2022 Form 8995-A

2022 Form 8995-A - The deduction can be taken in addition to the. This form is for income earned in tax year 2022, with tax returns due in april 2023. Do you have a turbotax online account? The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. Attach additional worksheets when needed. Web written by a turbotax expert • reviewed by a turbotax cpa. 1 (a) trade, business, or. Web for 2022, the qualified business net loss carryforward and the qualified reit dividends and qualified ptp loss carryforward from 2021entered on 2022 federal form 8995, lines 3 or. Web get the 8995 tax form and fill out qbid for the 2022 year. Updated for tax year 2022 • february 2, 2023 04:34 pm.

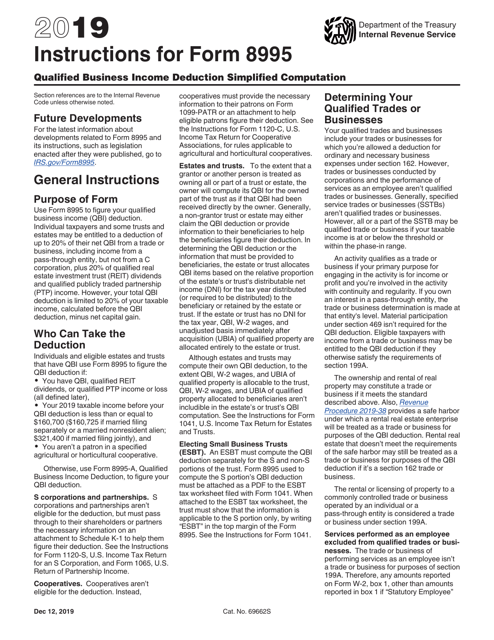

Web form 8995 is the simplified form and is used if all of the following are true: To enter the qualified business loss carryover on form 8995, line 16, do the following: Web written by a turbotax expert • reviewed by a turbotax cpa. Web we last updated federal 8995 in january 2023 from the federal internal revenue service. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web when will 2022 schedule a and form 8995 be available in turbo tax? Web information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on how to file. Steps to complete the federal form 8995 accurately. In this article, we’ll review. Use separate schedules a, b, c, and/or d, as.

1 (a) trade, business, or. Web we last updated federal 8995 in january 2023 from the federal internal revenue service. Include the following schedules (their specific instructions are shown later), as appropriate:. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. To enter the qualified business loss carryover on form 8995, line 16, do the following: In this article, we’ll review. Web for 2022, the qualified business net loss carryforward and the qualified reit dividends and qualified ptp loss carryforward from 2021entered on 2022 federal form 8995, lines 3 or. Web tax form 8995 for 2022 is especially relevant, as it helps taxpayers take maximum advantage of the new tax laws. Web written by a turbotax expert • reviewed by a turbotax cpa. Steps to complete the federal form 8995 accurately.

