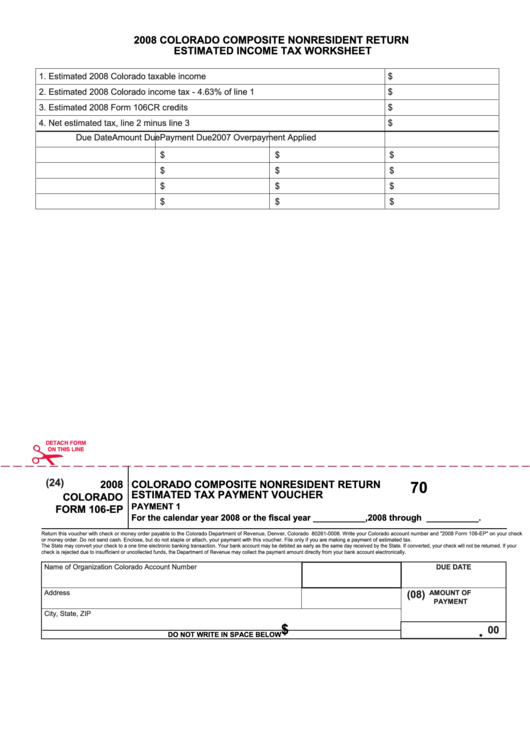

Colorado Estimated Tax Payment Form 2022

Colorado Estimated Tax Payment Form 2022 - Web your browser appears to have cookies disabled. Web we last updated the estimated corporation coupon/voucher in february 2023, so this is the latest version of form 112ep, fully updated for tax year 2022. Any taxpayer who jointly files their. Cookies are required to use this site. How to make a payment; Ad file heavy vehicle use tax form for vehicles weighing over 55,000 pounds. Web you can see a record of your estimated tax payments in your revenue online account. For taxpayers with a short taxable year,. Web colorado income tax forms. Web in most cases, a corporation is required to pay estimated tax if it can reasonably expect the net tax liability will exceed $5,000 for 2022.

Payment options by tax type; Web in most cases, a corporation is required to pay estimated tax if it can reasonably expect the net tax liability will exceed $5,000 for 2022. Web estimated tax payments are due on a quarterly basis; Web colorado income tax forms. Any taxpayer who jointly files their. Web we last updated the estimated corporation coupon/voucher in february 2023, so this is the latest version of form 112ep, fully updated for tax year 2022. Details on how to only. This form is for income earned in tax year 2022, with. Web you can see a record of your estimated tax payments in your revenue online account. Learn more about each tax type and how to.

April 15 (first calender quarter), june 15 (second calender quarter), september 15 for more. Web in most cases, a corporation is required to pay estimated tax if it can reasonably expect the net tax liability will exceed $5,000 for 2022. Learn more about each tax type and how to. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in colorado. Payment options by tax type; Cookies are required to use this site. For taxpayers with a short taxable year,. Be sure to verify that the form. Web colorado income tax forms. Estimated tax payments are claimed when you file your colorado individual income.

