2020 Form 8962 Instructions

2020 Form 8962 Instructions - Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year. How do i generate 8962 part v, alternative calculation for year of marriage?. This form is only used by taxpayers who. Form 8962 is used either (1) to reconcile a premium tax. Try it for free now! Name shown on your return. Web see the irs instructions for form 8962 for more information and specific allocation situations. Web medicaid & chip how to apply & enroll picking a plan check if you can change plans report income/family changes new, lower costs available health care tax forms,. Web 406 rows instructions for form 8962 (2022) instructions for form 8962. Web what is the premium tax credit (ptc)?

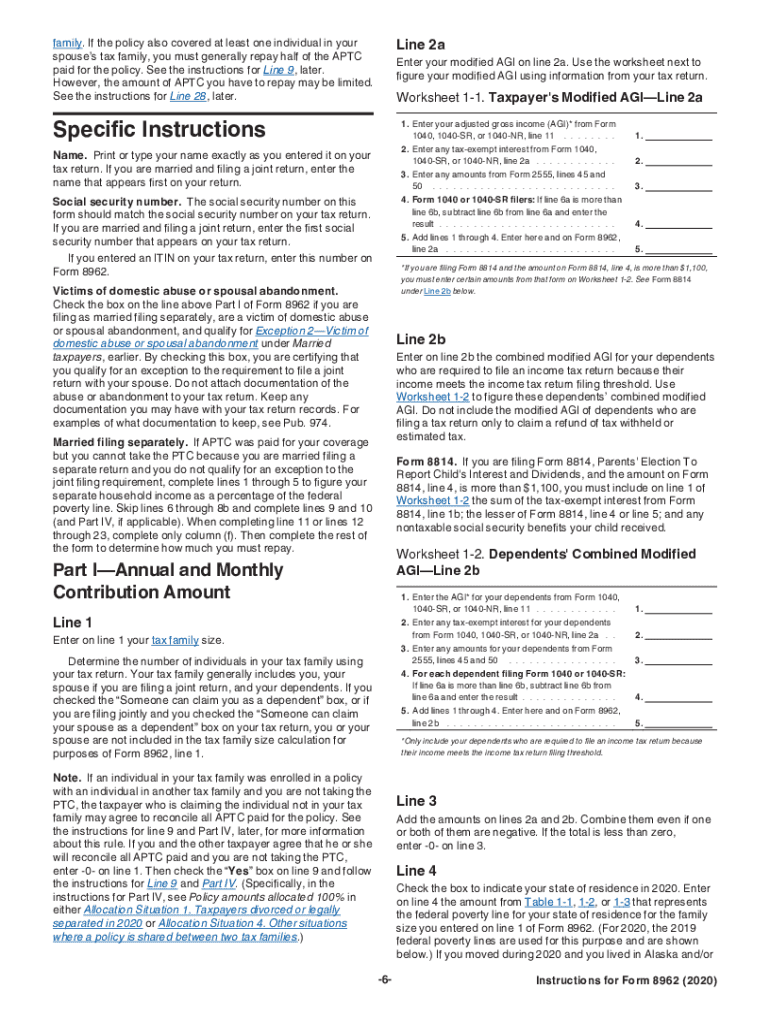

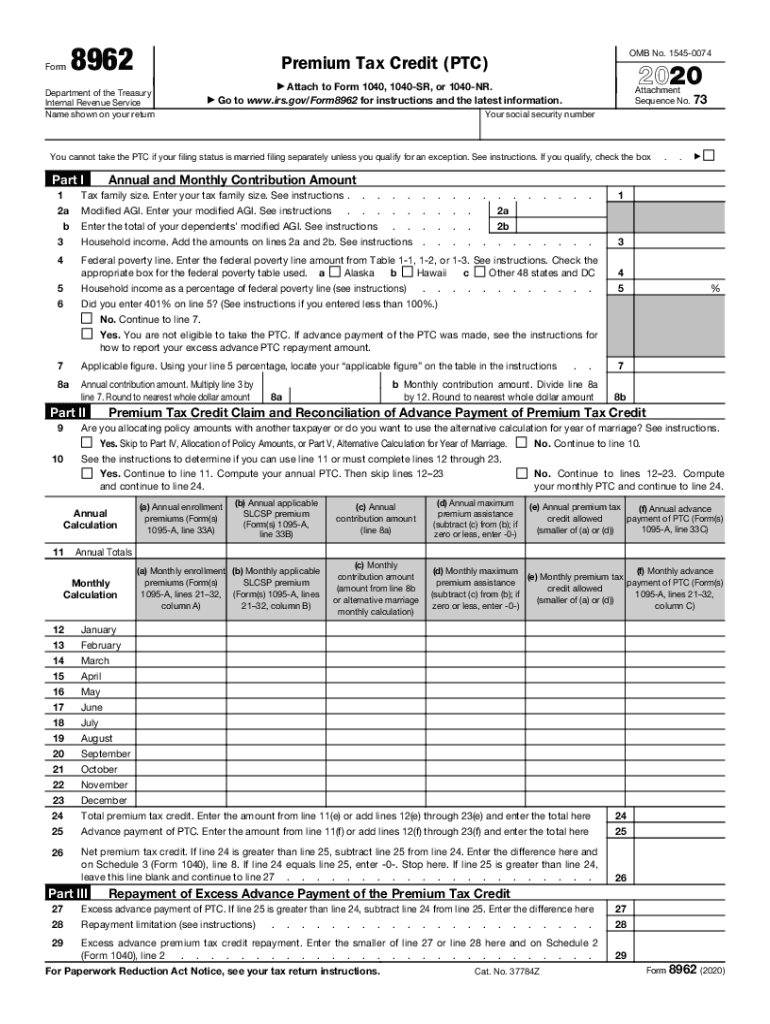

Web 406 rows instructions for form 8962 (2022) instructions for form 8962. Web see the irs instructions for form 8962 for more information and specific allocation situations. Who must file form 8962. Form 8962 is used either (1) to reconcile a premium tax. Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year. Web 20 20instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless. Web the requirement to repay excess aptc, the instructions for form 8962, premium tax credit,2 and irs fact sheet3 for more details about the changes related to. Web form 8962 at the end of these instructions. Web what is the premium tax credit (ptc)? This form is only used by taxpayers who.

Web 406 rows instructions for form 8962 (2022) instructions for form 8962. Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. Who can take the ptc. This form is only used by taxpayers who. Web medicaid & chip how to apply & enroll picking a plan check if you can change plans report income/family changes new, lower costs available health care tax forms,. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Web the purpose of form 8962 is to allow filers to calculate their premium tax credit (ptc) amount and to reconcile that amount with any advance premium tax credit (aptc). Web for instructions and the latest information. Web form 8962 at the end of these instructions. Upload, modify or create forms.

