Az State Tax Form 140Ez

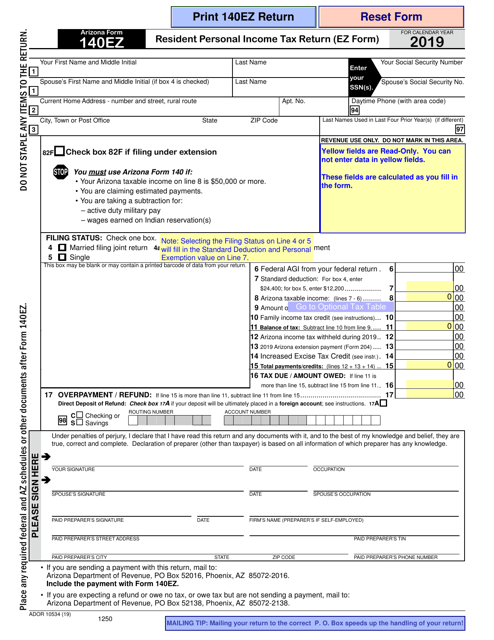

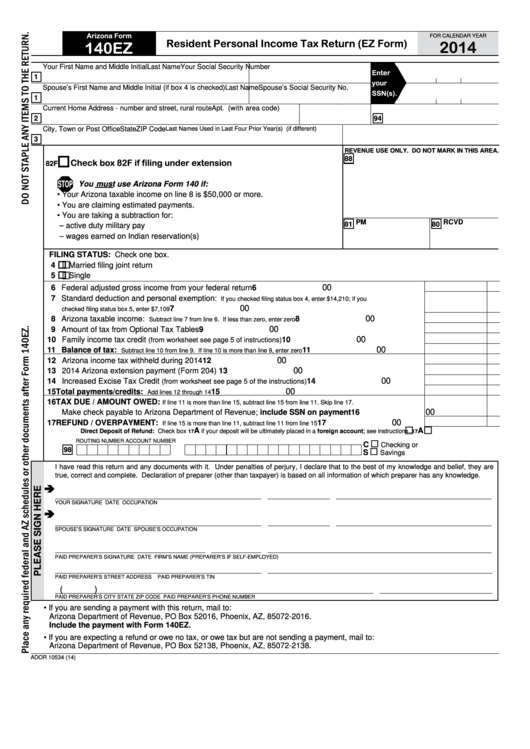

Az State Tax Form 140Ez - Once you receive your confirmation. Web who can use arizona form 140ez? Web personal income tax return filed by resident taxpayers. You can use form 140ez to file for 2019 if all of the following apply to you. • your arizona taxable income is less. Web • you are not claiming any tax credits except for the family income tax credit or the credit for increased excise taxes. Download or email az 140ez & more fillable forms, register and subscribe now! Upload, modify or create forms. Web use the same names(s) and social security number(s) that were listed on arizona form 140, 140a, 140ez, 140py or 140nr. Web 26 rows 140ez :

Web the correct amount to enter on line 6c is the total amount of charitable contributions made in 2020 for which you are claiming a tax credit for the current tax. • you are not making voluntary gifts through means of a refund. Web arizona form 2018 resident personal income tax return (ez form) 140ez for information or help, call one of the numbers listed: Az dor 140ez 2020 get az dor 140ez 2020 how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save. You are single, or if married, you and your spouse are filing a. Arizona form 140et even if you qualify to claim a credit for increased excise taxes, do not file form 140et if either of the following applies: You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. This form is for income earned in tax year 2022, with tax returns due in april. Form 140ez arizona resident personal income tax booklet. Web who can use arizona form 140ez?

