Ca Form 100S Instructions

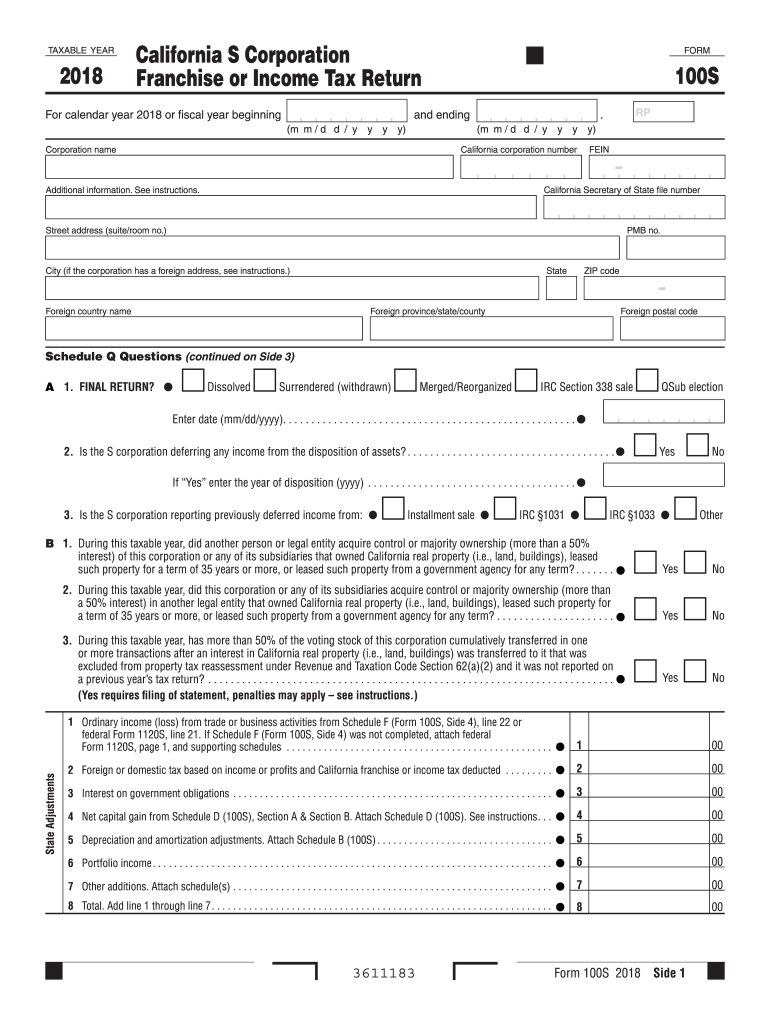

Ca Form 100S Instructions - References in these instructions are to the internal revenue code (irc) as of. Web marking s corporate form 100s as an initial return in proconnect. During this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50%. Web 2022 instructions for form 100 california corporation franchise or income tax return. Web efile your california tax return now efiling is easier, faster, and safer than filling out paper tax forms. Web california law is also different in the following areas: Corporations that incorporated or qualified. Web see the links below for the california ftb form instructions. Original due date is the 15th day of the 3rd month after the close of the taxable year and extended due date is the 15th day of the 9th month after the close of the taxable. California s corporation franchise or income tax return.

Web all california c corporations and llcs treated as corporations file form 100 (california franchise or income tax return). References in these instructions are to the internal revenue code (irc) as of. We are taking appointments at our field offices. Choosing a legal professional, making a scheduled appointment and going to the business office for a personal meeting makes completing a. Web 3611193 form 100s 2019 side 1 b 1. When do i file my corporation return? 2022 form 100s 2022 form 100s k1 2021 form 100s 2021 form 100s k1 2020 form 100s 2020. Web 2022 instructions for form 100 california corporation franchise or income tax return. Web see the links below for the california ftb form instructions. References in these instructions are to the internal revenue code (irc) as of.

