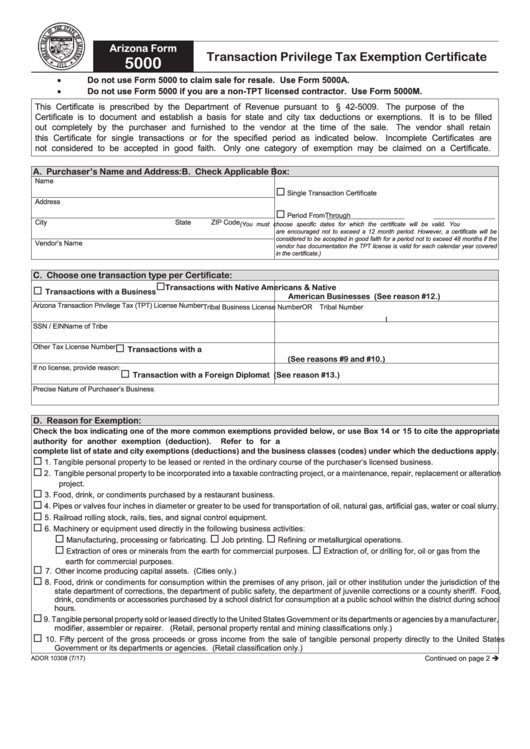

Az Form 5000

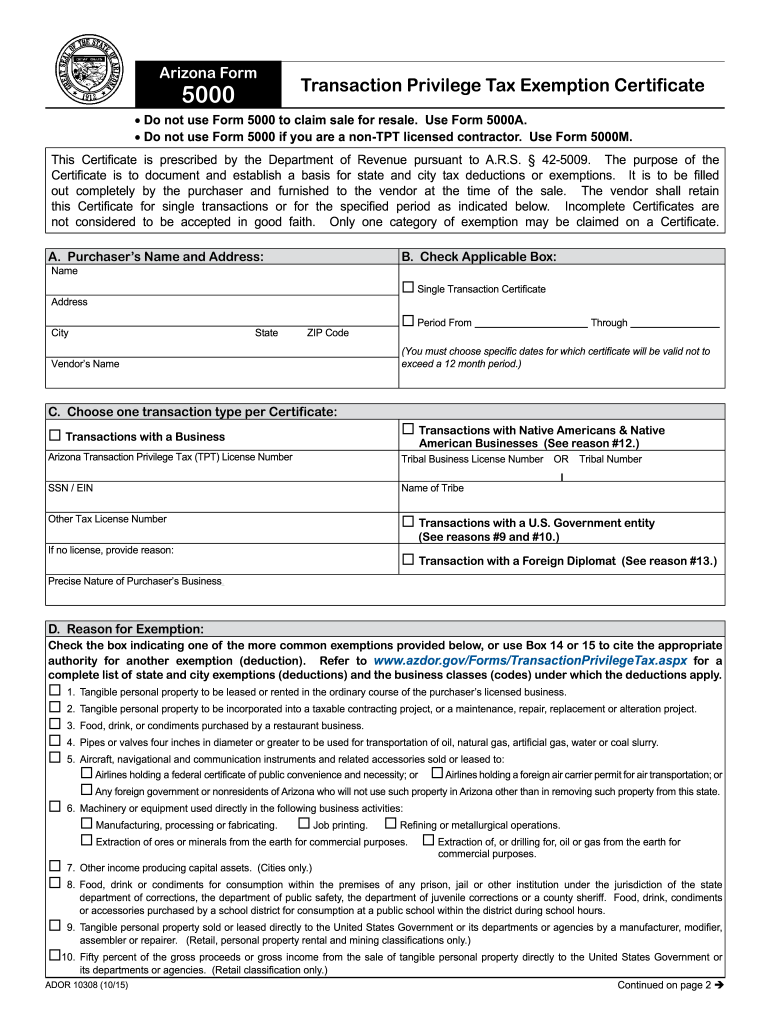

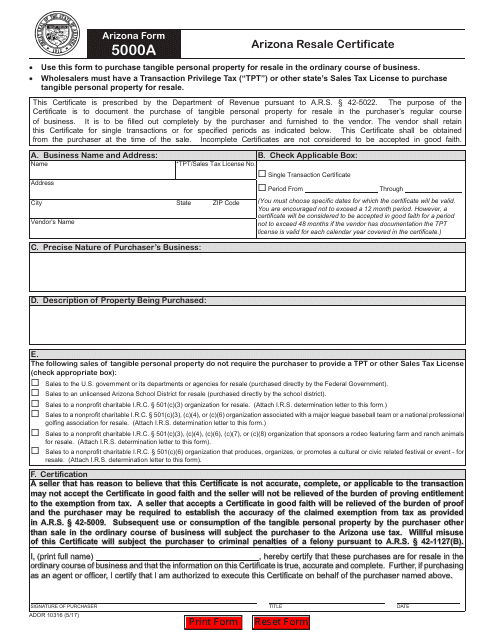

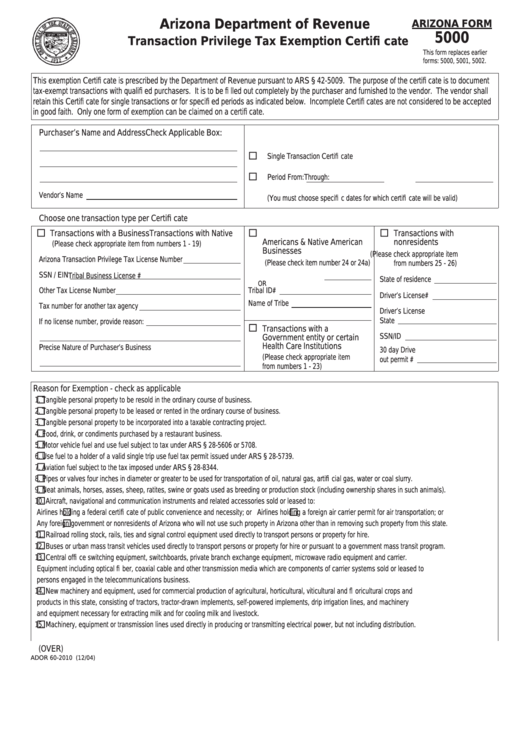

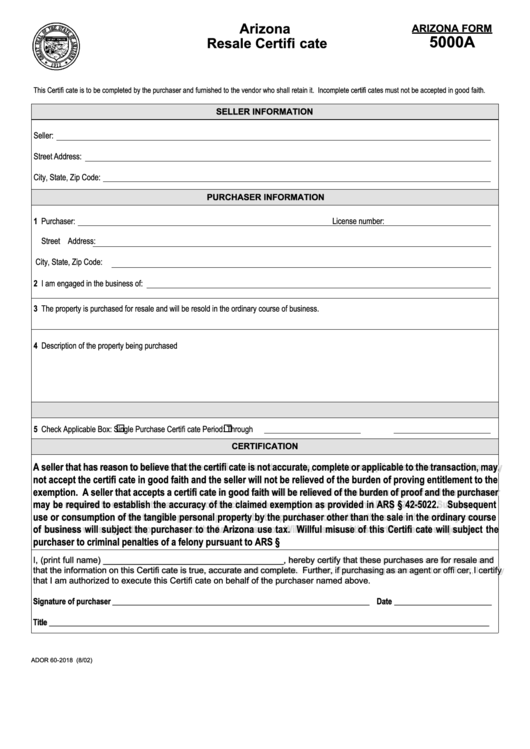

Az Form 5000 - Do not use form 5000 to claim sale for resale. Web rental of equipment sale and installation of tangible personal property annual bond exemption overview general what is a transaction privilege tax (tpt) license? The certificate must be provided to the vendor in order for the vendor to document why sales tax is not charged to the university in these cases, or for the vendor to refund the sales tax already billed to the university. This certificate is prescribed by the department of revenue pursuant to a.r.s. Web arizona form 5000transaction privilege tax exemption certificate do not use form 5000 to claim sale for resale. Web arizona form 5000 this form replaces earlier forms: This certificate is prescribed by the department of revenue pursuant to a.r.s. Web 5000aarizona resale certificate use this form to purchase tangible personal property for resale in the ordinary course of business. Web arizona form 5000 transaction privilege tax exemption certificate do not use form 5000 to claim sale for resale. Wholesalers must have a transaction privilege tax (“tpt”) or other state’s sales tax license to.

