Are Churches Required To File Form 990

Are Churches Required To File Form 990 - Churches are required to file form 990 (return of organization exempt from income tax) only if its annual gross receipts exceed $50,000. Web we have received conflicting opinions. Web churches are exempt from federal income tax, applying for exempt status, unemployment tax, and many tax information returns. Section 6033 (a) (3) (a) (i) exempts churches, their integrated auxiliaries, and conventions of churches from filing form. The due date for form 990. Churches or religious organizations that are an integral part of churches that are exempt from filing irs form 990 under provisions of 26 usc §6033; Section 6033 of the internal revenue code requires every. Web requirements for nonprofit churches. Your church is not required to file a form 990 with the federal government. We recommend that you do not submit form 990.

Web houses of worship (churches, synagogues, mosques and temples) are exempt from charitable solicitation registration in every state if they aren’t required to file a form 990. Churches are required to file form 990 (return of organization exempt from income tax) only if its annual gross receipts exceed $50,000. Web churches are exempt from having to file form 990 with the irs. For several evangelical organizations, that advantage—no 990 filing—has been a. While most nonprofits must file a form 990 with the irs, churches are exempt. Form 990 is a required filing that creates significant transparency for exempt organizations. Web churches are exempt from federal income tax, applying for exempt status, unemployment tax, and many tax information returns. Section 6033 exempts several organizations from the form 990 reporting requirements,. Nonprofit churches have 2 options to request a retail sales and use tax exemption: Web in the past, we have not filed 990’s as we are a small congregation.

We recommend that you do not submit form 990. While most nonprofits must file a form 990 with the irs, churches are exempt. The due date for form 990. Web one difference is that churches are not required to file the annual 990 form. Web in the past, we have not filed 990’s as we are a small congregation. Section 6033 (a) (3) (a) (i) exempts churches, their integrated auxiliaries, and conventions of churches from filing form. Web churches are exempt from federal income tax, applying for exempt status, unemployment tax, and many tax information returns. Web churches were found to receive between $6 billion and $10 billion from the ppp. Web houses of worship (churches, synagogues, mosques and temples) are exempt from charitable solicitation registration in every state if they aren’t required to file a form 990. Web churches are exempt from having to file form 990 with the irs.