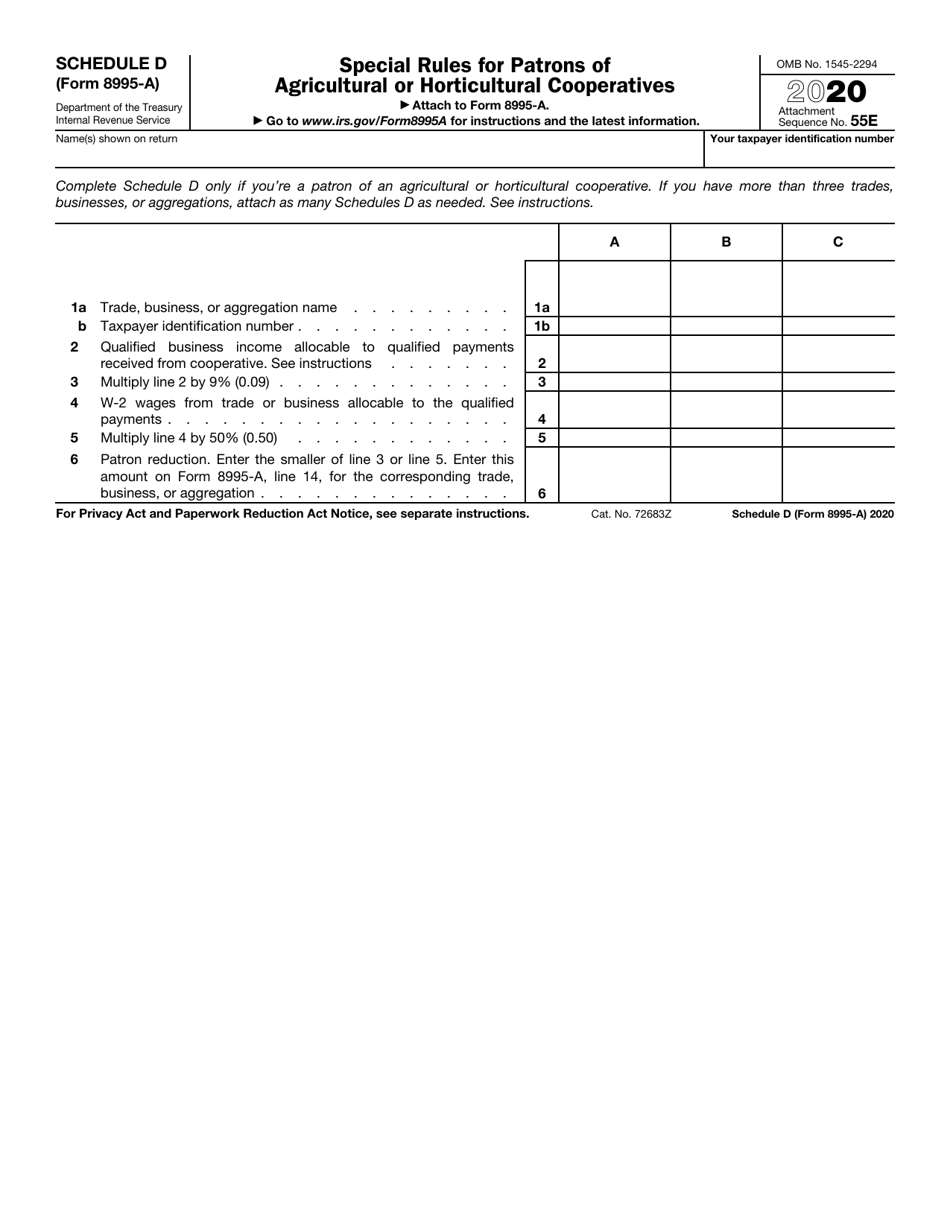

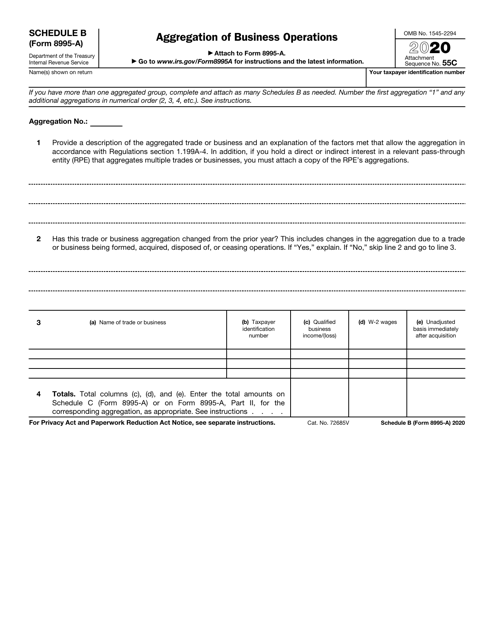

IRS Form 8995A Schedule D Download Fillable PDF or Fill Online Special

1 (a) trade, business, or. We'll help you get started or pick up where you. The deduction can be taken in addition to the. Web the qualified business income deduction (qbi) deduction is worth up to 20% of qualified net business income. Web for 2022, the qualified business net loss carryforward and the qualified reit dividends and qualified ptp loss.