Web vendors should retain copies of the form 5000 for their files. Transaction privilege tax aircraft exemption certificate: This certificate is prescribed by the department of revenue pursuant to a.r.s. Web arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. Purchasing materials for any contracting project tax free. Vendors should retain copies of the form 5000 for their files. Web form/certificate issued by provided to purpose notes; Web 5000aarizona resale certificate use this form to purchase tangible personal property for resale in the ordinary course of business. The certificate is provided to vendors so they can document why sales tax was not charged to the university in these cases, or why they refunded sales tax already collected. Web arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor.

Purchasing materials for any contracting project tax free. Vendors should retain copies of the form 5000 for their files. Wholesalers must have a transaction privilege tax (“tpt”) or other state’s sales tax license to. The certificate must be provided to the vendor in order for the vendor to document why sales tax is not charged to the university in these cases, or for the vendor to refund the sales tax already billed to the university. Web arizona form 5000 transaction privilege tax exemption certificate do not use form 5000 to claim sale for resale. Do not use form 5000 to claim sale for resale. Web form/certificate issued by provided to purpose notes; The certificate is provided to vendors so they can document why sales tax was not charged to the university in these cases, or why they refunded sales tax already collected. What is the difference between a maintenance, repair, replacement or alteration (mrra) and a prime contracting /modification project? Transaction privilege tax aircraft exemption certificate:

