Canadian Tax Form

Canadian Tax Form - Td1 personal tax credits returns; The return paperwork reports the sum of the previous year's (january to december) taxable income, tax credits, and other information relating to those two. Web file income tax, get the income tax and benefit package, and check the status of your tax refund business or professional income calculate business or professional income, get industry codes, and report various income types Web a canadian tax return refers to the obligatory forms that must be submitted to the canada revenue agency (cra) each financial year for individuals or corporations earning an income in canada. Based on your tax situation, turbotax® provides the tax forms you need. Web automated reminder to file your personal income tax return. Web view and download forms. Web find all canadian federal and provincial 2022 tax forms. Web get a paper or online version of 2022 income tax package for the province or territory where you reside, including specific tax return or form required for other tax situations. Go to what to expect when the canada revenue agency.

Web find all canadian federal and provincial 2022 tax forms. Web file taxes, and get tax information for individuals, businesses, charities, and trusts. Td1 forms for 2023 for pay received on january 1, 2023 or later Web view and download forms. Web automated reminder to file your personal income tax return. Individuals in québec must use the federal td1. The cra may call you between april 3, 2023 and may 29, 2023 using an automated telephone message to remind you to file your personal income tax return. Web all individuals must fill out the federal form td1, personal tax credits return. Web this is the main menu page for the t1 general income tax and benefit package for 2022. Go to what to expect when the canada revenue agency.

Web get a paper or online version of 2022 income tax package for the province or territory where you reside, including specific tax return or form required for other tax situations. Income tax, gst/hst, payroll, business number, savings and pension plans, child and family benefits, excise taxes, duties, and levies, charities and giving. Td1 forms for 2023 for pay received on january 1, 2023 or later Web file income tax, get the income tax and benefit package, and check the status of your tax refund business or professional income calculate business or professional income, get industry codes, and report various income types Web file taxes, and get tax information for individuals, businesses, charities, and trusts. Web view and download forms. Based on your tax situation, turbotax® provides the tax forms you need. Web all individuals must fill out the federal form td1, personal tax credits return. Web a canadian tax return refers to the obligatory forms that must be submitted to the canada revenue agency (cra) each financial year for individuals or corporations earning an income in canada. The return paperwork reports the sum of the previous year's (january to december) taxable income, tax credits, and other information relating to those two.

Canadian tax form stock photo. Image of form, document 18273838

Web all individuals must fill out the federal form td1, personal tax credits return. Web forms and publications; Individuals can select the link for their place of residence as of december 31, 2022, to get the forms and information needed to. Income tax, gst/hst, payroll, business number, savings and pension plans, child and family benefits, excise taxes, duties, and levies,.

