Colorado Tax Extension Form 2022

Colorado Tax Extension Form 2022 - If you miss the tax extension deadline,. Web the irs will automatically process an extension when a taxpayer selects form 4868 and makes a full or partial federal tax payment by the april 18 due date using. You can download or print. Get ready for tax season deadlines by completing any required tax forms today. Taxformfinder provides printable pdf copies of 65 current. Ad discover 2290 form due dates for heavy use vehicles placed into service. Colorado personal income tax returns are due by april 15. Once you have paid at least 90% of your income tax. Complete, edit or print tax forms instantly. Ad access irs tax forms.

Web forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets such as real estate, stocks & bonds for the. Web 2021 extension payment for colorado individual income tax (calendar year — due april 15, 2022) filing extensions are granted automatically, only return this form if you need to. Return this form only if you need to make an additional payment of tax. Web you need to either pay through revenue online or submit your payment with the extension payment form. Web file your state income taxes online department of revenue file your individual income tax return, submit documentation electronically, or apply for a ptc rebate. If you miss the tax extension deadline,. Once you have paid at least 90% of your income tax. Web 2022 extension of time for filing a coloradoc corporation income tax return filing extensions are granted automatically, only return this formif you need to make an. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Complete, edit or print tax forms instantly.

Instructions on how to receive an automatic colorado income tax extension step 2: You can download or print. Ad discover 2290 form due dates for heavy use vehicles placed into service. Web colorado has a flat state income tax of 4.63% , which is administered by the colorado department of revenue. Web you need to either pay through revenue online or submit your payment with the extension payment form. Web more about the colorado dr 0105 estate tax extension ty 2022. Return this form only if you need to make an additional payment of tax. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Ad access irs tax forms. We will update this page with a new version of the form for 2024 as soon as it is made available.

Colorado Department Of Revenue Online Payment Meyasity

This form is for income earned in tax year 2022, with tax returns due in. Complete, edit or print tax forms instantly. If you cannot file by that date, you can get an. Colorado personal income tax returns are due by april 15. Web (calendar year — due april 15, 2022) filing extensions are granted automatically.

Colorado Divorce Forms 1111 Universal Network

Web 2021 extension payment for colorado individual income tax (calendar year — due april 15, 2022) filing extensions are granted automatically, only return this form if you need to. Taxformfinder provides printable pdf copies of 65 current. Colorado personal income tax returns are due by april 15. Web file your state income taxes online department of revenue file your individual.

