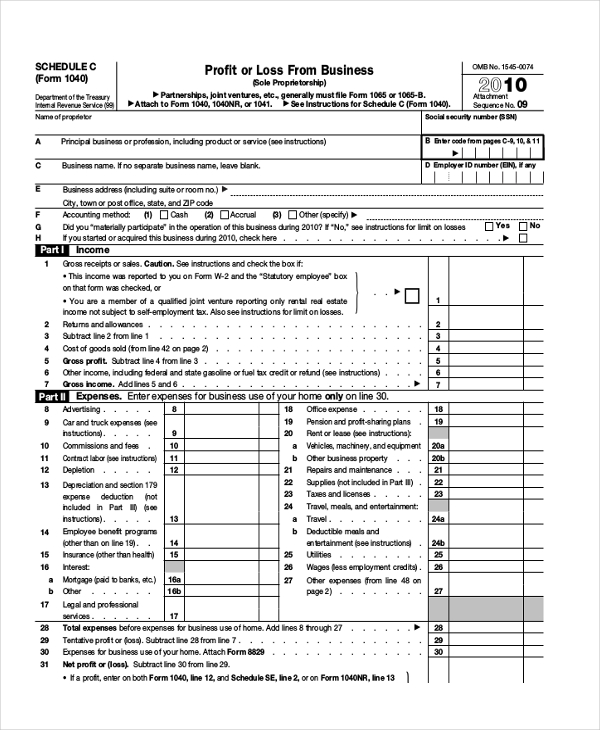

2019 Schedule C Form

2019 Schedule C Form - Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. If you’re using any other type of business structure—like an llc or partnership—you may need different forms to file your taxes. It's used by sole proprietors to let the irs know how much their business made or lost in the last year. A d cost b d lower of cost or market c d other (attach explanation) 34 was there any change in determining quantities, costs, or valuations between opening and closing inventory? Go to www.irs.gov/form8995a for instructions and the latest information. Web the schedule c is meant for sole proprietors who have made $400 or more in gross income from their business that year. All forms are printable and downloadable. Now, let’s dig into exactly what you’re reporting to the irs on schedule c. The irs uses the information in schedule c to calculate how much taxable profit you made and assess any taxes or refunds owing. Information on other service providers receiving direct or indirect compensation.

Web the schedule c is meant for sole proprietors who have made $400 or more in gross income from their business that year. Once completed you can sign your fillable form or send for signing. If you’re using any other type of business structure—like an llc or partnership—you may need different forms to file your taxes. Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; The irs uses the information in schedule c to calculate how much taxable profit you made and assess any taxes or refunds owing. Includes recent updates, related forms, and instructions on how to file. Partnerships generally must file form 1065. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity. Use fill to complete blank online others pdf forms for free. It's used by sole proprietors to let the irs know how much their business made or lost in the last year.

The irs uses the information in schedule c to calculate how much taxable profit you made and assess any taxes or refunds owing. Web the schedule c is meant for sole proprietors who have made $400 or more in gross income from their business that year. It's used by sole proprietors to let the irs know how much their business made or lost in the last year. A d cost b d lower of cost or market c d other (attach explanation) 34 was there any change in determining quantities, costs, or valuations between opening and closing inventory? Web schedule c is part of form 1040. All forms are printable and downloadable. If you’re using any other type of business structure—like an llc or partnership—you may need different forms to file your taxes. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity. Once completed you can sign your fillable form or send for signing. Partnerships generally must file form 1065.

