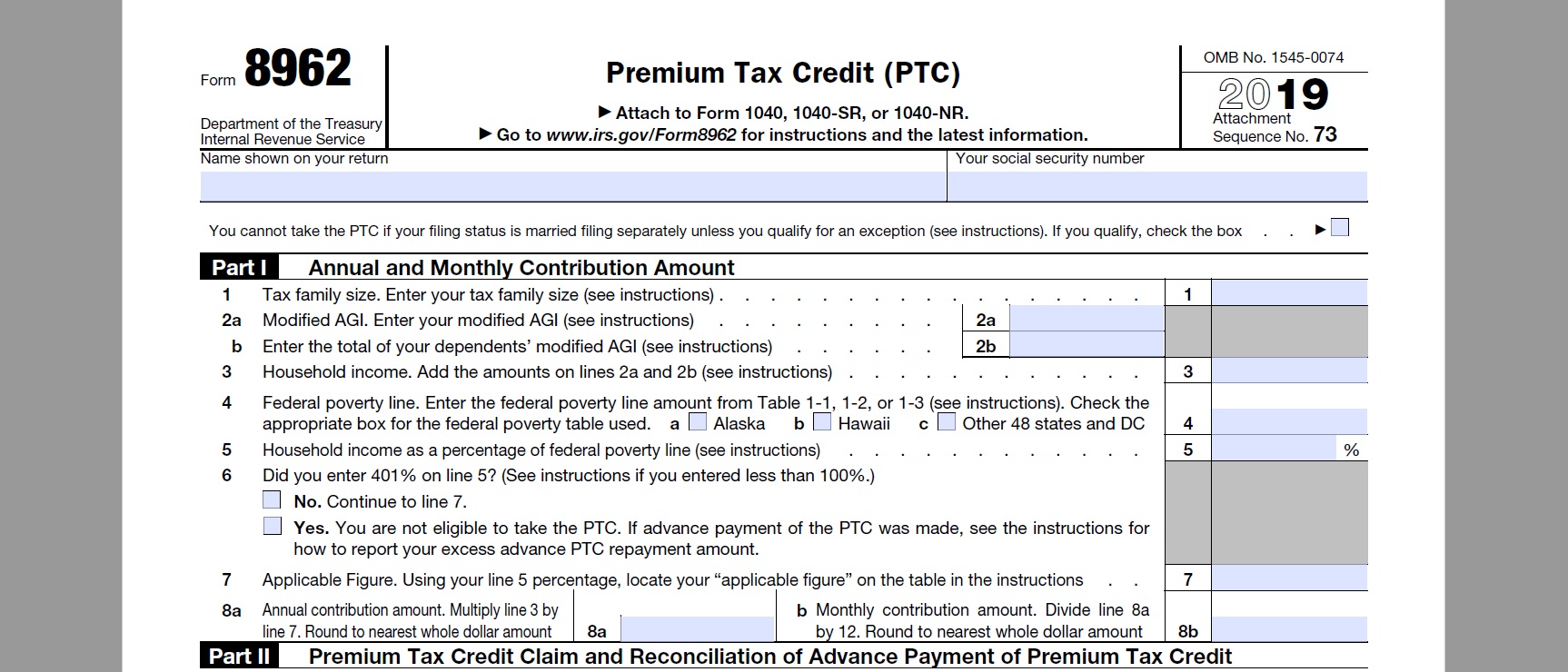

2019 Form 8962

2019 Form 8962 - Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. Ad access irs tax forms. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Web follow this guideline to properly and quickly fill in irs instructions 8962. This form is only used by taxpayers who. The best way to submit the irs instructions 8962 online: Click the button get form to open it and begin. Upload, modify or create forms. Reminders applicable federal poverty line percentages. Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year.

Try it for free now! The amount of excess premium tax credit repayment, calculated on line 29 of federal form 8962 premium tax. Web follow this guideline to properly and quickly fill in irs instructions 8962. If you paid full price. Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Form 8962 is used either (1) to reconcile a premium tax. Web you don’t have to fill out or include form 8962, premium tax credit, when you file your federal taxes. The best way to submit the irs instructions 8962 online: Web the purpose of form 8962 is to allow filers to calculate their premium tax credit (ptc) amount and to reconcile that amount with any advance premium tax credit (aptc).

Ad access irs tax forms. Web follow this guideline to properly and quickly fill in irs instructions 8962. Web you don’t have to fill out or include form 8962, premium tax credit, when you file your federal taxes. Click the button get form to open it and begin. If you had marketplace insurance and used premium tax credits to lower your monthly payment, you must file this health insurance tax form with. Reminders applicable federal poverty line percentages. Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year. Complete, edit or print tax forms instantly. Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. Web the purpose of form 8962 is to allow filers to calculate their premium tax credit (ptc) amount and to reconcile that amount with any advance premium tax credit (aptc).

