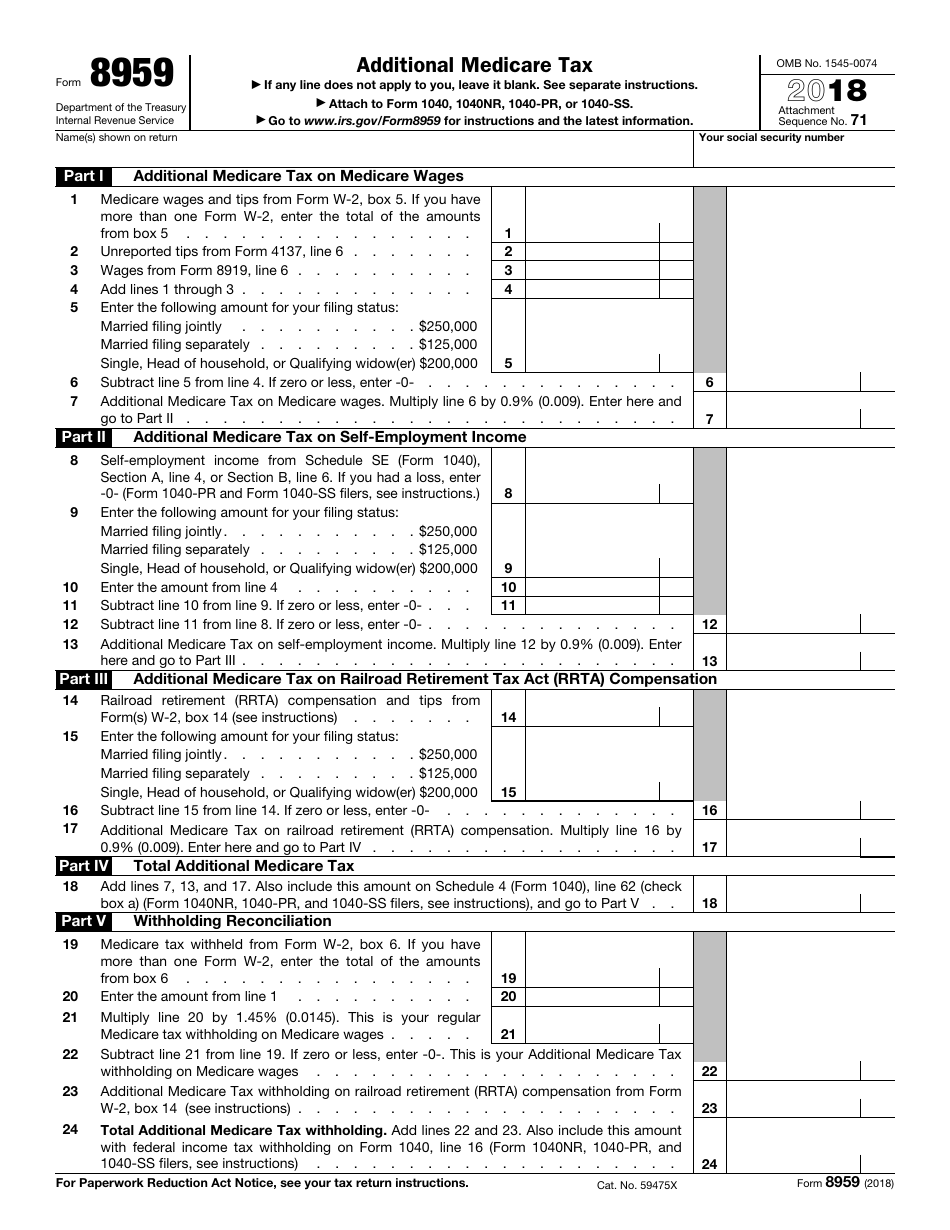

Additional Medicare Tax Form

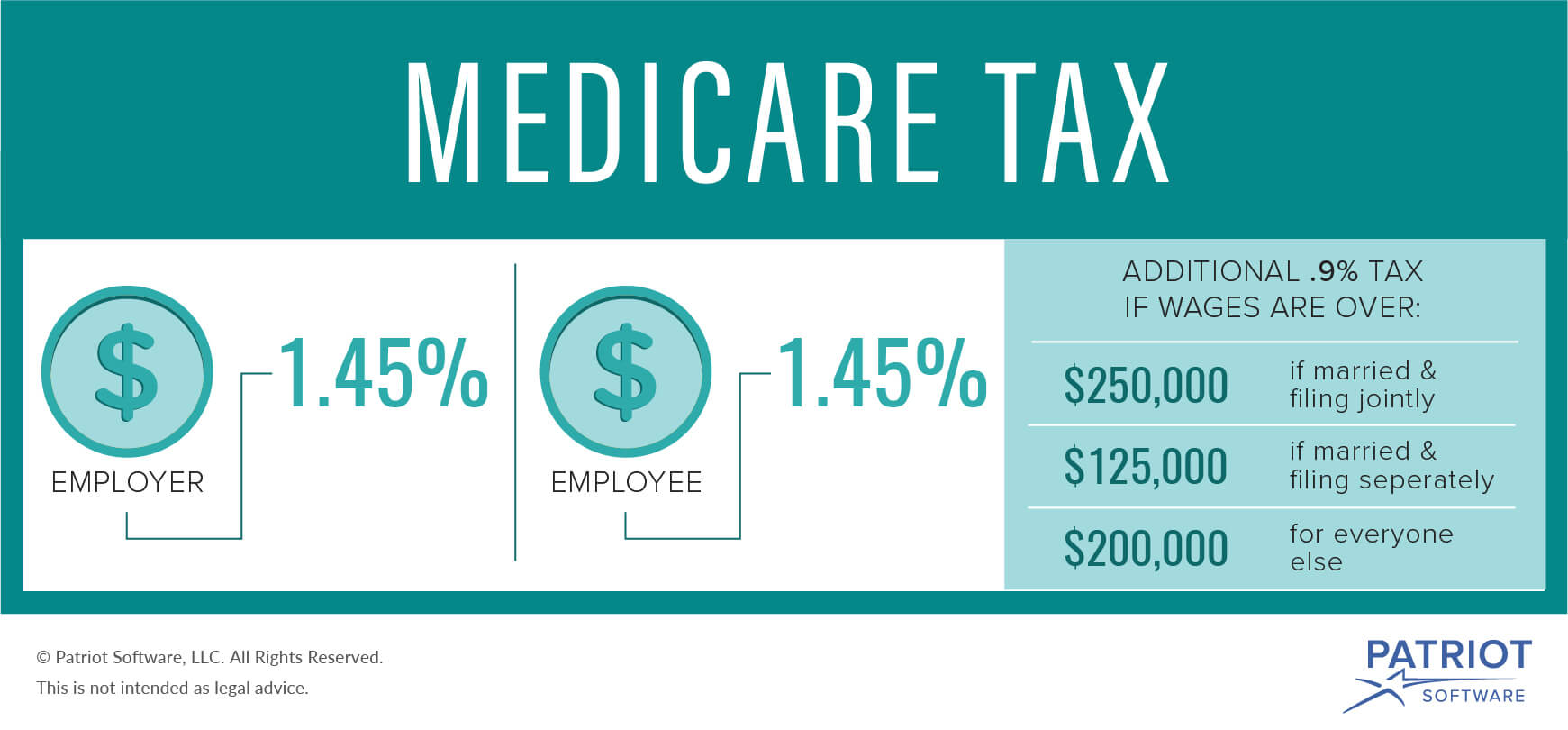

Additional Medicare Tax Form - Web this tax became effective in 2013 and is reported on form 8959, additional medicare tax. Our licensed fidelity medicare advisors can help. August social security checks are getting disbursed this week for recipients who've. This form will reconcile any additional medicare withholdings you've had with what you owe,. Web you'll use irs form 8959 to calculate your additional medicare tax. It also looks at who pays the additional tax, how the irs calculates it,. If an employer fails to. That’s the cycle of running payroll for you. Web this article explains the medicare standard tax and the medicare additional tax. Ad receive personalized medicare recommendations from a licensed fidelity medicare advisor.