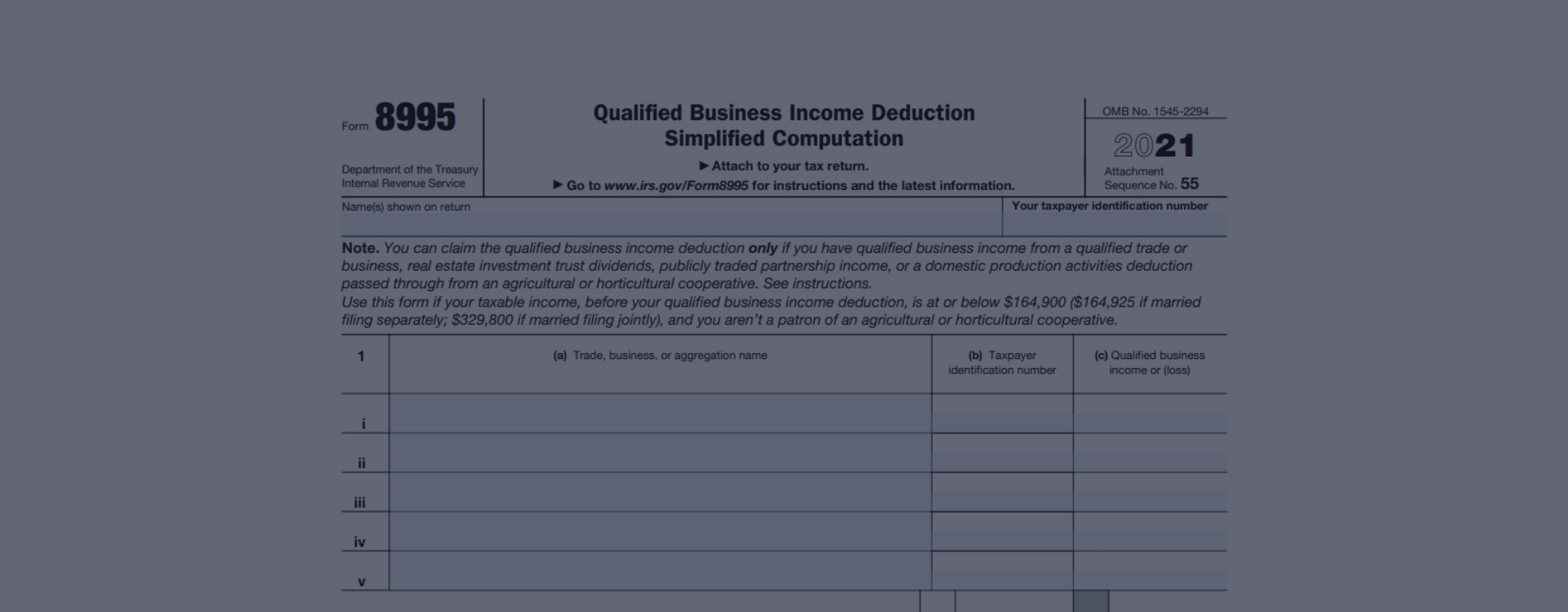

QBI gets 'formified'

This form is for income earned in tax year 2022, with tax returns due in april 2023. 1 (a) trade, business, or. Do you have a turbotax online account? Updated for tax year 2022 • february 2, 2023 04:34 pm. Use this form to figure your qualified business income deduction.

