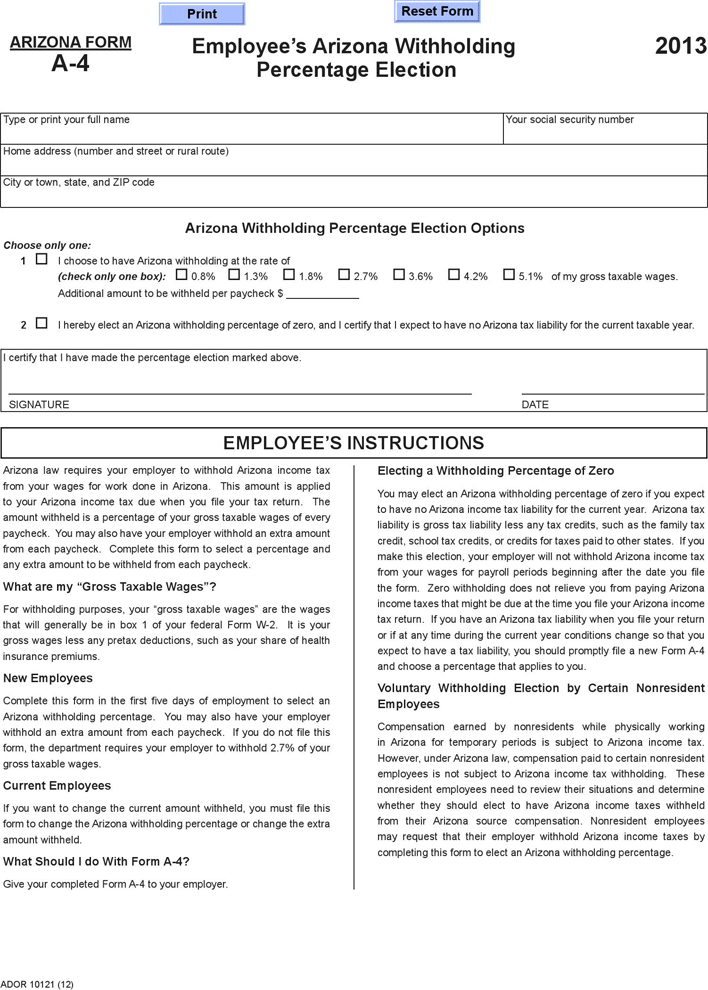

Arizona Form A-4 How Much To Withhold

Arizona Form A-4 How Much To Withhold - Web 20 rows withholding returns must be filed electronically for taxable years beginning from and after december 31, 2019. Get ready for tax season deadlines by completing any required tax forms today. Electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have no arizona income tax liability for the current year. Please encourage employees to consult a tax advisor to make a selection that is appropriate for their particular situation. 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% check this box and enter an extra amount to be withheld from each paycheck. Web withheld for arizona from each paycheck ($1,404 annually), while electing each paycheck ($1,872 annually). Tax season can be a confusing time for many individuals, especially when it comes to determining how much should be withheld from their paychecks. Web has agreed to withhold arizona income taxes from the employee’s compensation as authorized by a.r.s. Divide the annual arizona income tax withholding by 26 to obtain the biweekly arizona income tax withholding. Complete, edit or print tax forms instantly.

§ 43‑408(b), the employer understands and agrees that the employer and the employee are subject to the provisions of chapter 4 of title 43 of the arizona revised 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% check this box and enter an extra amount to be withheld from each paycheck. Get ready for tax season deadlines by completing any required tax forms today. If you want a little back, pick 3.36% and you'll get 0.38% ($152) back in april. Web to change the extra amount withheld. Please encourage employees to consult a tax advisor to make a selection that is appropriate for their particular situation. Employee’s arizona withholding percentage election arizona form a. This form is for income earned in tax year 2022, with tax returns due in april 2023. Complete, edit or print tax forms instantly. Web withheld for arizona from each paycheck ($1,404 annually), while electing each paycheck ($1,872 annually).