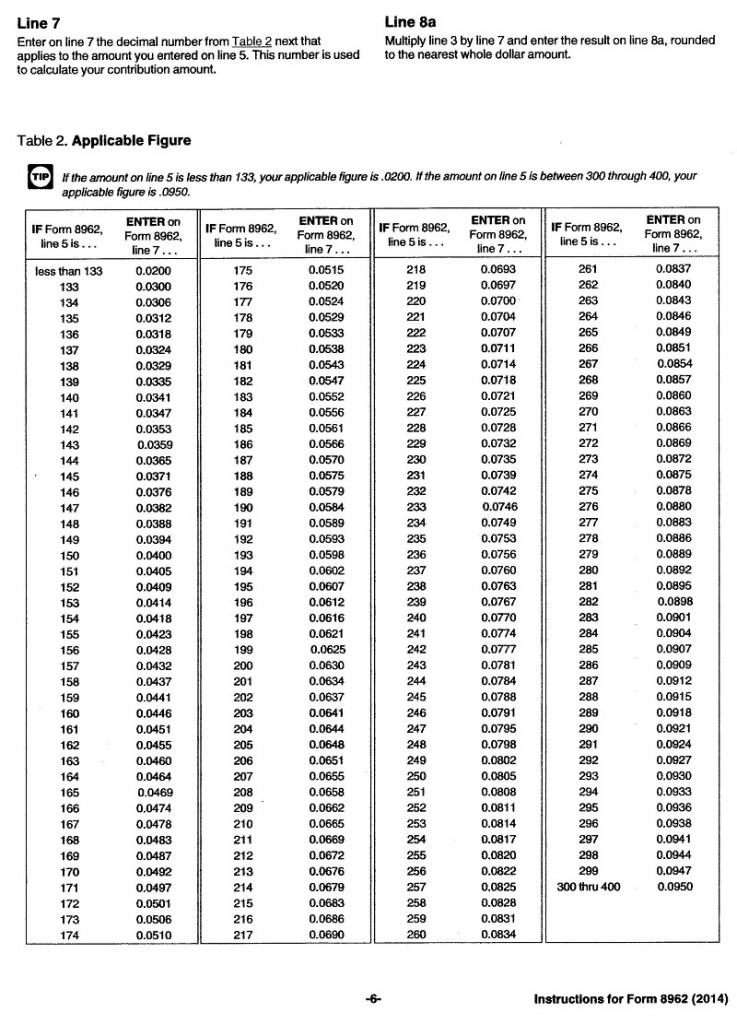

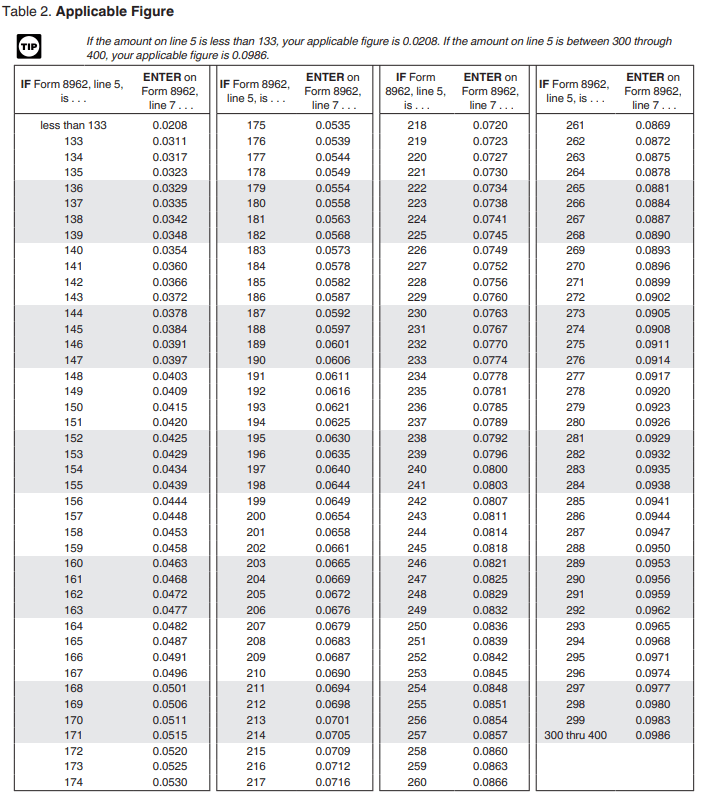

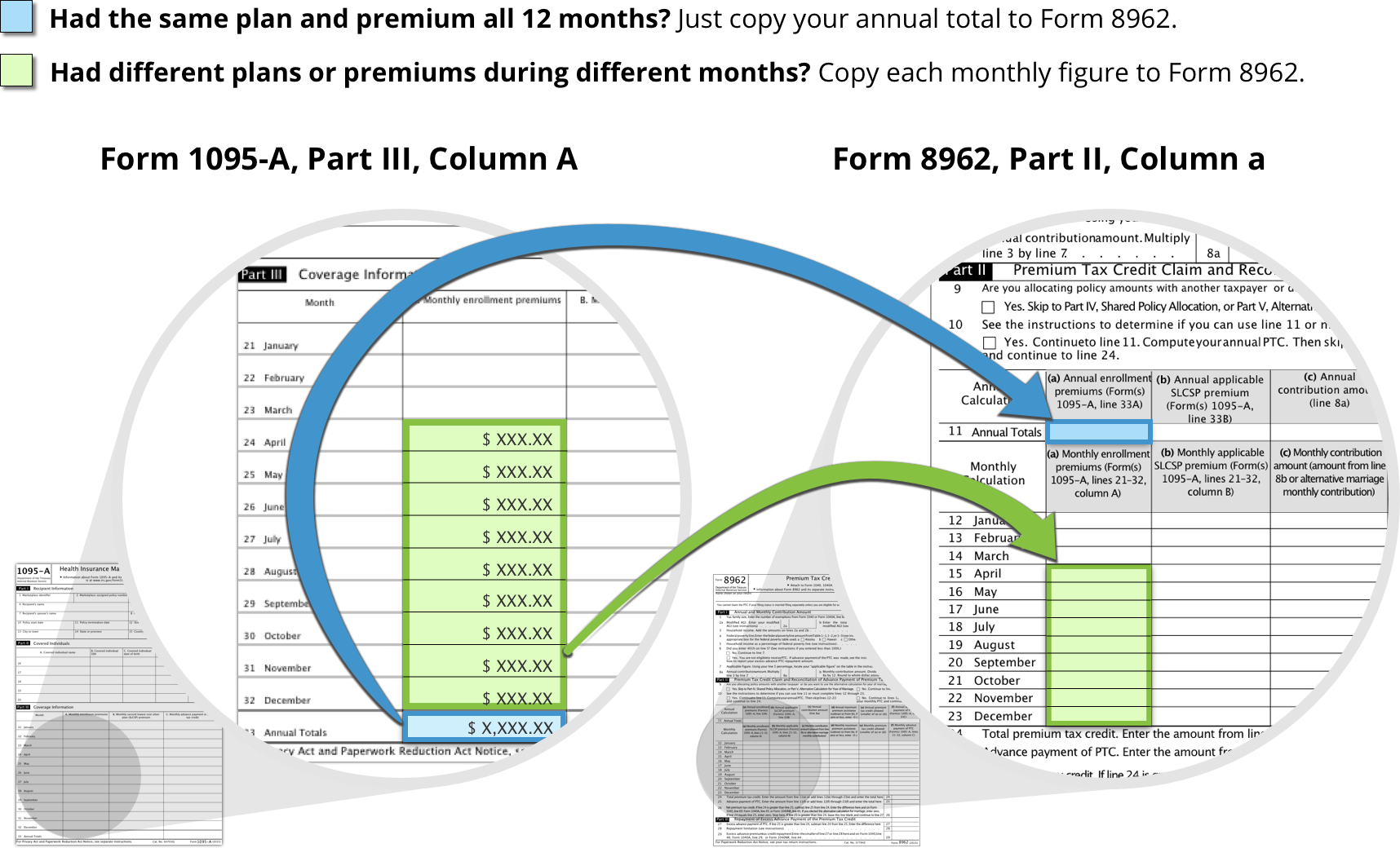

Inputs for calculating your health insurance premium assistance amount

Try it for free now! Who must file form 8962. Web the requirement to repay excess aptc, the instructions for form 8962, premium tax credit,2 and irs fact sheet3 for more details about the changes related to. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Web 406 rows instructions.

Form 8962 Fill Out and Sign Printable PDF Template signNow

The american rescue plan, signed into law on march 11, 2021, includes a provision that eliminates the requirement. Web what is the premium tax credit (ptc)? Web the requirement to repay excess aptc, the instructions for form 8962, premium tax credit,2 and irs fact sheet3 for more details about the changes related to. How do i generate 8962 part v,.

Irs form 8962 Irs form 8962 Instruction for How to Fill It Right Irs

This form is only used by taxpayers who. The american rescue plan, signed into law on march 11, 2021, includes a provision that eliminates the requirement. Additional information to help you determine if your health care coverage is minimum. Form 8962 is used either (1) to reconcile a premium tax. Reminders applicable federal poverty line.

