Broad Form Coverage

Broad Form Coverage - This means that if coverage is not specifically named, it’s excluded. Web broad form insurance refers to the causes of loss (or perils) form that dictates what types of losses will be covered under a property insurance policy. Special form coverage offers the widest. Only the driver's liability costs are covered under this type of policy. Web similar to the basic form policy, a broad form insurance policy covers perils on a named basis. Only a few states, including washington, allow broad form insurance to meet state minimums. The key difference between the two is that broad form covers 6 perils in addition to the 11 covered in. Broad form may appeal to people who want to pay as little for car. Web broad form insurance provides minimal auto liability insurance for one driver. Web the broad causes of loss form (cp 10 20) provides named perils coverage for the perils insured against in the basic causes of loss form (fire, lightning, explosion, smoke, windstorm, hail, riot, civil commotion, aircraft, vehicles, vandalism, sprinkler leakage, sinkhole collapse, volcanic action), plus the following additional perils:

Basic, broad, and special form are three common coverage forms when insuring property. The key difference between the two is that broad form covers 6 perils in addition to the 11 covered in. Web similar to the basic form policy, a broad form insurance policy covers perils on a named basis. Additional perils added to the broad form include: Web like basic form coverage, broad form covers only the perils listed in your policy. Web a broad form policy that adds more coverage, such as damage from broken windows and other structural glass, falling objects, and water damage. Only the driver's liability costs are covered under this type of policy. The broad form is made to cover all perils the basic form covers, along with some additional common perils that could occur. This means that if coverage is not specifically named, it’s excluded. Web what is basic form, broad form, and special form?

Additional perils added to the broad form include: Web a broad form policy that adds more coverage, such as damage from broken windows and other structural glass, falling objects, and water damage. This means that if coverage is not specifically named, it’s excluded. Web similar to the basic form policy, a broad form insurance policy covers perils on a named basis. Web the broad causes of loss form (cp 10 20) provides named perils coverage for the perils insured against in the basic causes of loss form (fire, lightning, explosion, smoke, windstorm, hail, riot, civil commotion, aircraft, vehicles, vandalism, sprinkler leakage, sinkhole collapse, volcanic action), plus the following additional perils: Web what is basic form, broad form, and special form? It goes above and beyond the basic. Basic, broad, and special form are three common coverage forms when insuring property. Basic form is the most restrictive, while special offers the greater level of protection. Broad form may appeal to people who want to pay as little for car.

Ho2 Broad Form Homeowners Insurance Types Of Home Insurance

Web what is basic form, broad form, and special form? Broad form may appeal to people who want to pay as little for car. Web broad form coverage is more encompassing than basic form coverage. Web broad form insurance refers to the causes of loss (or perils) form that dictates what types of losses will be covered under a property.

Broad Form Property Damage Endorsement What it is, How it Works

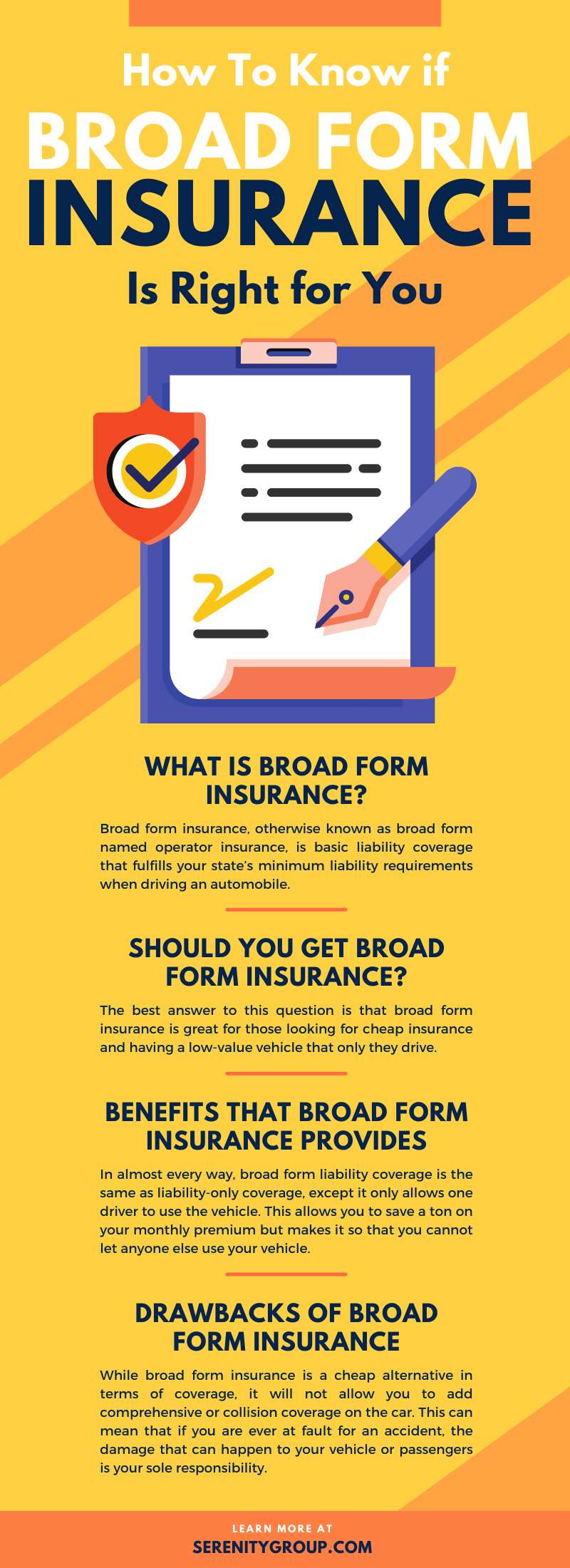

It goes above and beyond the basic. Only the driver's liability costs are covered under this type of policy. Broad form insurance does not cover you or your passengers' injuries or collision damage to your car. The coverages included in a standard broad form policy are the same as in the basic form insurance policy plus the following: Basic, broad,.