We will update this page with a new version of the form for 2024 as soon as it is made available by the arizona government. Electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have no arizona income tax liability for the current year. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web withheld for arizona from each paycheck ($1,404 annually), while electing each paycheck ($1,872 annually). Complete, edit or print tax forms instantly. Web 2.88% on your next 15k ($432) 3.36% on your next 15k ($504) your tax burden is $1,195, or 2.98%. Web 20 rows withholding returns must be filed electronically for taxable years beginning from and after december 31, 2019. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web has agreed to withhold arizona income taxes from the employee’s compensation as authorized by a.r.s.

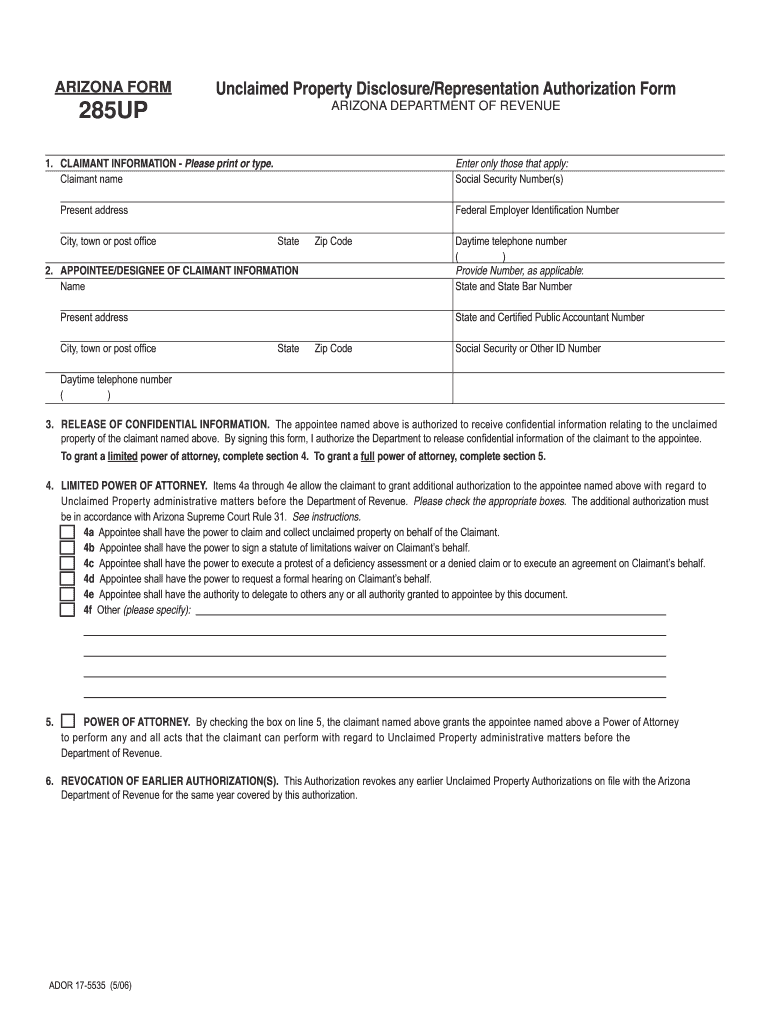

Arizona Form Property Disclosure Fill Out and Sign Printable PDF

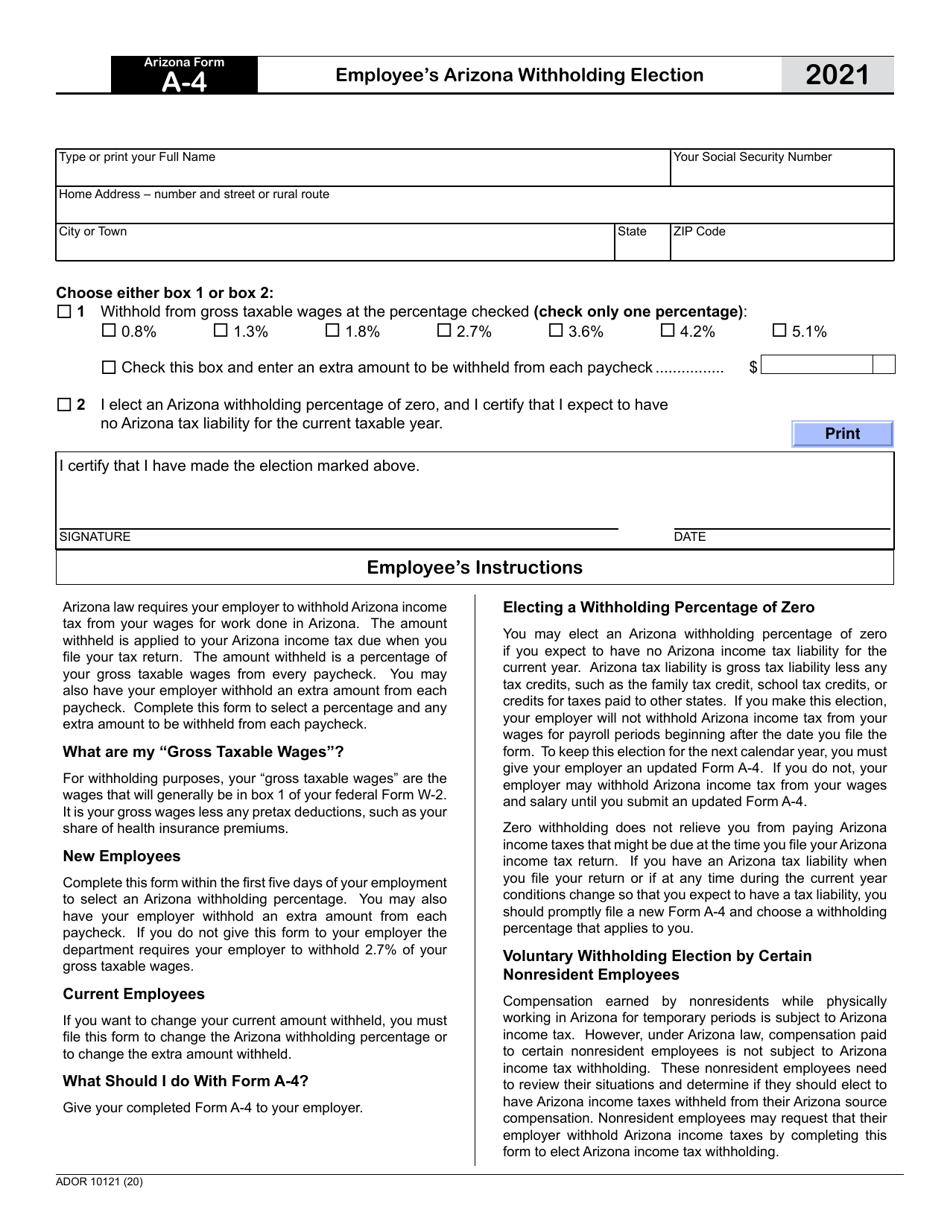

Web choose either box 1 or box 2: Web complete this form to select a percentage of arizona income tax to be withheld, as well as any additional amount to be withheld from each paycheck. If you want a little back, pick 3.36% and you'll get 0.38% ($152) back in april. Please encourage employees to consult a tax advisor to.

State Tax Withholding Forms Template Free Download Speedy Template

Web with so much up in the air regarding the future of arizona football, the program needed a big recruiting triumph. Electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have no arizona income tax liability for the current year. 1 withhold from gross taxable wages at the percentage checked.