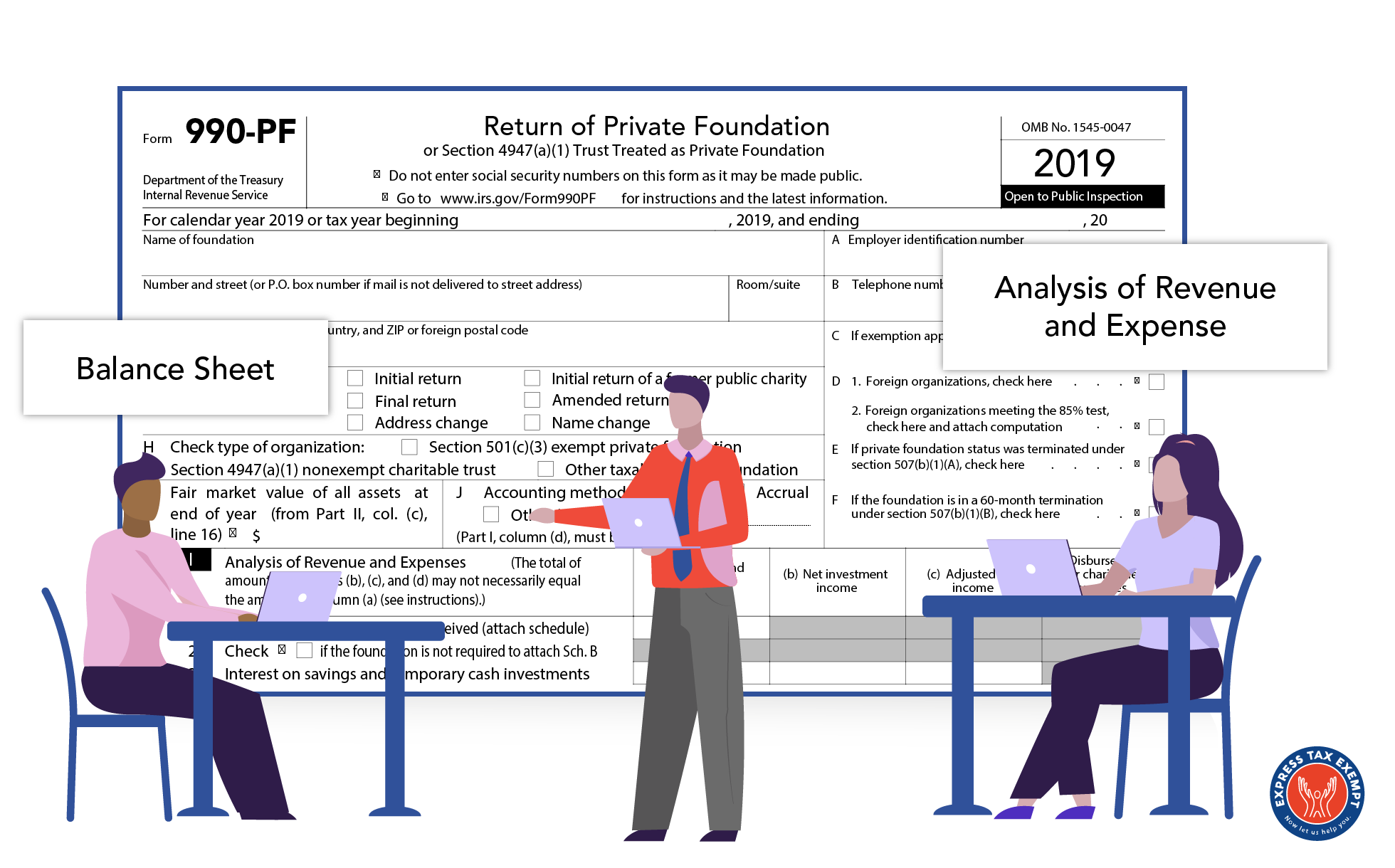

What is Form 990PF?

Section 6033 (a) (3) (a) (i) exempts churches, their integrated auxiliaries, and conventions of churches from filing form. Web requirements for nonprofit churches. We recommend that you do not submit form 990. Nonprofit churches have 2 options to request a retail sales and use tax exemption: Churches or religious organizations that are an integral part of churches that are exempt.

7 Things You Need to Know About Churches and Form 990

Web we have received conflicting opinions. Web churches that have completed form 1023 are not required to complete form 990. The due date for form 990. Web requirements for nonprofit churches. Nonprofit churches have 2 options to request a retail sales and use tax exemption:

IRS Form 990 • Nonprofits with >25,000 (except churches)

Web houses of worship (churches, synagogues, mosques and temples) are exempt from charitable solicitation registration in every state if they aren’t required to file a form 990. Web churches are exempt from having to file form 990 with the irs. Web requirements for nonprofit churches. Web churches typically do not have to file 990 tax returns. Web churches that have.

IRS Form 990 • Nonprofits with >25,000 (except churches)

Web one difference is that churches are not required to file the annual 990 form. Web churches are exempt from federal income tax, applying for exempt status, unemployment tax, and many tax information returns. Web bona fide duly constituted religious institutions and such separate groups or corporations which form an integral part of a religious institution and are exempt from.

Efile Form 990 2021 IRS Form 990 Online Filing

Section 6033 of the internal revenue code requires every. Web churches typically do not have to file 990 tax returns. The due date for form 990. Churches are required to file form 990 (return of organization exempt from income tax) only if its annual gross receipts exceed $50,000. Web churches are exempt from federal income tax, applying for exempt status,.