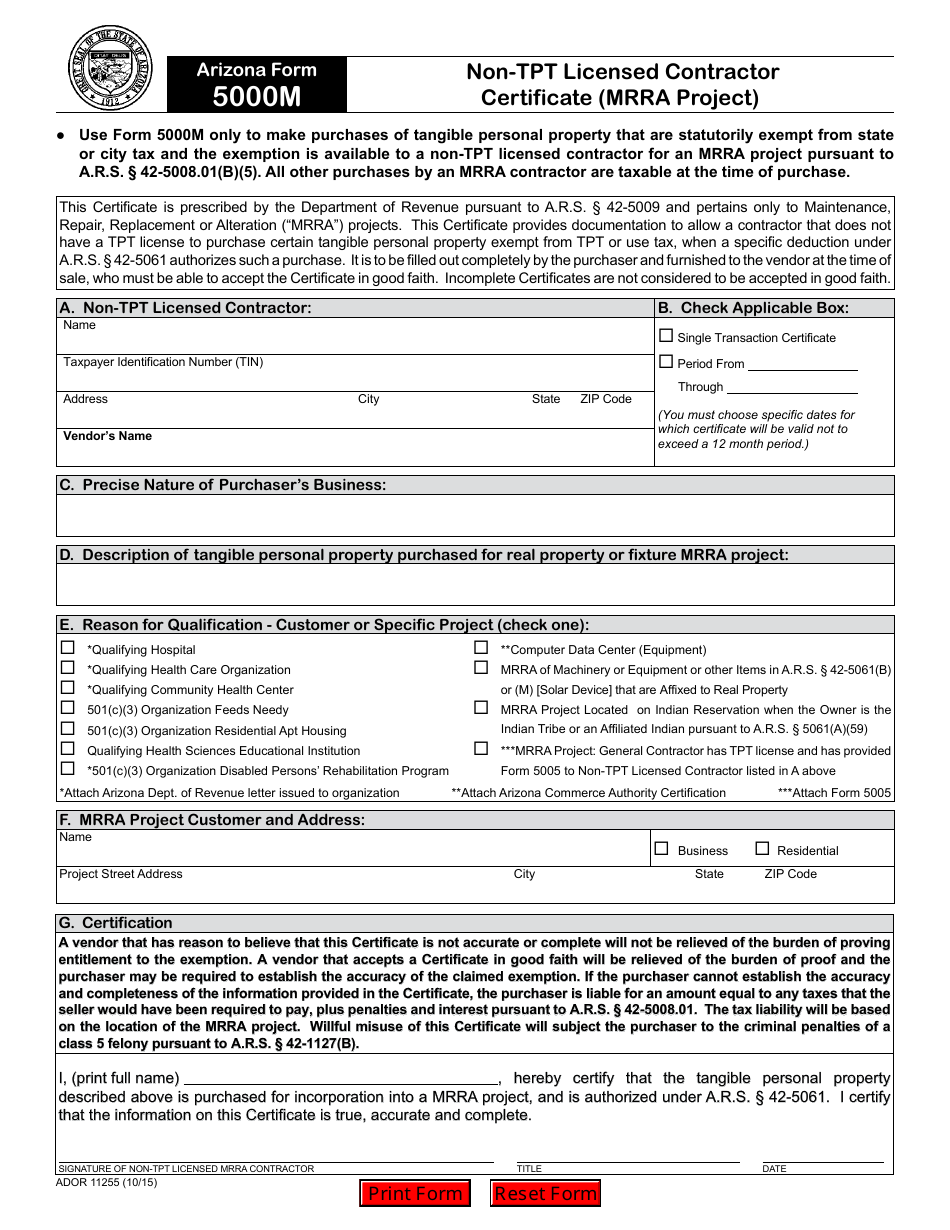

Arizona Form 5000M (ADOR11255) Download Fillable PDF or Fill Online Non

Wholesalers must have a transaction privilege tax (“tpt”) or other state’s sales tax license to. What is the difference between a maintenance, repair, replacement or alteration (mrra) and a prime contracting /modification project? The certificate is provided to vendors so they can document why sales tax was not charged to the university in these cases, or why they refunded sales.

Fill Free fillable forms Arizona Department of Real Estate

It is to be fi lled out completely by the purchaser and furnished to the vendor. Web arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. Web arizona form 5000 this form replaces earlier forms: What is the difference between a maintenance, repair, replacement or alteration (mrra) and a prime contracting /modification project? Web.

2015 Form AZ DoR 5000 Fill Online, Printable, Fillable, Blank pdfFiller

Web rental of equipment sale and installation of tangible personal property annual bond exemption overview general what is a transaction privilege tax (tpt) license? What is the difference between a maintenance, repair, replacement or alteration (mrra) and a prime contracting /modification project? The certificate is provided to vendors so they can document why sales tax was not charged to the.