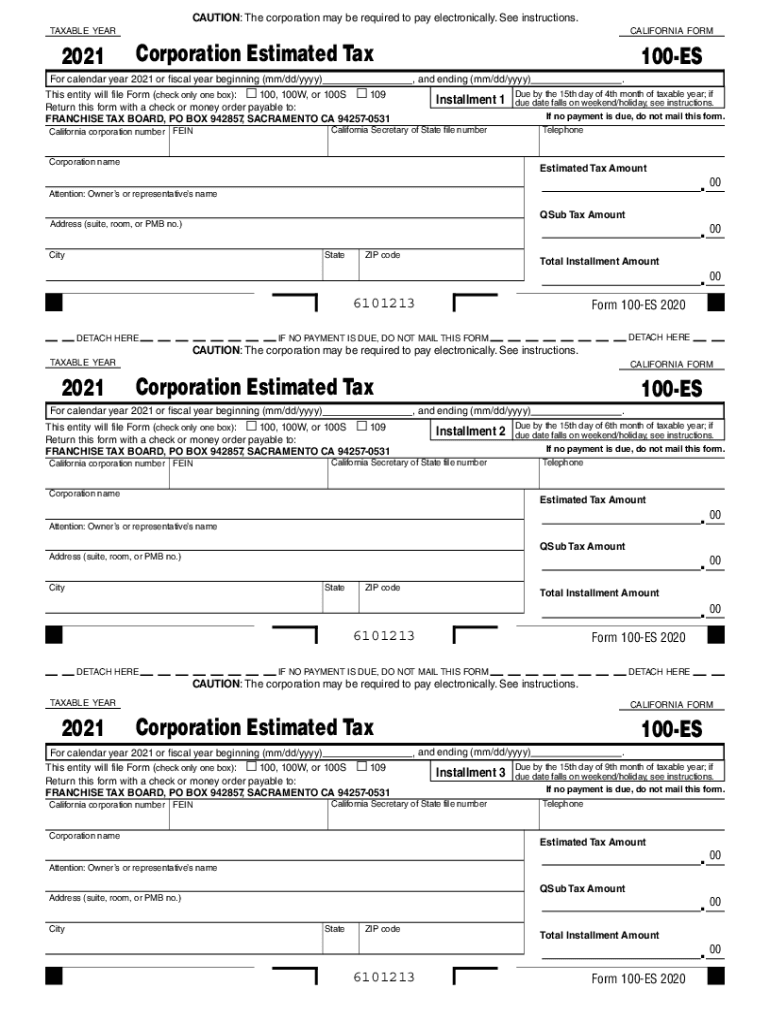

Estimate Ca Tax INCOBEMAN

Ad file heavy vehicle use tax form for vehicles weighing over 55,000 pounds. Learn more about each tax type and how to. Cookies are required to use this site. Web general rule in most cases, you must pay estimated tax if you expect to owe more than $1,000 in net tax for 2021, after subtracting any withholding or credits you.

Colorado Form 105Ep Estate/trust Estimated Tax Payment Voucher

Any taxpayer who jointly files their. Estimated tax payments 19 revised december 2021 in general, an individual must remit colorado estimated tax payments if his or her total colorado tax liability, less. How to make a payment; Cookies are required to use this site. Ad file heavy vehicle use tax form for vehicles weighing over 55,000 pounds.

CA FTB 100ES 20212022 Fill out Tax Template Online US Legal Forms

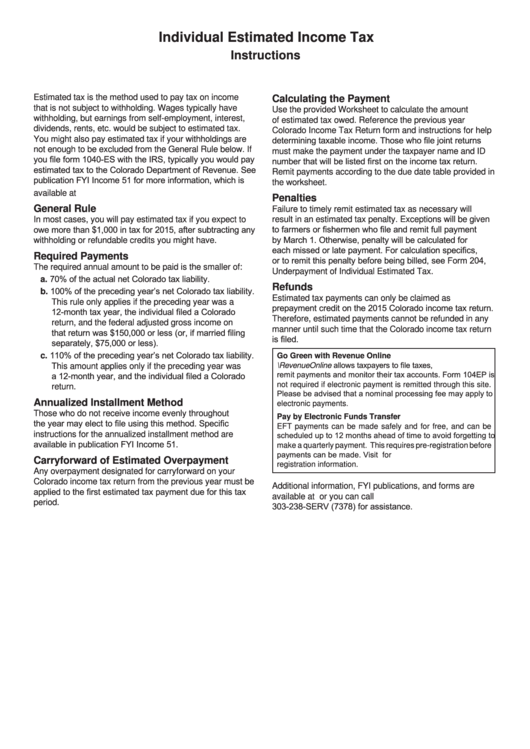

Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example,. Estimated 2022 colorado taxable income $ 00 2. Web file your state income taxes online department of revenue file your individual income tax return, submit documentation electronically, or apply for a ptc rebate. Web general rule in most cases, you must pay.

