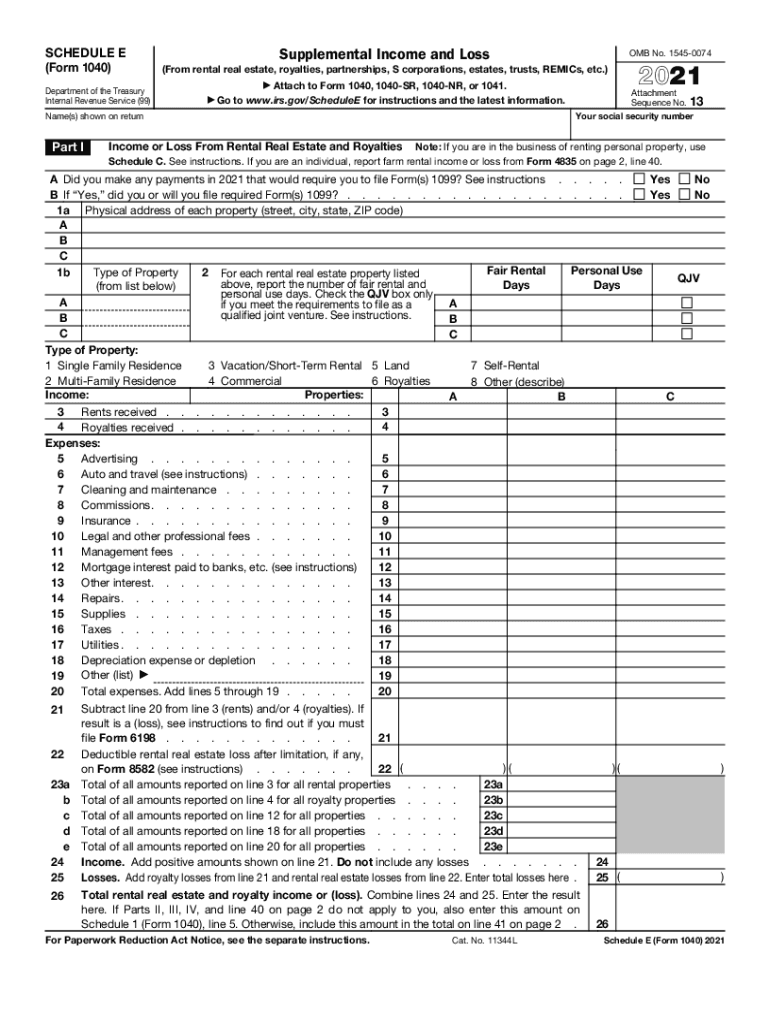

2021 Schedule E Form

2021 Schedule E Form - Web updated for tax year 2022 • june 2, 2023 08:40 am overview if you earn rental income on a home or building you own, receive royalties or have income reported. If you are a real estate investor or. Include photos, crosses, check and text boxes, if it is supposed. Complete, edit or print tax forms instantly. Interests in partnerships and s. Irs form 1040 schedule e (2021) is used to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. Web use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in remics. Try it for free now! Web schedule e is a tax form that you will complete and attach to form 1040. Complete, edit or print tax forms instantly.

