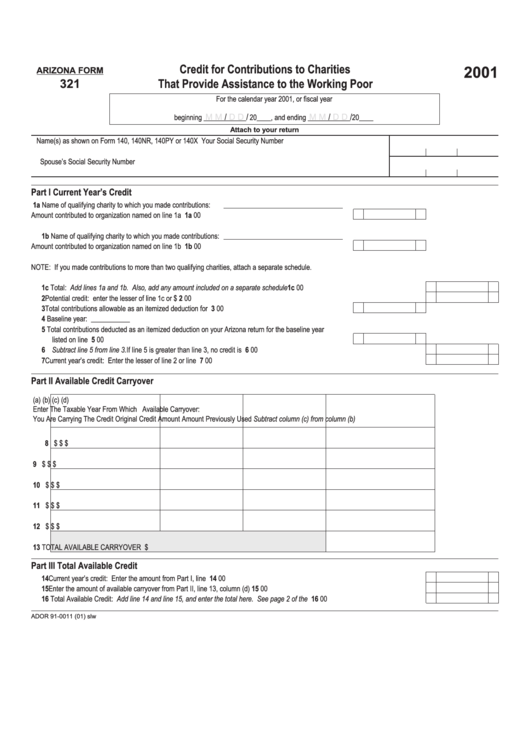

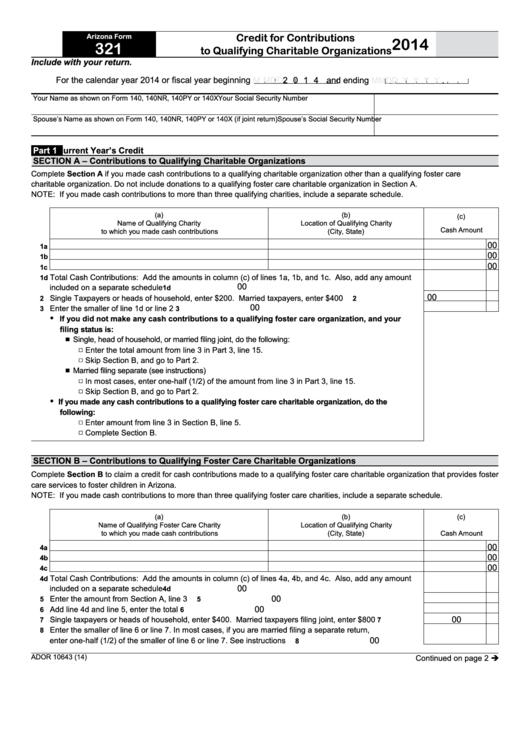

Az Form 321

Az Form 321 - Web credit claimed on arizona form 321for cash contributions made to a qualifying charitable organization (qco). Credit for increased excise taxes: Save or instantly send your ready documents. Web how do i claim an arizona charitable tax credit? The maximum qco credit donation amount for 2022: Web 2021 credit for contributions arizona form to qualifying charitable organizations 321 for information or help, call one of the numbers listed: Ad register and subscribe now to work on your az dor form 321 & more fillable forms. Web arizona form 321 1 (1) include with your return. Web 26 rows form number title; Web 26 rows resident shareholder's information schedule form with instructions:

Web 2021 credit for contributions arizona form to qualifying charitable organizations 321 for information or help, call one of the numbers listed: You must also complete arizona form 301, nonrefundable individual tax credits and recapture , and include forms 301 and 321with your tax. This form is for income earned in tax year 2022, with tax returns due in april. Web how do i claim an arizona charitable tax credit? Get ready for tax season deadlines by completing any required tax forms today. Web complete az form 321 and include it when you file your 2022 state taxes. Tax credits forms, individual : Web ador 11294 (20) az form 352 (2020) page 2 of 3 your name (as shown on page 1) your social security number part 2 available credit carryover if you have a carryover amount. Credit for increased excise taxes: You must also complete arizona form 301, nonrefundable individual tax credits and recapture, and include forms 301 and 321 with your tax.