References in these instructions are to the internal revenue code (irc) as of. Web 2021 instructions for form 100california corporation franchise or income tax return. All federal s corporations subject to california laws must file form 100s. Web see the links below for the california ftb form instructions. This is a reminder for you and your clients to make sure to file form 100s, california s. Corporations that incorporated or qualified. Original due date is the 15th day of the 3rd month after the close of the taxable year and extended due date is the 15th day of the 9th month after the close of the taxable. Web 2015 instructions for form 100s. California s corporation franchise or income tax return. Web marking s corporate form 100s as an initial return in proconnect.

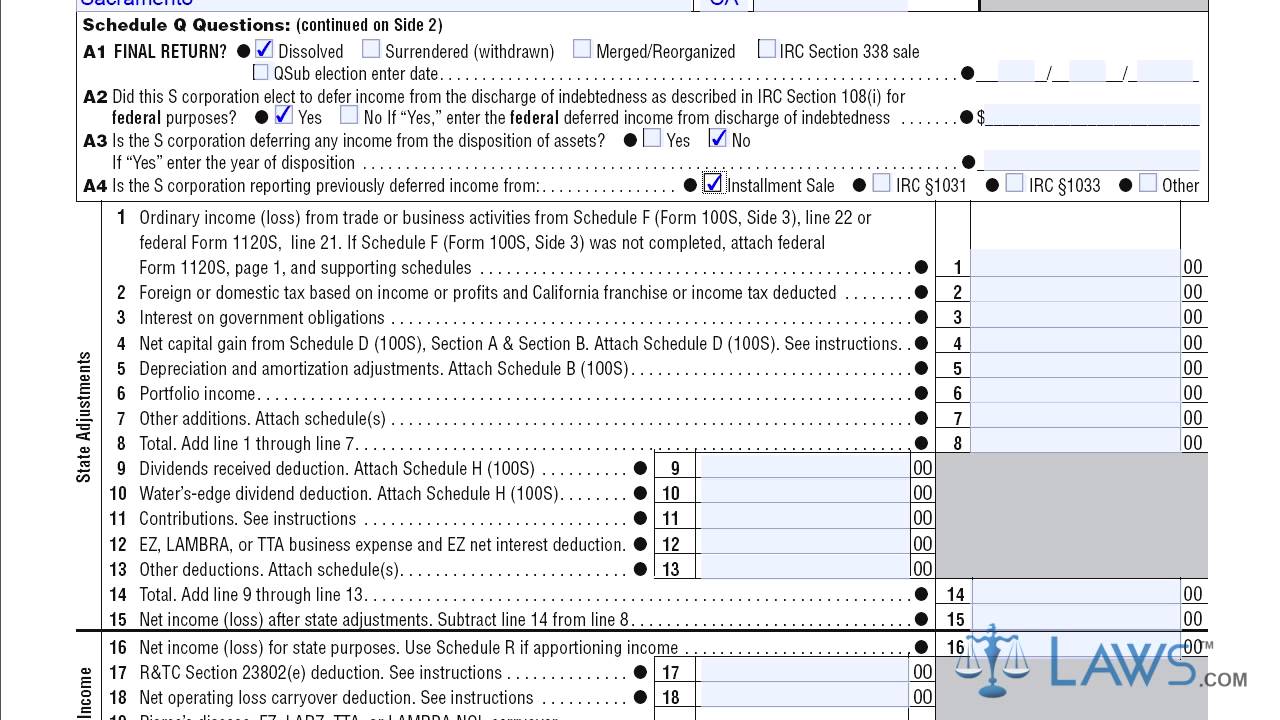

Form 100S California S Corporation Franchise or Tax Return YouTube

References in these instructions are to the internal revenue code (irc) as of. Web form 100s is used if a corporation has elected to be a small business corporation (s corporation). During this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50%. We are taking appointments at our field offices. File your.

Ca form 100s instructions 2017

Web all california c corporations and llcs treated as corporations file form 100 (california franchise or income tax return). References in these instructions are to the internal revenue code (irc) as of. References in these instructions are to the internal revenue code (irc) as of january. Web instructions for form 100s california s corporation franchise or income tax return references.