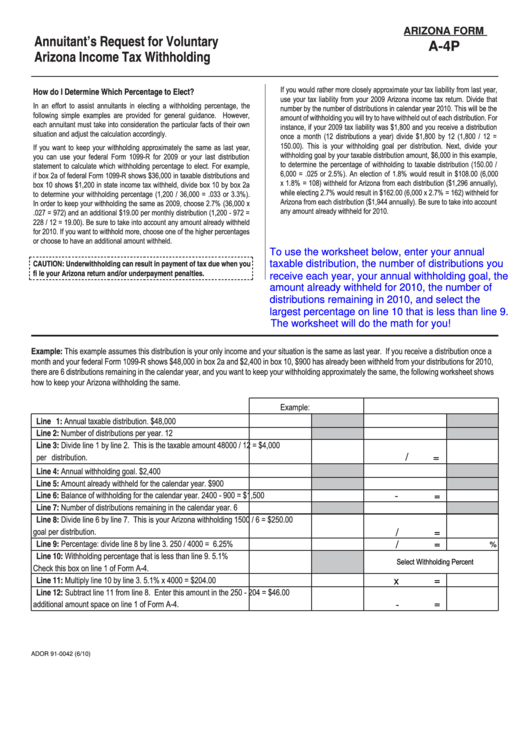

Instructions For Arizona Form A4 Annuitant'S Request For Voluntary

Web with so much up in the air regarding the future of arizona football, the program needed a big recruiting triumph. We will update this page with a new version of the form for 2024 as soon as it is made available by the arizona government. Complete, edit or print tax forms instantly. Web to change the extra amount withheld..

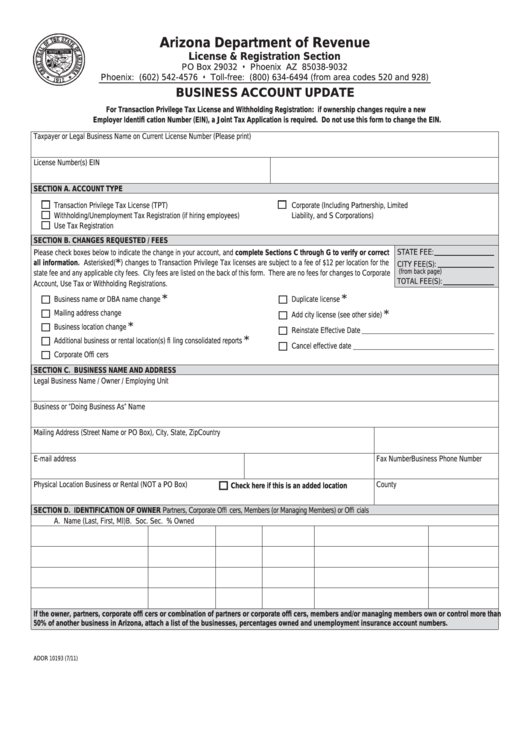

Fillable Arizona Form 10193 Business Account Update printable pdf

Arizona tax liability is gross tax liability. Web withheld for arizona from each paycheck ($1,404 annually), while electing each paycheck ($1,872 annually). Web to change the extra amount withheld. Tax season can be a confusing time for many individuals, especially when it comes to determining how much should be withheld from their paychecks. We will update this page with a.

Fillable Arizona Form A4 Employee'S Arizona Withholding Percentage

Divide the annual arizona income tax withholding by 26 to obtain the biweekly arizona income tax withholding. Arizona tax liability is gross tax liability. Web choose either box 1 or box 2: Employee’s arizona withholding percentage election arizona form a. Complete, edit or print tax forms instantly.

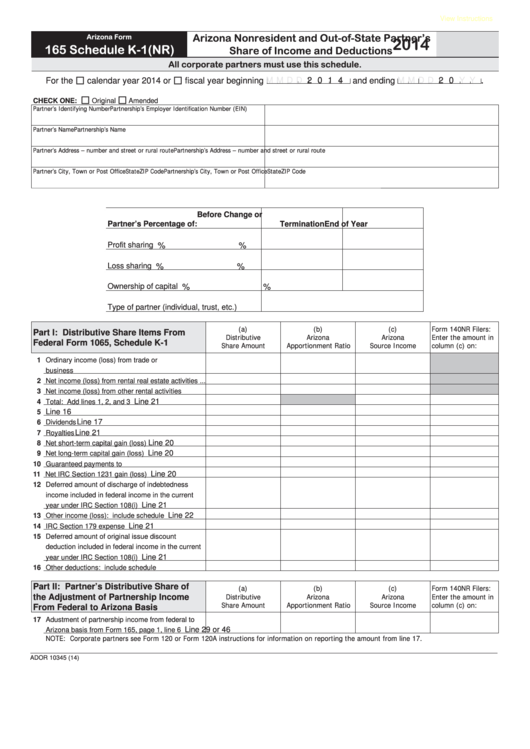

Fillable Schedule K1(Nr) (Arizona Form 165) Arizona Nonresident And

Be sure to take into account any amount already withheld for 2010. Please encourage employees to consult a tax advisor to make a selection that is appropriate for their particular situation. 1 withhold from gross taxable wages at the percentage checked (check only one percentage): Web withheld for arizona from each paycheck ($1,404 annually), while electing each paycheck ($1,872 annually)..