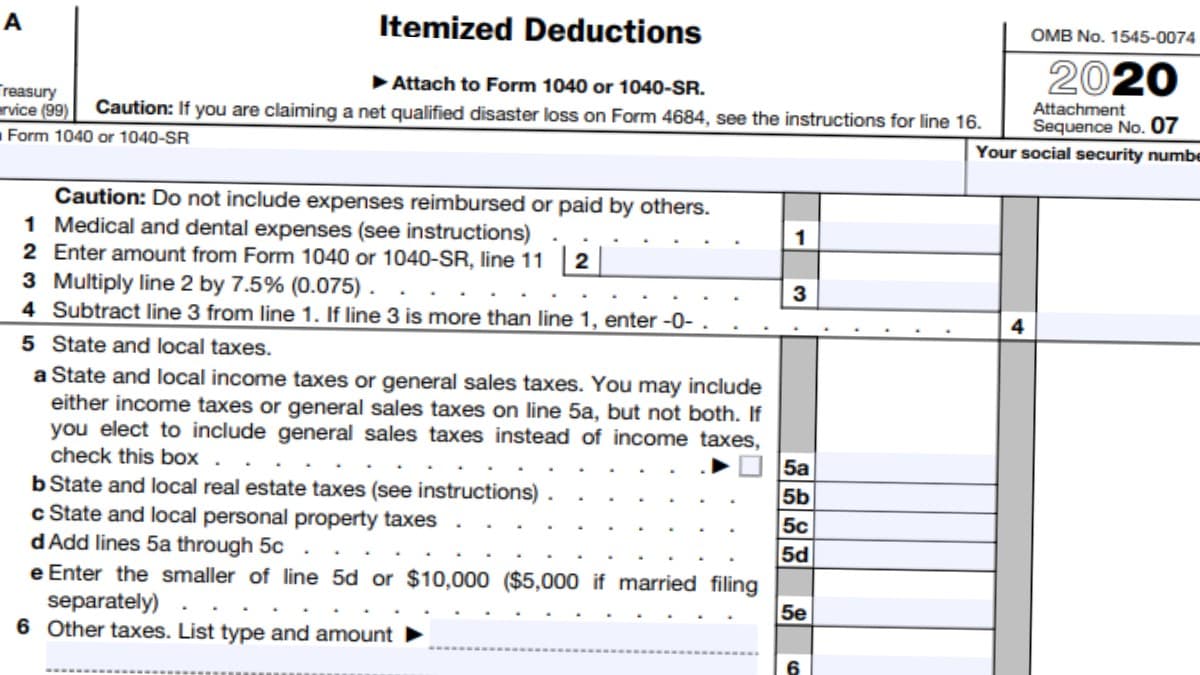

Web schedule e(form 1040) department of the treasury internal revenue service (99) supplemental income and loss (from rental real estate, royalties, partnerships, s. Web use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in remics. Web schedule e (form 1040) 2022: Web schedule e is a tax form that you will complete and attach to form 1040. You will use part i of schedule e to report rental and royalty income and part ii of. If you are a real estate investor or. Web updated for tax year 2022 • june 2, 2023 08:40 am overview if you earn rental income on a home or building you own, receive royalties or have income reported. Try it for free now! Please use the link below. Web open the file in our advanced pdf editor.

Upload, modify or create forms. Web federal supplemental income and loss 1040 (schedule e) pdf form content report error it appears you don't have a pdf plugin for this browser. Web use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in remics. You will use part i of schedule e to report rental and royalty income and part ii of. Try it for free now! This form is for income earned in tax year 2022, with tax returns. 71397a schedule e (form 5471) (rev. Complete, edit or print tax forms instantly. Please use the link below. Find tax calculators and tax forms for all.

2020 2021 form 1040 schedule e Fill Online, Printable, Fillable

Irs form 1040 schedule e (2021) is used to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. August social security checks are getting disbursed this week for recipients who've. Web we last updated federal 1040 (schedule e) in december 2022 from the federal internal revenue service. Web federal supplemental income and loss.