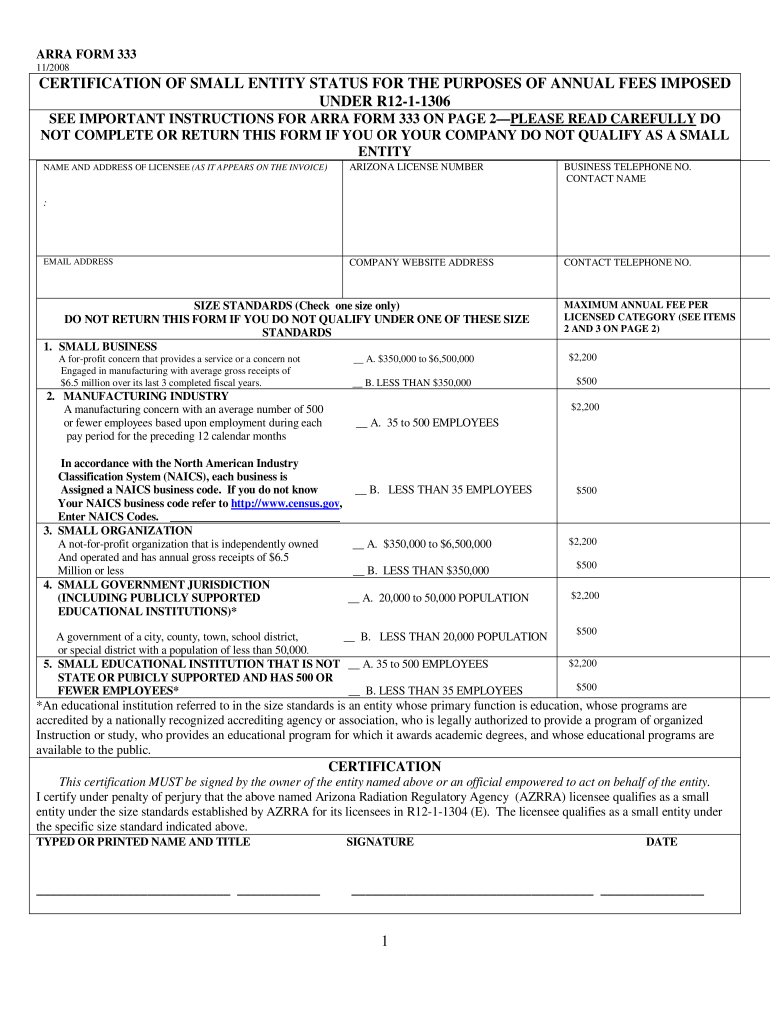

Az Form 333 Fill Online, Printable, Fillable, Blank pdfFiller

Transaction privilege tax aircraft exemption certificate: Web arizona form 5000 transaction privilege tax exemption certificate do not use form 5000 to claim sale for resale. The certificate is provided to vendors so they can document why sales tax was not charged to the university in these cases, or why they refunded sales tax already collected. The certificate must be provided.

AZ 5000 Form The Connect Center

Web arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. It is to be fi lled out completely by the purchaser and furnished to the vendor. The certificate must be provided to the vendor in order for the vendor to document why sales tax is not charged to the university in these cases, or.

Arizona Form 5000A (ADOR10316) Download Fillable PDF or Fill Online

What is the difference between a maintenance, repair, replacement or alteration (mrra) and a prime contracting /modification project? Web arizona form 5000transaction privilege tax exemption certificate do not use form 5000 to claim sale for resale. The certificate is provided to vendors so they can document why sales tax was not charged to the university in these cases, or why.

1346 Arizona Tax Forms And Templates free to download in PDF

Do not use form 5000 to claim sale for resale. Purchasing materials for any contracting project tax free. This certificate is prescribed by the department of revenue pursuant to a.r.s. It is to be fi lled out completely by the purchaser and furnished to the vendor. Web 5000aarizona resale certificate use this form to purchase tangible personal property for resale.

Fillable Arizona Form 5000 Transaction Privilege Tax Exemption

Web arizona form 5000 transaction privilege tax exemption certificate do not use form 5000 to claim sale for resale. Purchasing materials for any contracting project tax free. It is to be fi lled out completely by the purchaser and furnished to the vendor. This certificate is prescribed by the department of revenue pursuant to a.r.s. The certificate must be provided.

Fillable Arizona Form 5000a Arizona Resale Certificate 2002

This certificate is prescribed by the department of revenue pursuant to a.r.s. Web 5000aarizona resale certificate use this form to purchase tangible personal property for resale in the ordinary course of business. The certificate is provided to vendors so they can document why sales tax was not charged to the university in these cases, or why they refunded sales tax.