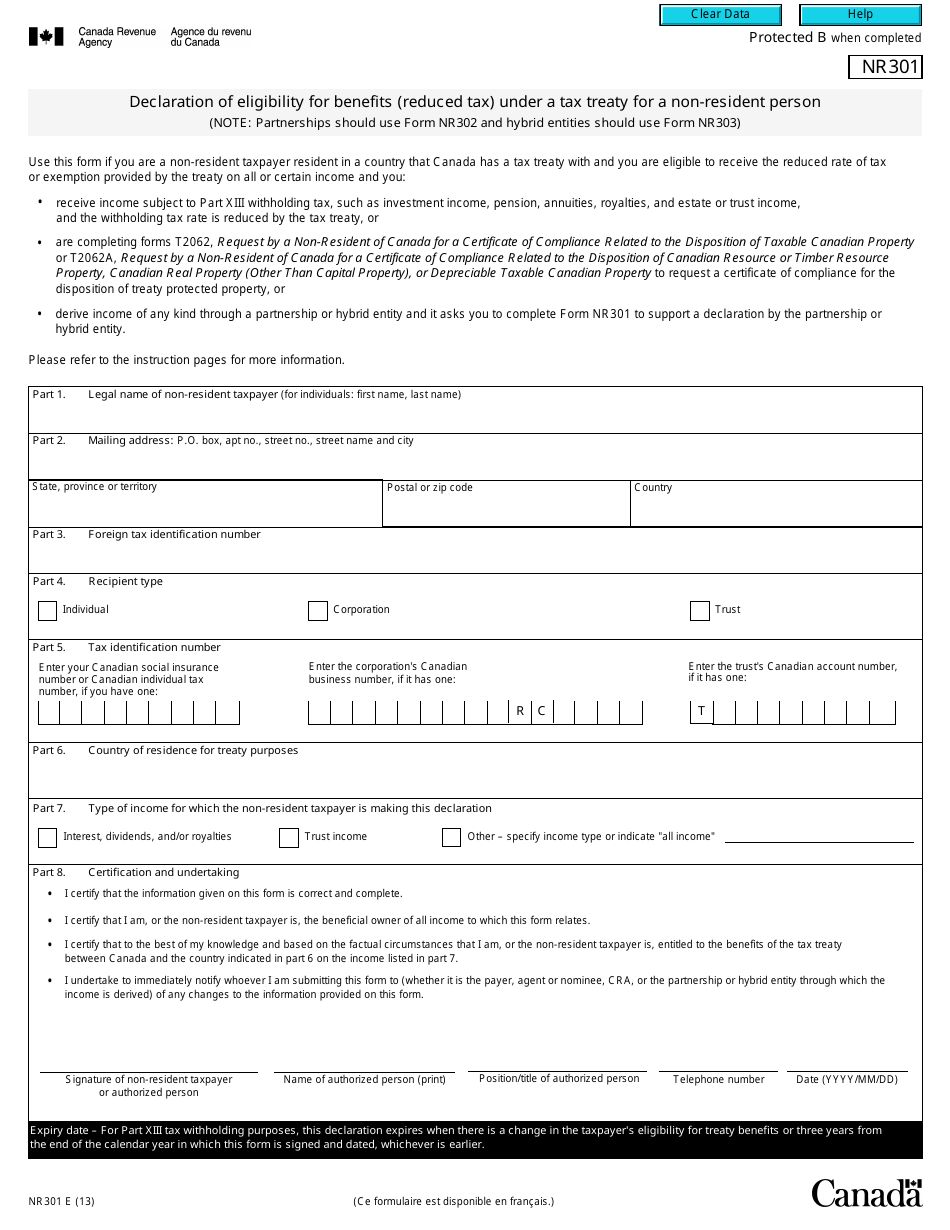

Form NR301 Download Fillable PDF or Fill Online Declaration of

Web a canadian tax return refers to the obligatory forms that must be submitted to the canada revenue agency (cra) each financial year for individuals or corporations earning an income in canada. Web this is the main menu page for the t1 general income tax and benefit package for 2022. Web all individuals must fill out the federal form td1,.

