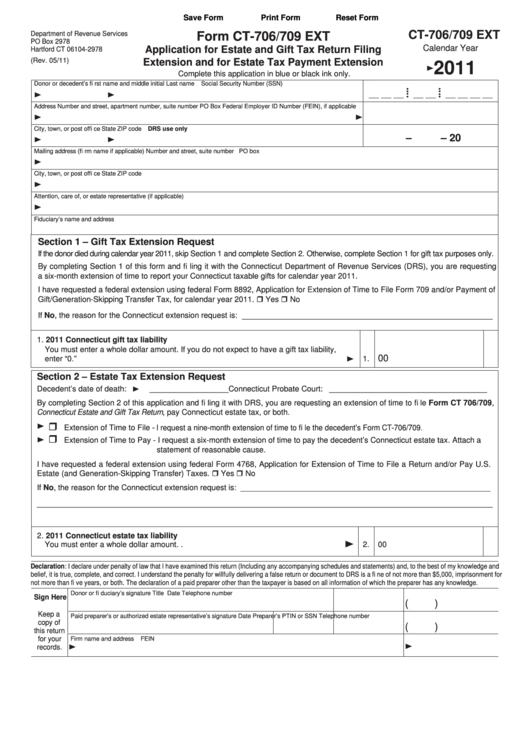

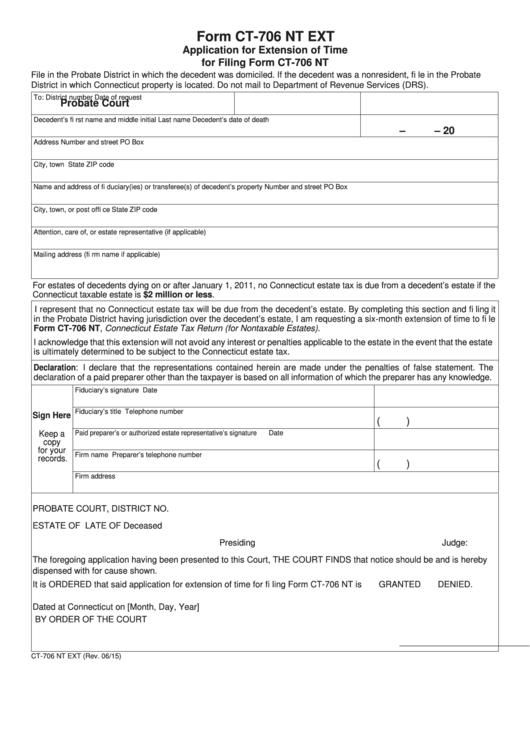

Fillable Form Ct706/709 Ext Application For Estate And Gift Tax

Web connecticut — application for extension of time to file connecticut income tax return for individuals download this form print this form it appears you don't have a pdf. Simple, secure, and can be completed from the comfort of your home. The form is used for: 16, 2023 and the connecticut paper filing due date is october 16, 2023. This.

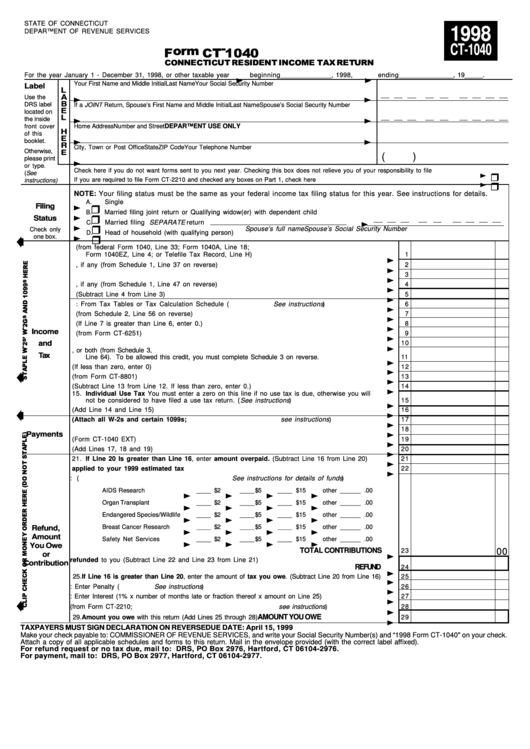

Fillable Form Ct1040 Connecticut Resident Tax Return

Claiming an extension of the time to file a connecticut income tax return. Web to request an extension of time to file your return, you must file form ct‑1040 ext, application for extension of time to file connecticut income tax return for. Web for a faster refund, fi le your return electronically at www.ct.gov/drs. Apply for an itin circular 230;.