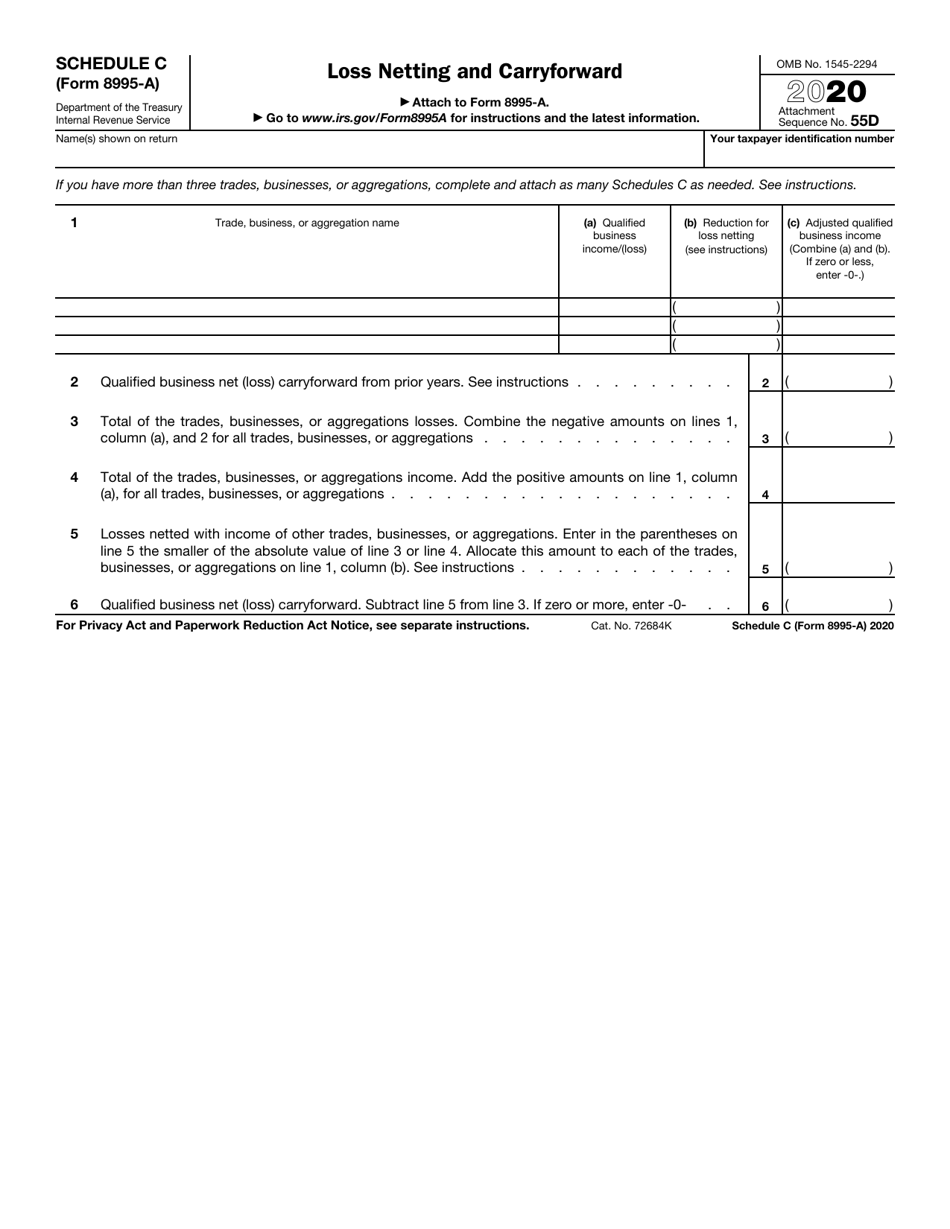

IRS Form 8995A Schedule C Download Fillable PDF or Fill Online Loss

We'll help you get started or pick up where you. The deduction can be taken in addition to the. Include the following schedules (their specific instructions are shown later), as appropriate:. Updated for tax year 2022 • february 2, 2023 04:34 pm. Use this form to figure your qualified business income deduction.