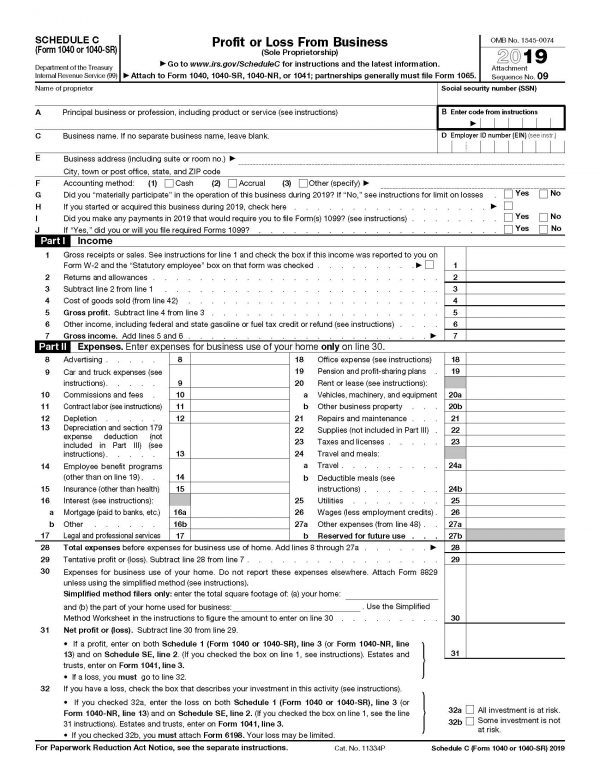

Fill Free fillable 2019 Schedule C ( Form 1040 Or 1040SR) PDF form

Web the schedule c is meant for sole proprietors who have made $400 or more in gross income from their business that year. Go to www.irs.gov/form8995a for instructions and the latest information. All forms are printable and downloadable. Once completed you can sign your fillable form or send for signing. The irs uses the information in schedule c to calculate.

How to Complete 2019 Schedule C Form 1040 Line A to J YouTube

Web schedule c is part of form 1040. Except for those persons for whom you answered “yes” to line 1a above, complete as many entries as needed to list each person receiving, directly or indirectly, $5,000 or more in total compensation Partnerships generally must file form 1065. If you’re using any other type of business structure—like an llc or partnership—you.

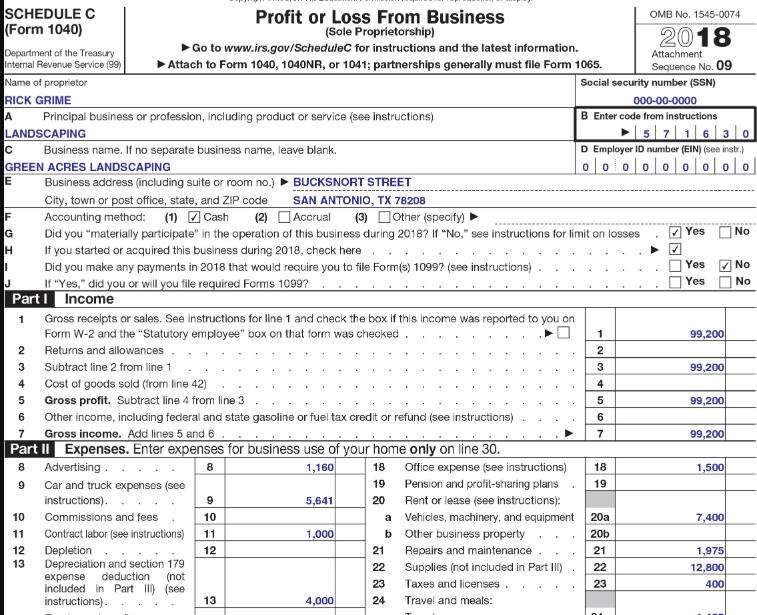

FREE 17+ Sample Schedule Forms in PDF MS Word Excel

Use fill to complete blank online others pdf forms for free. Web schedule c is part of form 1040. If you’re using any other type of business structure—like an llc or partnership—you may need different forms to file your taxes. A d cost b d lower of cost or market c d other (attach explanation) 34 was there any change.

How To Make A 1040 Schedule C 2020 Hampel Bloggen

The irs uses the information in schedule c to calculate how much taxable profit you made and assess any taxes or refunds owing. Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; Now, let’s dig into exactly what you’re reporting.