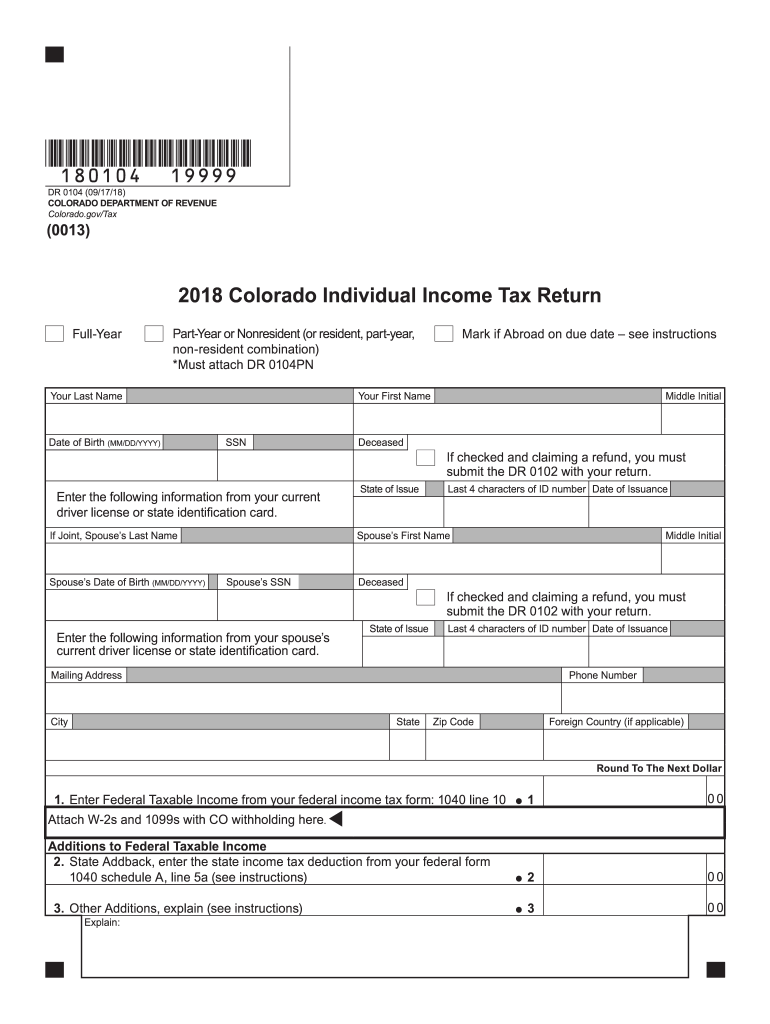

Colorado State Tax Form

Once you have paid at least 90% of your income tax. Get ready for tax season deadlines by completing any required tax forms today. Instructions on how to efile an irs income tax return extension colorado income. Web 2021 extension payment for colorado individual income tax (calendar year — due april 15, 2022) filing extensions are granted automatically, only return.

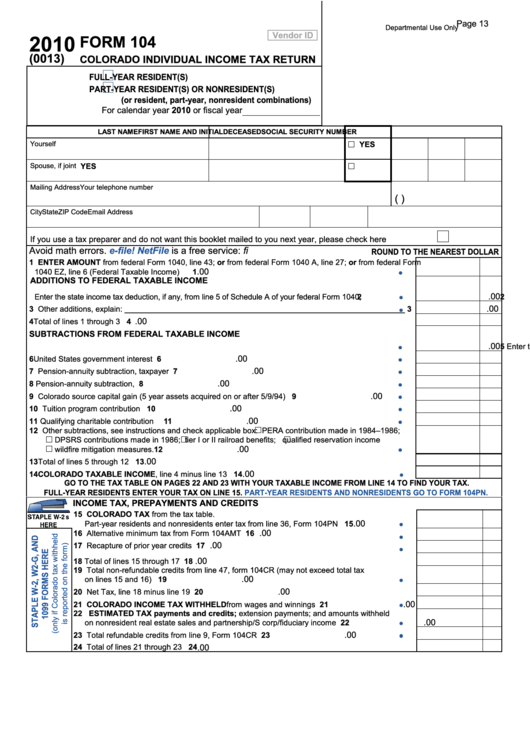

Individual Tax Form 104 Colorado Free Download

Web colorado has a flat state income tax of 4.63% , which is administered by the colorado department of revenue. Web file your state income taxes online department of revenue file your individual income tax return, submit documentation electronically, or apply for a ptc rebate. You can download or print. Once you have paid at least 90% of your income.

Top10 US Tax Forms in 2022 Explained PDF.co

Web this will allow you an additional six month to file your return. Get ready for tax season deadlines by completing any required tax forms today. Web the state of colorado has issued the following guidance regarding income tax filing deadlines for individuals: Web forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses.