Broad Homeowners Insurance

Web broad form insurance, often referred to as broad form named operator insurance, is a type of basic liability coverage that can fulfill your state’s minimum liability requirements for auto insurance. Web what is basic form, broad form, and special form? The broad form is made to cover all perils the basic form covers, along with some additional common perils.

Here’s what to know about broad form coverage to help you decide

Web what is basic form, broad form, and special form? Web similar to the basic form policy, a broad form insurance policy covers perils on a named basis. Broad form insurance does not cover you or your passengers' injuries or collision damage to your car. This means that if coverage is not specifically named, it’s excluded. The key difference between.

Basic, Broad Form Coverage and Special Form Insurance Coverage

It goes above and beyond the basic. Web the broad causes of loss form (cp 10 20) provides named perils coverage for the perils insured against in the basic causes of loss form (fire, lightning, explosion, smoke, windstorm, hail, riot, civil commotion, aircraft, vehicles, vandalism, sprinkler leakage, sinkhole collapse, volcanic action), plus the following additional perils: Broad form may appeal.

Broad Form Insurance AwesomeFinTech Blog

Only the driver's liability costs are covered under this type of policy. Special form coverage offers the widest. Basic form is the most restrictive, while special offers the greater level of protection. Web broad form insurance refers to the causes of loss (or perils) form that dictates what types of losses will be covered under a property insurance policy. Web.

Special Form Coverage Hitchings Insurance Agency

Additional perils added to the broad form include: The broad form is made to cover all perils the basic form covers, along with some additional common perils that could occur. Web broad form coverage is more encompassing than basic form coverage. Broad form insurance does not cover you or your passengers' injuries or collision damage to your car. The key.

Broad form Homeowners Insurance Beautiful Help Understanding Home

It goes above and beyond the basic. The key difference between the two is that broad form covers 6 perils in addition to the 11 covered in. Only the driver's liability costs are covered under this type of policy. The coverages included in a standard broad form policy are the same as in the basic form insurance policy plus the.

Is It Covered? Burst Pipes • National Real Estate Insurance Group

Only the driver's liability costs are covered under this type of policy. Additional perils added to the broad form include: Only a few states, including washington, allow broad form insurance to meet state minimums. The broad form is made to cover all perils the basic form covers, along with some additional common perils that could occur. Web what is basic.

How To Know if Broad Form Insurance Is Right for You

Only the driver's liability costs are covered under this type of policy. Web like basic form coverage, broad form covers only the perils listed in your policy. Web a broad form policy that adds more coverage, such as damage from broken windows and other structural glass, falling objects, and water damage. Web broad form insurance refers to the causes of.

Web A Broad Form Policy That Adds More Coverage, Such As Damage From Broken Windows And Other Structural Glass, Falling Objects, And Water Damage.

This means that if coverage is not specifically named, it’s excluded. Web broad form coverage is more encompassing than basic form coverage. Additional perils added to the broad form include: Web broad form insurance provides minimal auto liability insurance for one driver.

The Key Difference Between The Two Is That Broad Form Covers 6 Perils In Addition To The 11 Covered In.

Basic form is the most restrictive, while special offers the greater level of protection. The coverages included in a standard broad form policy are the same as in the basic form insurance policy plus the following: The broad form is made to cover all perils the basic form covers, along with some additional common perils that could occur. Web the broad causes of loss form (cp 10 20) provides named perils coverage for the perils insured against in the basic causes of loss form (fire, lightning, explosion, smoke, windstorm, hail, riot, civil commotion, aircraft, vehicles, vandalism, sprinkler leakage, sinkhole collapse, volcanic action), plus the following additional perils:

Broad Form May Appeal To People Who Want To Pay As Little For Car.

Web broad form insurance, often referred to as broad form named operator insurance, is a type of basic liability coverage that can fulfill your state’s minimum liability requirements for auto insurance. Only the driver's liability costs are covered under this type of policy. Web what is basic form, broad form, and special form? Web broad form insurance refers to the causes of loss (or perils) form that dictates what types of losses will be covered under a property insurance policy.

Web Similar To The Basic Form Policy, A Broad Form Insurance Policy Covers Perils On A Named Basis.

Only a few states, including washington, allow broad form insurance to meet state minimums. Special form coverage offers the widest. Broad form insurance does not cover you or your passengers' injuries or collision damage to your car. Basic, broad, and special form are three common coverage forms when insuring property.

:max_bytes(150000):strip_icc()/broad-form-property-damage-endorsement.asp_finalv2-efc9e99563b04237a9ac94a33716326f.png)