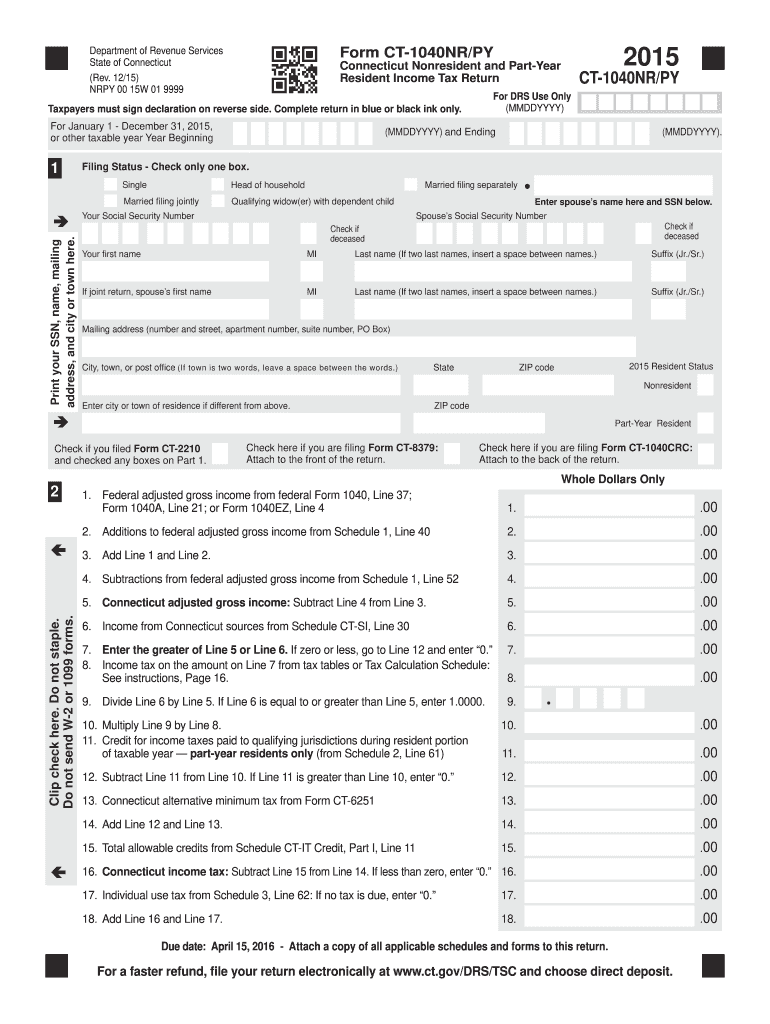

2015 Form CT DRS CT1040NR/PY Fill Online, Printable, Fillable, Blank

Web filed connecticut income tax return or extension. Web file your 2022 connecticut income tax return online! We last updated the connecticut resident income tax return in january 2023, so this is the. Extending the time to file an individual. Simple, secure, and can be completed from the comfort of your home.