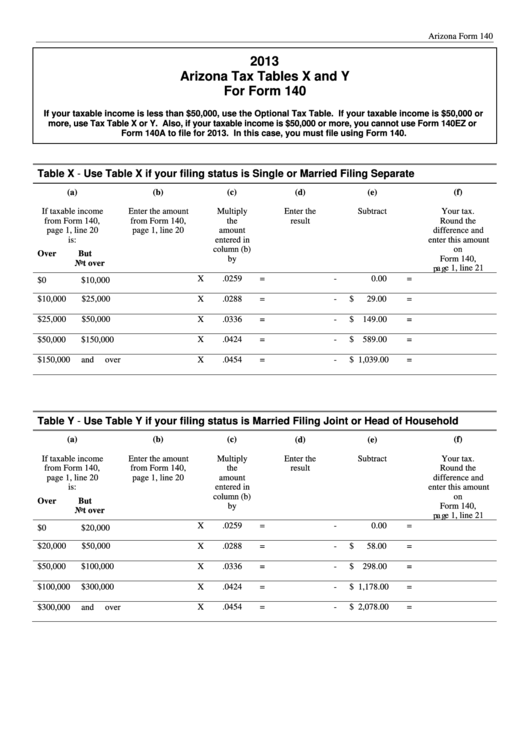

Web if your taxable income is $50,000 or more, you must use tax tables x and y to figure your tax. Download or email az 140ez & more fillable forms, register and subscribe now! You may use form 140ez if all of the following apply: You are single, or if married, you and your spouse are filing a. Web the correct amount to enter on line 6c is the total amount of charitable contributions made in 2020 for which you are claiming a tax credit for the current tax. Web arizona form 2018 resident personal income tax return (ez form) 140ez for information or help, call one of the numbers listed: Web who can use arizona form 140ez? You can use form 140ez to file for 2019 if all of the following apply to you. This form is for income earned in tax year 2022, with tax returns due in april. Web we last updated arizona form 140ez in february 2023 from the arizona department of revenue.

