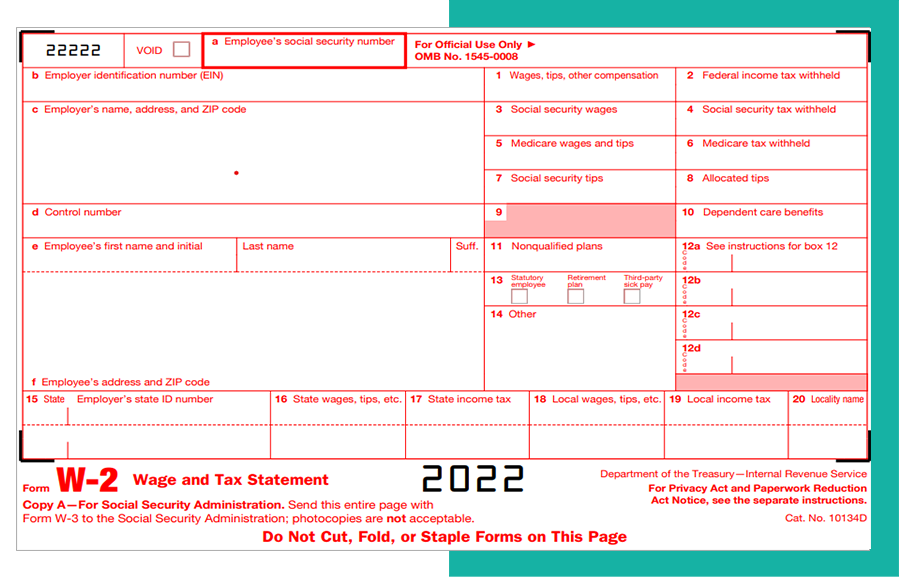

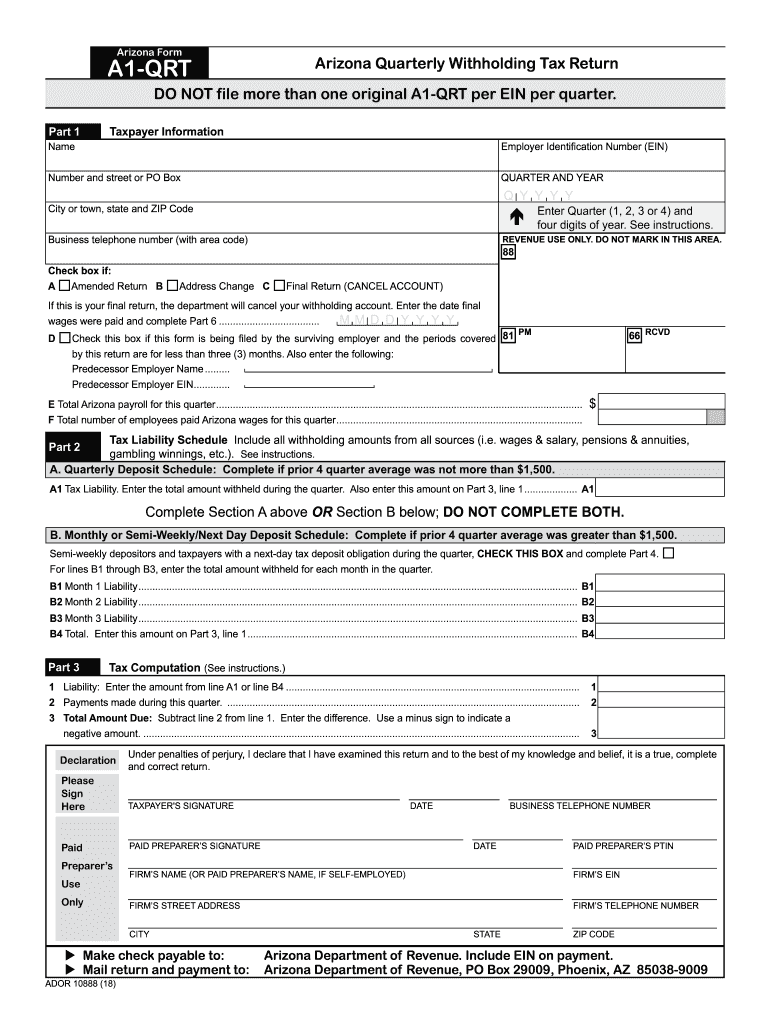

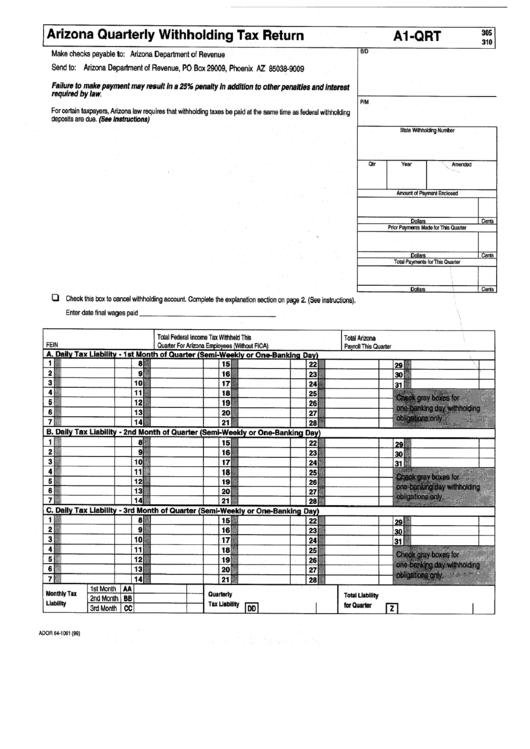

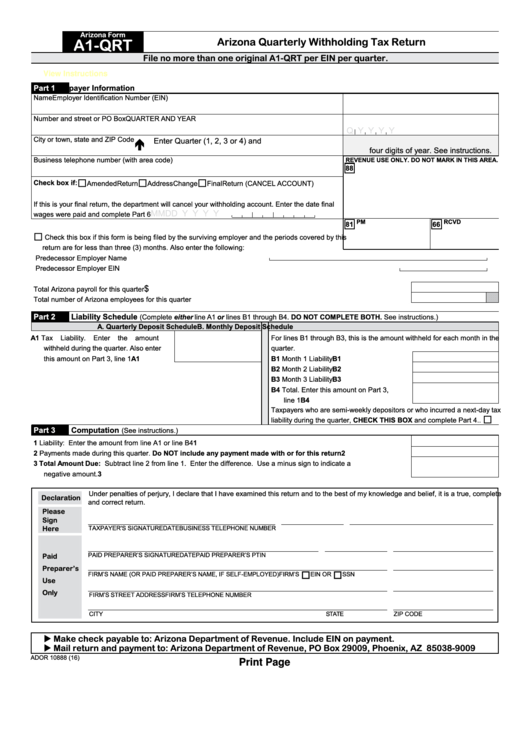

A1-Qrt Form

A1-Qrt Form - City or town, state and zip code business telephone number (with area. We last updated the arizona quarterly withholding tax return in august 2022, so this is the. Employer identification number (ein) quarter and year*: Web state of arizona department of revenue toggle navigation. Income tax must be withheld, unless those wages. Q y y y y *quarter (1, 2, 3 or 4) and four digits of year for. If changes do not affect return, send letter of explanation. Web missouri and kansas city require a valid federal attachment in the electronic file. Download blank or fill out online in pdf format. Payroll service providers registered with arizona can upload electronic files containing.

Web missouri and kansas city require a valid federal attachment in the electronic file. Employer identification number (ein) quarter and year*: Download blank or fill out online in pdf format. We last updated the arizona quarterly withholding tax return in august 2022, so this is the. Minnesota amended individual income tax. Q y y y y *quarter (1, 2, 3 or 4) and four digits of year for. Income tax must be withheld, unless those wages. Payroll service providers registered with arizona can upload electronic files containing. Quarterly payment of reduced withholding for tax credits:. City or town, state and zip code business telephone number (with area.