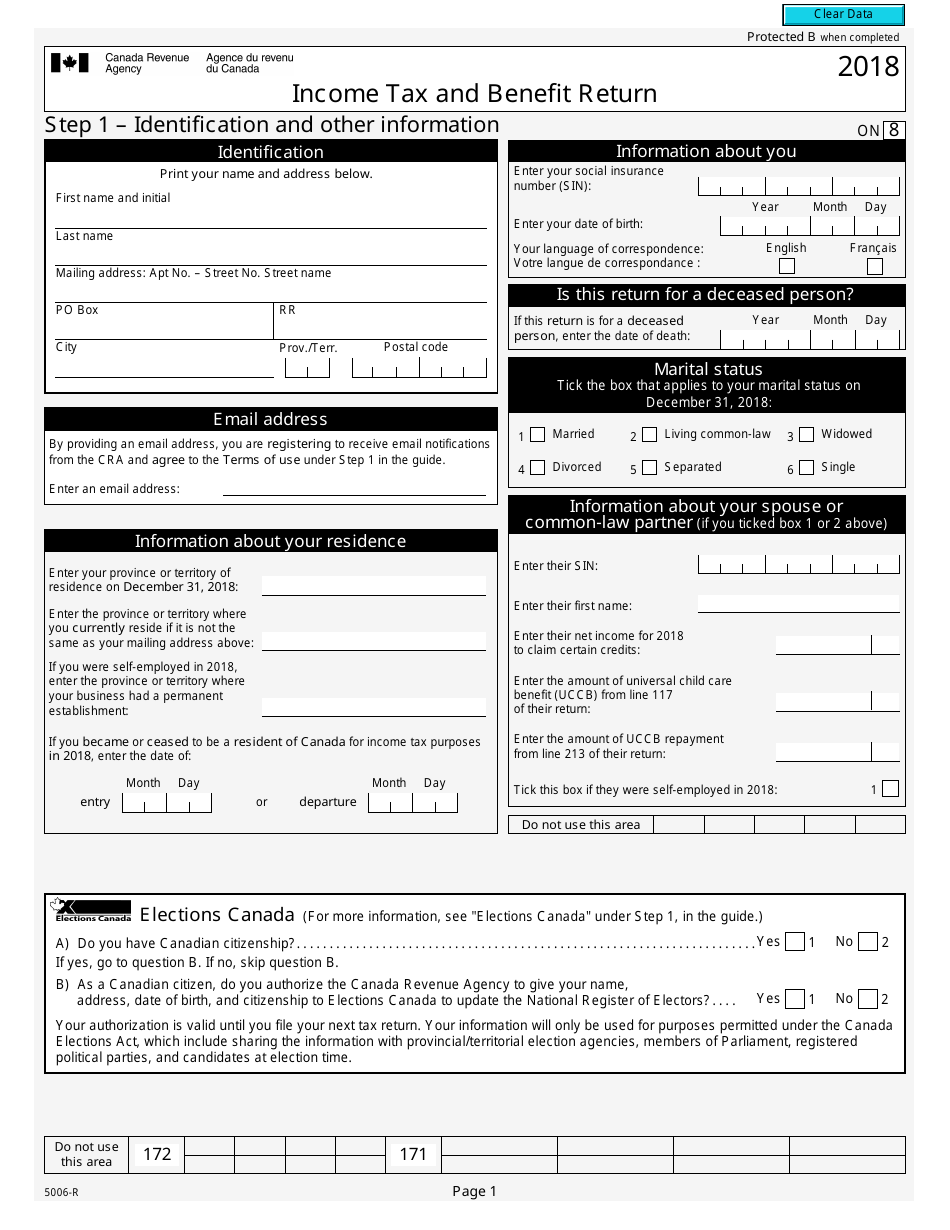

Form 5006R Download Fillable PDF or Fill Online Tax and Benefit

The return paperwork reports the sum of the previous year's (january to december) taxable income, tax credits, and other information relating to those two. Web find all canadian federal and provincial 2022 tax forms. Income tax, gst/hst, payroll, business number, savings and pension plans, child and family benefits, excise taxes, duties, and levies, charities and giving. Web file taxes, and.

Canadian tax form stock photo. Image of form, canada 18273962

Web view and download forms. Individuals can select the link for their place of residence as of december 31, 2022, to get the forms and information needed to. During this call, you will not be asked to give any personal information. Web find all canadian federal and provincial 2022 tax forms. Based on your tax situation, turbotax® provides the tax.