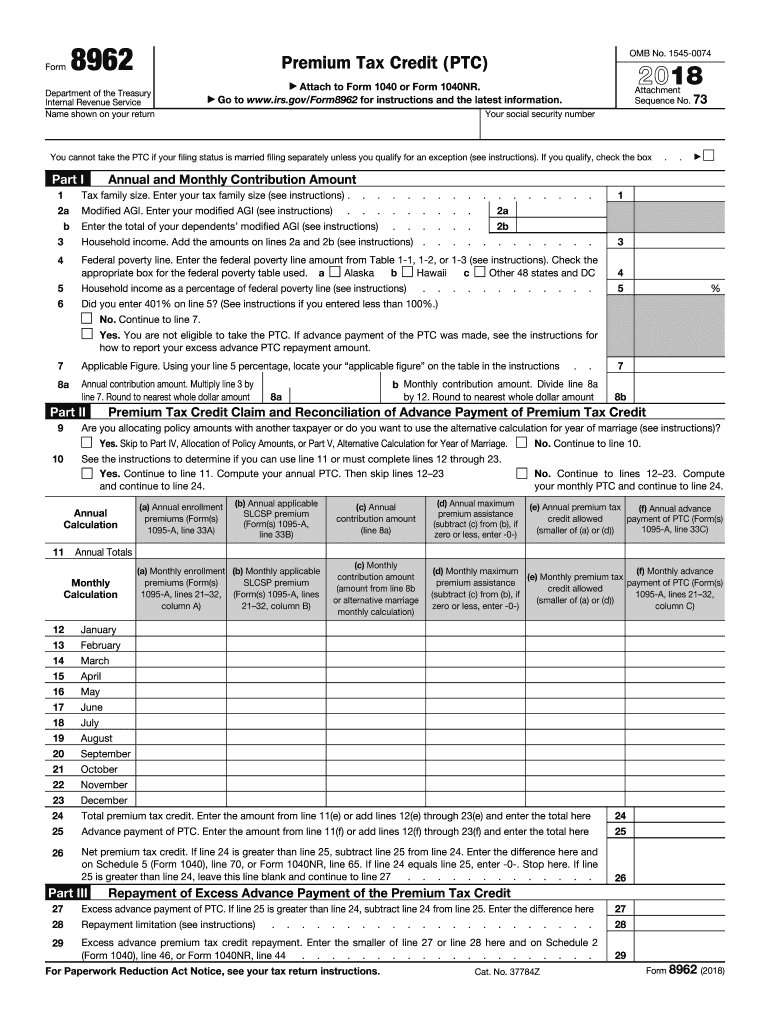

Tax Season 2018 File IRS Form 8962 for Health Insurance Credit

If you paid full price. Click the button get form to open it and begin. Web if the irs sends you a letter about a 2019 form 8962, that means we need more information from you to finish processing your 2019 tax return. Web form 8962, premium tax credit. Select the document you want to sign and click upload.

Breanna Image Of Form 8962

Click the button get form to open it and begin. Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. The amount of excess premium tax credit repayment, calculated on line 29 of federal form 8962 premium tax. Use form 8962 to reconcile your premium tax credit.