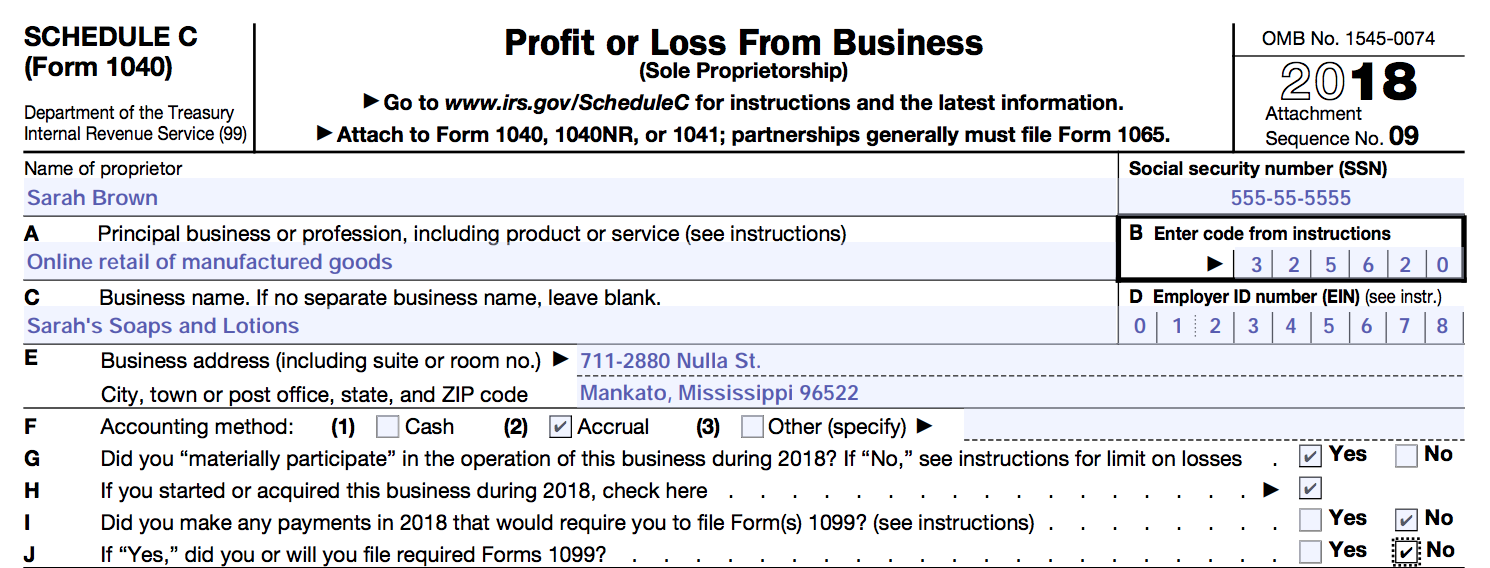

What Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet

Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; Web the schedule c is meant for sole proprietors who have made $400 or more in gross income from their business that year. Now, let’s dig into exactly what you’re reporting.

Editable Schedule C Fill Online, Printable, Fillable, Blank pdfFiller

Includes recent updates, related forms, and instructions on how to file. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit Once completed you can sign your fillable form or send for signing. Use fill to complete blank online others pdf forms for free. Information on other service providers receiving.

2019 schedule c instructions Fill Online, Printable, Fillable Blank

Information on other service providers receiving direct or indirect compensation. Web schedule c (form 5500) 2019 v. Once completed you can sign your fillable form or send for signing. Partnerships generally must file form 1065. The irs uses the information in schedule c to calculate how much taxable profit you made and assess any taxes or refunds owing.

2019 Schedule C Form 1040 ( how to fill it out ) YouTube

Includes recent updates, related forms, and instructions on how to file. Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; Except for those persons for whom you answered “yes” to line 1a above, complete as many entries as needed to.

How To Make A 1040 Schedule C 2019 bmphankering

Web the schedule c is meant for sole proprietors who have made $400 or more in gross income from their business that year. If you’re using any other type of business structure—like an llc or partnership—you may need different forms to file your taxes. The irs uses the information in schedule c to calculate how much taxable profit you made.