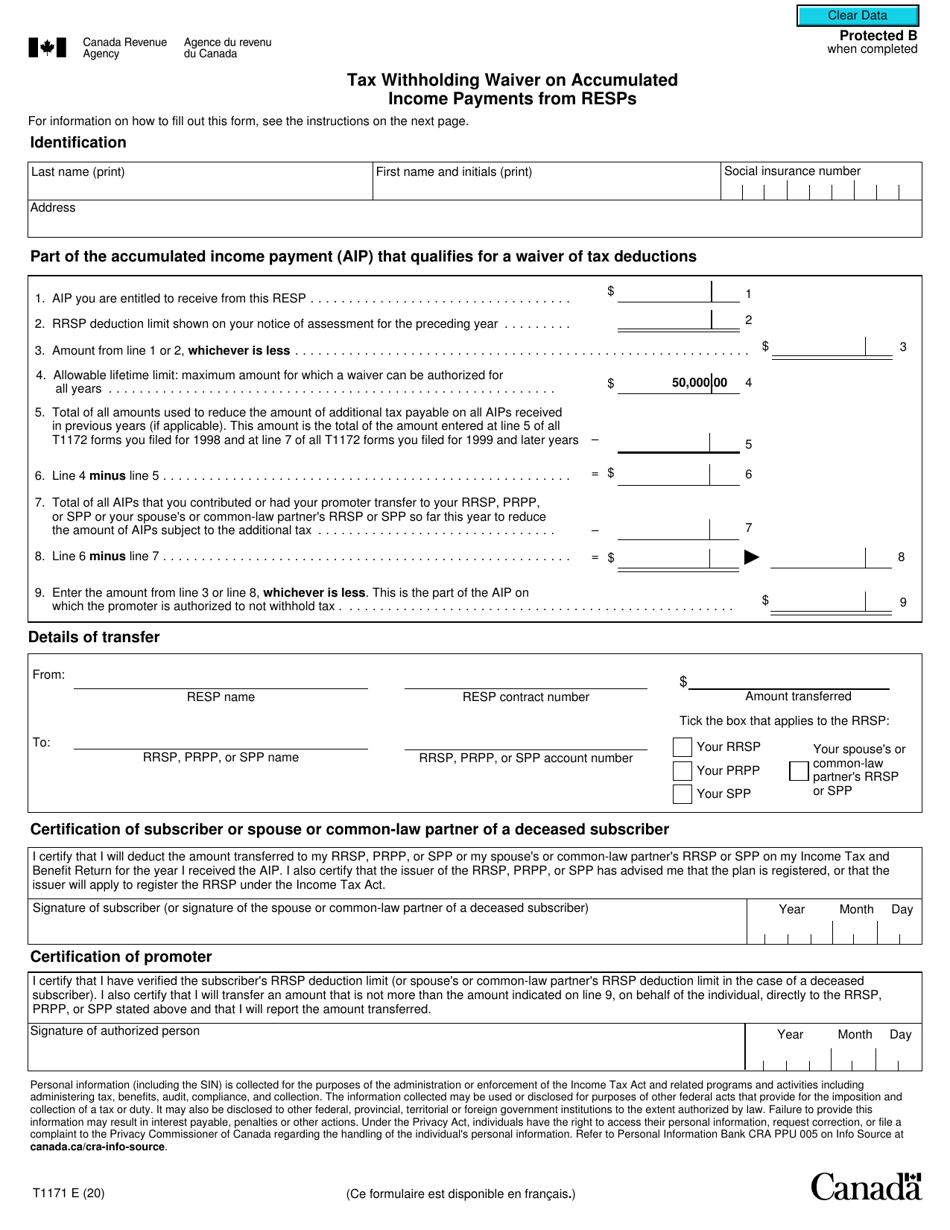

Form T1171 Download Fillable PDF or Fill Online Tax Withholding Waiver

Web file taxes, and get tax information for individuals, businesses, charities, and trusts. Individuals can select the link for their place of residence as of december 31, 2022, to get the forms and information needed to. Td1 forms for 2023 for pay received on january 1, 2023 or later Income tax, gst/hst, payroll, business number, savings and pension plans, child.