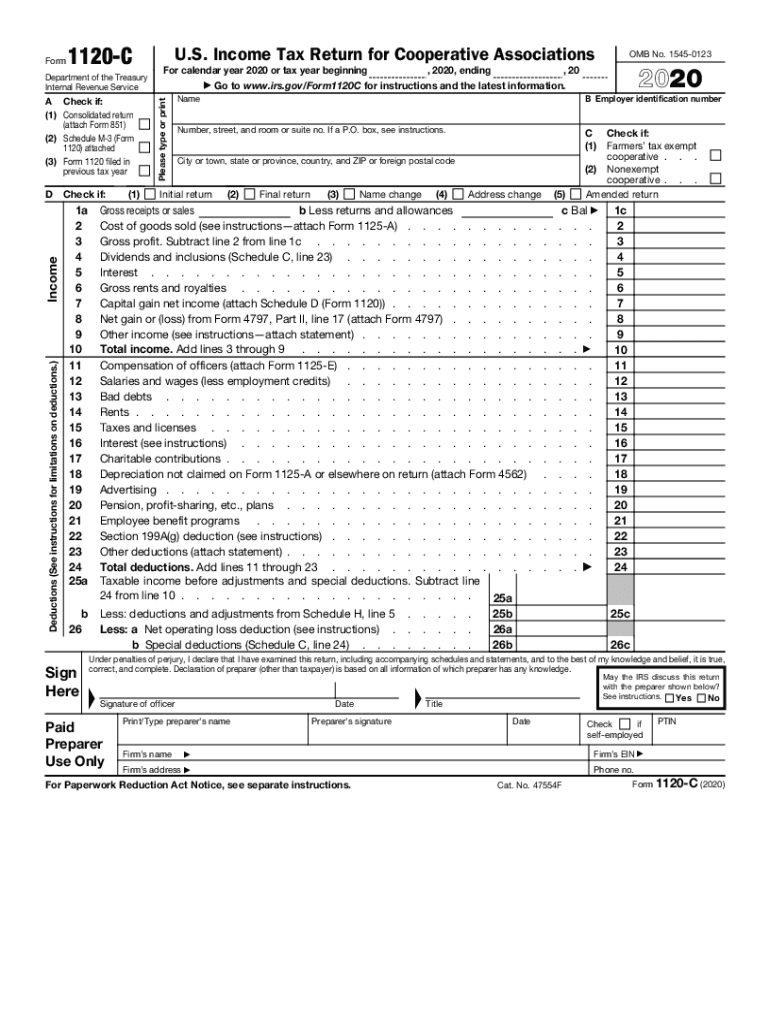

2020 Form IRS 1120C Fill Online, Printable, Fillable, Blank pdfFiller

This form is for income earned in tax year 2022, with tax returns. Web schedule e (form 1040) department of the treasury internal revenue service (99) supplemental income and loss (from rental real estate, royalties, partnerships, s. Web schools schedule e (form 990) schools omb no. Irs form 1040 schedule e (2021) is used to report income or loss from.

