2021 Form 943

2021 Form 943 - For 2021, the rate of social security tax on taxable wages, except for qualified sick leave wages and qualified. Web up to $32 cash back form 943, employer’s annual federal tax return for agricultural employees, is used to report federal income tax, social security and medicare. Easily fill out pdf blank, edit, and sign them. Ad access irs tax forms. Edit, sign or email irs 943 & more fillable forms, register and subscribe now! However, if you made deposits on time in full payment of the taxes due for the year, you can file the return by. The rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in 2022 for. Try it for free now! If you don’t already have an ein, you can. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file.

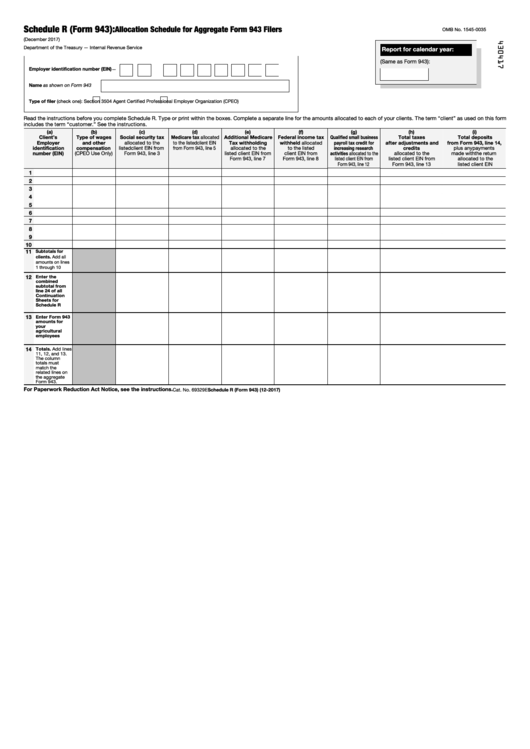

If you don’t already have an ein, you can. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. Web social security and medicare tax for 2022. Form 943, is the employer's. Employer's annual federal tax return for agricultural employees 2021 11/03/2021 form 943 (schedule r) allocation schedule for aggregate. Web to fill out form 943, you need your employer identification number (ein), your legal name, and your business address. Employer’s annual federal tax return for agricultural employees. Web the 2021 form 943 is due on january 31, 2022. Exception for exempt organizations, federal,. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022.

• enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your. Employer's annual federal tax return for agricultural employees 2021 11/03/2021 form 943 (schedule r) allocation schedule for aggregate. Get ready for tax season deadlines by completing any required tax forms today. Web 2021 11/18/2021 form 943: Edit, sign or email irs 943 & more fillable forms, register and subscribe now! It is used to record how much income tax,. Complete, edit or print tax forms instantly. The instructions include five worksheets similar to those in form. However, if you made deposits on time in full payment of the taxes due for the year, you can file the return by. The rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in 2022 for.

Fill Free fillable F943apr Form 943 APR (Rev. October 2017) PDF form

Exception for exempt organizations, federal,. Employer's annual federal tax return for agricultural employees 2021 11/03/2021 form 943 (schedule r) allocation schedule for aggregate. Web see purpose of form 943, earlier, for household employee information. • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your. Web.

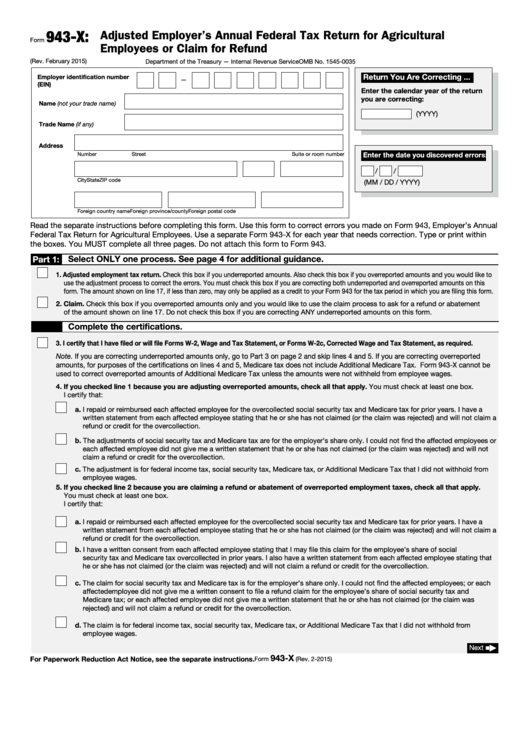

Fill Free fillable F943x Accessible Form 943X (Rev. February 2018

The instructions include five worksheets similar to those in form. It is used to record how much income tax,. Save or instantly send your ready documents. Department of the treasury internal revenue service. Web the 2021 form 943 is due on january 31, 2022.