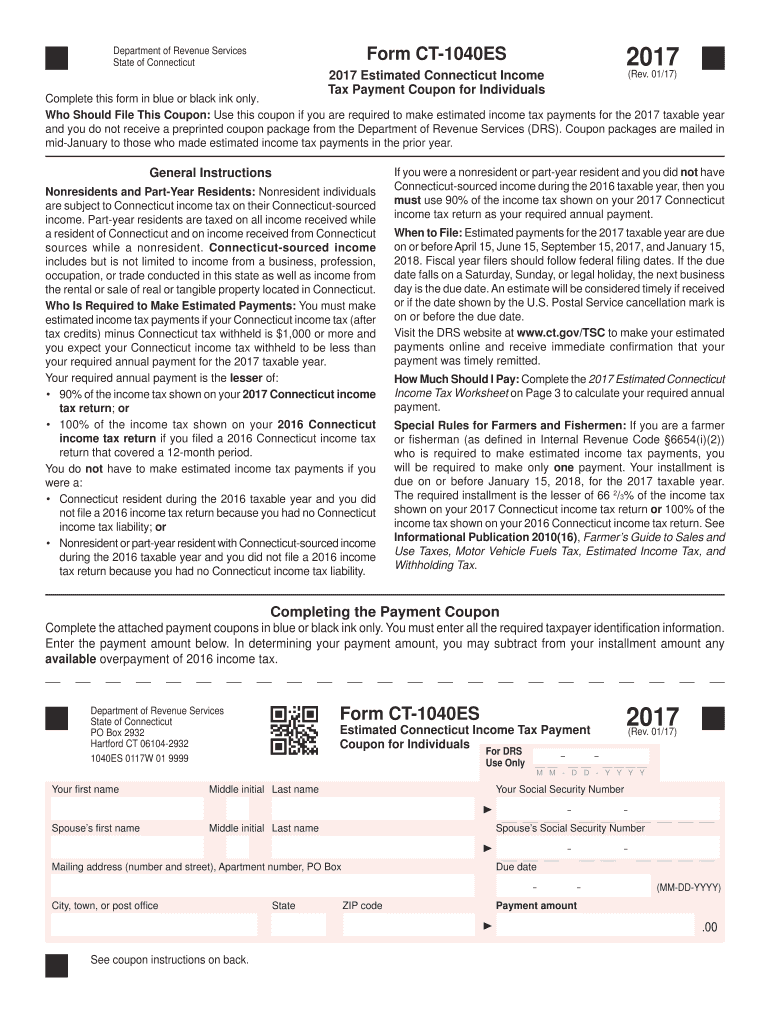

Ct 1040Es Fill Out and Sign Printable PDF Template signNow

Web you must file a connecticut (ct) state income tax return if any of the following is true for the 2022 tax year: The form is used for: Rules governing practice before irs 16, 2023 and the connecticut paper filing due date is october 16, 2023. Claiming an extension of the time to file a connecticut income tax return.

Form Ct1040 Ext Application For Extension Of Time To File

Web you must file a connecticut (ct) state income tax return if any of the following is true for the 2022 tax year: Simple, secure, and can be completed from the comfort of your home. Claiming an extension of the time to file a connecticut income tax return. Benefits to electronic filing include: The form is used for:

Form Ct706 Nt Ext Application For Extension Of Time For Filing Form

Apply for an itin circular 230; Web connecticut — application for extension of time to file connecticut income tax return for individuals download this form print this form it appears you don't have a pdf. Claiming an extension of the time to file a connecticut income tax return. This is a fillable form that extends the time to file an.

2014 Form CT DRS CT1040NR/PY Fill Online, Printable, Fillable, Blank

Web for a faster refund, fi le your return electronically at www.ct.gov/drs. Web to request an extension of time to file your return, you must file form ct‑1040 ext, application for extension of time to file connecticut income tax return for. This is a fillable form that extends the time to file an income tax return. Web filed connecticut income.

Fillable Form Ct1040 Ext Application For Extension Of Time To File

16, 2023 and the connecticut paper filing due date is october 16, 2023. Web for a faster refund, fi le your return electronically at www.ct.gov/drs. Extending the time to file an individual. Web to request an extension of time to file your return, you must file form ct‑1040 ext, application for extension of time to file connecticut income tax return.

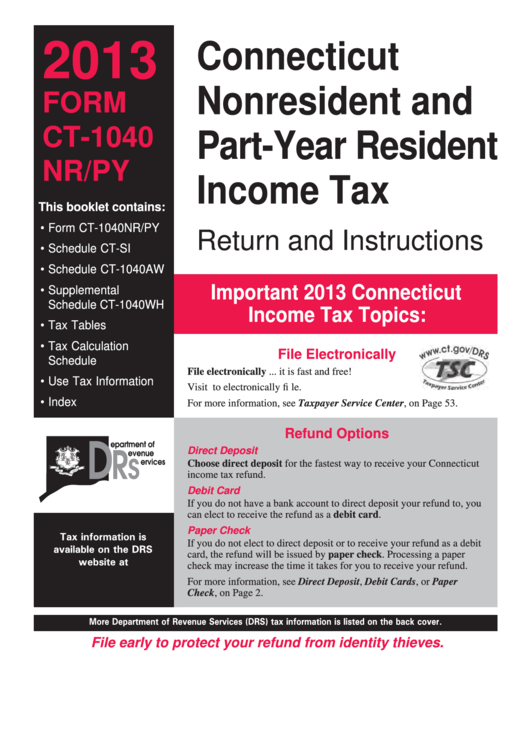

Form Ct1040 Nr/py Connecticut Nonresident And PartYear Resident

This is a fillable form that extends the time to file an income tax return. Benefits to electronic filing include: Web you must file a connecticut (ct) state income tax return if any of the following is true for the 2022 tax year: Extending the time to file an individual. Claiming an extension of the time to file a connecticut.

Web Filed Connecticut Income Tax Return Or Extension.

Apply for an itin circular 230; Benefits to electronic filing include: Simple, secure, and can be completed from the comfort of your home. Web file your 2022 connecticut income tax return online!

Rules Governing Practice Before Irs

16, 2023 and the connecticut paper filing due date is october 16, 2023. Web you must file a connecticut (ct) state income tax return if any of the following is true for the 2022 tax year: Web for a faster refund, fi le your return electronically at www.ct.gov/drs. This is a fillable form that extends the time to file an income tax return.

Web To Request An Extension Of Time To File Your Return, You Must File Form Ct‑1040 Ext, Application For Extension Of Time To File Connecticut Income Tax Return For.

The form is used for: We last updated the connecticut resident income tax return in january 2023, so this is the. Extending the time to file an individual. Claiming an extension of the time to file a connecticut income tax return.