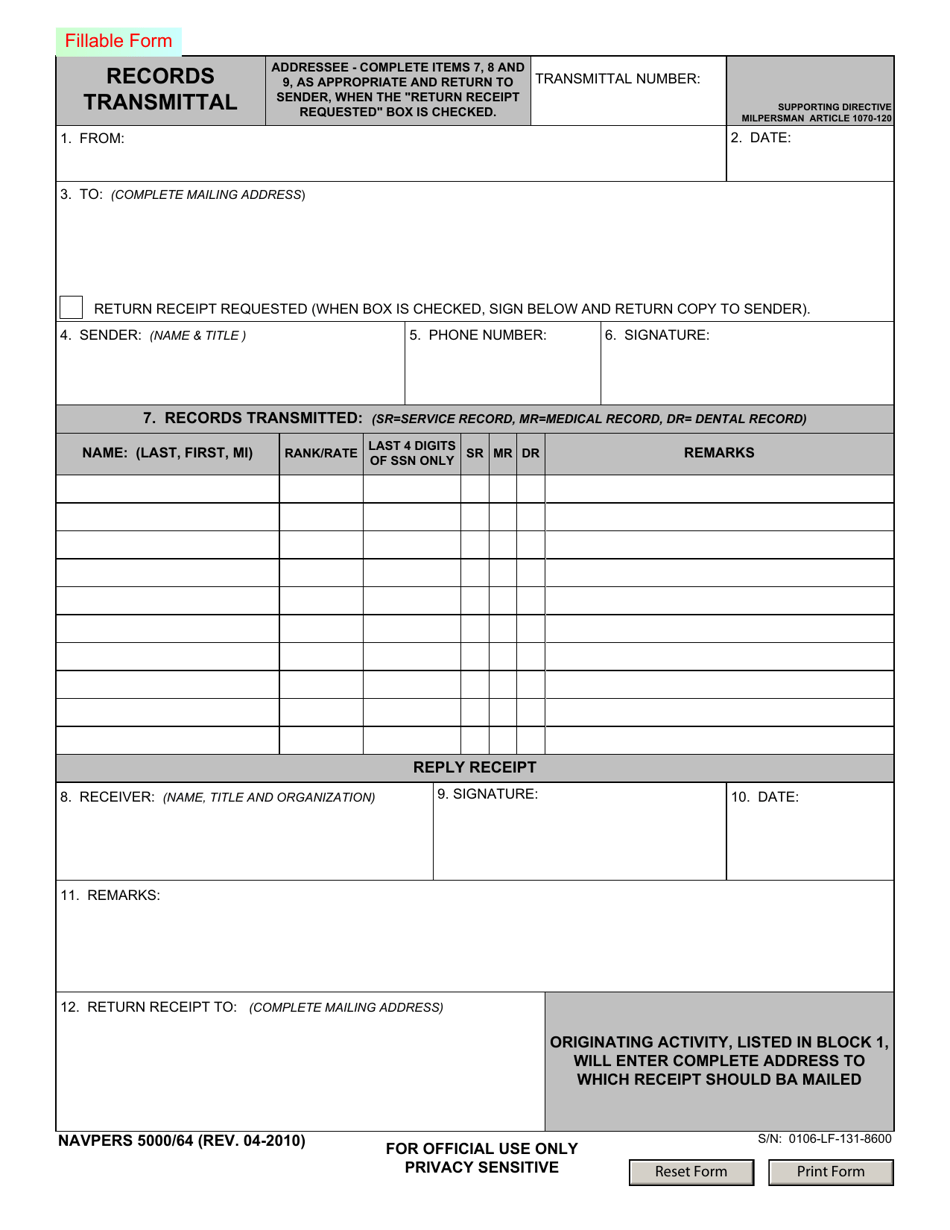

NAVPERS Form 5000/64 Download Fillable PDF or Fill Online Records

Do not use form 5000 to claim sale for resale. Transaction privilege tax aircraft exemption certificate: Web arizona form 5000 this form replaces earlier forms: Wholesalers must have a transaction privilege tax (“tpt”) or other state’s sales tax license to. Vendors should retain copies of the form 5000 for their files.

Purchasing Materials For Any Contracting Project Tax Free.

Transaction privilege tax aircraft exemption certificate: Web arizona form 5000 transaction privilege tax exemption certificate do not use form 5000 to claim sale for resale. The certificate must be provided to the vendor in order for the vendor to document why sales tax is not charged to the university in these cases, or for the vendor to refund the sales tax already billed to the university. It is to be fi lled out completely by the purchaser and furnished to the vendor.

Web Vendors Should Retain Copies Of The Form 5000 For Their Files.

Vendors should retain copies of the form 5000 for their files. The certificate is provided to vendors so they can document why sales tax was not charged to the university in these cases, or why they refunded sales tax already collected. Do not use form 5000 to claim sale for resale. Web arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor.

Web Rental Of Equipment Sale And Installation Of Tangible Personal Property Annual Bond Exemption Overview General What Is A Transaction Privilege Tax (Tpt) License?

Web form/certificate issued by provided to purpose notes; Web arizona form 5000 this form replaces earlier forms: Web arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. Web arizona form 5000transaction privilege tax exemption certificate do not use form 5000 to claim sale for resale.

This Certificate Is Prescribed By The Department Of Revenue Pursuant To A.r.s.

Web 5000aarizona resale certificate use this form to purchase tangible personal property for resale in the ordinary course of business. This certificate is prescribed by the department of revenue pursuant to a.r.s. Wholesalers must have a transaction privilege tax (“tpt”) or other state’s sales tax license to. What is the difference between a maintenance, repair, replacement or alteration (mrra) and a prime contracting /modification project?