The maximum qco credit donation amount for 2022: For the calendar year 2021 or fiscal year beginning mmdd2021. Easily fill out pdf blank, edit, and sign them. For the calendar year 2019 or fiscal year beginning mmdd2019. Web 26 rows resident shareholder's information schedule form with instructions: Web i made a qco donation between 1/1/2022 and 4/18/2022, but form 321 will not accept the qco code which shows up on the 2022 list at the az dor. You must also complete arizona form 301, nonrefundable individual tax credits and recapture , and include forms 301 and 321with your tax. Web arizona form 321 2 the maximum amount of credit that a taxpayer can establish for the current taxable year is $400 for single taxpayers or heads of household. Save or instantly send your ready documents. Cash contributions made january 1, 2021 through december 31, 2021.

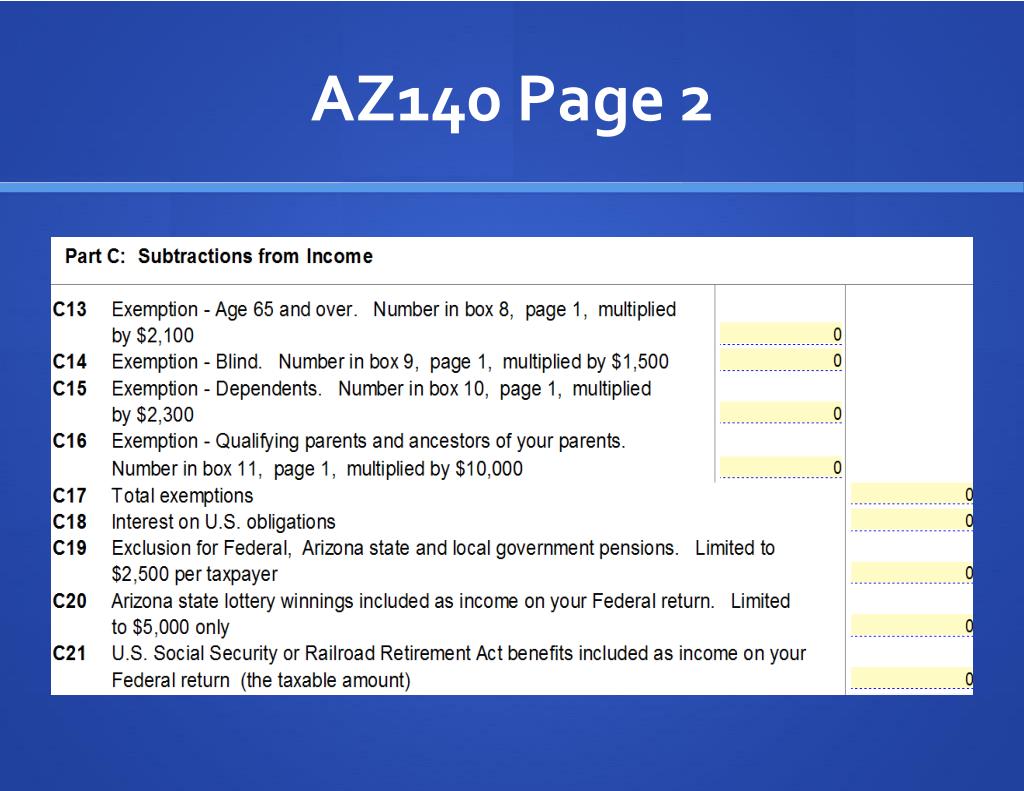

PPT Arizona State Tax Return 2012 PowerPoint Presentation, free

Credit for contributions to qualifying charitable organizations. Web arizona form credit for contributions 321to qualifying charitable organizations2021 include with your return. Arizona has a state income tax that ranges between 2.59% and 4.5% , which is administered by the arizona department of revenue. Web arizona form credit for contributions 321to qualifying charitable organizations2019 include with your return. Web arizona form.