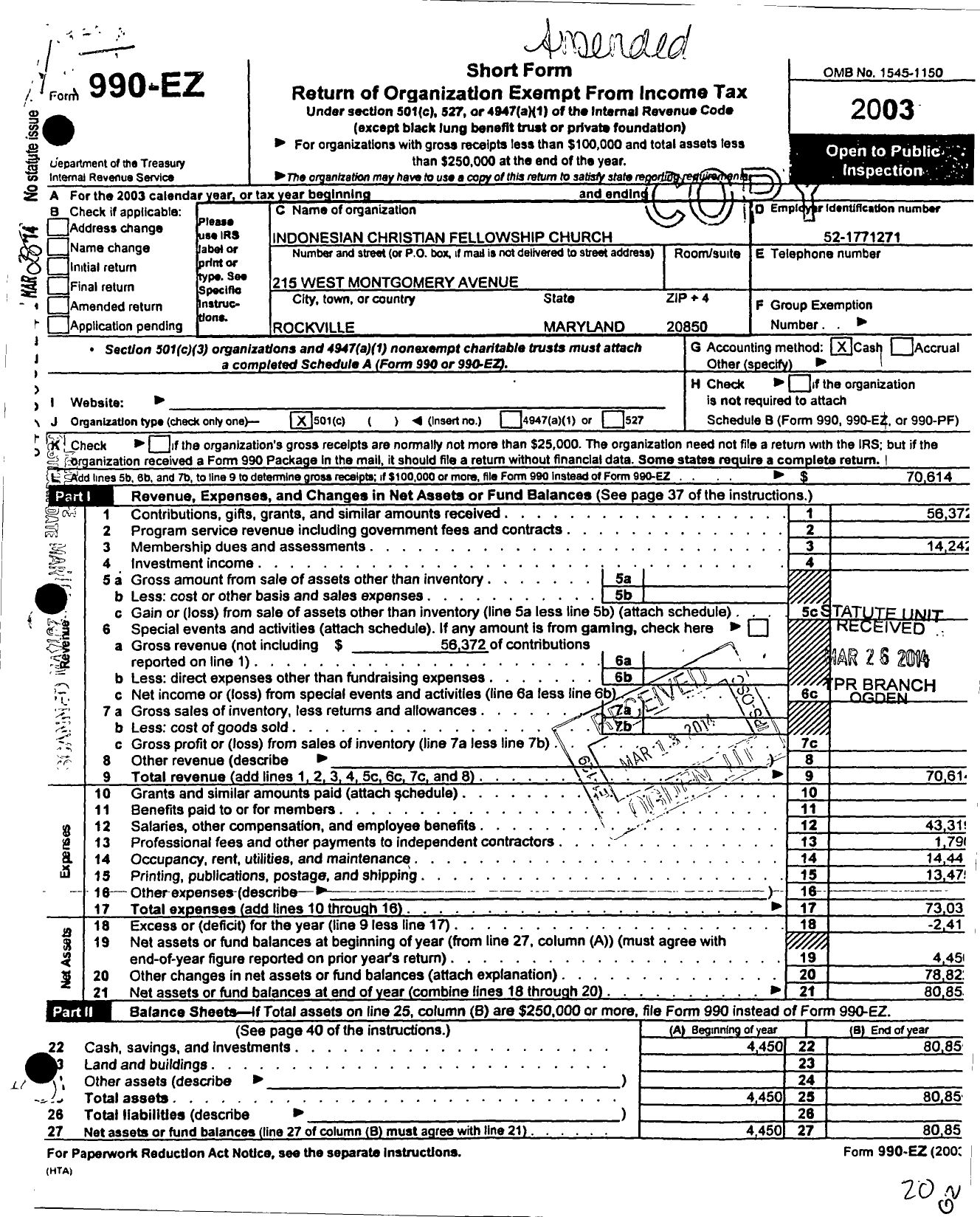

2003 Form 990 for Indonesian Christian Fellowship Church Cause IQ

Section 6033 (a) (3) (a) (i) exempts churches, their integrated auxiliaries, and conventions of churches from filing form. We recommend that you do not submit form 990. Section 6033 exempts several organizations from the form 990 reporting requirements,. The due date for form 990. This means you are not required.

Instructions to file your Form 990PF A Complete Guide

The due date for form 990. Churches are required to file form 990 (return of organization exempt from income tax) only if its annual gross receipts exceed $50,000. Section 6033 exempts several organizations from the form 990 reporting requirements,. Web we have received conflicting opinions. This means you are not required.