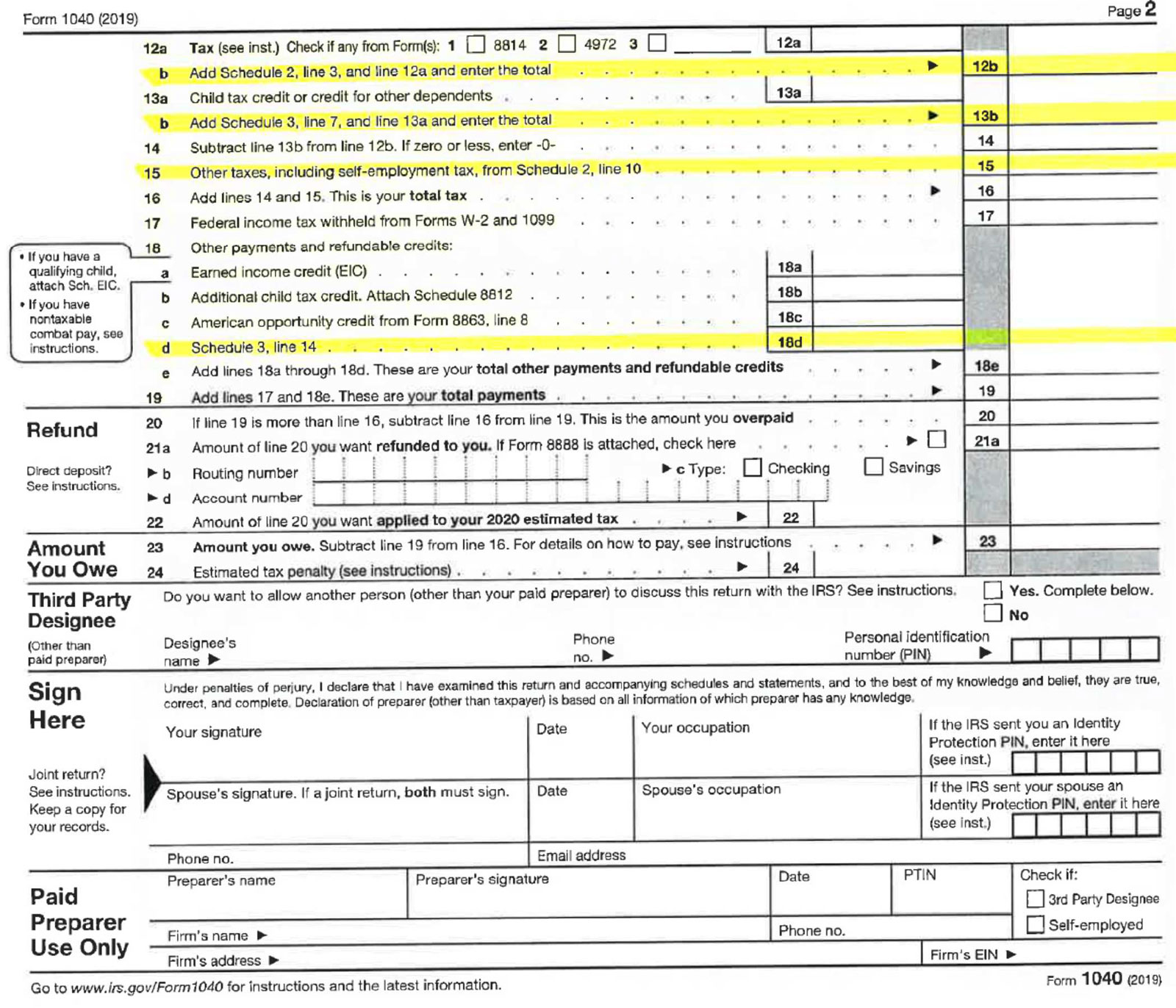

Do you need to submit a schedule 1, 2, and 3 along with your 1040 Tax

Do not enter name and social security number if shown on other side. Please use the link below. Web march 02, 2023 what is the irs schedule e: 71397a schedule e (form 5471) (rev. Web federal supplemental income and loss 1040 (schedule e) pdf form content report error it appears you don't have a pdf plugin for this browser.

2020 2021 Schedule B Interest And Ordinary Dividends 1040 Form

Web march 02, 2023 what is the irs schedule e: Web federal supplemental income and loss 1040 (schedule e) pdf form content report error it appears you don't have a pdf plugin for this browser. Try it for free now! Web schedule e is a tax form that you will complete and attach to form 1040. Interests in partnerships and.

941 schedule b 2021 Fill Online, Printable, Fillable Blank form941

Include photos, crosses, check and text boxes, if it is supposed. You will use part i of schedule e to report rental and royalty income and part ii of. Web federal supplemental income and loss 1040 (schedule e) pdf form content report error it appears you don't have a pdf plugin for this browser. Do not enter name and social.