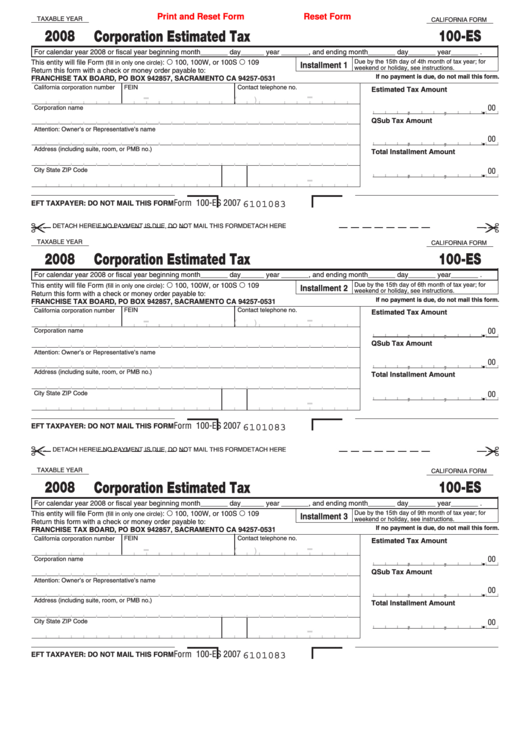

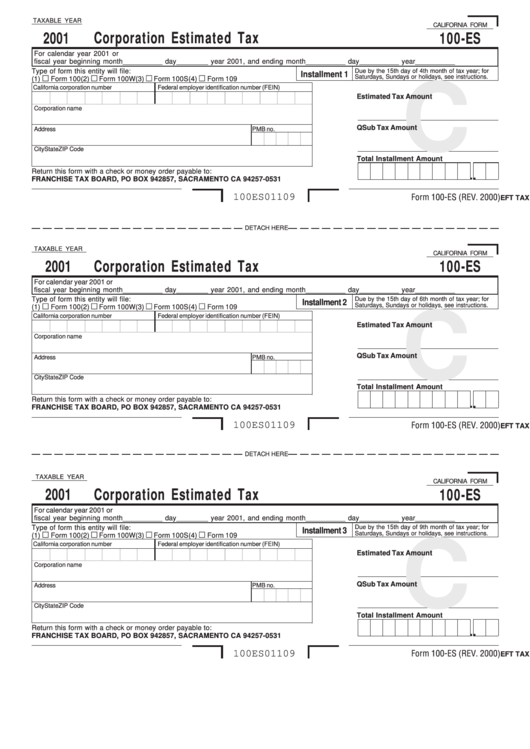

Fillable California Form 100Es Corporation Estimated Tax 2008

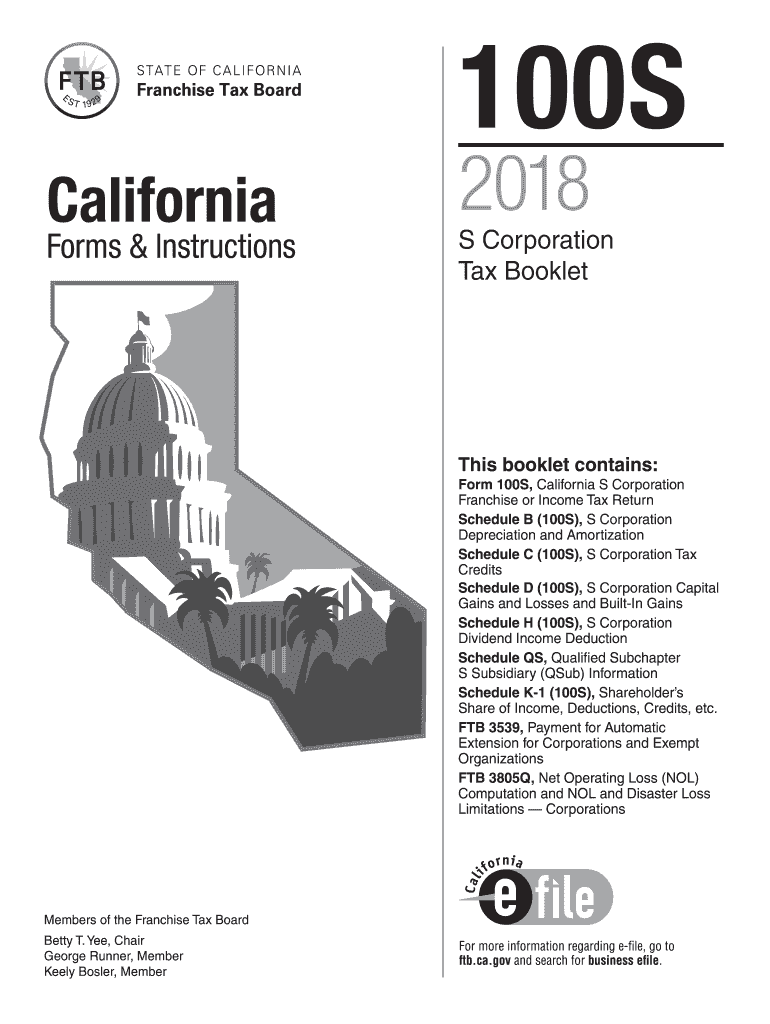

References in these instructions are to the internal revenue code (irc) as of. Side 4 form 100s 20203614203. Choosing a legal professional, making a scheduled appointment and going to the business office for a personal meeting makes completing a. The s corporation is allowed tax credits and net operating losses. Web forms & instructions 100s 2010 s corporation tax booklet.

2012 Form 100S Franchise Tax Board Edit, Fill, Sign Online Handypdf