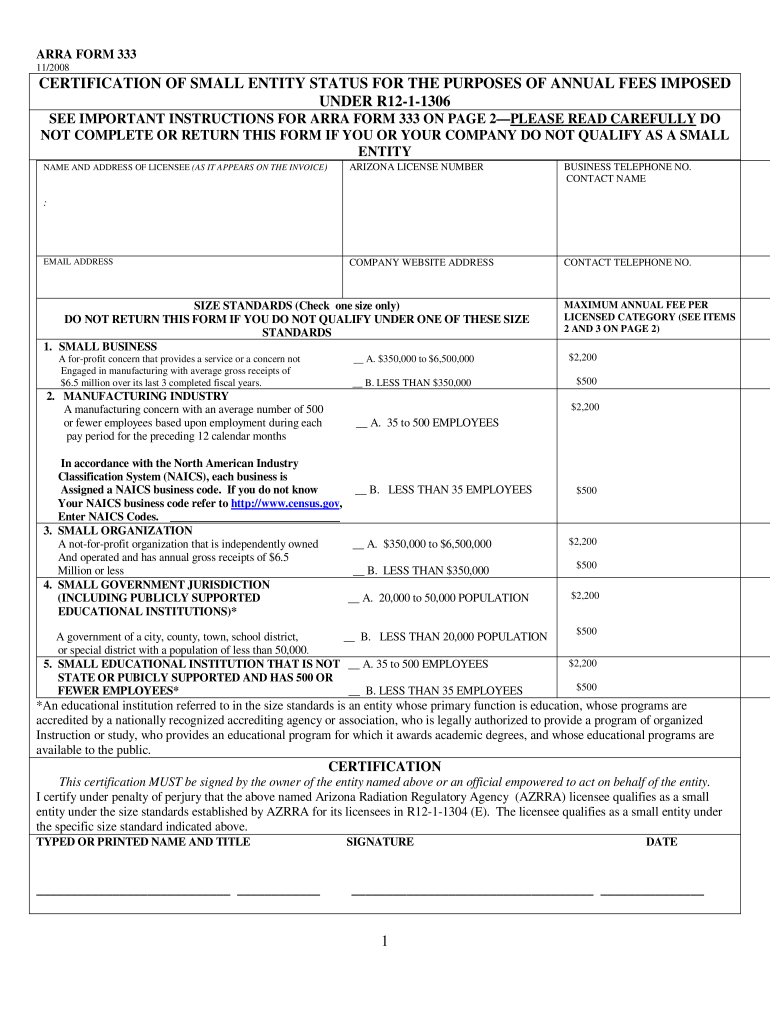

Az Form 333 Fill Online, Printable, Fillable, Blank pdfFiller

Web arizona form 321 1 (1) include with your return. Web arizona form credit for contributions 321to qualifying charitable organizations2021 include with your return. For the calendar year 2021 or fiscal year beginning mmdd2021. Web credit claimed on arizona form 321for cash contributions made to a qualifying charitable organization (qco). Check out how easy it is to complete and esign.

Give a Tax Credit Donation By April 15 Stepping Stones Agencies

Easily fill out pdf blank, edit, and sign them. Web arizona form 321 2 the maximum amount of credit that a taxpayer can establish for the current taxable year is $400 for single taxpayers or heads of household. You must also complete arizona form 301, nonrefundable individual tax credits and recapture , and include forms 301 and 321with your tax..