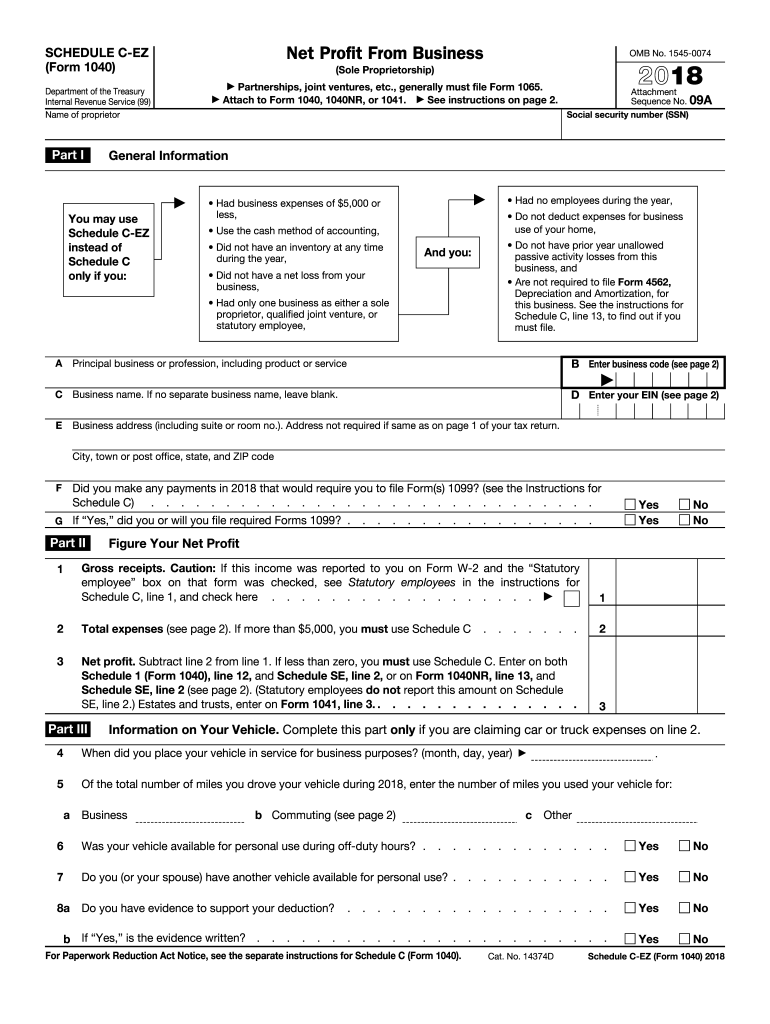

C Ez 1040 Fill Out and Sign Printable PDF Template signNow

Except for those persons for whom you answered “yes” to line 1a above, complete as many entries as needed to list each person receiving, directly or indirectly, $5,000 or more in total compensation Web schedule c is part of form 1040. It's used by sole proprietors to let the irs know how much their business made or lost in the.

An Activity Qualifies As A Business If Your Primary Purpose For Engaging In The Activity Is For Income Or Profit

Partnerships generally must file form 1065. Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; Except for those persons for whom you answered “yes” to line 1a above, complete as many entries as needed to list each person receiving, directly or indirectly, $5,000 or more in total compensation Web schedule c (form 5500) 2019 v.

Go To Www.irs.gov/Form8995A For Instructions And The Latest Information.

Once completed you can sign your fillable form or send for signing. If you’re using any other type of business structure—like an llc or partnership—you may need different forms to file your taxes. Web schedule c is part of form 1040. It's used by sole proprietors to let the irs know how much their business made or lost in the last year.

Web The Schedule C Is Meant For Sole Proprietors Who Have Made $400 Or More In Gross Income From Their Business That Year.

A d cost b d lower of cost or market c d other (attach explanation) 34 was there any change in determining quantities, costs, or valuations between opening and closing inventory? Includes recent updates, related forms, and instructions on how to file. For instructions and the latest information. All forms are printable and downloadable.

An Activity Qualifies As A Business If Your Primary Purpose For Engaging In The Activity Is For Income Or Profit And You Are Involved In The Activity With Continuity And Regularity.

Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Information on other service providers receiving direct or indirect compensation. The irs uses the information in schedule c to calculate how much taxable profit you made and assess any taxes or refunds owing. Now, let’s dig into exactly what you’re reporting to the irs on schedule c.