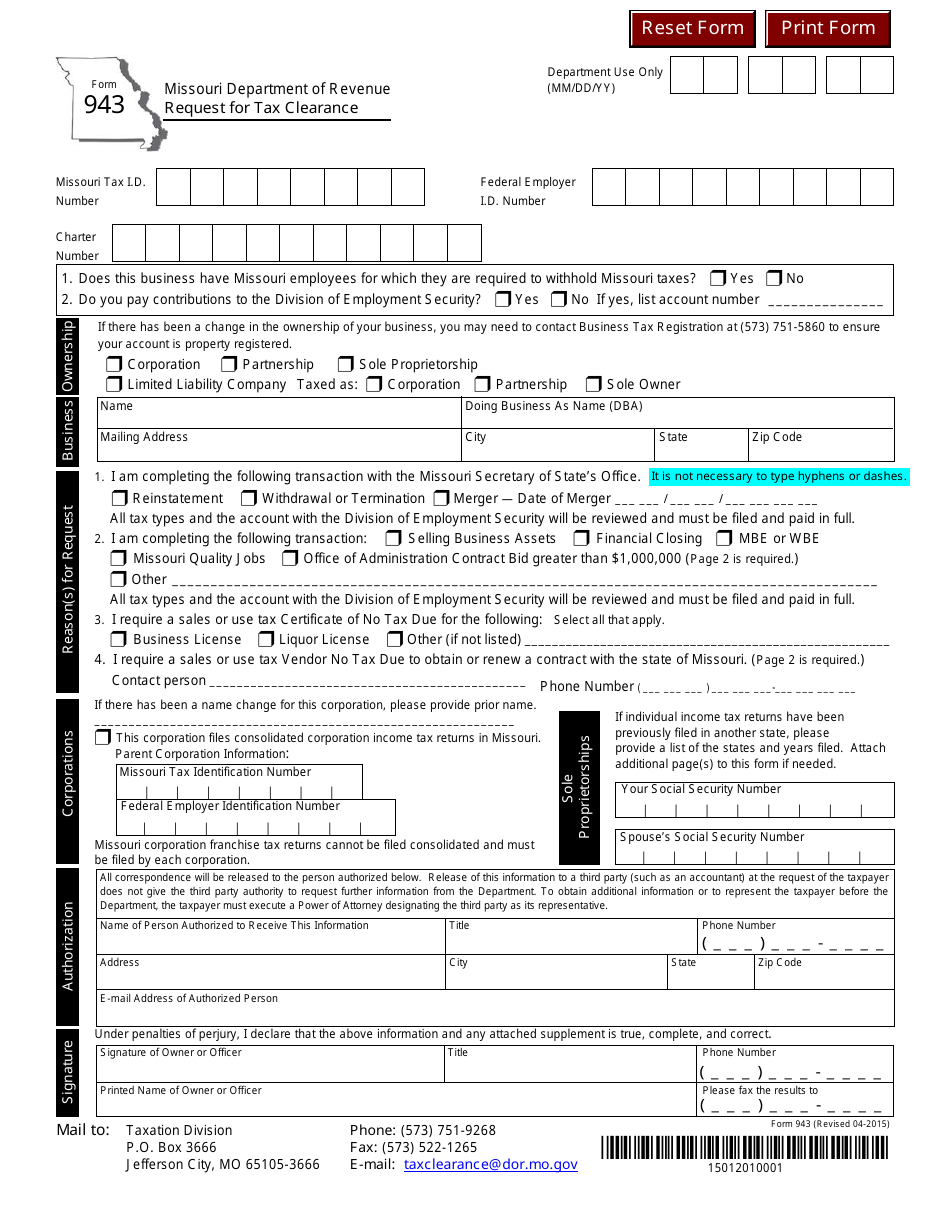

Form 943 Download Fillable PDF or Fill Online Request for Tax Clearance

Web see purpose of form 943, earlier, for household employee information. Exception for exempt organizations, federal,. Web social security and medicare tax for 2022. Web 2021 11/18/2021 form 943: • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your.

Fillable Schedule R (Form 943) Allocation Schedule For Aggregate Form

• enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your. Web the 2021 form 943 is due on january 31, 2022. The final version did not contain any changes from the draft. Get ready for tax season deadlines by completing any required tax forms today..