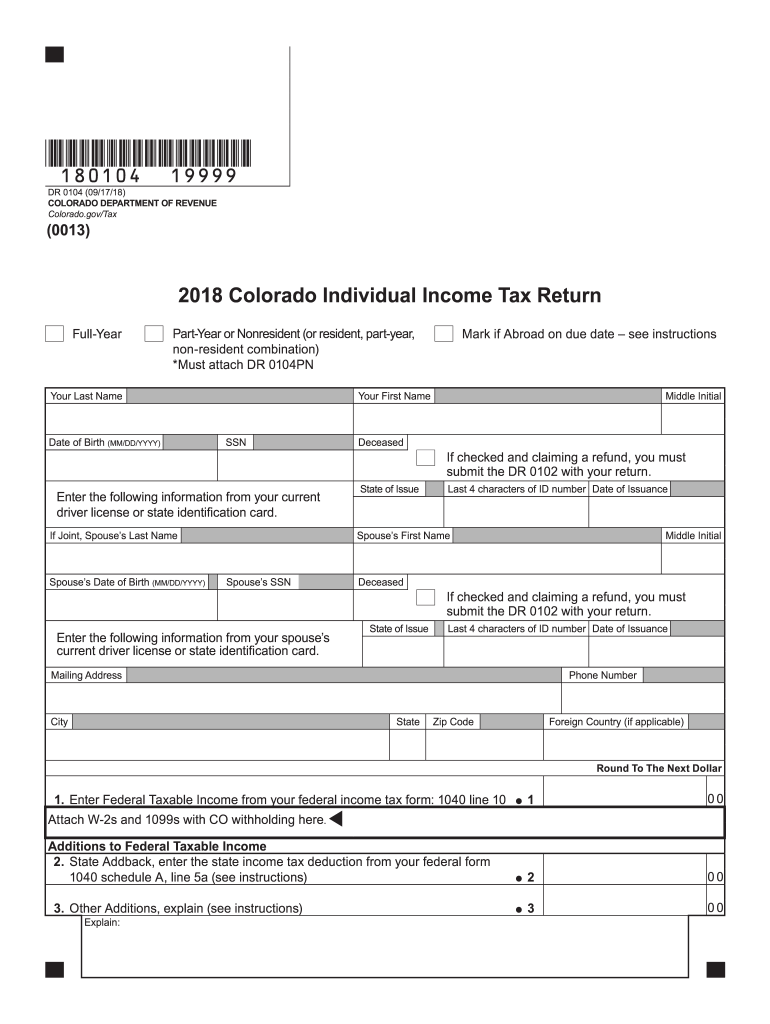

Colorado tax forms 2018 Fill out & sign online DocHub

Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example,. For taxpayers with a short taxable year,. Web colorado income tax forms. Cookies are required to use this site. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in colorado.