But every so often, you’ll get a. This form will reconcile any additional medicare withholdings you've had with what you owe,. Our licensed fidelity medicare advisors can help. Additional medicare tax on medicare wages. Web employers are responsible for withholding and reporting the 0.9 percent additional medicare tax, which became effective in 2013. Web this article explains the medicare standard tax and the medicare additional tax. Web the additional medicare tax is 0.9% (0.009) of an employee's gross pay (wages, salaries, bonuses, etc.) that are in excess of $200,000 during a calendar year. Web the additional medicare tax is 0.9%, but it doesn’t apply to everyone like standard medicare tax does. It also looks at who pays the additional tax, how the irs calculates it,. For example, john smith is.

If an employer fails to. Web you'll use irs form 8959 to calculate your additional medicare tax. You’ll only have to pay the additional tax if your income. July 29, 2023 5:00 a.m. Web this tax became effective in 2013 and is reported on form 8959, additional medicare tax. Ad receive personalized medicare recommendations from a licensed fidelity medicare advisor. Our licensed fidelity medicare advisors can help. August social security checks are getting disbursed this week for recipients who've. Web this article explains the medicare standard tax and the medicare additional tax. Web employers are responsible for withholding and reporting the 0.9 percent additional medicare tax, which became effective in 2013.

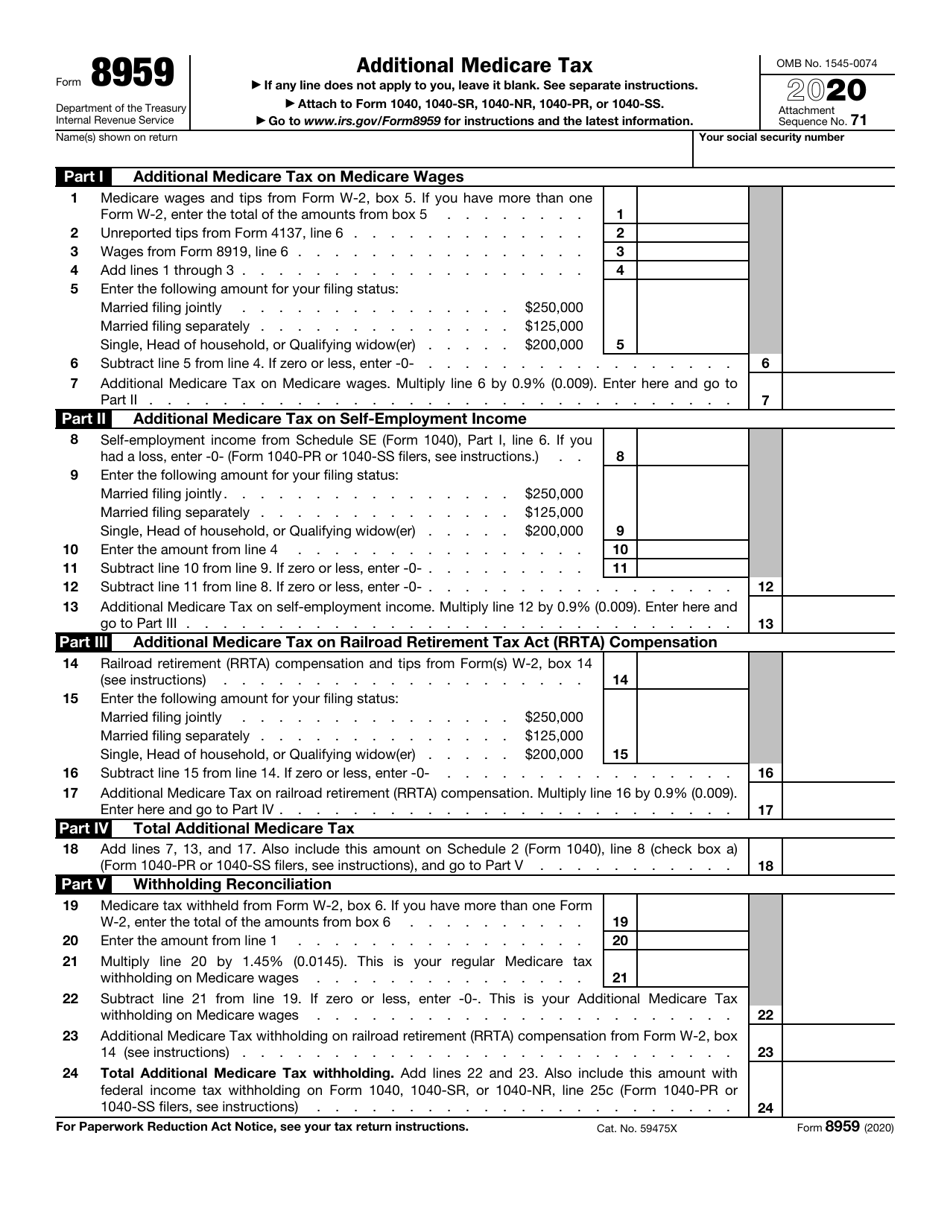

Form 8959 Additional Medicare Tax (2014) Free Download

That’s the cycle of running payroll for you. Ad receive personalized medicare recommendations from a licensed fidelity medicare advisor. If an employer fails to. But every so often, you’ll get a. Form 8959—additional medicare tax reconcile — taxa ct a form to be filed.

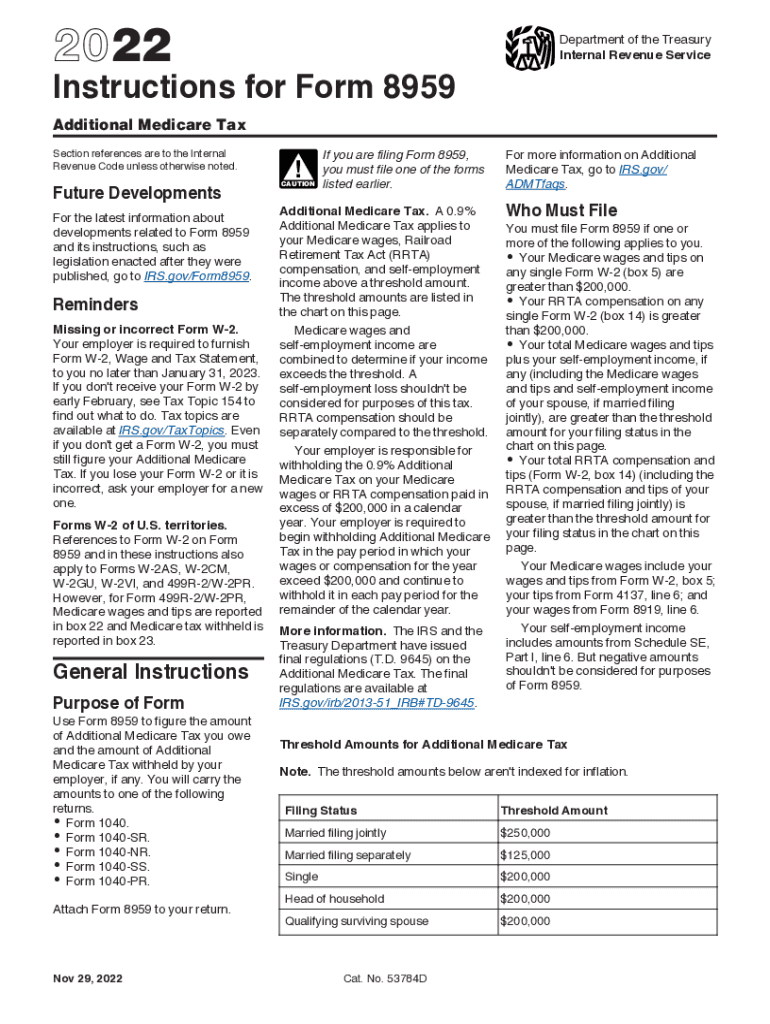

2022 Form IRS 8959 Instructions Fill Online, Printable, Fillable

Web form 8959 is used to calculate the amount of additional medicare tax owed and the amount of additional medicare tax withheld by a taxpayer’s employer, if any. July 29, 2023 5:00 a.m. Web the additional medicare tax is 0.9%, but it doesn’t apply to everyone like standard medicare tax does. This form will reconcile any additional medicare withholdings you've.

IRS Form 8959 Download Fillable PDF or Fill Online Additional Medicare

Our licensed fidelity medicare advisors can help. Web this article explains the medicare standard tax and the medicare additional tax. Web this tax became effective in 2013 and is reported on form 8959, additional medicare tax. That’s the cycle of running payroll for you. July 29, 2023 5:00 a.m.