Solved • by intuit • 2 • updated march 21, 2023. Web marking s corporate form 100s as an initial return in proconnect. Web all california c corporations and llcs treated as corporations file form 100 (california franchise or income tax return). References in these instructions are to the internal revenue code (irc) as of. All federal s corporations subject.

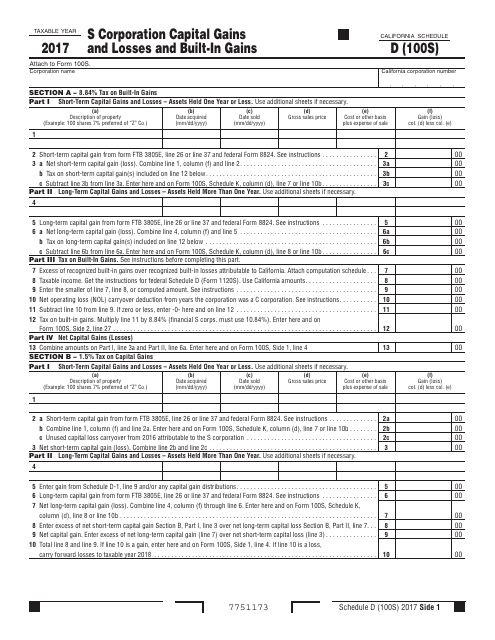

Form 100S Schedule D Download Printable PDF or Fill Online S

Web 2022 instructions for form 100 california corporation franchise or income tax return. References in these instructions are to the internal revenue code (irc) as of january. Solved • by intuit • 2 • updated march 21, 2023. Web see the links below for the california ftb form instructions. California s corporation franchise or income tax return.