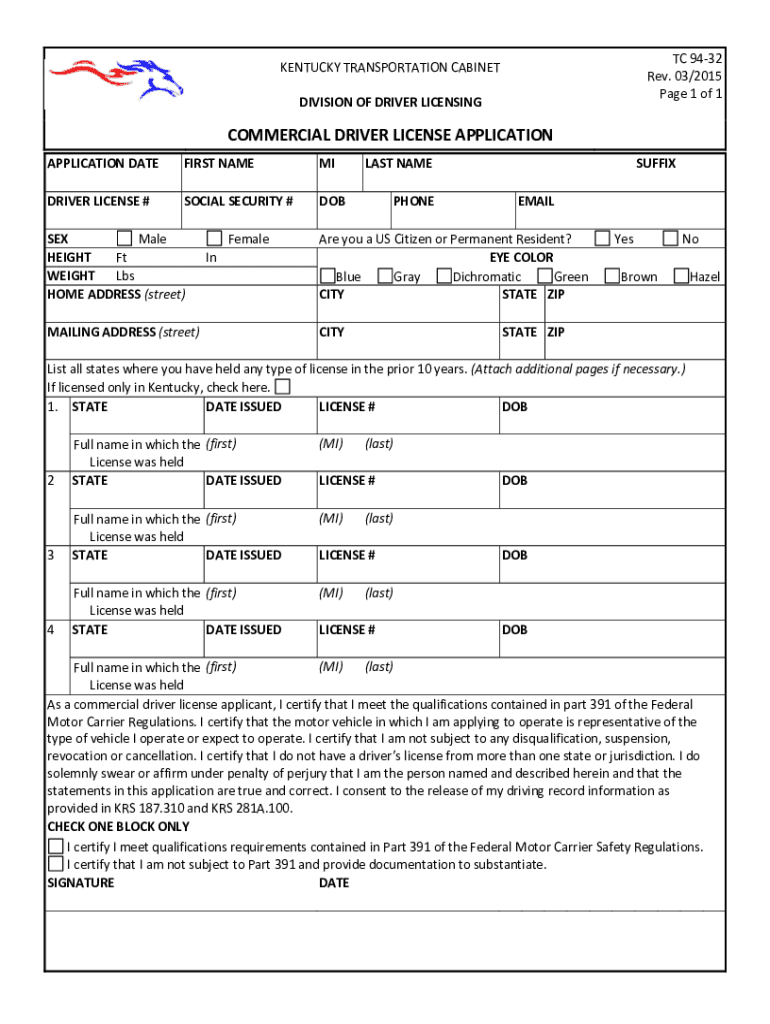

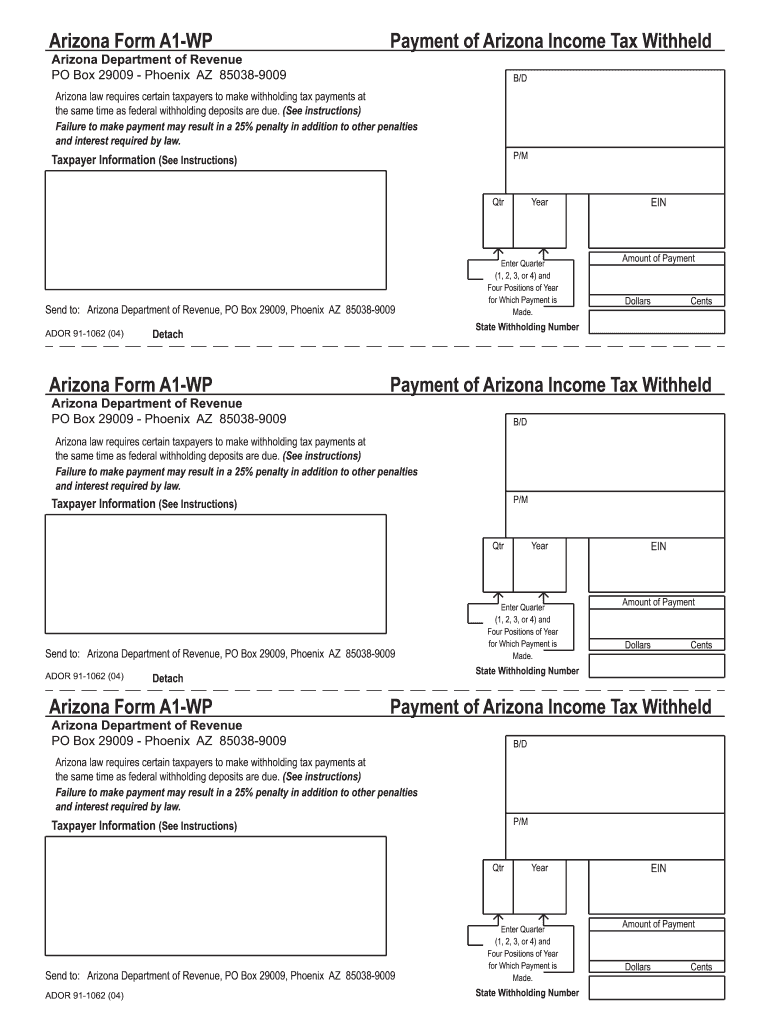

Q y y y y *quarter (1, 2, 3 or 4) and four digits of year for. The payment transmittal form for payments made on a quarterly basis when those payments are made by check or money order; We last updated the arizona quarterly withholding tax return in august 2022, so this is the. Complete, sign, print and send your tax documents easily with us legal forms. Income tax must be withheld, unless those wages. Minnesota amended individual income tax. An employer must withhold arizona income tax from wages paid for services performed in arizona. Web state of arizona department of revenue toggle navigation. City or town, state and zip code business telephone number (with area. Employer identification number (ein) quarter and year*:

Arizona Tax Filings Requirements Efile 1099/W2 for the Arizona State

The payment transmittal form for payments made on a quarterly basis when those payments are made by check or money order; Web missouri and kansas city require a valid federal attachment in the electronic file. City or town, state and zip code business telephone number (with area. If you have not renewed your 2023 state tpt license, penalties will be.

Form A1 Invoice Money

