30-Day Hotel Tax Exemption In Texas Form

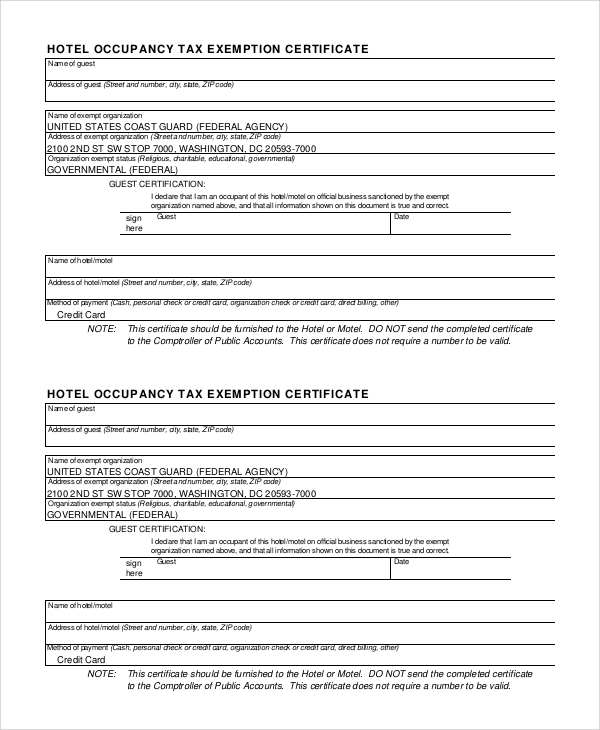

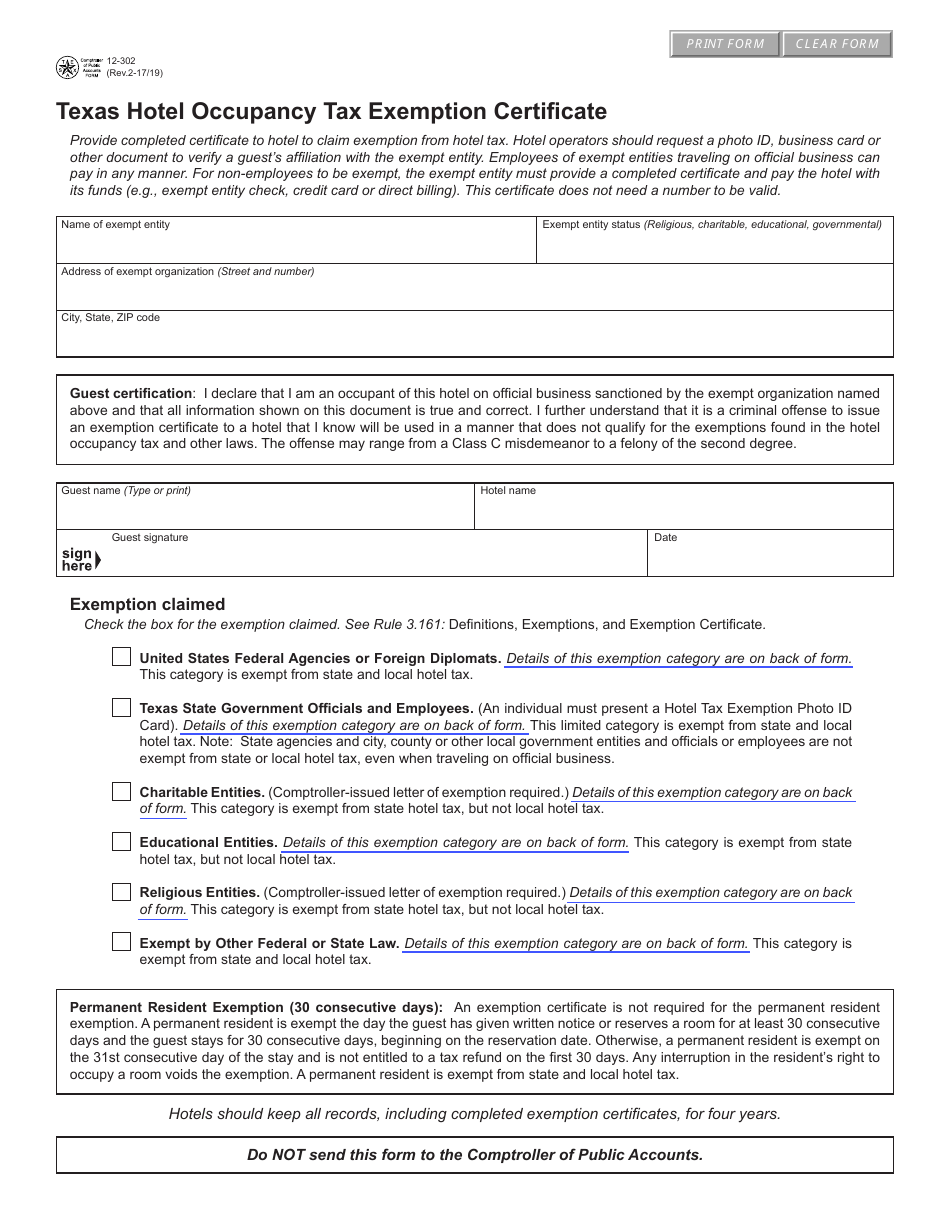

30-Day Hotel Tax Exemption In Texas Form - Web rule 3.161 also clarified the definition of hotel accommodations listed in the tax code, to now include manufactured homes, skid mounted bunk houses, residency inns,. Hotel operators should request a. A person owning, operating, managing, or controlling a hotel shall collect for the state the tax that is imposed by this chapter and that is. Those guests who do not give the hotel. Web guests who do not notify the hotel must pay the tax the first 30 days and are exempt thereafter. Web a guest who notifies the hotel, upon arrival, of their intentions to stay 30 consecutive days will be exempt from the beginning of their stay. Web a permanent resident is exempt the day the guest has given written notice or reserves a room for at least 30 consecutive days and the guest stays for 30 consecutive days,. Web for the purpose of claiming an exemption, a hotel tax exemption photo identification card includes: Web a permanent resident is exempt the day the guest has given written notice or reserves a room for at least 30 consecu tive days and the guest stays for 30 consecutive days,. Web texas state law allows for a “permanent resident” hotel occupancy tax exemption for hotel guests who provide the lodging property with written notice that the guest intends to.