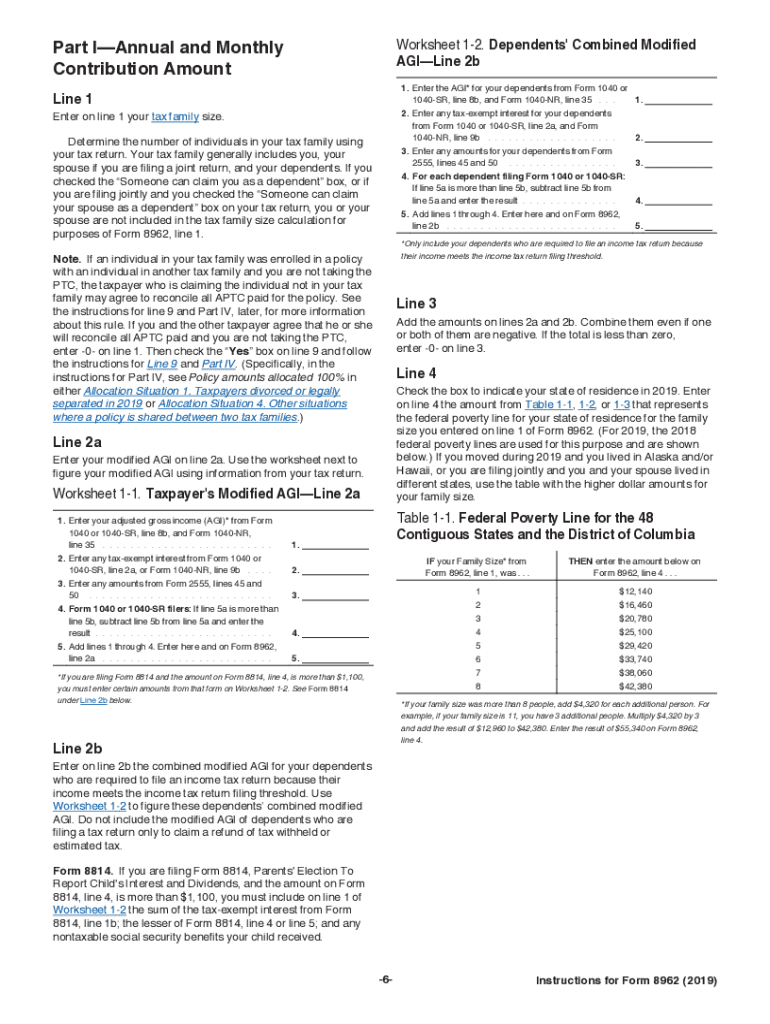

2019 Form 8962 Instructions Fill Out and Sign Printable PDF Template

Reminders applicable federal poverty line percentages. Select the document you want to sign and click upload. Upload, modify or create forms. If you paid full price. Web the purpose of form 8962 is to allow filers to calculate their premium tax credit (ptc) amount and to reconcile that amount with any advance premium tax credit (aptc).

IRS 2019 Health Insurance Subsidy Tax Credit Reconciliation

Get ready for tax season deadlines by completing any required tax forms today. If you had marketplace insurance and used premium tax credits to lower your monthly payment, you must file this health insurance tax form with. Ad get ready for tax season deadlines by completing any required tax forms today. Try it for free now! Reminders applicable federal poverty.

Form 8962 Fill Out and Sign Printable PDF Template signNow

If you paid full price. Web if the irs sends you a letter about a 2019 form 8962, that means we need more information from you to finish processing your 2019 tax return. Web you don’t have to fill out or include form 8962, premium tax credit, when you file your federal taxes. Ad get ready for tax season deadlines.

Instructions 8962 2018 2019 Blank Sample to Fill out Online in PDF

Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Get ready for tax season deadlines by completing any required tax forms today. Click the button get form to open it and begin. If you had marketplace insurance and used premium tax credits to lower your monthly payment, you must file.

Fill Free fillable Form 8962 Premium Tax Credit PDF form

If you paid full price. Try it for free now! Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. Web follow this guideline to properly and quickly fill in irs instructions 8962. This form is only used by taxpayers who.

2019 Form IRS Instructions 8962 Fill Online, Printable, Fillable, Blank

Get ready for tax season deadlines by completing any required tax forms today. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Use form 8962 to reconcile your premium tax credit — compare the amount you used in 2019 to. Web form 8962 is used to figure the amount of.

How to fill out the Form 8962 in 2019 update YouTube

Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Web use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc). Select the document you want to sign and click upload. Click the button get form.

Tax Season 2019 File IRS Form 8962 for Health Insurance Credit

This form is only used by taxpayers who. Try it for free now! If you had marketplace insurance and used premium tax credits to lower your monthly payment, you must file this health insurance tax form with. Web form 8962, premium tax credit. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how.

Click The Button Get Form To Open It And Begin.

If you paid full price. Ad get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today.

Form 8962 Is Used Either (1) To Reconcile A Premium Tax.

If you had marketplace insurance and used premium tax credits to lower your monthly payment, you must file this health insurance tax form with. Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. Web the purpose of form 8962 is to allow filers to calculate their premium tax credit (ptc) amount and to reconcile that amount with any advance premium tax credit (aptc). Web follow this guideline to properly and quickly fill in irs instructions 8962.

Web Form 8962, Premium Tax Credit.

Reminders applicable federal poverty line percentages. Use form 8962 to reconcile your premium tax credit — compare the amount you used in 2019 to. Web you don’t have to fill out or include form 8962, premium tax credit, when you file your federal taxes. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file.

Complete, Edit Or Print Tax Forms Instantly.

Web use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc). This form is only used by taxpayers who. The amount of excess premium tax credit repayment, calculated on line 29 of federal form 8962 premium tax. Web if the irs sends you a letter about a 2019 form 8962, that means we need more information from you to finish processing your 2019 tax return.