How to Complete IRS Form 8959 Additional Medicare Tax YouTube

The 0.9 percent additional medicare tax applies to an individual’s wages, railroad. For example, john smith is. That’s the cycle of running payroll for you. August social security checks are getting disbursed this week for recipients who've. Web the additional medicare tax is 0.9%, but it doesn’t apply to everyone like standard medicare tax does.

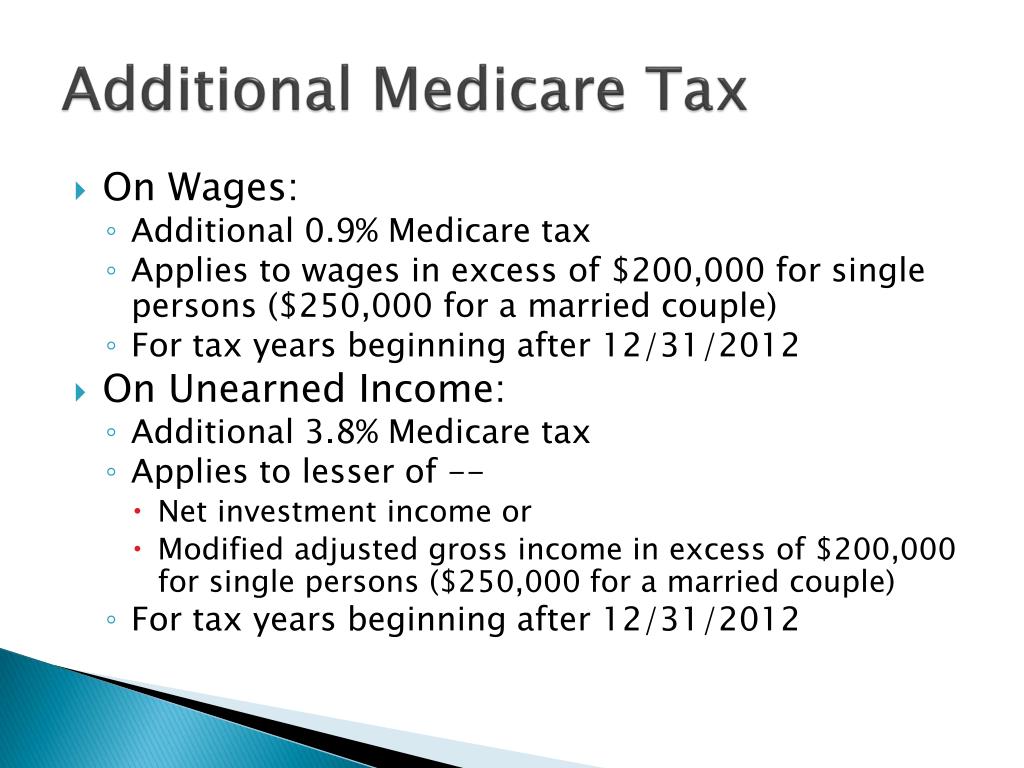

PPT 2010 Significant Tax Law Changes PowerPoint Presentation, free

This form will reconcile any additional medicare withholdings you've had with what you owe,. For example, john smith is. Web this tax became effective in 2013 and is reported on form 8959, additional medicare tax. Ad receive personalized medicare recommendations from a licensed fidelity medicare advisor. Web you'll use irs form 8959 to calculate your additional medicare tax.