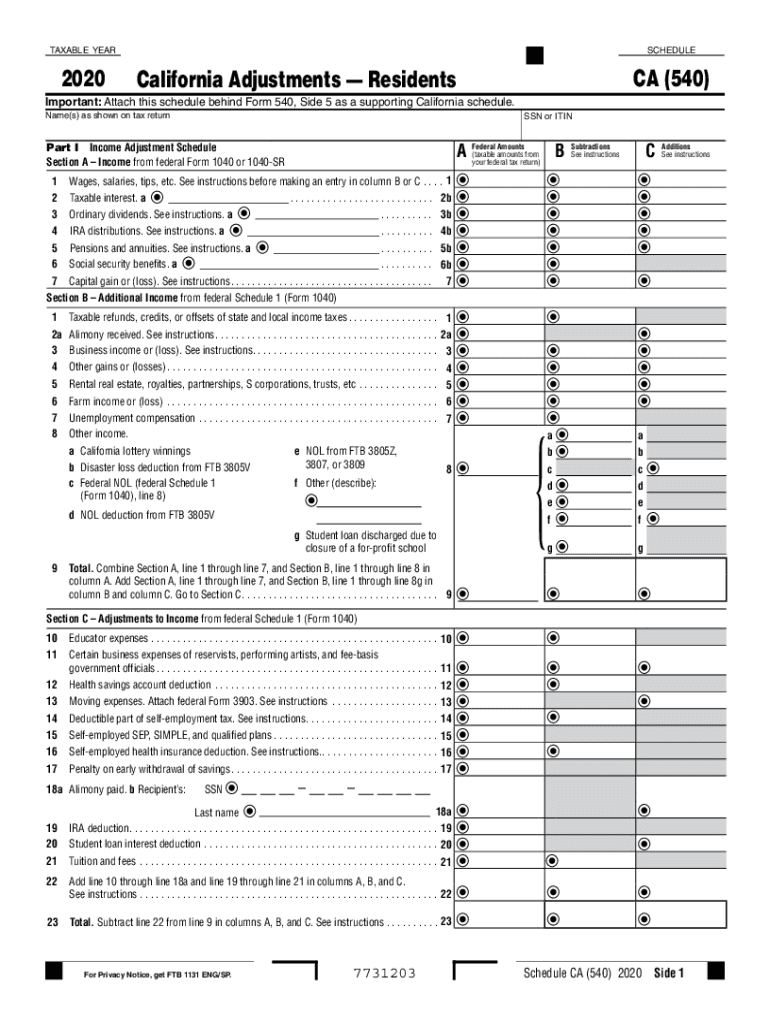

CA FTB Schedule CA (540) 20202022 Fill out Tax Template Online US

Please use the link below. If you are a real estate investor or. This form is for income earned in tax year 2022, with tax returns. Web open the file in our advanced pdf editor. Web schedule e is the form you use to report supplemental income you earn from any of the following sources:

2021 Form IRS 1040 Schedule E Fill Online, Printable, Fillable, Blank

Web updated for tax year 2022 • june 2, 2023 08:40 am overview if you earn rental income on a home or building you own, receive royalties or have income reported. Irs form 1040 schedule e (2021) is used to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. Web we last updated.

2020 2021 Form 1040 Individual Tax Return 1040 Form

Irs form 1040 schedule e (2021) is used to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. Interests in partnerships and s. Web information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on how to file. If you are a real estate investor or..

2021 schedule for website CAGS

Irs form 1040 schedule e (2021) is used to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. Web schedule e is a tax form that you will complete and attach to form 1040. Upload, modify or create forms. Web schedule e(form 1040) department of the treasury internal revenue service (99) supplemental income.