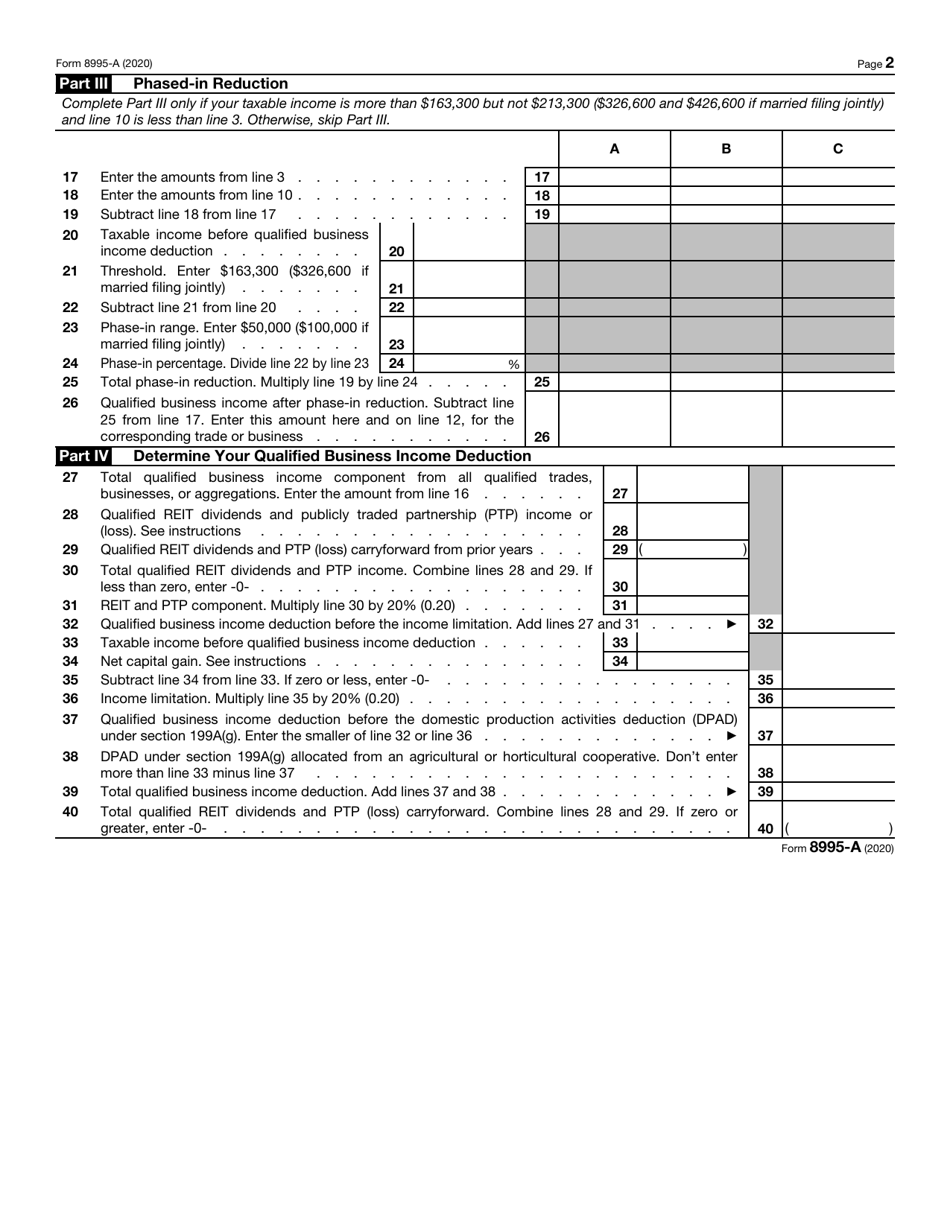

IRS Form 8995A Download Fillable PDF or Fill Online Qualified Business

The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. Attach additional worksheets when needed. 1 (a) trade, business, or. Web form 8995 is the simplified form and is used if all of the following are true: Web when will 2022 schedule a and form 8995 be available in turbo tax?