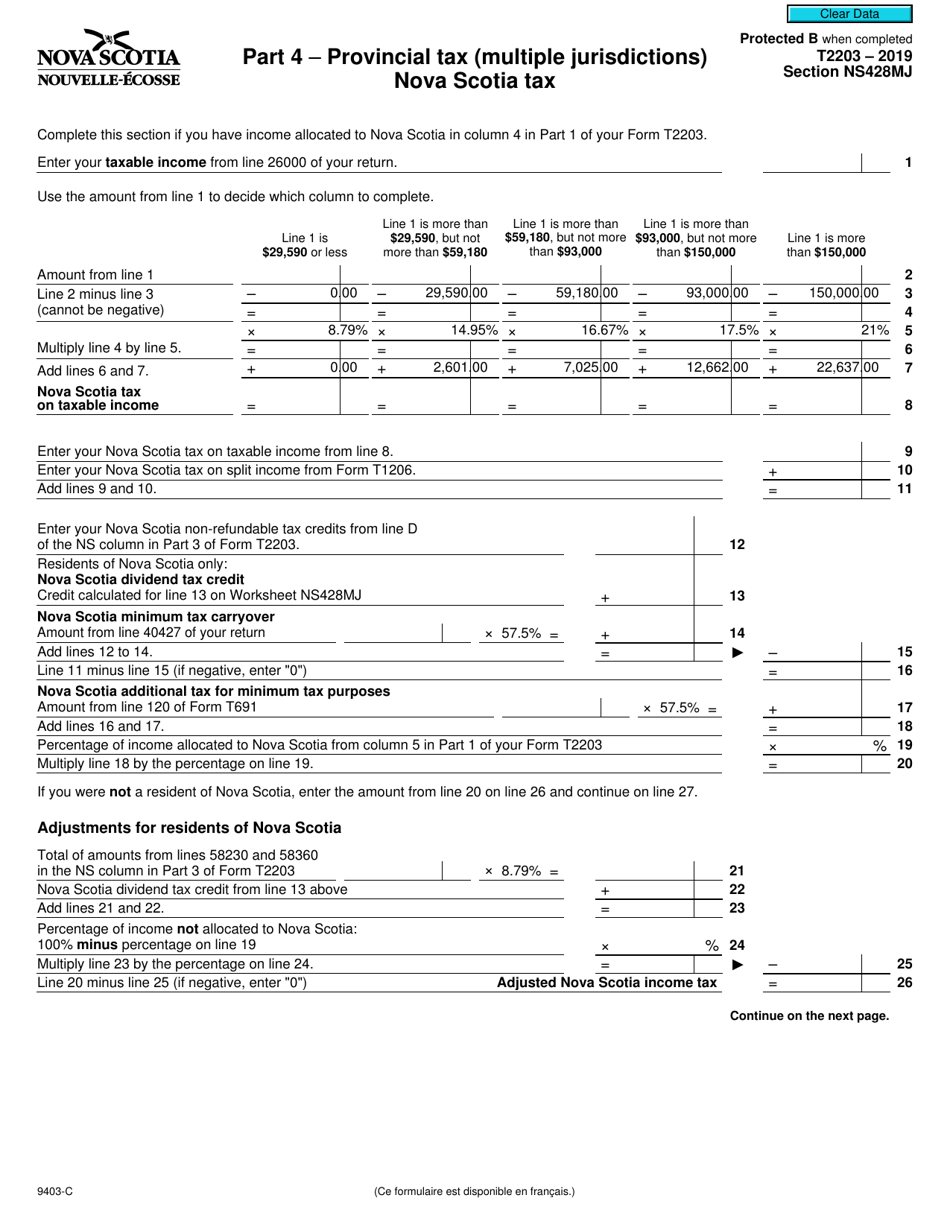

Form T2203 (9403C) Section NS428MJ Download Fillable PDF or Fill

Based on your tax situation, turbotax® provides the tax forms you need. Individuals can select the link for their place of residence as of december 31, 2022, to get the forms and information needed to. Web automated reminder to file your personal income tax return. Web file taxes, and get tax information for individuals, businesses, charities, and trusts. The return.