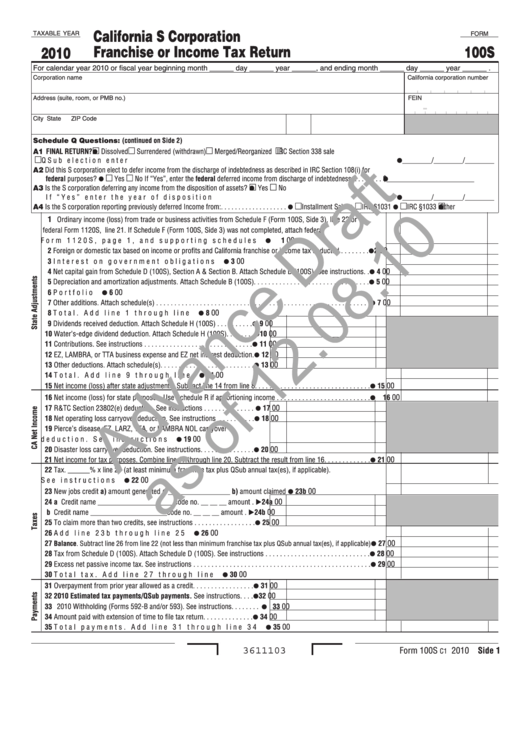

Form 100s Draft California S Corporation Franchise Or Tax

Web efile your california tax return now efiling is easier, faster, and safer than filling out paper tax forms. Web marking s corporate form 100s as an initial return in proconnect. Web 2021 instructions for form 100california corporation franchise or income tax return. During this taxable year, did another person or legal entity acquire control or majority ownership (more than.

2012 Form 100S Franchise Tax Board Edit, Fill, Sign Online Handypdf

Web 2015 instructions for form 100s. We are taking appointments at our field offices. Web 2021 instructions for form 100california corporation franchise or income tax return. California s corporation franchise or income tax return. Web efile your california tax return now efiling is easier, faster, and safer than filling out paper tax forms.

Form 100Es Corporation Estimated Tax California printable pdf download

Web all california c corporations and llcs treated as corporations file form 100 (california franchise or income tax return). Side 4 form 100s 20203614203. 2022 form 100s 2022 form 100s k1 2021 form 100s 2021 form 100s k1 2020 form 100s 2020. 1 a)gross receipts or sales ____________ b)less returns and allowances _______________ c)balance. All federal s corporations subject to.

20182022 Form CA FTB 100S Tax Booklet Fill Online, Printable, Fillable

California s corporation franchise or income tax return. Web follow the simple instructions below: When do i file my corporation return? 1 a)gross receipts or sales ____________ b)less returns and allowances _______________ c)balance. During this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50%.

California Form 100s Instructions PDF Fill Out and Sign Printable PDF

Web see the links below for the california ftb form instructions. Original due date is the 15th day of the 3rd month after the close of the taxable year and extended due date is the 15th day of the 9th month after the close of the taxable. During this taxable year, did another person or legal entity acquire control or.

References In These Instructions Are To The Internal Revenue Code (Irc) As Of.

Original due date is the 15th day of the 3rd month after the close of the taxable year and extended due date is the 15th day of the 9th month after the close of the taxable. Web 2015 instructions for form 100s. References in these instructions are to the internal revenue code (irc) as of january. Web 2021 instructions for form 100california corporation franchise or income tax return.

We Are Taking Appointments At Our Field Offices.

Side 4 form 100s 20203614203. Web forms & instructions 100s 2010 s corporation tax booklet members of the franchise tax board john chiang, chair betty t. File your california and federal tax returns online with turbotax in minutes. When do i file my corporation return?

Web All California C Corporations And Llcs Treated As Corporations File Form 100 (California Franchise Or Income Tax Return).

Web california law is also different in the following areas: California s corporation franchise or income tax return. Web form 100s is used if a corporation has elected to be a small business corporation (s corporation). Web 3611193 form 100s 2019 side 1 b 1.

Web Instructions For Form 100S California S Corporation Franchise Or Income Tax Return References In These Instructions Are To The Internal Revenue Code (Irc) As Of January.

Choosing a legal professional, making a scheduled appointment and going to the business office for a personal meeting makes completing a. The s corporation is allowed tax credits and net operating losses. Web follow the simple instructions below: Solved • by intuit • 2 • updated march 21, 2023.