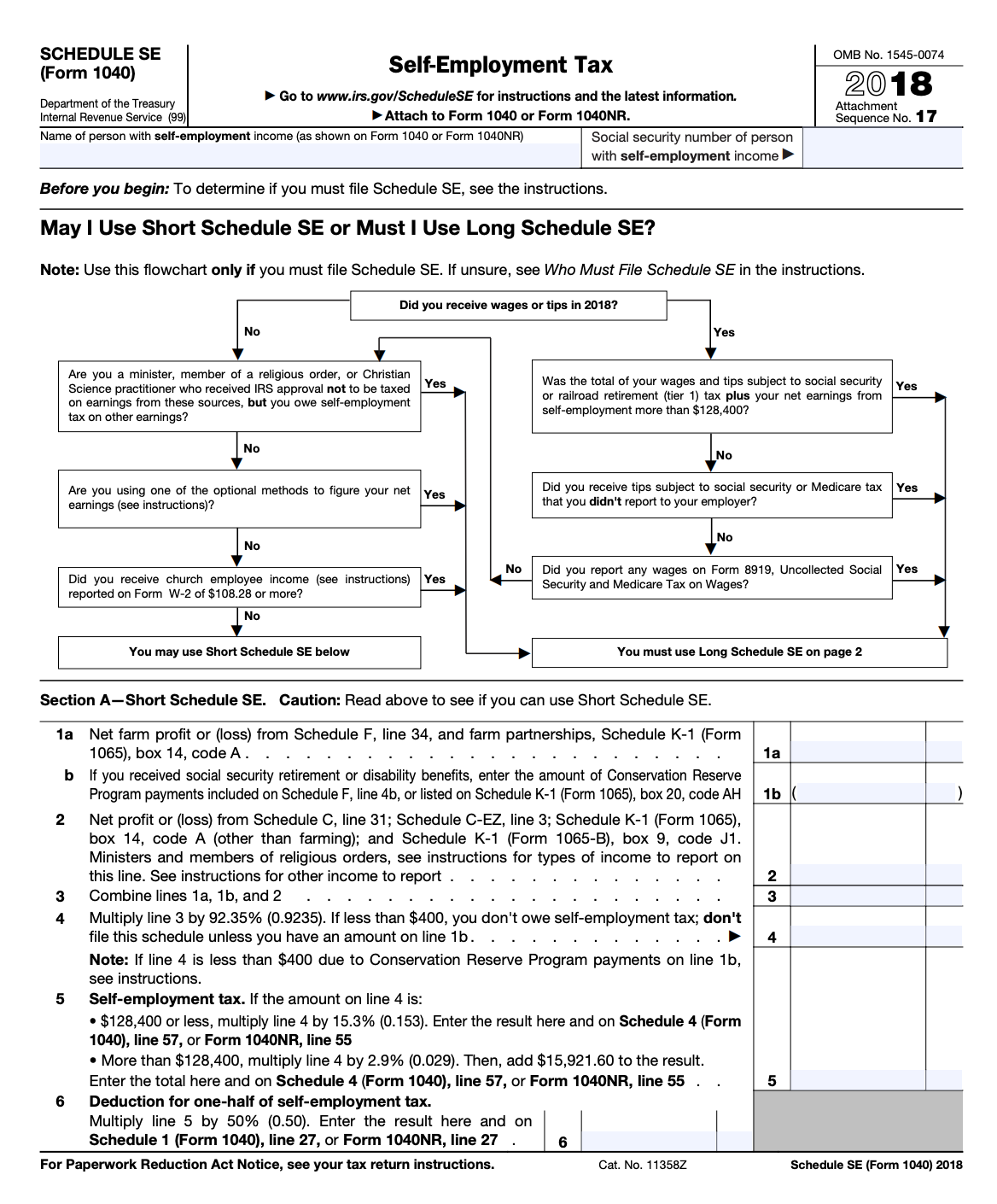

Schedule SE A Simple Guide to Filing the SelfEmployment Tax Form

Schedule e is used to. August social security checks are getting disbursed this week for recipients who've. Web schedule e is the form you use to report supplemental income you earn from any of the following sources: Irs form 1040 schedule e (2021) is used to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts,.

Web Schools Schedule E (Form 990) Schools Omb No.

August social security checks are getting disbursed this week for recipients who've. Please use the link below. You will use part i of schedule e to report rental and royalty income and part ii of. This form is for income earned in tax year 2022, with tax returns.

Web Updated For Tax Year 2022 • June 2, 2023 08:40 Am Overview If You Earn Rental Income On A Home Or Building You Own, Receive Royalties Or Have Income Reported.

Web federal supplemental income and loss 1040 (schedule e) pdf form content report error it appears you don't have a pdf plugin for this browser. 71397a schedule e (form 5471) (rev. If you are a real estate investor or. Do not enter name and social security number if shown on other side.

Web Use Schedule E (Form 1040) To Report Income Or Loss From Rental Real Estate, Royalties, Partnerships, S Corporations, Estates, Trusts, And Residual Interests In Remics.

Find tax calculators and tax forms for all. Complete, edit or print tax forms instantly. Web open the file in our advanced pdf editor. Web march 02, 2023 what is the irs schedule e:

Include Photos, Crosses, Check And Text Boxes, If It Is Supposed.

Web use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in remics. Web schedule e (form 1040) department of the treasury internal revenue service (99) supplemental income and loss (from rental real estate, royalties, partnerships, s. Irs form 1040 schedule e (2021) is used to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. Interests in partnerships and s.