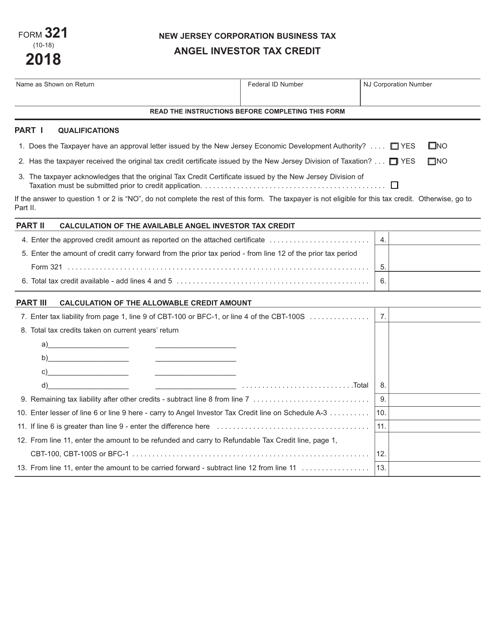

Form 321 Download Fillable PDF or Fill Online Angel Investor Tax Credit

Part 1 current year’s credit a. Web ador 11294 (20) az form 352 (2020) page 2 of 3 your name (as shown on page 1) your social security number part 2 available credit carryover if you have a carryover amount. Web arizona form 321 2 the maximum amount of credit that a taxpayer can establish for the current taxable year.

Tax Credit Donation Deadline May 17 Stepping Stones Agencies

$400 single, married filing separate or head of household; Is the arizona charitable tax credit refundable? The maximum qco credit donation amount for 2022: Web i made a qco donation between 1/1/2022 and 4/18/2022, but form 321 will not accept the qco code which shows up on the 2022 list at the az dor. You must also complete arizona form.

Arizona Form 321 Credit For Contributions To Charities That Provide

Web 26 rows form number title; If you made cash contributions to a. Web how do i claim an arizona charitable tax credit? Tax credits forms, individual : Web i made a qco donation between 1/1/2022 and 4/18/2022, but form 321 will not accept the qco code which shows up on the 2022 list at the az dor.

Fillable Arizona Form 321 Credit For Contributions To Qualifying

Ad register and subscribe now to work on your az dor form 321 & more fillable forms. Tax credits forms, individual : Web 26 rows resident shareholder's information schedule form with instructions: Credit for contributions to qualifying charitable organizations. What is az form 321?

Charitable Tax Credit Gospel Rescue Mission

Web arizona form 321 credit for contributions to qualifying charitable organizations include with your return. You must also complete arizona form 301, nonrefundable individual tax credits and recapture , and include forms 301 and 321with your tax. Ad register and subscribe now to work on your az dor form 321 & more fillable forms. For the calendar year 2021 or.

Modamı Dediniz Qarışıq Şəkillər 2019 (321) » Feat.Az Sekiller

Web 26 rows resident shareholder's information schedule form with instructions: Save or instantly send your ready documents. Web arizona form 321 credit for contributions to qualifying charitable organizations include with your return. Cash contributions made january 1, 2021 through december 31, 2021. If you made cash contributions to a.