State Of Michigan Land Contract Form Form Resume Examples

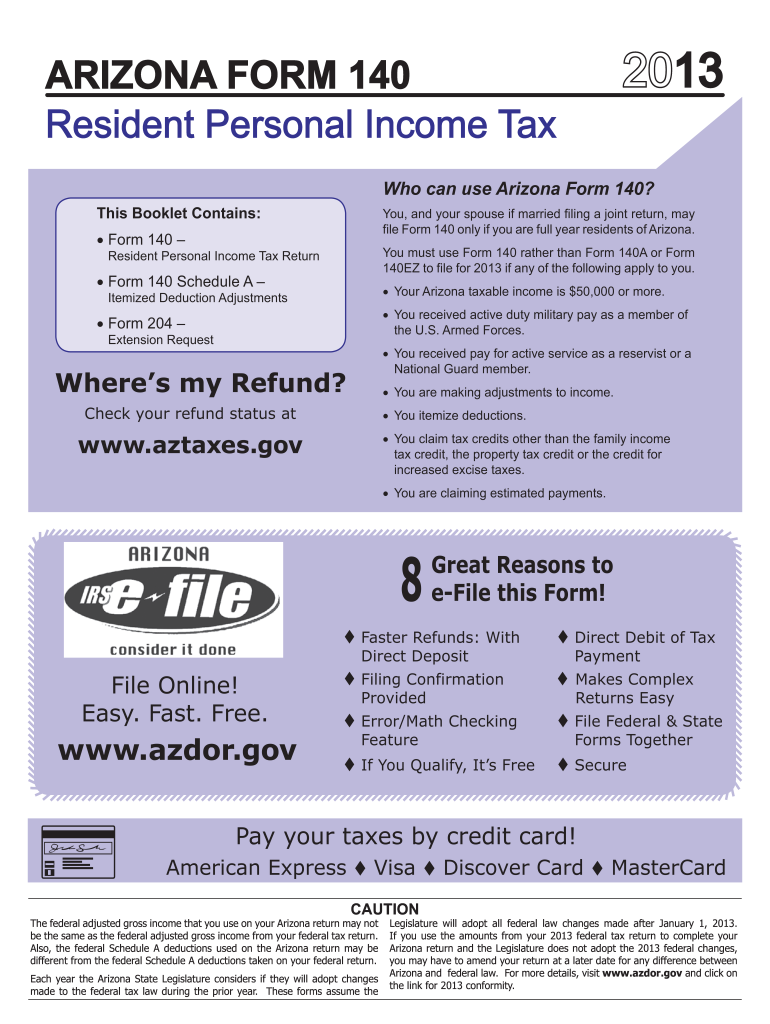

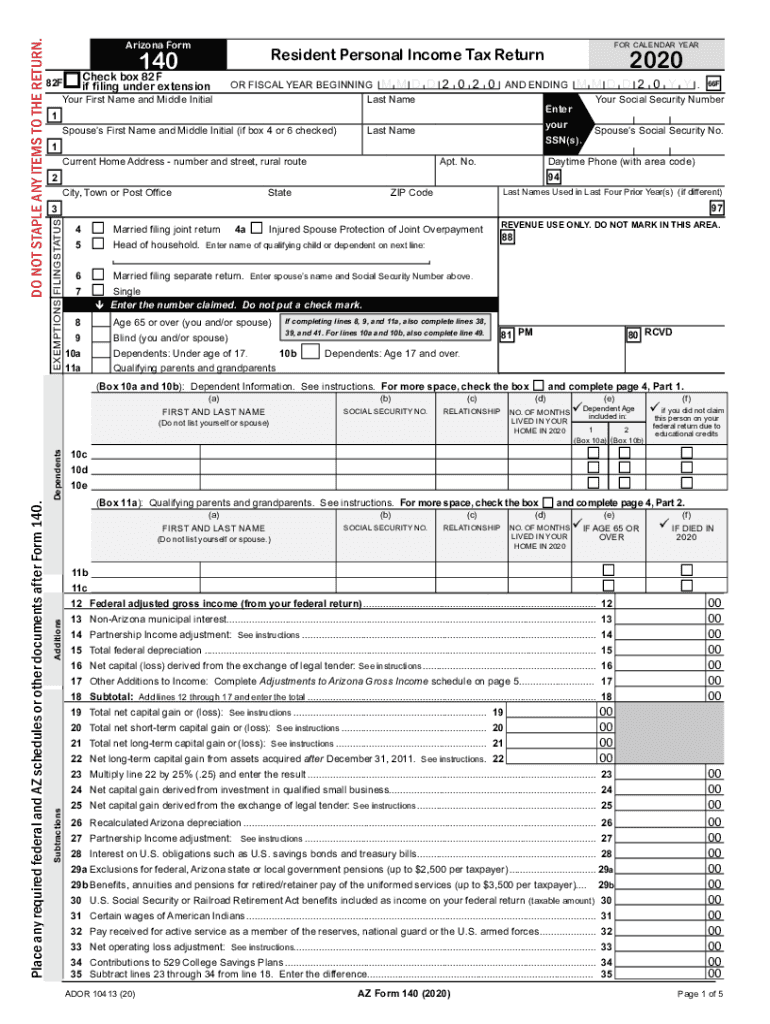

2021 arizona resident personal income tax return booklet (easy form) Web personal income tax return filed by resident taxpayers. Web if your taxable income is $50,000 or more, you must use tax tables x and y to figure your tax. You may file form 140 only if you (and your spouse, if married filing a joint return) are full year.

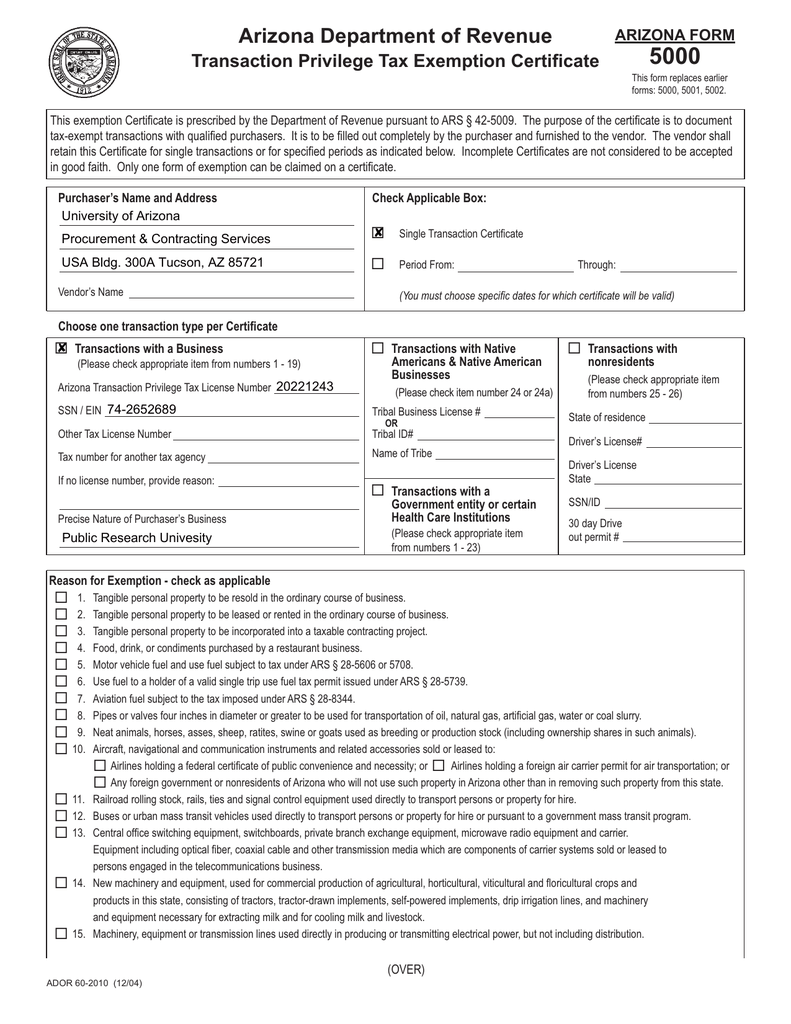

Arizona Department Of Revenue Tax Id Number Tax Walls

Web • you are not claiming any tax credits except for the family income tax credit or the credit for increased excise taxes. Web arizona form 2018 resident personal income tax return (ez form) 140ez for information or help, call one of the numbers listed: Web who can file form 140et? Web personal income tax return filed by resident taxpayers..