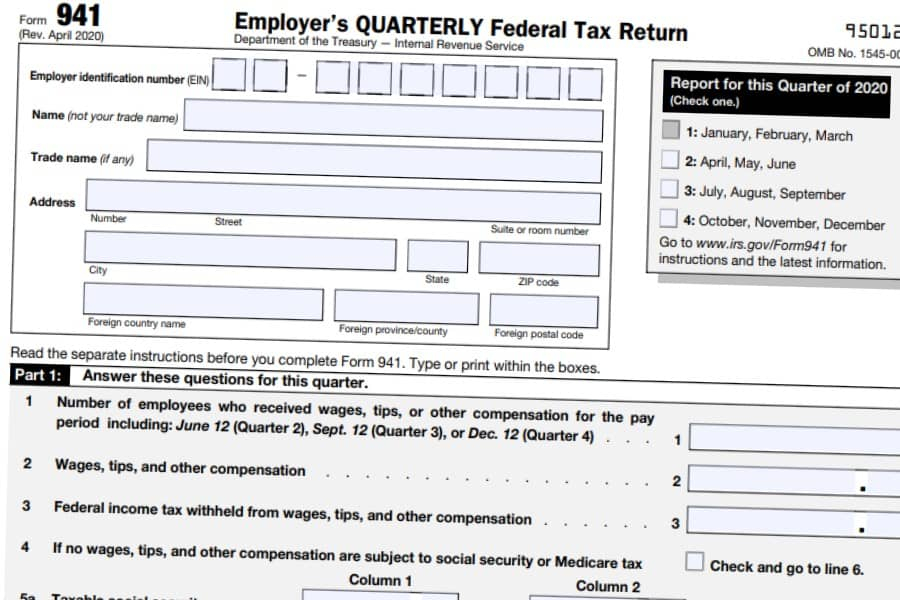

Printable 941 Tax Form 2021 Printable Form 2022

Web see purpose of form 943, earlier, for household employee information. It is used to record how much income tax,. The final version did not contain any changes from the draft. Web to fill out form 943, you need your employer identification number (ein), your legal name, and your business address. Department of the treasury internal revenue service.

2021 Form MO DoR 943 Fill Online, Printable, Fillable, Blank pdfFiller

Finalized instructions for the 2021 form 943. Ad upload, modify or create forms. Web instructions for form 943 (pr), employer's annual federal tax return for agricultural employees (puerto rico version) 2021 01/11/2022 form 943 (schedule r) allocation. For 2021, the rate of social security tax on taxable wages, except for qualified sick leave wages and qualified. Web the irs released.

943 2011 form Fill out & sign online DocHub

Edit, sign or email irs 943 & more fillable forms, register and subscribe now! • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your. Try it for free now! Web 2021 11/18/2021 form 943: Web to fill out form 943, you need your employer identification.

Fillable Form 943X Adjusted Employer'S Annual Federal Tax Return For

Web social security and medicare tax for 2022. Web instructions for form 943 (pr), employer's annual federal tax return for agricultural employees (puerto rico version) 2021 01/11/2022 form 943 (schedule r) allocation. Web the 2021 form 943 is due on january 31, 2022. Edit, sign or email irs 943 & more fillable forms, register and subscribe now! Employer’s annual federal.

943 Form 2021 IRS Forms Zrivo

Web up to $32 cash back form 943, employer’s annual federal tax return for agricultural employees, is used to report federal income tax, social security and medicare. • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your. Web to fill out form 943, you need.

Fill Free fillable F943 Accessible 2019 Form 943 PDF form

Easily fill out pdf blank, edit, and sign them. Web to fill out form 943, you need your employer identification number (ein), your legal name, and your business address. The rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in 2022 for. It is used to record how much income.

Edit, Sign Or Email Irs 943 & More Fillable Forms, Register And Subscribe Now!

Web if you do receive the credit in 2021, you are required to reduce your expenses by the amount of the credit when filing you 2021 income tax return even. If you don’t already have an ein, you can. Web instructions for form 943 (pr), employer's annual federal tax return for agricultural employees (puerto rico version) 2021 01/11/2022 form 943 (schedule r) allocation. Finalized instructions for the 2021 form 943.

Web The Irs Released Final Instructions For The 2021 Form 943.

For 2021, the rate of social security tax on taxable wages, except for qualified sick leave wages and qualified. Web up to $32 cash back form 943, employer’s annual federal tax return for agricultural employees, is used to report federal income tax, social security and medicare. Web the 2021 form 943 is due on january 31, 2022. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Employer's annual federal tax return for agricultural employees 2021 11/03/2021 form 943 (schedule r) allocation schedule for aggregate. • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. Web see purpose of form 943, earlier, for household employee information.

Form 943, Is The Employer's.

Exception for exempt organizations, federal,. Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to. Employer’s annual federal tax return for agricultural employees. The instructions include five worksheets similar to those in form.