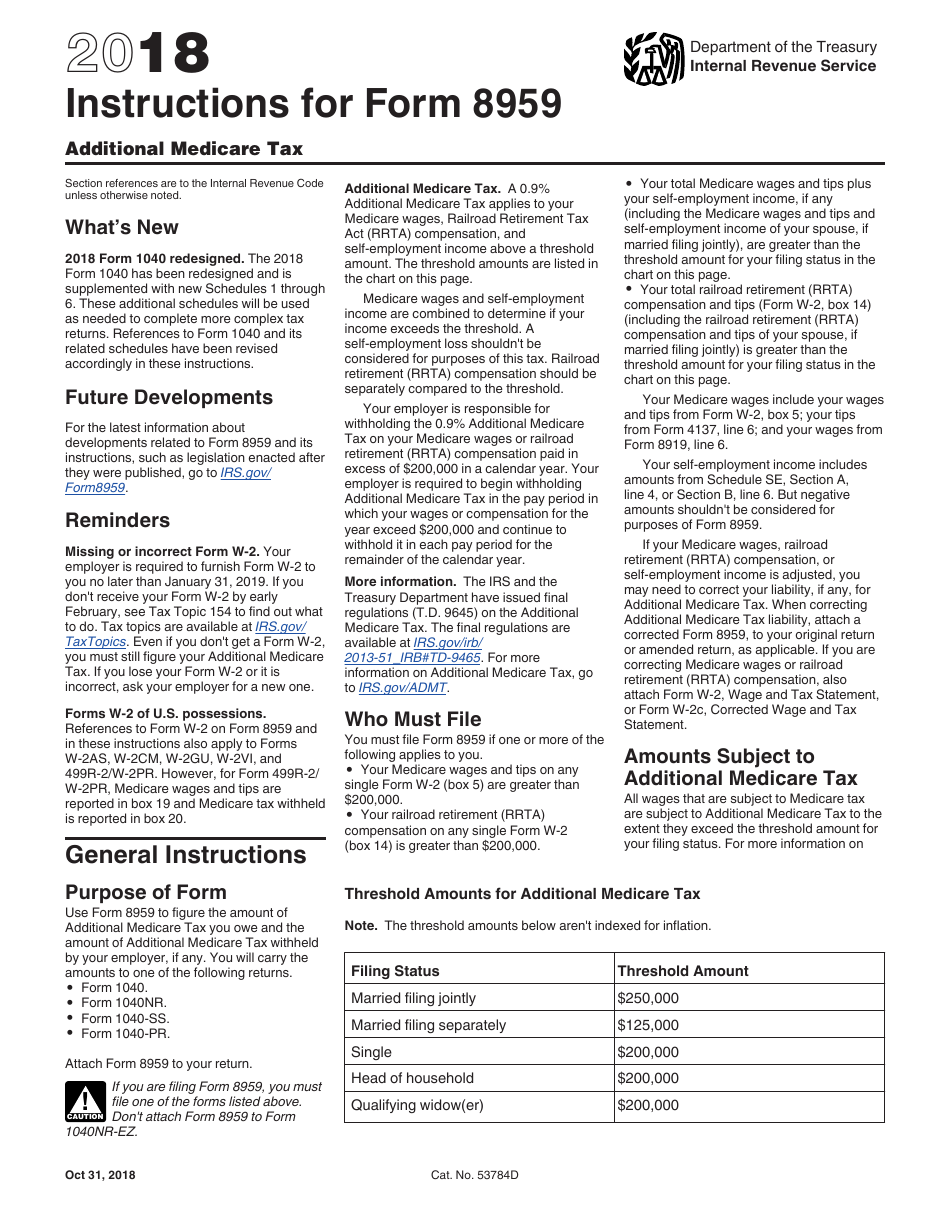

Download Instructions for IRS Form 8959 Additional Medicare Tax PDF

Our licensed fidelity medicare advisors can help. That’s the cycle of running payroll for you. August social security checks are getting disbursed this week for recipients who've. Web you'll use irs form 8959 to calculate your additional medicare tax. Web the additional medicare tax is 0.9%, but it doesn’t apply to everyone like standard medicare tax does.

IRS Form 8959 Download Fillable PDF or Fill Online Additional Medicare

Web you'll use irs form 8959 to calculate your additional medicare tax. Form 8959—additional medicare tax reconcile — taxa ct a form to be filed. Ad receive personalized medicare recommendations from a licensed fidelity medicare advisor. Web the additional medicare tax is 0.9%, but it doesn’t apply to everyone like standard medicare tax does. The 0.9 percent additional medicare tax.