Arizona Form A4 (ADOR10121) Download Fillable PDF or Fill Online

Be sure to take into account any amount already withheld for 2010. Arizona tax liability is gross tax liability. Get ready for tax season deadlines by completing any required tax forms today. Tax season can be a confusing time for many individuals, especially when it comes to determining how much should be withheld from their paychecks. Complete, edit or print.

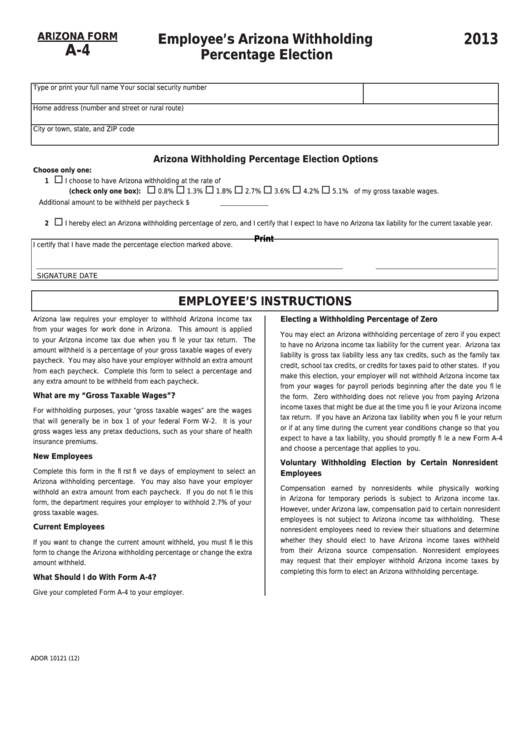

Download Arizona Form A4 (2013) for Free FormTemplate

§ 43‑408(b), the employer understands and agrees that the employer and the employee are subject to the provisions of chapter 4 of title 43 of the arizona revised Web has agreed to withhold arizona income taxes from the employee’s compensation as authorized by a.r.s. Web complete this form to select a percentage of arizona income tax to be withheld, as.

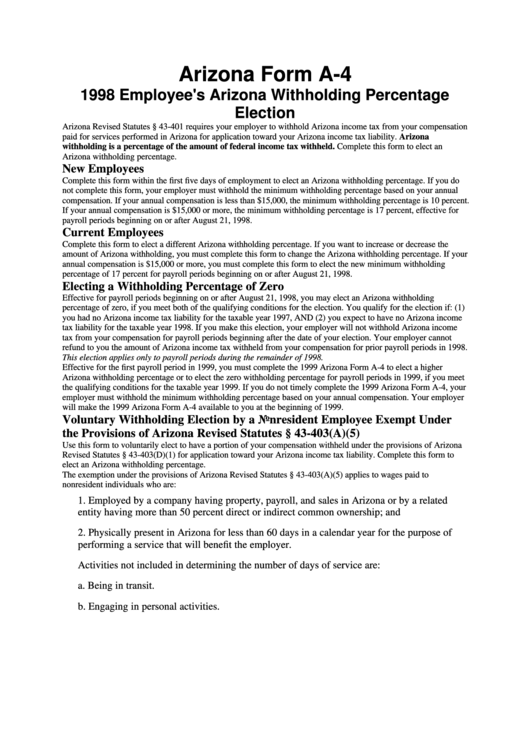

Arizona Form A4 1998 Employee'S Arizona Withholding Percentage

0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% check this box and enter an extra amount to be withheld from each paycheck. Web withheld for arizona from each paycheck ($1,404 annually), while electing each paycheck ($1,872 annually). Web choose either box 1 or box 2: Get ready for tax season deadlines by completing any required tax forms today. All employees may.