Payroll service providers registered with arizona can upload electronic files containing. Web state of arizona department of revenue toggle navigation. If changes do not affect return, send letter of explanation. Quarterly payment of reduced withholding for tax credits:. Employer identification number (ein) quarter and year*:

Arizona Form A1 QRT Fillable Az A1 Qrt Form Top Fill Out and Sign

Complete, sign, print and send your tax documents easily with us legal forms. Q y y y y *quarter (1, 2, 3 or 4) and four digits of year for. An employer must withhold arizona income tax from wages paid for services performed in arizona. Payroll service providers registered with arizona can upload electronic files containing. Web missouri and kansas.

2004 Form AZ ADOR A1WP Fill Online, Printable, Fillable, Blank pdfFiller

The payment transmittal form for payments made on a quarterly basis when those payments are made by check or money order; We last updated the arizona quarterly withholding tax return in august 2022, so this is the. Employer identification number (ein) quarter and year*: If changes do not affect return, send letter of explanation. Payroll service providers registered with arizona.

A1 Art Fill Out and Sign Printable PDF Template signNow

Web or try to claim refunds with this return. Web state of arizona department of revenue toggle navigation. Payroll service providers registered with arizona can upload electronic files containing. Web arizona withholding reconciliation tax return. Download blank or fill out online in pdf format.