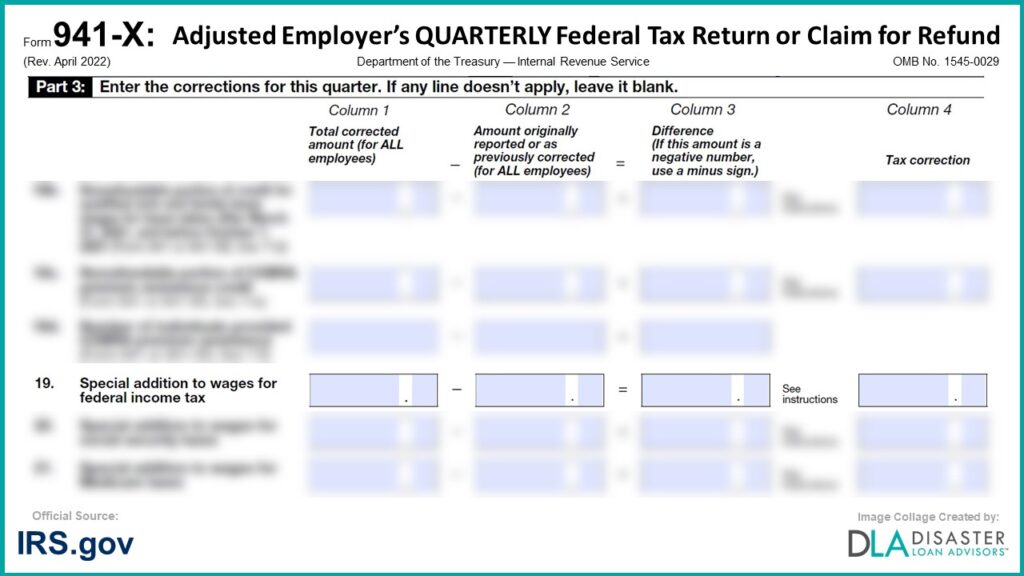

941X 19. Special Additions to Wages for Federal Tax, Social

Ad receive personalized medicare recommendations from a licensed fidelity medicare advisor. The 0.9 percent additional medicare tax applies to an individual’s wages, railroad. Web this article explains the medicare standard tax and the medicare additional tax. That’s the cycle of running payroll for you. Form 8959—additional medicare tax reconcile — taxa ct a form to be filed.

How Can Small Business Owners Reduce Social Security and Medicare Taxes?

For example, john smith is. Web form 8959 is used to calculate the amount of additional medicare tax owed and the amount of additional medicare tax withheld by a taxpayer’s employer, if any. But every so often, you’ll get a. Our licensed fidelity medicare advisors can help. Web the additional medicare tax is 0.9%, but it doesn’t apply to everyone.

What is Medicare Tax Purpose, Rate, Additional Medicare, and More

For example, john smith is. Web the additional medicare tax is 0.9%, but it doesn’t apply to everyone like standard medicare tax does. You’ll only have to pay the additional tax if your income. July 29, 2023 5:00 a.m. Web the additional medicare tax is 0.9% (0.009) of an employee's gross pay (wages, salaries, bonuses, etc.) that are in excess.

Additional Medicare Tax On Medicare Wages.

Ad receive personalized medicare recommendations from a licensed fidelity medicare advisor. The 0.9 percent additional medicare tax applies to an individual’s wages, railroad. That’s the cycle of running payroll for you. Web employers are responsible for withholding and reporting the 0.9 percent additional medicare tax, which became effective in 2013.

Our Licensed Fidelity Medicare Advisors Can Help.

Web this article explains the medicare standard tax and the medicare additional tax. July 29, 2023 5:00 a.m. Web this tax became effective in 2013 and is reported on form 8959, additional medicare tax. But every so often, you’ll get a.

It Also Looks At Who Pays The Additional Tax, How The Irs Calculates It,.

Form 8959—additional medicare tax reconcile — taxa ct a form to be filed. August social security checks are getting disbursed this week for recipients who've. Web form 8959 is used to calculate the amount of additional medicare tax owed and the amount of additional medicare tax withheld by a taxpayer’s employer, if any. If an employer fails to.

Web The Additional Medicare Tax Is 0.9%, But It Doesn’t Apply To Everyone Like Standard Medicare Tax Does.

Web you'll use irs form 8959 to calculate your additional medicare tax. Web the additional medicare tax is 0.9% (0.009) of an employee's gross pay (wages, salaries, bonuses, etc.) that are in excess of $200,000 during a calendar year. For example, john smith is. This form will reconcile any additional medicare withholdings you've had with what you owe,.