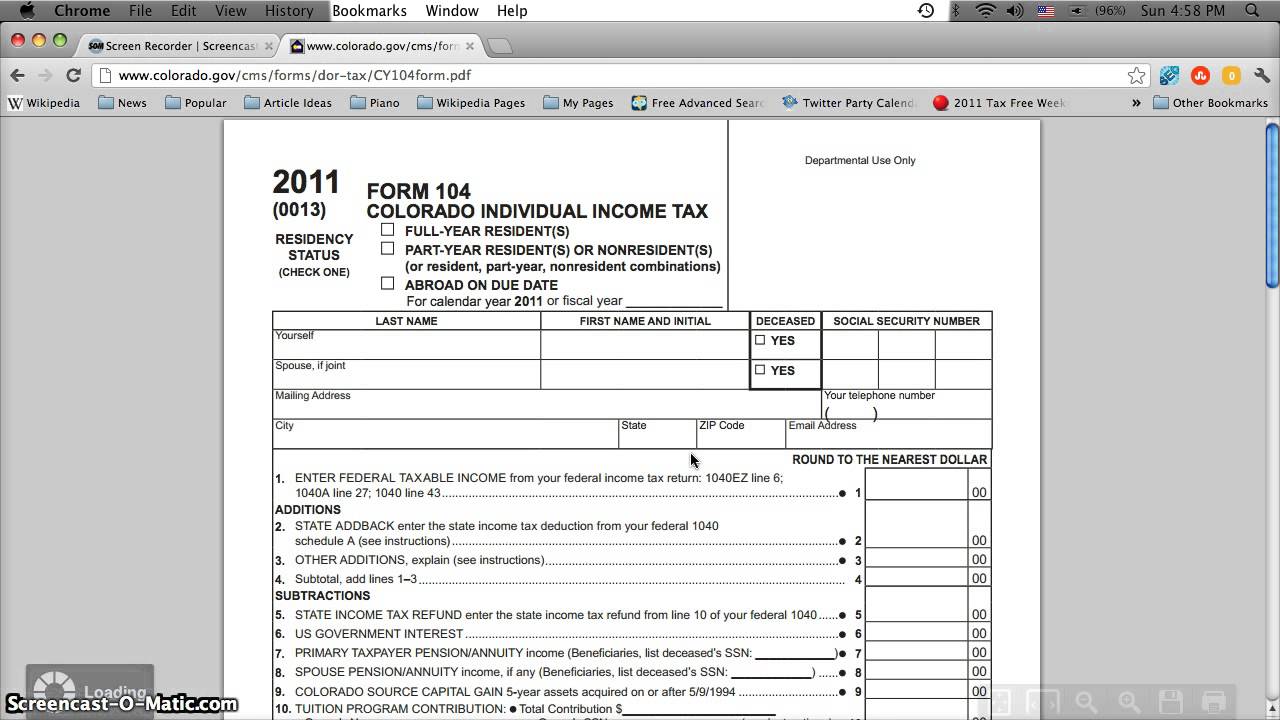

Colorado Printable Tax Forms 2012 Form 104 Online Printable or Fill

This form is for income earned in tax year 2022, with. Web your browser appears to have cookies disabled. Web file now with turbotax we last updated colorado form 104ep in february 2023 from the colorado department of revenue. Learn more about each tax type and how to. Be sure to verify that the form.

20192021 Form CO DR0021W Fill Online, Printable, Fillable, Blank

Web include a colorado estimated income tax payment form (dr 0104ep) with their payment to ensure proper crediting of their account. Web general rule in most cases, you must pay estimated tax if you expect to owe more than $1,000 in net tax for 2021, after subtracting any withholding or credits you might have. Any taxpayer who jointly files their..

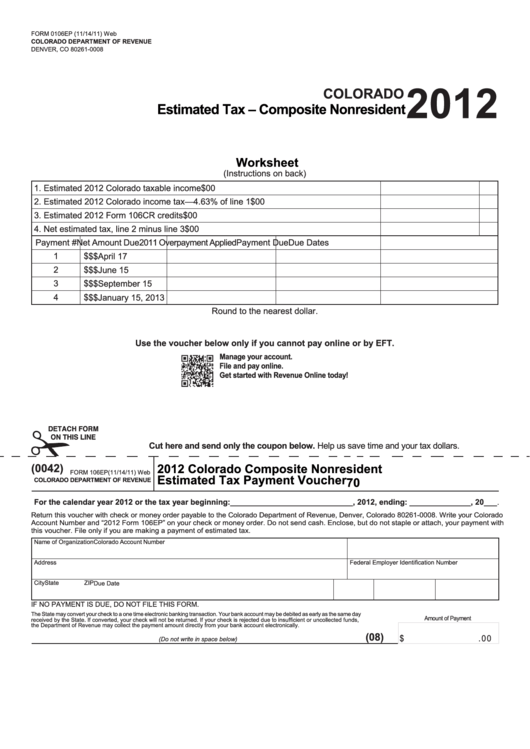

Form 0106ep Colorado Estimated Nonresident 2012

Web file now with turbotax we last updated colorado form 104ep in february 2023 from the colorado department of revenue. Estimated tax payments 19 revised december 2021 in general, an individual must remit colorado estimated tax payments if his or her total colorado tax liability, less. How to make a payment; Web general rule in most cases, you must pay.