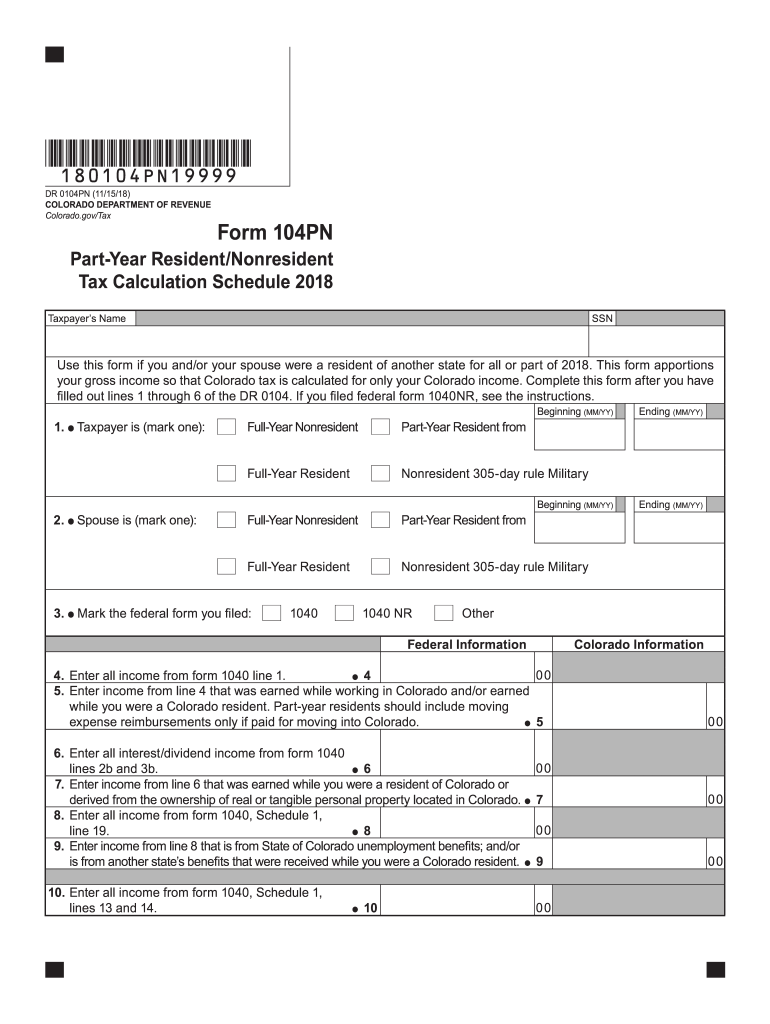

Tax Form 104Pn Fill Out and Sign Printable PDF Template signNow

Web colorado has a flat state income tax of 4.63% , which is administered by the colorado department of revenue. Web 2022 extension of time for filing a coloradoc corporation income tax return filing extensions are granted automatically, only return this formif you need to make an. Get ready for tax season deadlines by completing any required tax forms today..

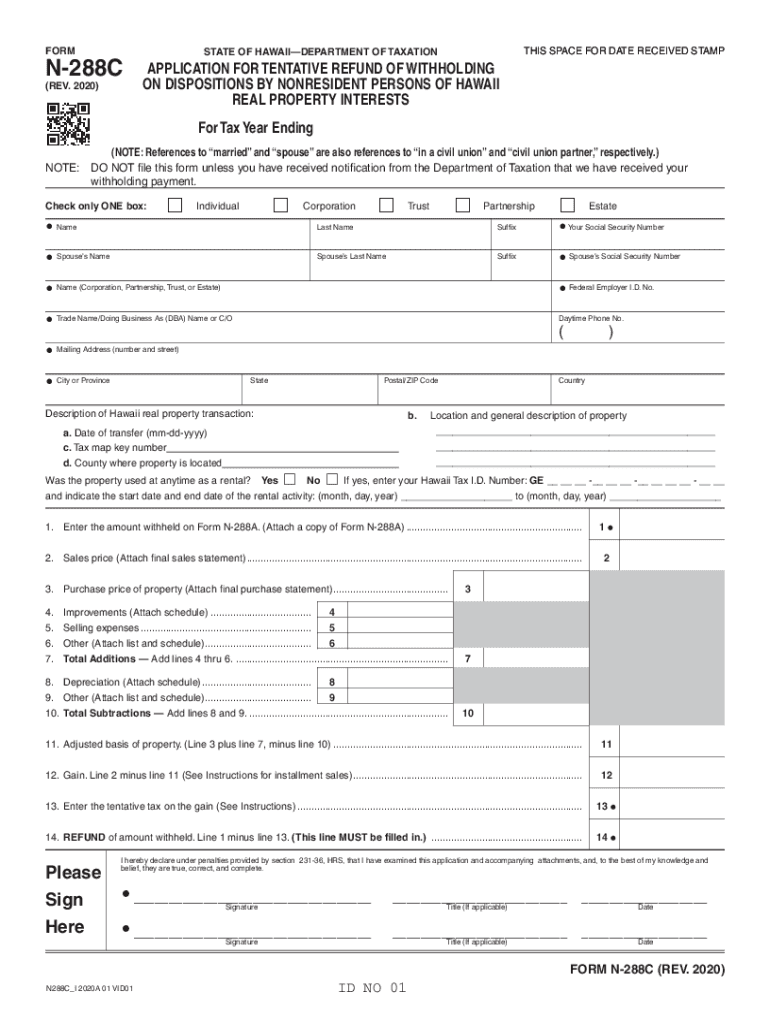

20202022 Form HI DoT N288C Fill Online, Printable, Fillable, Blank

Web $34.95 now only $29.95 file your personal tax extension now! Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web this will allow you an additional six month to file your return. Web forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on.