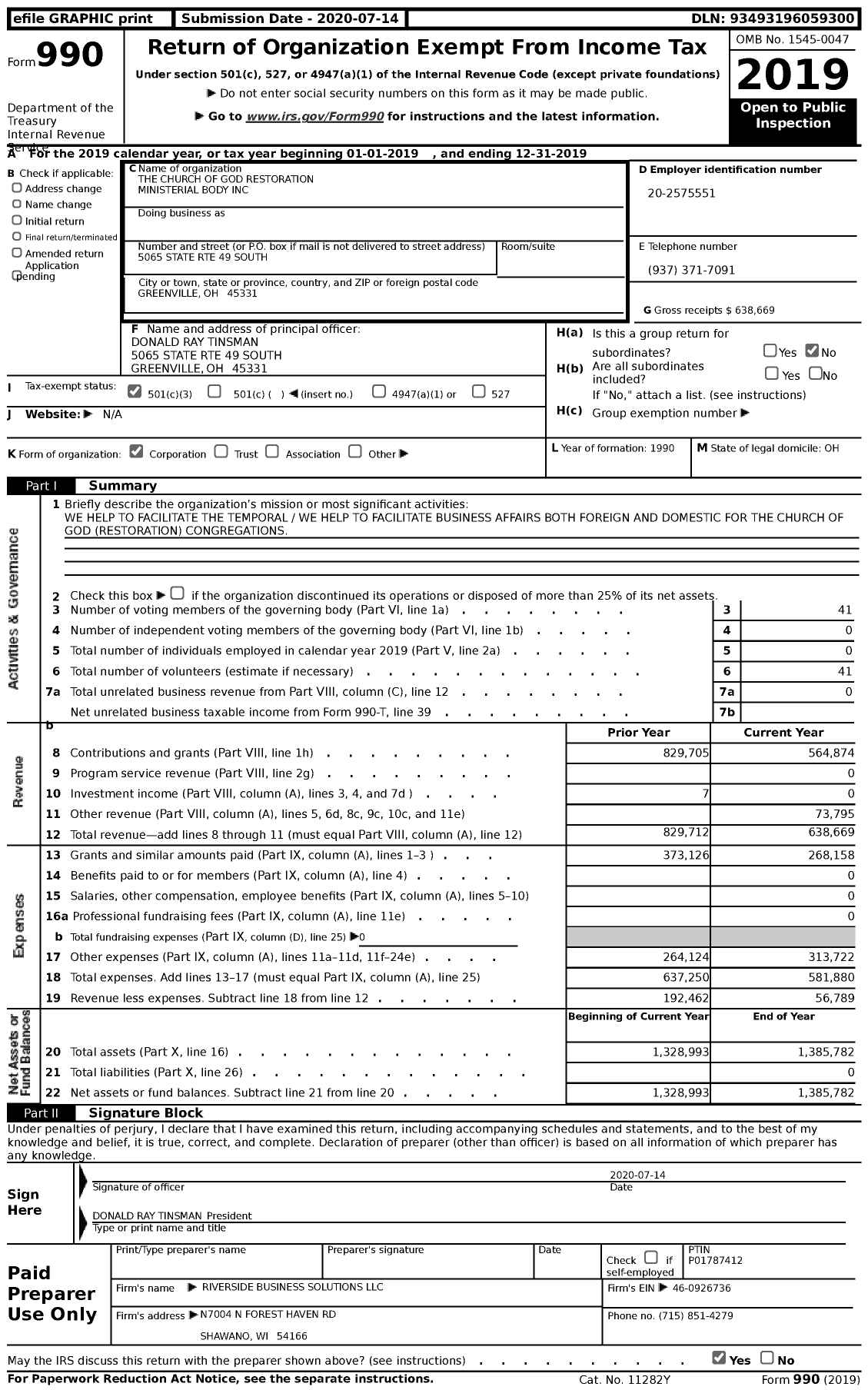

2019 Form 990 for The Church of God Restoration Ministerial Body Cause IQ

We recommend that you do not submit form 990. Section 6033 of the internal revenue code requires every. Section 6033 (a) (3) (a) (i) exempts churches, their integrated auxiliaries, and conventions of churches from filing form. Web churches that have completed form 1023 are not required to complete form 990. Web in the past, we have not filed 990’s as.

Form 990N ePostcard

For several evangelical organizations, that advantage—no 990 filing—has been a. Web churches that have completed form 1023 are not required to complete form 990. Your church is not required to file a form 990 with the federal government. Web one difference is that churches are not required to file the annual 990 form. Web churches were found to receive between.

Do Churches File Form 990? YouTube

Form 990 is a required filing that creates significant transparency for exempt organizations. While most nonprofits must file a form 990 with the irs, churches are exempt. Section 6033 (a) (3) (a) (i) exempts churches, their integrated auxiliaries, and conventions of churches from filing form. Section 6033 of the internal revenue code requires every. Web bona fide duly constituted religious.

This Means You Are Not Required.

We recommend that you do not submit form 990. Web churches that have completed form 1023 are not required to complete form 990. Web houses of worship (churches, synagogues, mosques and temples) are exempt from charitable solicitation registration in every state if they aren’t required to file a form 990. The due date for form 990.

Your Church Is Not Required To File A Form 990 With The Federal Government.

Web churches typically do not have to file 990 tax returns. In 1971, it was harder to get your hands on a. Section 6033 of the internal revenue code requires every. While most nonprofits must file a form 990 with the irs, churches are exempt.

Web One Difference Is That Churches Are Not Required To File The Annual 990 Form.

Web bona fide duly constituted religious institutions and such separate groups or corporations which form an integral part of a religious institution and are exempt from filing an annual. Nonprofit churches have 2 options to request a retail sales and use tax exemption: For several evangelical organizations, that advantage—no 990 filing—has been a. Web every organization exempt from federal income tax under internal revenue code section 501 (a) must file an annual information return except:

Web We Have Received Conflicting Opinions.

Form 990 is a required filing that creates significant transparency for exempt organizations. Churches are required to file form 990 (return of organization exempt from income tax) only if its annual gross receipts exceed $50,000. Web churches are exempt from federal income tax, applying for exempt status, unemployment tax, and many tax information returns. Churches or religious organizations that are an integral part of churches that are exempt from filing irs form 990 under provisions of 26 usc §6033;