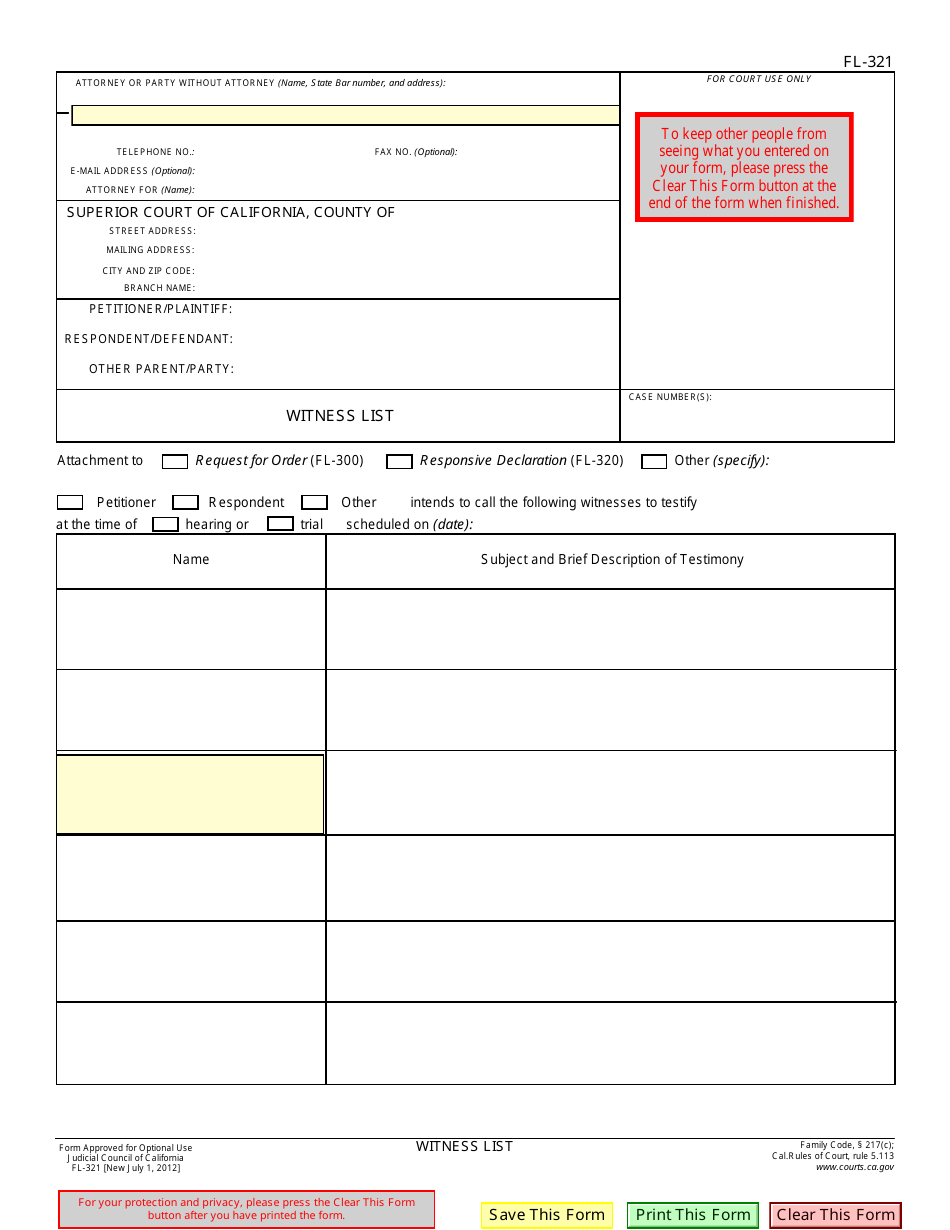

Form FL321 Download Fillable PDF or Fill Online Witness List

If you made cash contributions to a. Tax credits forms, individual : The maximum qco credit donation amount for 2022: Web 2021 credit for contributions arizona form to qualifying charitable organizations 321 for information or help, call one of the numbers listed: What is az form 321?

Tax Credits Forms, Individual :

Web complete az form 321 and include it when you file your 2022 state taxes. Get ready for tax season deadlines by completing any required tax forms today. Ad register and subscribe now to work on your az dor form 321 & more fillable forms. Web 2021 credit for contributions arizona form to qualifying charitable organizations 321 for information or help, call one of the numbers listed:

Web We Last Updated Arizona Form 321 In February 2023 From The Arizona Department Of Revenue.

Credit for contributions to qualifying charitable organizations. Is the arizona charitable tax credit refundable? Tax credits forms, individual : Arizona has a state income tax that ranges between 2.59% and 4.5% , which is administered by the arizona department of revenue.

$400 Single, Married Filing Separate Or Head Of Household;

Web i made a qco donation between 1/1/2022 and 4/18/2022, but form 321 will not accept the qco code which shows up on the 2022 list at the az dor. Save or instantly send your ready documents. For the calendar year 2019 or fiscal year beginning mmdd2019. For the calendar year 2021 or fiscal year beginning mmdd2021.

Web Arizona Form Credit For Contributions 321To Qualifying Charitable Organizations2019 Include With Your Return.

Web credit claimed on arizona form 321for cash contributions made to a qualifying charitable organization (qco). You must also complete arizona form 301, nonrefundable individual tax credits and recapture, and include forms 301 and 321 with your tax. Web 26 rows form number title; This form is for income earned in tax year 2022, with tax returns due in april.