Arizona Form 140EZ (ADOR10534) Download Fillable PDF or Fill Online

Web if your taxable income is $50,000 or more, you must use tax tables x and y to figure your tax. Web we last updated arizona form 140ez in february 2023 from the arizona department of revenue. Web who can file form 140et? • your arizona taxable income is less. You may use form 140ez if all of the following.

Az Ez Tax Form Form Resume Examples

• you are single, or if married, you and your spouse are filing a. Web personal income tax return filed by resident taxpayers. You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. Web • you are not claiming any tax credits except for the family income.

Az 140 Fillable Form Fill Online, Printable, Fillable, Blank pdfFiller

Web personal income tax return filed by resident taxpayers. Upload, modify or create forms. Complete, edit or print tax forms instantly. Try it for free now! Web 26 rows 140ez :

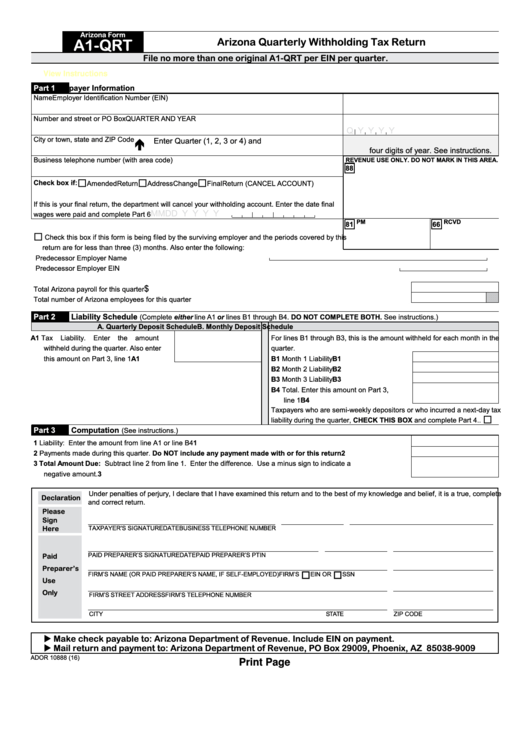

Fillable Arizona Quarterly Withholding Tax Return (Arizona Form A1Qrt

Web arizona form 140ez pay your taxes by credit card! Web arizona form 2018 resident personal income tax return (ez form) 140ez for information or help, call one of the numbers listed: Try it for free now! Form 140ez arizona resident personal income tax booklet. Web who can file form 140et?

Fillable Arizona Tax Tables X And Y For Form 140 2013 printable pdf

Download or email az 140ez & more fillable forms, register and subscribe now! Once you receive your confirmation. This form is for income earned in tax year 2022, with tax returns due in april. You may use form 140ez if all of the following apply: Web if your taxable income is $50,000 or more, you must use tax tables x.

Fillable Arizona Form 140ez Resident Personal Tax Return (Ez

You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. 2021 arizona resident personal income tax return booklet (easy form) Try it for free.

2020 AZ Form 140 Fill Online, Printable, Fillable, Blank pdfFiller

Az dor 140ez 2020 get az dor 140ez 2020 how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save. • your arizona taxable income is less. Web personal income tax return filed by resident taxpayers. Web arizona form 140ez pay your taxes by credit card! Web • you.

AZ DoR JT1/UC001 20192021 Fill out Tax Template Online US Legal

Arizona form 140et even if you qualify to claim a credit for increased excise taxes, do not file form 140et if either of the following applies: Complete, edit or print tax forms instantly. You are single, or if married, you and your spouse are filing a. Web we last updated arizona form 140ez in february 2023 from the arizona department.

Web Personal Income Tax Return Filed By Resident Taxpayers.

Web the correct amount to enter on line 6c is the total amount of charitable contributions made in 2020 for which you are claiming a tax credit for the current tax. Web arizona form 2018 resident personal income tax return (ez form) 140ez for information or help, call one of the numbers listed: • your arizona taxable income is less. You are single, or if married, you and your spouse are filing a.

• You Are Not Making Voluntary Gifts Through Means Of A Refund.

Try it for free now! • you are single, or if married, you and your spouse are filing a. Complete, edit or print tax forms instantly. Web who can file form 140et?

Once You Receive Your Confirmation.

Arizona form 140et even if you qualify to claim a credit for increased excise taxes, do not file form 140et if either of the following applies: Download or email az 140ez & more fillable forms, register and subscribe now! Web • you are not claiming any tax credits except for the family income tax credit or the credit for increased excise taxes. You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona.

If Your Taxable Income Is $50,000 Or More, You Cannot Use Form 140Ez Or.

Form 140ez arizona resident personal income tax booklet. Web use the same names(s) and social security number(s) that were listed on arizona form 140, 140a, 140ez, 140py or 140nr. 2021 arizona resident personal income tax return booklet (easy form) This form is for income earned in tax year 2022, with tax returns due in april.