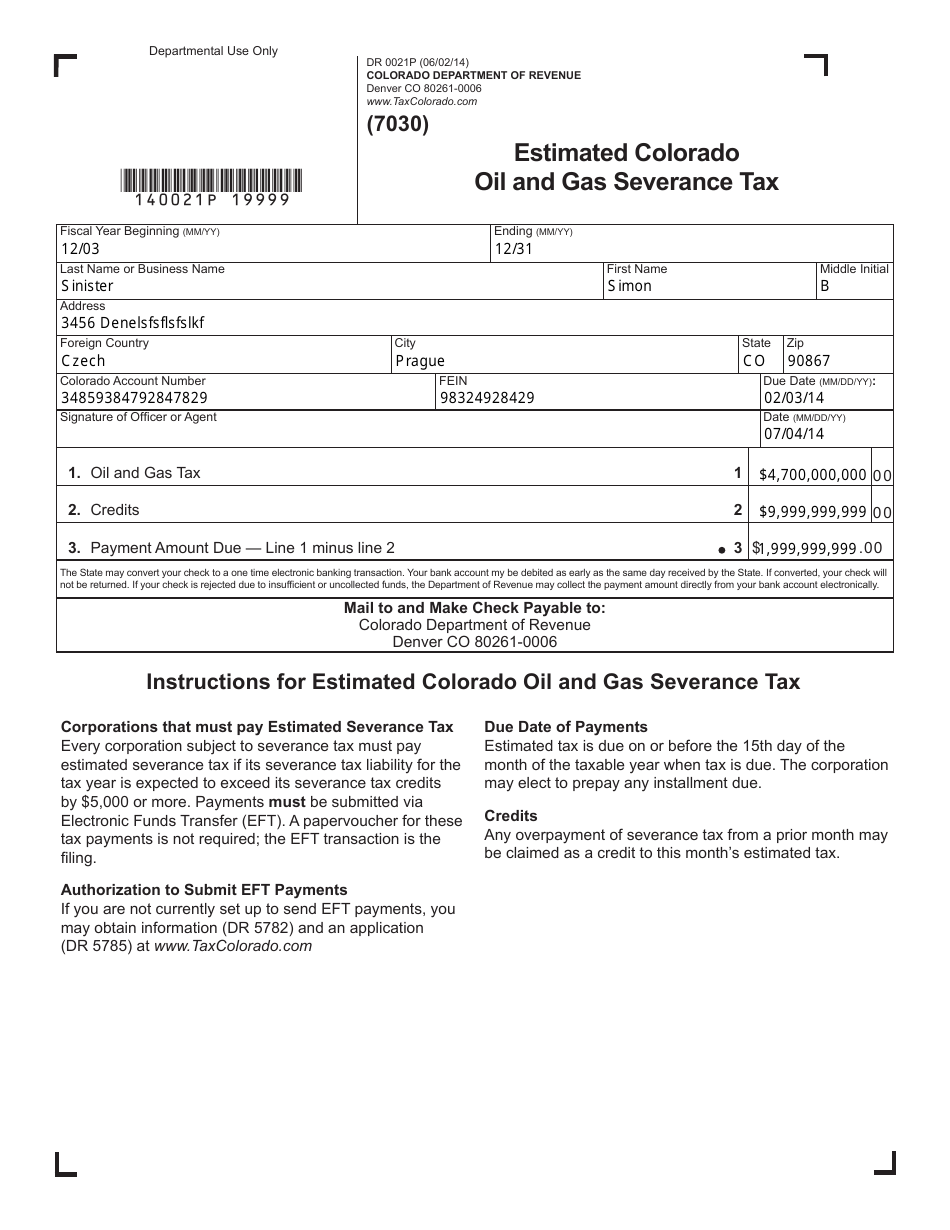

Form DR0021P Download Fillable PDF or Fill Online Estimated Colorado

Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in colorado. Web your browser appears to have cookies disabled. Web general rule in most cases, you must pay estimated tax if you expect to owe more than $1,000 in net tax for 2021, after subtracting any withholding or credits you might.

Fillable Form Dr 0104ep Colorado Estimated Tax Payment Voucher

Learn more about each tax type and how to. Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example,. For taxpayers with a short taxable year,. Web general rule in most cases, you must pay estimated tax if you expect to owe more than $1,000 in net tax for 2021, after subtracting.