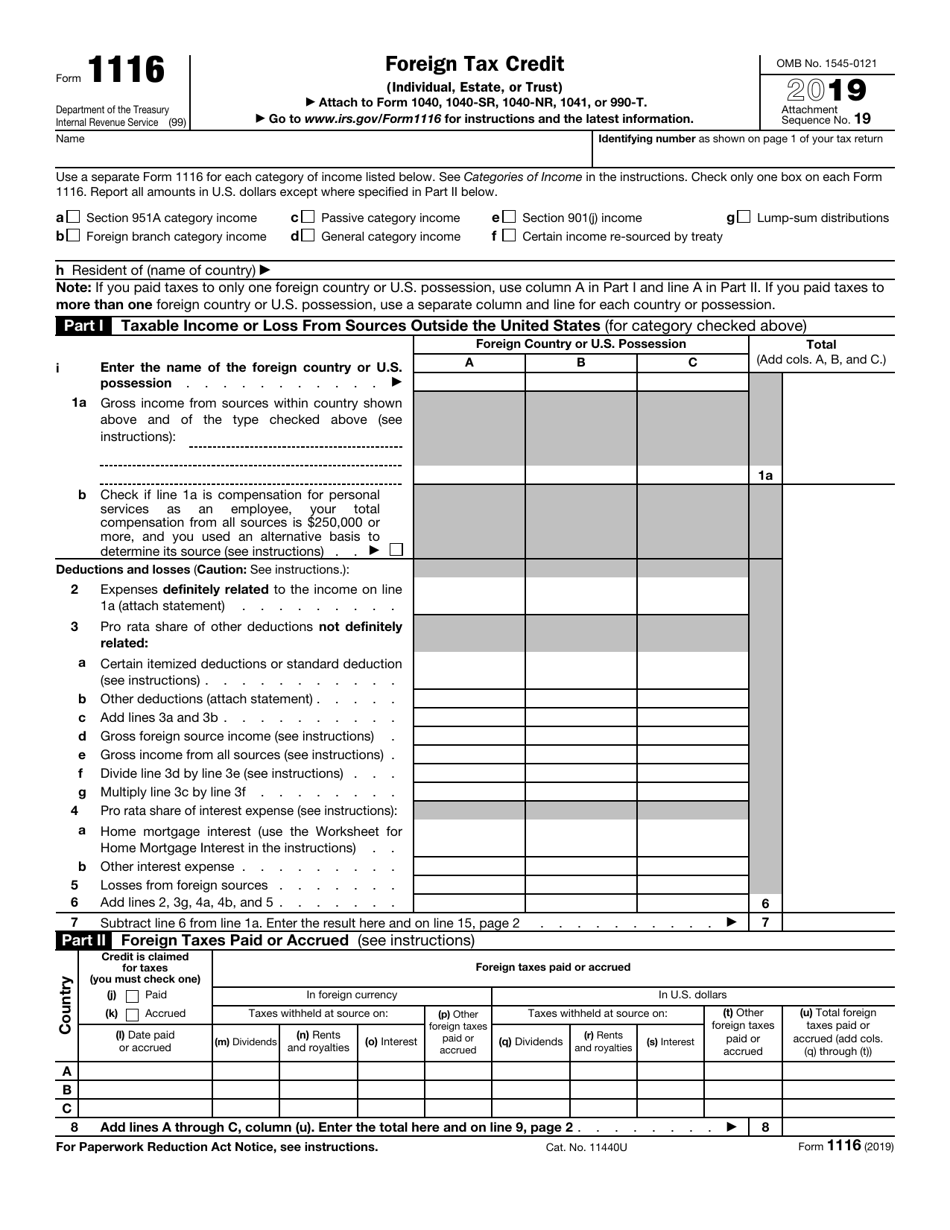

IRS Form 1116 Download Fillable PDF or Fill Online Foreign Tax Credit

Web for instructions and the latest information. Web see the irs instructions for form 8962 for more information and specific allocation situations. Web the purpose of form 8962 is to allow filers to calculate their premium tax credit (ptc) amount and to reconcile that amount with any advance premium tax credit. Web form 8962 is a form you must file.

Premium Tax Credit Form 8962 and Instructions Obamacare Facts

Form 8962 is used either (1) to reconcile a premium tax. Complete, edit or print tax forms instantly. Reminders applicable federal poverty line. Web the purpose of form 8962 is to allow filers to calculate their premium tax credit (ptc) amount and to reconcile that amount with any advance premium tax credit (aptc). Upload, modify or create forms.

irs form 8962 instructions Fill Online, Printable, Fillable Blank

Who can take the ptc. Name shown on your return. Reminders applicable federal poverty line. Web form 8962 at the end of these instructions. Web go to www.irs.gov/form8962 for instructions and the latest information.