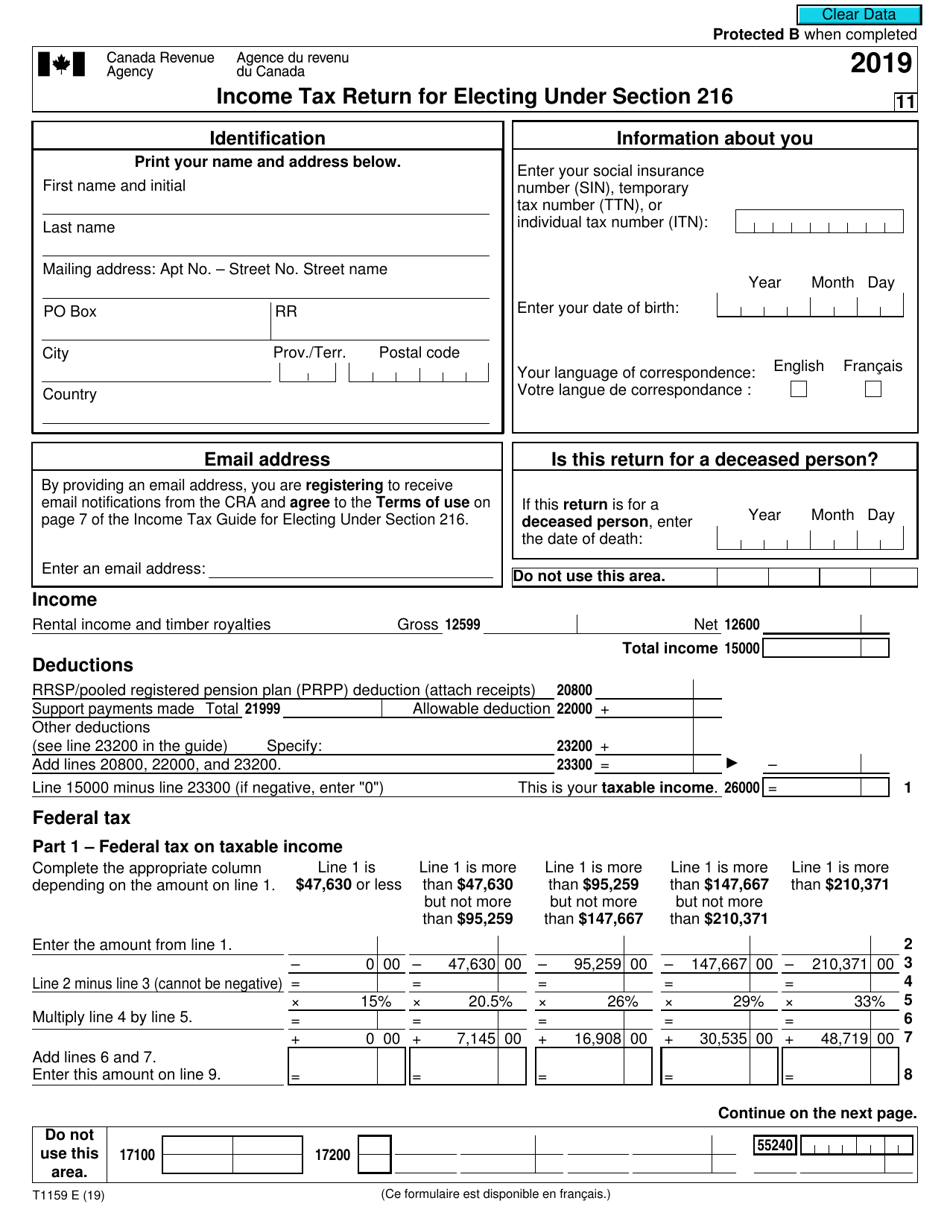

Form T1159 Download Fillable PDF or Fill Online Tax Return for

Web forms and publications; The cra may call you between april 3, 2023 and may 29, 2023 using an automated telephone message to remind you to file your personal income tax return. Web file taxes, and get tax information for individuals, businesses, charities, and trusts. During this call, you will not be asked to give any personal information. Td1 personal.