Form A1Qrt Arizona Quarterly Withholding Tax Return printable pdf

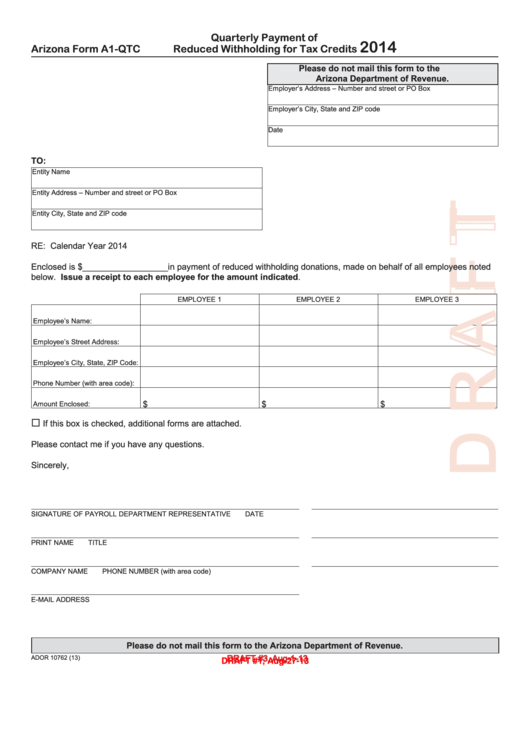

Quarterly payment of reduced withholding for tax credits:. Employer identification number (ein) quarter and year*: The payment transmittal form for payments made on a quarterly basis when those payments are made by check or money order; An employer must withhold arizona income tax from wages paid for services performed in arizona. Download blank or fill out online in pdf format.

Fillable Arizona Quarterly Withholding Tax Return (Arizona Form A1Qrt

Download blank or fill out online in pdf format. Web state of arizona department of revenue toggle navigation. Income tax must be withheld, unless those wages. If changes do not affect return, send letter of explanation. Minnesota amended individual income tax.

form a1 Scribd india

Quarterly payment of reduced withholding for tax credits:. Web state of arizona department of revenue toggle navigation. Web missouri and kansas city require a valid federal attachment in the electronic file. Web arizona withholding reconciliation tax return. Employer identification number (ein) quarter and year*:

form a1 Scribd india

If you have not renewed your 2023 state tpt license, penalties will be applied and you will not receive your license until all renewal fees are paid. Q y y y y *quarter (1, 2, 3 or 4) and four digits of year for. The payment transmittal form for payments made on a quarterly basis when those payments are made.

Form A1Qtc Draft 2014 Quarterly Payment Of Reduced Withholding For

Download blank or fill out online in pdf format. Quarterly payment of reduced withholding for tax credits:. Web or try to claim refunds with this return. If changes do not affect return, send letter of explanation. Employer identification number (ein) quarter and year*:

Minnesota Amended Individual Income Tax.

Arizona quarterly withholding tax return: Web arizona withholding reconciliation tax return. We last updated the arizona quarterly withholding tax return in august 2022, so this is the. City or town, state and zip code business telephone number (with area.

The Payment Transmittal Form For Payments Made On A Quarterly Basis When Those Payments Are Made By Check Or Money Order;

Quarterly payment of reduced withholding for tax credits:. Payroll service providers registered with arizona can upload electronic files containing. Web missouri and kansas city require a valid federal attachment in the electronic file. Income tax must be withheld, unless those wages.

If Changes Do Not Affect Return, Send Letter Of Explanation.

Download blank or fill out online in pdf format. If you have not renewed your 2023 state tpt license, penalties will be applied and you will not receive your license until all renewal fees are paid. Web state of arizona department of revenue toggle navigation. Q y y y y *quarter (1, 2, 3 or 4) and four digits of year for.

Complete, Sign, Print And Send Your Tax Documents Easily With Us Legal Forms.

An employer must withhold arizona income tax from wages paid for services performed in arizona. Employer identification number (ein) quarter and year*: Web or try to claim refunds with this return.