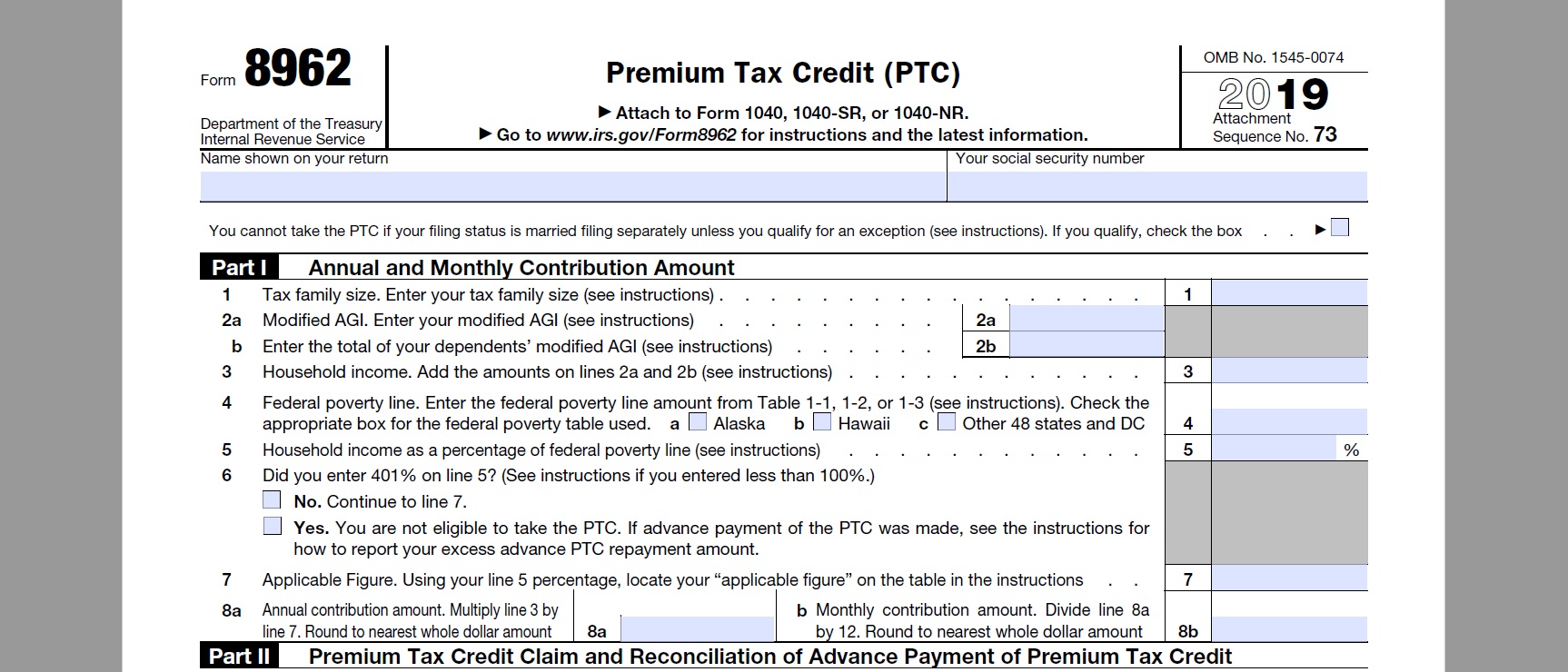

IRS 2019 Health Insurance Subsidy Tax Credit Reconciliation

Complete, edit or print tax forms instantly. Web medicaid & chip how to apply & enroll picking a plan check if you can change plans report income/family changes new, lower costs available health care tax forms,. Web for instructions and the latest information. Web form 8962 at the end of these instructions. Web the purpose of form 8962 is to.

8962 Form Fill Out and Sign Printable PDF Template signNow

Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. How do i generate 8962 part v, alternative calculation for year of marriage?. Web for instructions and the latest information. Complete, edit or print tax forms instantly. 73 name shown on your return your social.

Publication 974 (2021), Premium Tax Credit (PTC) Internal Revenue Service

Web the purpose of form 8962 is to allow filers to calculate their premium tax credit (ptc) amount and to reconcile that amount with any advance premium tax credit (aptc). Web medicaid & chip how to apply & enroll picking a plan check if you can change plans report income/family changes new, lower costs available health care tax forms,. Web.

How to reconcile your premium tax credit HealthCare.gov

Form 8962 is used either (1) to reconcile a premium tax. Web 20 20instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless. Web 406 rows instructions for form 8962 (2022) instructions for form 8962. Reminders applicable federal poverty line. Web go to www.irs.gov/form8962 for instructions.

Name Shown On Your Return.

Reminders applicable federal poverty line. Web 20 20instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless. Web 406 rows instructions for form 8962 (2022) instructions for form 8962. Web medicaid & chip how to apply & enroll picking a plan check if you can change plans report income/family changes new, lower costs available health care tax forms,.

Web What Is The Premium Tax Credit (Ptc)?

Web the purpose of form 8962 is to allow filers to calculate their premium tax credit (ptc) amount and to reconcile that amount with any advance premium tax credit. Web the requirement to repay excess aptc, the instructions for form 8962, premium tax credit,2 and irs fact sheet3 for more details about the changes related to. Web form 8962 at the end of these instructions. Who can take the ptc.

Web The Purpose Of Form 8962 Is To Allow Filers To Calculate Their Premium Tax Credit (Ptc) Amount And To Reconcile That Amount With Any Advance Premium Tax Credit (Aptc).

Web for instructions and the latest information. Form 8962 is used either (1) to reconcile a premium tax. Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. This form is only used by taxpayers who.

Try It For Free Now!

Upload, modify or create forms. 73 name shown on your return your social. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Web go to www.irs.gov/form8962 for instructions and the latest information.