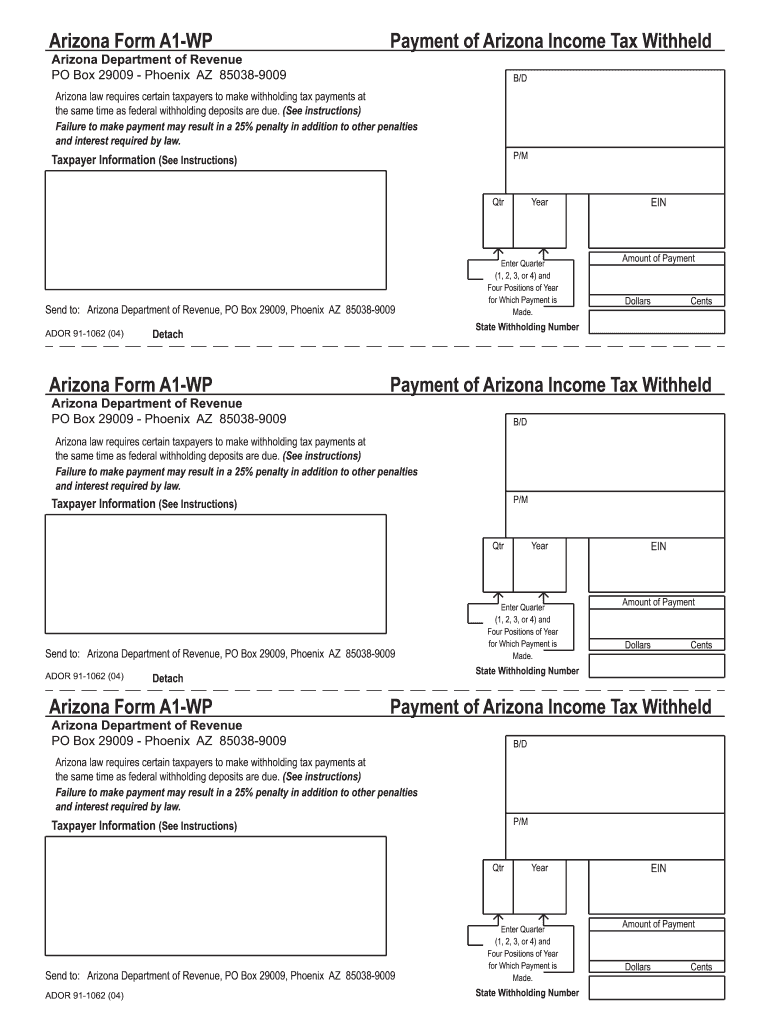

2004 Form AZ ADOR A1WP Fill Online, Printable, Fillable, Blank pdfFiller

Complete, edit or print tax forms instantly. Web with so much up in the air regarding the future of arizona football, the program needed a big recruiting triumph. Please encourage employees to consult a tax advisor to make a selection that is appropriate for their particular situation. 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% check this box and enter an.

Web To Change The Extra Amount Withheld.

Please encourage employees to consult a tax advisor to make a selection that is appropriate for their particular situation. Web complete this form to select a percentage of arizona income tax to be withheld, as well as any additional amount to be withheld from each paycheck. Complete, edit or print tax forms instantly. This form is for income earned in tax year 2022, with tax returns due in april 2023.

Web Choose Either Box 1 Or Box 2:

1 withhold from gross taxable wages at the percentage checked (check only one percentage): 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% check this box and enter an extra amount to be withheld from each paycheck. Complete, edit or print tax forms instantly. If you want a little back, pick 3.36% and you'll get 0.38% ($152) back in april.

Web 20 Rows Withholding Returns Must Be Filed Electronically For Taxable Years Beginning From And After December 31, 2019.

§ 43‑408(b), the employer understands and agrees that the employer and the employee are subject to the provisions of chapter 4 of title 43 of the arizona revised All employees may update their federal and state income tax withholdings anytime throughout the year. Web has agreed to withhold arizona income taxes from the employee’s compensation as authorized by a.r.s. Web withheld for arizona from each paycheck ($1,404 annually), while electing each paycheck ($1,872 annually).

Web With So Much Up In The Air Regarding The Future Of Arizona Football, The Program Needed A Big Recruiting Triumph.

Employee’s arizona withholding percentage election arizona form a. We will update this page with a new version of the form for 2024 as soon as it is made available by the arizona government. Electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have no arizona income tax liability for the current year. Be sure to take into account any amount already withheld for 2010.