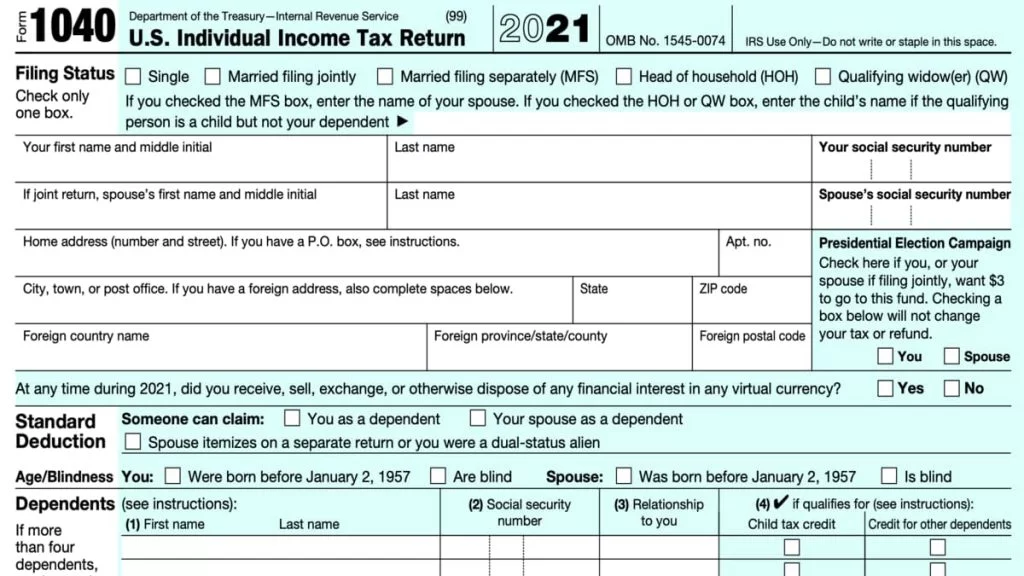

Form 1040 Instructions Booklet 2021 2022 1040 Forms TaxUni

Use this form to figure your qualified business income deduction. The deduction can be taken in addition to the. Do you have a turbotax online account? Attach additional worksheets when needed. The newest instructions for business owners & examples.

8995 Form 📝 IRS Form 8995 for Instructions Printable Sample With PDF

Web get the 8995 tax form and fill out qbid for the 2022 year. Web we last updated federal 8995 in january 2023 from the federal internal revenue service. Do you have a turbotax online account? Web the qualified business income deduction (qbi) deduction is worth up to 20% of qualified net business income. The newest instructions for business owners.

Form 8995a Qualified Business Deduction Phrase on the Sheet

Attach additional worksheets when needed. We'll help you get started or pick up where you. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web the internal revenue service (irs) created a new tax form, irs form 8995, to help provide a simplified computation of their new deduction. Steps to complete the.

Download Instructions for IRS Form 8995 Qualified Business

Web the internal revenue service (irs) created a new tax form, irs form 8995, to help provide a simplified computation of their new deduction. Web tax form 8995 for 2022 is especially relevant, as it helps taxpayers take maximum advantage of the new tax laws. This form is for income earned in tax year 2022, with tax returns due in.

IRS Form 8995A Schedule B Download Fillable PDF or Fill Online

This form is for income earned in tax year 2022, with tax returns due in april 2023. The deduction can be taken in addition to the. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. Web get the 8995 tax form and fill out qbid for the 2022 year. Updated for tax year 2022.

Form 8995A Draft WFFA CPAs

Web for 2022, the qualified business net loss carryforward and the qualified reit dividends and qualified ptp loss carryforward from 2021entered on 2022 federal form 8995, lines 3 or. Web the qualified business income deduction (qbi) deduction is worth up to 20% of qualified net business income. Web form 8995 is the simplified form and is used if all of.

Use Separate Schedules A, B, C, And/Or D, As.

Web the qualified business income deduction (qbi) deduction is worth up to 20% of qualified net business income. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. Steps to complete the federal form 8995 accurately. Do you have a turbotax online account?

Web The Internal Revenue Service (Irs) Created A New Tax Form, Irs Form 8995, To Help Provide A Simplified Computation Of Their New Deduction.

The newest instructions for business owners & examples. Web get the 8995 tax form and fill out qbid for the 2022 year. Include the following schedules (their specific instructions are shown later), as appropriate:. Web we last updated federal 8995 in january 2023 from the federal internal revenue service.

The Deduction Can Be Taken In Addition To The.

Web form 8995 is the simplified form and is used if all of the following are true: Web for 2022, the qualified business net loss carryforward and the qualified reit dividends and qualified ptp loss carryforward from 2021entered on 2022 federal form 8995, lines 3 or. In this article, we’ll review. Attach additional worksheets when needed.

1 (A) Trade, Business, Or.

Web when will 2022 schedule a and form 8995 be available in turbo tax? Use this form to figure your qualified business income deduction. Web information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on how to file. Web written by a turbotax expert • reviewed by a turbotax cpa.