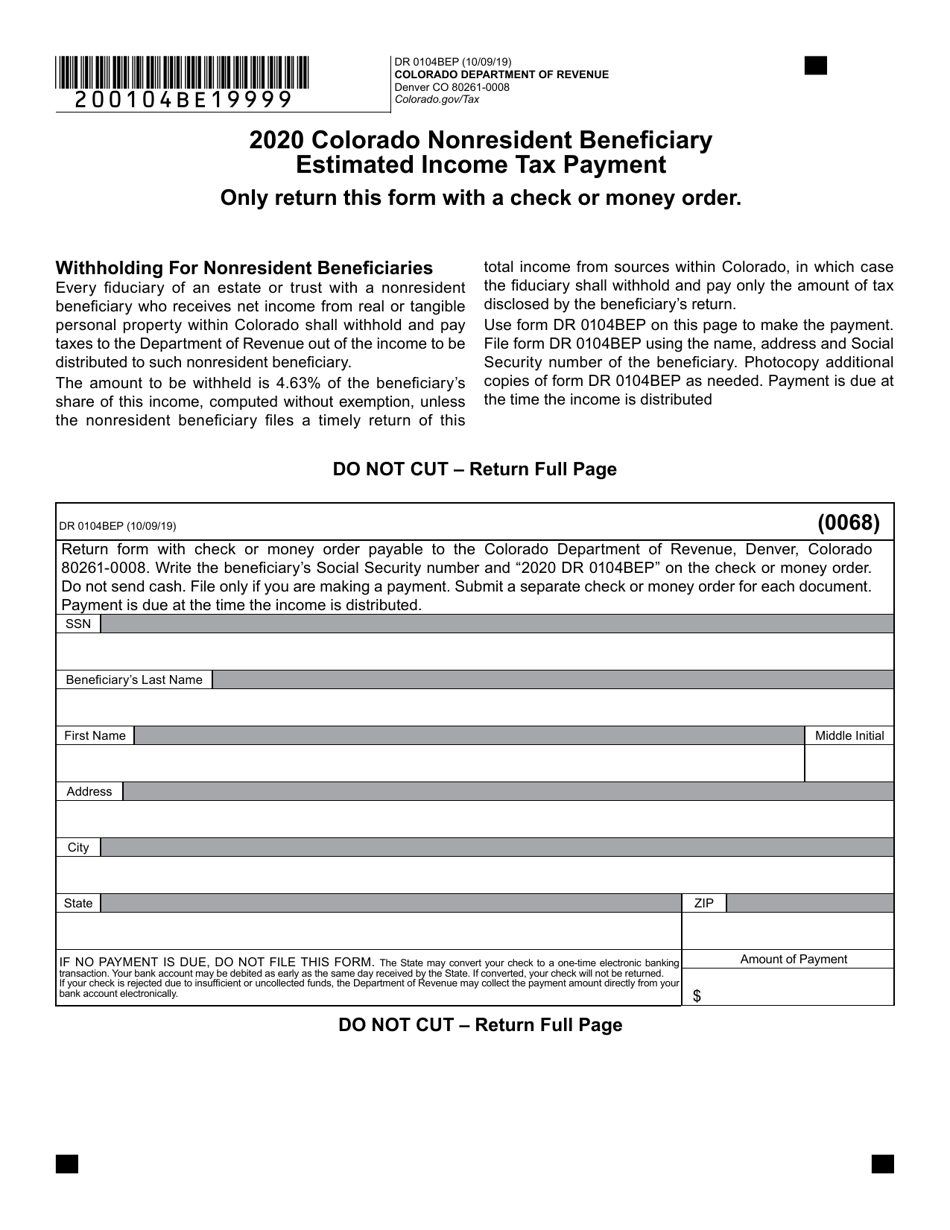

Form DR0104BEP Download Fillable PDF or Fill Online Colorado

April 15 (first calender quarter), june 15 (second calender quarter), september 15 for more. Be sure to verify that the form. Web colorado income tax forms. Web we last updated the estimated corporation coupon/voucher in february 2023, so this is the latest version of form 112ep, fully updated for tax year 2022. Web you can see a record of your.

This Form Is For Income Earned In Tax Year 2022, With.

Web pay taxes online department of revenue each tax type has specific requirements regarding how you are able to pay your tax liability. Payment options by tax type; Learn more about each tax type and how to. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in colorado.

Estimated 2022 Colorado Taxable Income $ 00 2.

Web file your state income taxes online department of revenue file your individual income tax return, submit documentation electronically, or apply for a ptc rebate. Cookies are required to use this site. Web estimated tax payments are due on a quarterly basis; Web colorado income tax forms.

Web General Rule In Most Cases, You Must Pay Estimated Tax If You Expect To Owe More Than $1,000 In Net Tax For 2021, After Subtracting Any Withholding Or Credits You Might Have.

Web file now with turbotax we last updated colorado form 104ep in february 2023 from the colorado department of revenue. Any taxpayer who jointly files their. Web your browser appears to have cookies disabled. April 15 (first calender quarter), june 15 (second calender quarter), september 15 for more.

Web In Most Cases, A Corporation Is Required To Pay Estimated Tax If It Can Reasonably Expect The Net Tax Liability Will Exceed $5,000 For 2022.

Details on how to only. Be sure to verify that the form. Estimated tax payments are claimed when you file your colorado individual income. Ad file heavy vehicle use tax form for vehicles weighing over 55,000 pounds.