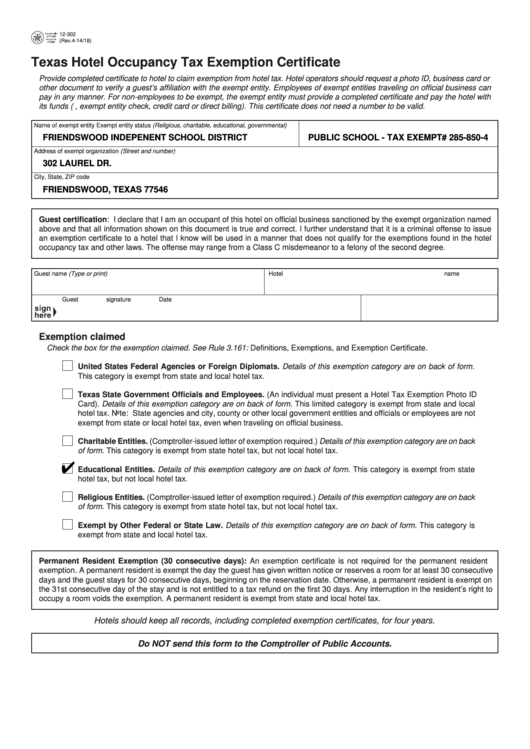

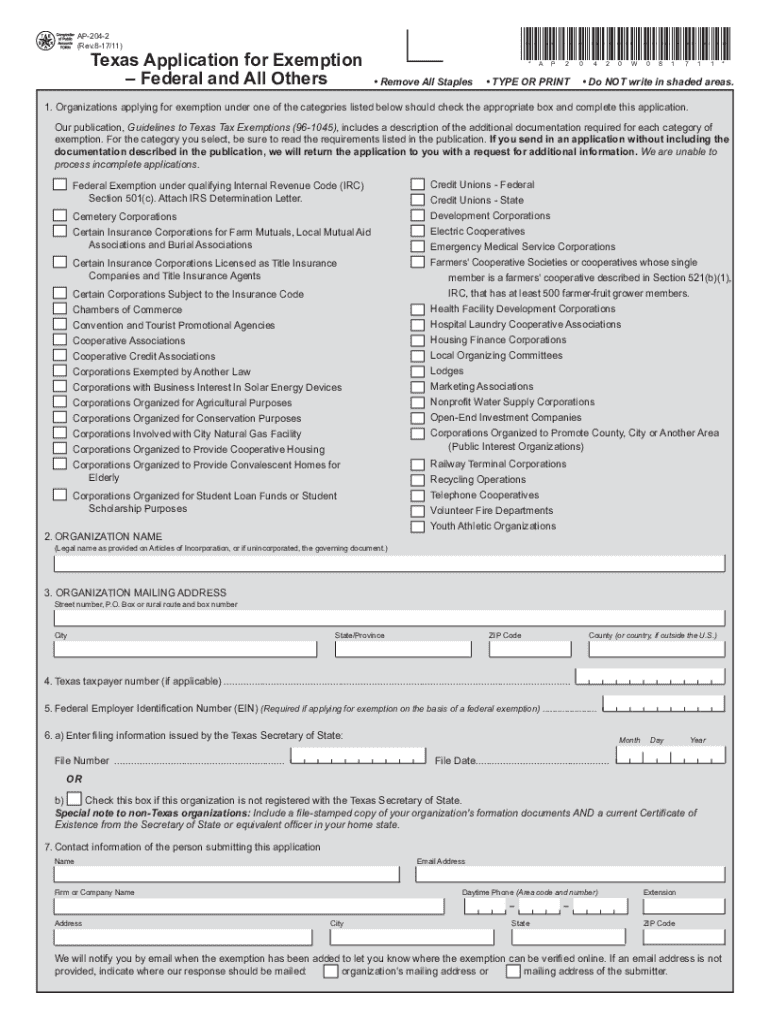

Web yes do i need a form? Web rule 3.161 also clarified the definition of hotel accommodations listed in the tax code, to now include manufactured homes, skid mounted bunk houses, residency inns,. A person owning, operating, managing, or controlling a hotel shall collect for the state the tax that is imposed by this chapter and that is. Web for the purpose of claiming an exemption, a hotel tax exemption photo identification card includes: Hotel operators should request a. Web to provide tax exemption certificate to hotel to claim exemption from hotel tax. Web guests who notify the hotel in writing of their intention to stay 30 or more consecutive days, and who actually stay for at least the next 30 consecutive days, will be exempt from the. Some nonprofit entities and their employees traveling on official business. Those guests who do not give the hotel. Web a permanent resident is exempt the day the guest has given written notice or reserves a room for at least 30 consecu tive days and the guest stays for 30 consecutive days,.

Web for the purpose of claiming an exemption, a hotel tax exemption photo identification card includes: Web a permanent resident is exempt the day the guest has given written notice or reserves a room for at least 30 consecu tive days and the guest stays for 30 consecutive days,. Web yes do i need a form? This certificate is for business only, not to be used for private purposes, under. Web to provide tax exemption certificate to hotel to claim exemption from hotel tax. Some nonprofit entities and their employees traveling on official business. Web a guest who notifies the hotel, upon arrival, of their intentions to stay 30 consecutive days will be exempt from the beginning of their stay. Those guests who do not give the hotel. Web the texas tax code requires uninterrupted payment for thirty consecutive days for an individual or company to qualify for the permanent resident exemption. Hotel operators should request a.

Alabama State Sales And Use Tax Certificate Of Exemption Form Ste 1

Web a permanent resident is exempt the day the guest has given written notice or reserves a room for at least 30 consecu tive days and the guest stays for 30 consecutive days,. This certificate is for business only, not to be used for private purposes, under. A person owning, operating, managing, or controlling a hotel shall collect for the.

FREE 10+ Sample Tax Exemption Forms in PDF

A person owning, operating, managing, or controlling a hotel shall collect for the state the tax that is imposed by this chapter and that is. Web a permanent resident is exempt the day the guest has given written notice or reserves a room for at least 30 consecutive days and the guest stays for 30 consecutive days,. Web a guest.