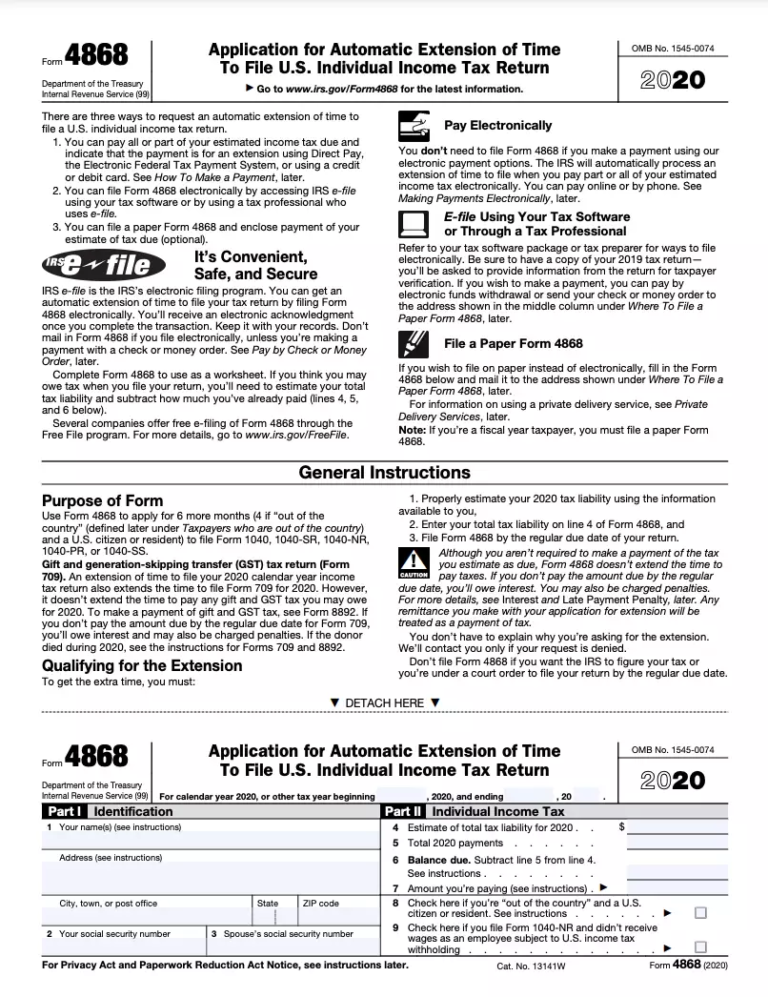

Tax extension IRS automatically give without filing Form 4868 if you do

Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Web 2021 extension payment for colorado individual income tax (calendar year — due april 15, 2022) filing extensions are granted automatically, only return this form if you need to. Web colorado has a flat state.

Tax Extension Deadline 2021 Colorado TAXIRIN

Return this form only if you need to make an additional payment of tax. Dr 0105 is a colorado estate tax form. Web $34.95 now only $29.95 file your personal tax extension now! Complete, edit or print tax forms instantly. Instructions on how to receive an automatic colorado income tax extension step 2:

Printable 2018 Federal Tax Withholding Tables

Ad discover 2290 form due dates for heavy use vehicles placed into service. Complete, edit or print tax forms instantly. If you cannot file by that date, you can get an. Get ready for tax season deadlines by completing any required tax forms today. Web 2022 extension of time for filing a coloradoc corporation income tax return filing extensions are.

Web This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April 2023.

Return this form only if you need to make an additional payment of tax. Web this will allow you an additional six month to file your return. Web 2021 extension payment for colorado individual income tax (calendar year — due april 15, 2022) filing extensions are granted automatically, only return this form if you need to. Dr 0105 is a colorado estate tax form.

Web $34.95 Now Only $29.95 File Your Personal Tax Extension Now!

Ad discover 2290 form due dates for heavy use vehicles placed into service. Instructions on how to receive an automatic colorado income tax extension step 2: Web the irs will automatically process an extension when a taxpayer selects form 4868 and makes a full or partial federal tax payment by the april 18 due date using. Get ready for tax season deadlines by completing any required tax forms today.

The State Filing Deadline Is April 18, 2023.

Once you have paid at least 90% of your income tax. You can download or print. If you cannot file by that date, you can get an. Ad access irs tax forms.

Web File Your State Income Taxes Online Department Of Revenue File Your Individual Income Tax Return, Submit Documentation Electronically, Or Apply For A Ptc Rebate.

Colorado personal income tax returns are due by april 15. Web (calendar year — due april 15, 2022) filing extensions are granted automatically. Web colorado has a flat state income tax of 4.63% , which is administered by the colorado department of revenue. Taxformfinder provides printable pdf copies of 65 current.