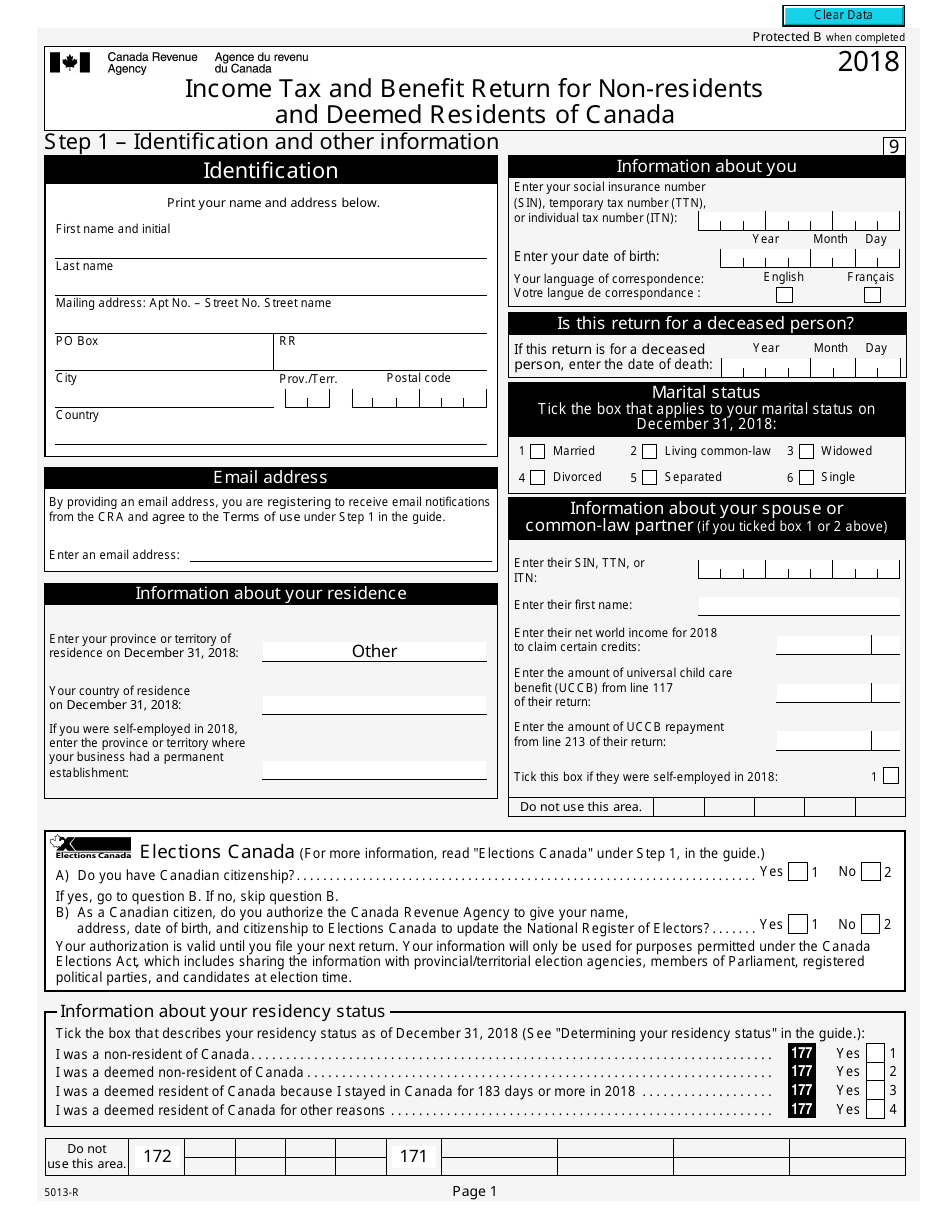

Form 5013R Download Fillable PDF or Fill Online Tax and Benefit

Td1 personal tax credits returns; Web find all canadian federal and provincial 2022 tax forms. Web all individuals must fill out the federal form td1, personal tax credits return. Based on your tax situation, turbotax® provides the tax forms you need. Web get a paper or online version of 2022 income tax package for the province or territory where you.

Canadian Tax Return Stock Photo Download Image Now iStock

Based on your tax situation, turbotax® provides the tax forms you need. The cra may call you between april 3, 2023 and may 29, 2023 using an automated telephone message to remind you to file your personal income tax return. Web view and download forms. Web get a paper or online version of 2022 income tax package for the province.