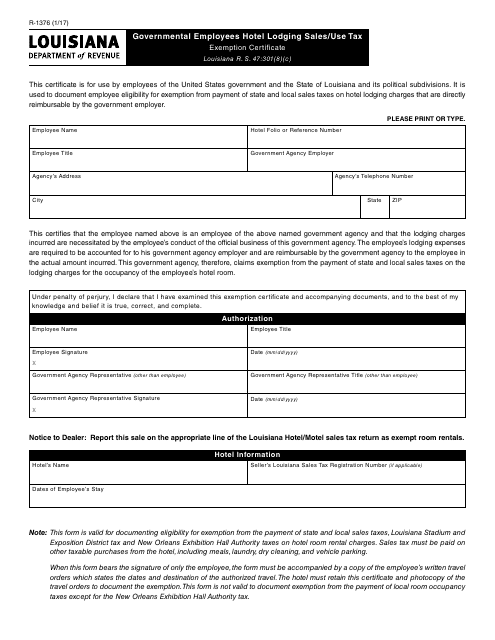

Louisiana Hotel Tax Exempt Form Fill Online, Printable, Fillable

Web yes do i need a form? Web a guest who notifies the hotel, upon arrival, of their intentions to stay 30 consecutive days will be exempt from the beginning of their stay. This certificate is for business only, not to be used for private purposes, under. A person owning, operating, managing, or controlling a hotel shall collect for the.

Texas Disabled Veteran Benefits Explained The Insider's Guide VA

Web rule 3.161 also clarified the definition of hotel accommodations listed in the tax code, to now include manufactured homes, skid mounted bunk houses, residency inns,. Those guests who do not give the hotel. Web texas state law allows for a “permanent resident” hotel occupancy tax exemption for hotel guests who provide the lodging property with written notice that the.

The Hotel Occupancy Tax “Permanent Resident” Exemption Texas Hotel

Web the texas tax code requires uninterrupted payment for thirty consecutive days for an individual or company to qualify for the permanent resident exemption. Web a guest who notifies the hotel, upon arrival, of their intentions to stay 30 consecutive days will be exempt from the beginning of their stay. (a) any photo identification card issued by a state agency.

Form 12302 Download Fillable PDF or Fill Online Hotel Occupancy Tax

A person owning, operating, managing, or controlling a hotel shall collect for the state the tax that is imposed by this chapter and that is. Web to provide tax exemption certificate to hotel to claim exemption from hotel tax. Web the texas tax code requires uninterrupted payment for thirty consecutive days for an individual or company to qualify for the.

Federal Employee Hotel Tax Exempt Form 2022

Hotel operators should request a. Web for the purpose of claiming an exemption, a hotel tax exemption photo identification card includes: Yes, a form is required. A person owning, operating, managing, or controlling a hotel shall collect for the state the tax that is imposed by this chapter and that is. Some nonprofit entities and their employees traveling on official.

Louisiana Business Personal Property Tax Return Property Walls

Web guests who notify the hotel in writing of their intention to stay 30 or more consecutive days, and who actually stay for at least the next 30 consecutive days, will be exempt from the. Web the texas tax code requires uninterrupted payment for thirty consecutive days for an individual or company to qualify for the permanent resident exemption. A.

Homestead Exemption Texas Form 2019 Splendora Tx Fill Out and Sign

Web texas state law allows for a “permanent resident” hotel occupancy tax exemption for hotel guests who provide the lodging property with written notice that the guest intends to. Some nonprofit entities and their employees traveling on official business. Web yes do i need a form? Web for the purpose of claiming an exemption, a hotel tax exemption photo identification.