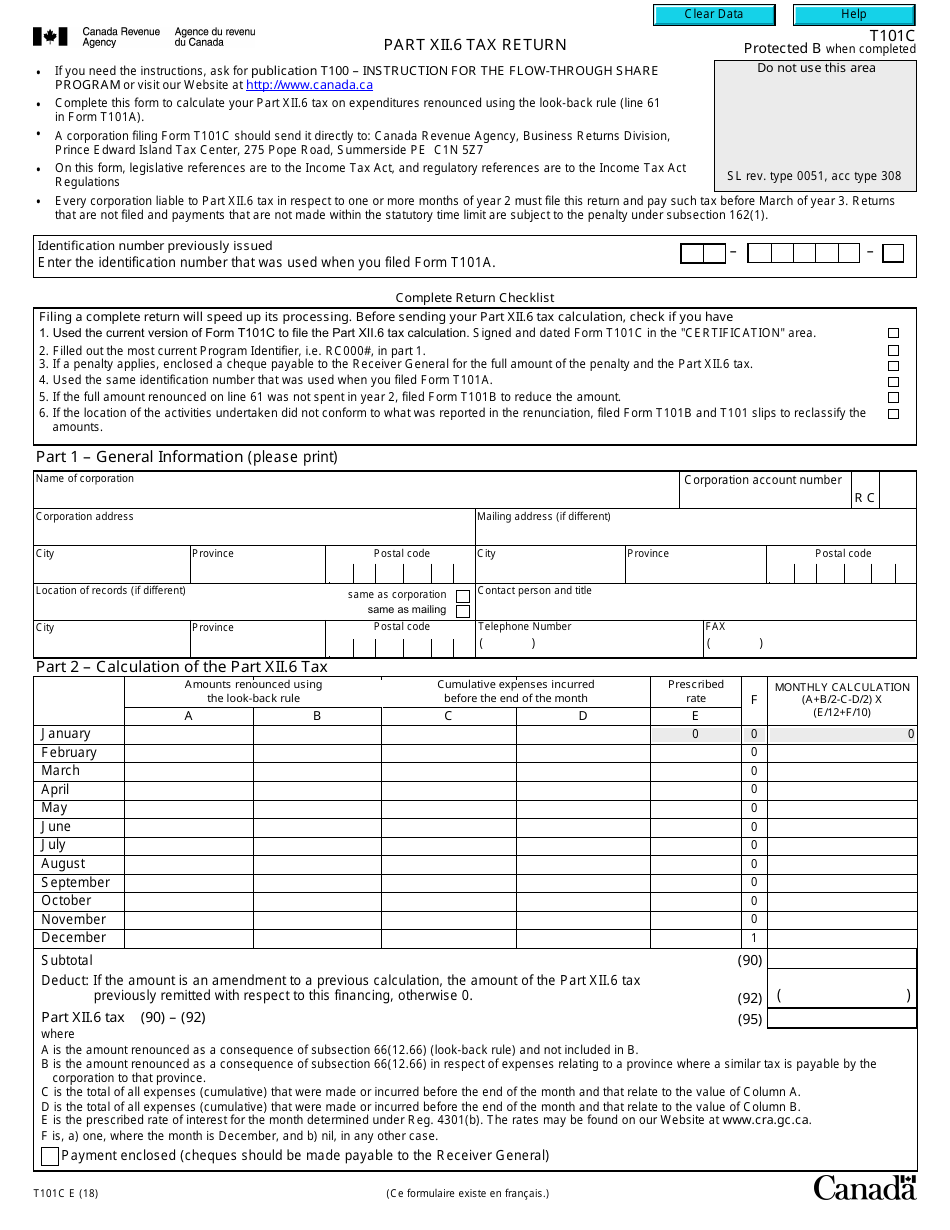

Form T101C Download Fillable PDF or Fill Online Part XII. 6 Tax Return

Web file taxes, and get tax information for individuals, businesses, charities, and trusts. Web forms and publications; Web get a paper or online version of 2022 income tax package for the province or territory where you reside, including specific tax return or form required for other tax situations. All canada revenue agency forms listed by number and title. During this.

Web This Is The Main Menu Page For The T1 General Income Tax And Benefit Package For 2022.

Based on your tax situation, turbotax® provides the tax forms you need. Td1 personal tax credits returns; Td1 forms for 2023 for pay received on january 1, 2023 or later Web a canadian tax return refers to the obligatory forms that must be submitted to the canada revenue agency (cra) each financial year for individuals or corporations earning an income in canada.

Web Get A Paper Or Online Version Of 2022 Income Tax Package For The Province Or Territory Where You Reside, Including Specific Tax Return Or Form Required For Other Tax Situations.

The cra may call you between april 3, 2023 and may 29, 2023 using an automated telephone message to remind you to file your personal income tax return. The return paperwork reports the sum of the previous year's (january to december) taxable income, tax credits, and other information relating to those two. Income tax, gst/hst, payroll, business number, savings and pension plans, child and family benefits, excise taxes, duties, and levies, charities and giving. During this call, you will not be asked to give any personal information.

All Canada Revenue Agency Forms Listed By Number And Title.

Web automated reminder to file your personal income tax return. Individuals in québec must use the federal td1. Web forms and publications; Web view and download forms.

Individuals Can Select The Link For Their Place Of Residence As Of December 31, 2022, To Get The Forms And Information Needed To.

Web find all canadian federal and provincial 2022 tax forms. Web all individuals must fill out the federal form td1, personal tax credits return. Web file taxes, and get tax information for individuals, businesses, charities, and trusts. Web file income tax, get the income tax and benefit package, and check the status of your tax refund business or professional income calculate business or professional income, get industry codes, and report various income types