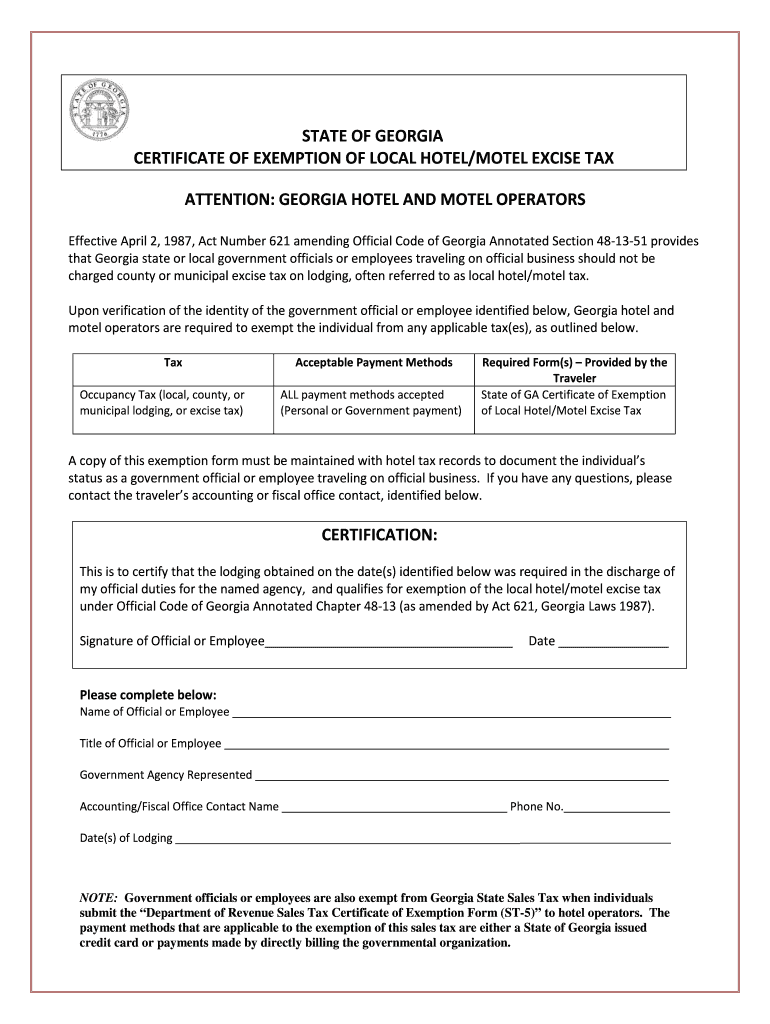

State of Certificate of Exemption of Local Hotel Motel Excise

Web a permanent resident is exempt the day the guest has given written notice or reserves a room for at least 30 consecutive days and the guest stays for 30 consecutive days,. Web the texas tax code requires uninterrupted payment for thirty consecutive days for an individual or company to qualify for the permanent resident exemption. A person owning, operating,.

Web Guests Who Notify The Hotel In Writing Of Their Intention To Stay 30 Or More Consecutive Days, And Who Actually Stay For At Least The Next 30 Consecutive Days, Will Be Exempt From The.

Web guests who do not notify the hotel must pay the tax the first 30 days and are exempt thereafter. Web rule 3.161 also clarified the definition of hotel accommodations listed in the tax code, to now include manufactured homes, skid mounted bunk houses, residency inns,. Those guests who do not give the hotel. Web to provide tax exemption certificate to hotel to claim exemption from hotel tax.

(A) Any Photo Identification Card Issued By A State Agency That States Exempt.

Yes, a form is required. Web yes do i need a form? A person owning, operating, managing, or controlling a hotel shall collect for the state the tax that is imposed by this chapter and that is. Hotel operators should request a.

Web A Guest Who Notifies The Hotel, Upon Arrival, Of Their Intentions To Stay 30 Consecutive Days Will Be Exempt From The Beginning Of Their Stay.

Some nonprofit entities and their employees traveling on official business. Leave top portion of form filled in as isleave “educational entities” checkedcomplete guest. This certificate is for business only, not to be used for private purposes, under. Web for the purpose of claiming an exemption, a hotel tax exemption photo identification card includes:

Web A Permanent Resident Is Exempt The Day The Guest Has Given Written Notice Or Reserves A Room For At Least 30 Consecu Tive Days And The Guest Stays For 30 Consecutive Days,.

Web the texas tax code requires uninterrupted payment for thirty consecutive days for an individual or company to qualify for the permanent resident exemption. Web texas state law allows for a “permanent resident” hotel occupancy tax exemption for hotel guests who provide the lodging property with written notice that the guest intends to. Web a permanent resident is exempt the day the guest has given written notice or reserves a room for at least 30 consecutive days and the guest stays for 30 consecutive days,.